The Focus Paper (in Italian) offers a concise comparison of the public finance objectives of EU countries, as described in the European Commission’s Recommendations and Assessments of the Stability and Convergence Programmes (SCPs) presented last April. With the adoption by the Economic and Financial Affairs Council (ECOFIN) of the Country Specific Recommendations related to the 2019 SCPs on July 9, 2019, the analysis and coordination of the public finance objectives of Member States has been completed and the “national semester” of implementation of national fiscal policies has begun. The latter will continue to be monitored at EU level to verify compliance, at least in general, with the recommendations of the Council of the EU.

The Focus paper is divided into three parts. In the first one, the various budget indicators are compared for all EU countries, especially those relevant to the rules of the Stability and Growth Pact (SGP) for 2018, 2019 and 2020. The second part briefly analyses the fiscal stance of the European Union and the euro-area. The third part discusses the budgetary strategies of the main euro area economies (excluding Italy), namely Germany, France, Spain, the Netherlands and Belgium.

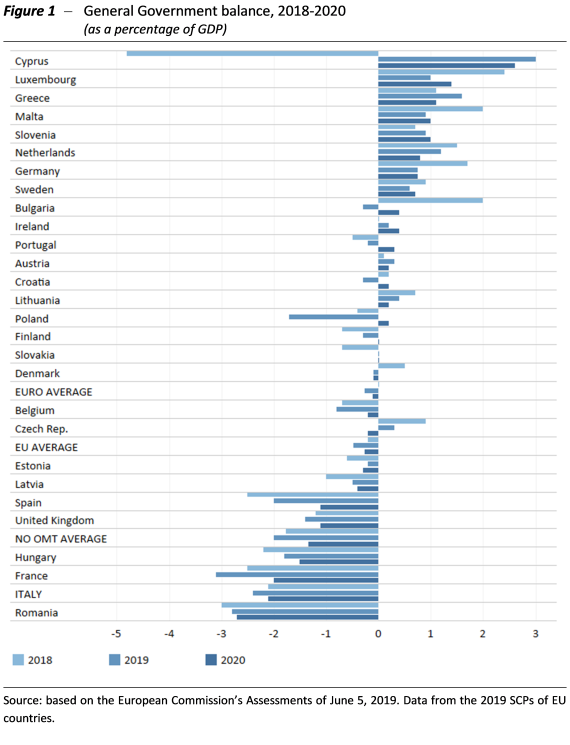

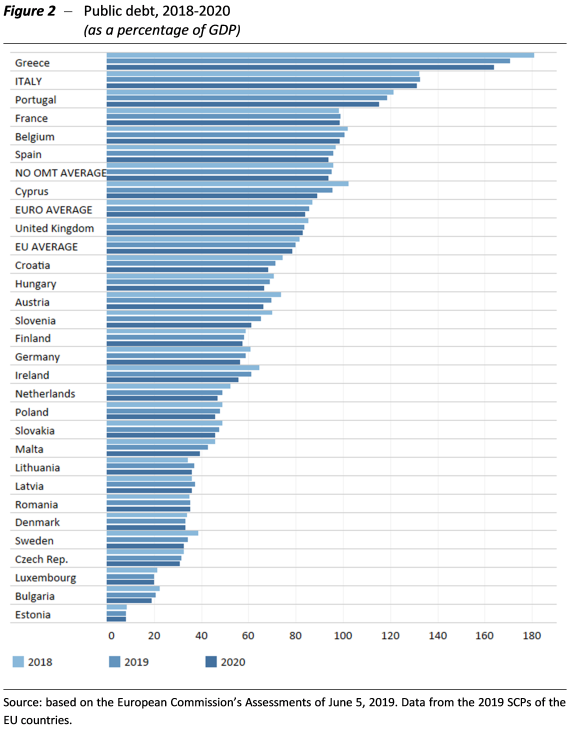

The data regarding the budget objectives (for those regarding the general government balance and the level of public debt as a percentage of GDP, see Figures 1 and 2) and the Commission’s assessments reported in the Focus paper are also available in infographic form downloadable from: https://en.upbilancio.it/comparison-between-the-stability-and-convergence-programs-2019/.

The main indications arising from the comparison of the SCPs presented by the individual Member States in the 2019 round are summarised below.

- The SCPs report stable annual average general government balances in 2019-2020 among EU countries and a reduction of 0.1 points of GDP among euro-area countries. By 2020, it is estimated that the average general government deficit for EU countries will stand at 0.3 per cent of GDP, while that for euro-area countries would be 0.1 per cent. Italy’s target deficit (2.1 per cent of GDP) would be stable on average and would be the second largest after Romania (2.7 per cent of GDP). The country with the largest general government surplus is Cyprus (2.6 per cent of GDP).

- In both the European Union and the euro area, the average primary balance will be 1.2 per cent in 2020. In both cases it will deteriorate slightly in 2019-2020 (0.1 points of GDP). Italy’s primary surplus in 2020 (1.6 per cent of GDP) would be stable and larger than the average. The country with the largest primary surplus target is still Cyprus (4.8 per cent of GDP), just as Romania remains the country with the largest primary deficit target (1.4 per cent of GDP).

- The SCPs show that the public debt of EU countries should decline from 81.5 per cent of GDP in 2018 to 78.4 per cent in 2020, with an average annual reduction of around 1.5 points of GDP. Among euro-area countries, the debt/GDP ratio is expected to fall from 87.1 per cent of GDP in 2018 to 84 per cent in 2020 (the average annual reduction would be around 1.6 points). The country with the largest forecast public debt in 2020 is Greece (163.9 per cent of GDP, but with an expected reduction of 8.6 points), followed by Italy with 131.3 per cent and a smaller-than-average forecast decrease (0.4 points of GDP). By contrast, the country with the smallest expected public debt is Estonia (8.1 per cent of GDP).

- The structural deficits forecast for 2020, as presented in the SCPs and recalculated by the European Commission, are equal to 0.8 per cent on average for both the EU and the euro area. In both cases they are stable over the 2019-2020 period. The country with the largest expected structural surplus in 2020 is Greece (2 per cent), while that with the largest structural deficit in 2020 is Romania (2.9 per cent). Italy’s structural deficit in 2020 is projected to be larger than the average (2.1 per cent) but expected to improve slightly on average (0.1 points).

- Overall, against a background of a deterioration in the main macroeconomic indicators starting from the second half of 2018, the SCPs suggest a more accommodative fiscal stance in 2019 than the restrictive position recommended in June 2018 by the European Fiscal Board (EFB), whose assessments, however, were formulated on the basis of a stronger macroeconomic outlook. At the same time, the SCPs reveal a more restrictive orientation for the euro area’s fiscal policy in 2020 than the recommendations issued by the EFB last June, as the expansionary contribution of the countries with the greatest fiscal space (Germany and the Netherlands, mainly) has dissipated.

- Germany and the Netherlands continue to overachieve their medium-term objective (MTO). In 2019, the debt/GDP ratio of both countries will be below the 60 per cent threshold and will continue to fall over the SP programming horizon. Both the Commission and the Council recommend using the fiscal space available to boost investment.

- Spain corrected its excessive deficit in 2018 on a lasting basis and the excessive deficit procedure opened in 2009 was closed this year. The Commission warns of the risk of a significant deviation in annual terms in 2019 and in annual and two-year terms in 2020, while the debt criterion will not be fulfilled in either of the two years.

- For France, the Commission prepared a report under Article 126 (3) of the Treaty for breach of the debt rule in 2018 and for an estimated breach of the deficit rule in 2019. The Commission concluded that France had complied with both rules. France is also at risk of a significant deviation in 2019 and 2020, in annual and two-year terms, while the debt rule will not be complied with.

- The Commission prepared a report under Article 126 (3) of the Treaty for Belgium’s breach of the debt rule in 2018, and concluded that there was insufficient evidence to determine whether the criterion was met or not. Belgium is not expected to comply with the debt rule in 2019 and 2020. Furthermore, the Commission notes the risk of a significant deviation in 2019, in two-year terms, and in 2020, in annual and two-year terms.

Text of document (in Italian)