Sustained by the favourable international environment and growth in domestic demand, the recovery of the Italian economy, according to Report on recent economic developments for July, is proceeding at a slightly more robust pace than assumed in the spring.

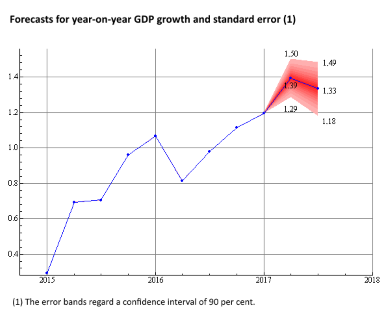

Recovery accelerates: after a strong first quarter, GDP growth is estimated at 0.3 per cent and 0.2 per cent in the second and third quarters; for 2017 as a whole, GDP is forecast to expand by 1.2-1.3 per cent

Real GDP growth, corrected upwards by ISTAT to 0.4 per cent in the first quarter, was estimated by the PBO at 0.3 per cent in the second (1.4 per cent year-on-year) and 0.2 per cent in the third (1.3 per cent year-on-year). Despite the acceleration at the start of the year, the pace of growth of the Italian economy is still slower than the euro-area average. Assuming growth in the fourth quarter as well, the economy could grow by 1.2-1.3 per cent, more rapidly than assumed in the EFD (1.1 per cent).

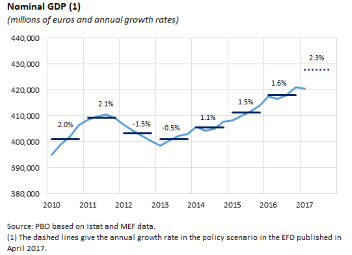

But the growth of nominal GDP, which is significant for the public finances, is weak and appears to fall short of the EFD forecast

The strong performance of real growth does not appear likely to be reflected in nominal GDP, a key indicator of the sustainability of the public finances, especially for a resumption of the decline in the debt/GDP ratio. GDP at current prices decreased slightly in the first quarter owing to a decline in the GDP deflator, which more than offset the good performance of output in real terms. The decrease in the GDP deflator in the first quarter reflected the weakening of domestic inflationary pressures (both unit labour costs and unit profit margins, while the increase in external pressures (oil prices) raised the consumption deflator in that period. In view of the negative start to the year, unlike real GDP, nominal GDP growth is well off the forecast presented by the Government in the EFD for 2017 as a whole (+0.5 per cent for growth achieved after the first quarter if there were no further changes, compared with a policy objective of +2.3 per cent).

The strong performance of real growth does not appear likely to be reflected in nominal GDP, a key indicator of the sustainability of the public finances, especially for a resumption of the decline in the debt/GDP ratio. GDP at current prices decreased slightly in the first quarter owing to a decline in the GDP deflator, which more than offset the good performance of output in real terms. The decrease in the GDP deflator in the first quarter reflected the weakening of domestic inflationary pressures (both unit labour costs and unit profit margins, while the increase in external pressures (oil prices) raised the consumption deflator in that period. In view of the negative start to the year, unlike real GDP, nominal GDP growth is well off the forecast presented by the Government in the EFD for 2017 as a whole (+0.5 per cent for growth achieved after the first quarter if there were no further changes, compared with a policy objective of +2.3 per cent).

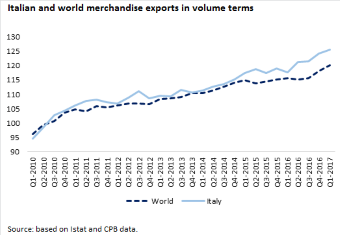

Thanks to the gradual recovery in market shares, exports have been boosted

World trade is picking up. Although the geographical composition of the revival of international trade has been relatively less favourable for Italy, exports continued to recover in the first half of 2017. Merchandise exports increased by 1.7 per cent in the first quarter and continued to perform well in subsequent months (+0.8 per cent at current prices in April-May). In the last four quarters, Italian exports have expanded more rapidly than world exports (6.8 per cent, compared with 4 per cent), continuing the gradual recovery in markets shares that began in 2010. The expansion of exports was outpaced by the even faster growth in imports. As a result, the first part of the year external demand made a negative contribution to GDP growth.

World trade is picking up. Although the geographical composition of the revival of international trade has been relatively less favourable for Italy, exports continued to recover in the first half of 2017. Merchandise exports increased by 1.7 per cent in the first quarter and continued to perform well in subsequent months (+0.8 per cent at current prices in April-May). In the last four quarters, Italian exports have expanded more rapidly than world exports (6.8 per cent, compared with 4 per cent), continuing the gradual recovery in markets shares that began in 2010. The expansion of exports was outpaced by the even faster growth in imports. As a result, the first part of the year external demand made a negative contribution to GDP growth.

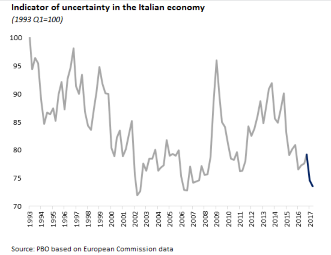

A reduction in uncertainty (PBO indicator) could boost the economy in the coming months

The performance of quantitative indicators, such as developments in industrial production (+0.7 per cent in May, after contracting in January and April), was uneven, despite the expansion in economic activity. The average level of the aggregate indicator of business confidence in April-June was in line with that in the first quarter, well above the long-term average. The favourable climate of confidence spread to nearly all productive sectors. Additional positive news comes from the PBO uncertainty indicator, which fell markedly in the first half of 2017, returning to the level seen prior to the 2008-2009 crisis. By stimulating investment and consumption and increasing demand for the factors of production, lower uncertainty represents a necessary condition for sustaining the recovery in the second half of 2017.

The performance of quantitative indicators, such as developments in industrial production (+0.7 per cent in May, after contracting in January and April), was uneven, despite the expansion in economic activity. The average level of the aggregate indicator of business confidence in April-June was in line with that in the first quarter, well above the long-term average. The favourable climate of confidence spread to nearly all productive sectors. Additional positive news comes from the PBO uncertainty indicator, which fell markedly in the first half of 2017, returning to the level seen prior to the 2008-2009 crisis. By stimulating investment and consumption and increasing demand for the factors of production, lower uncertainty represents a necessary condition for sustaining the recovery in the second half of 2017.

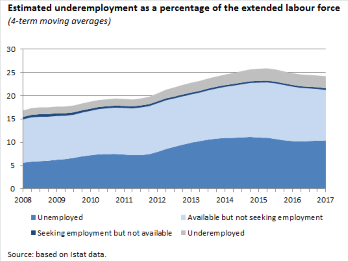

Labour market improves but underemployment remains very widespread (24.5 per cent)

With economic activity gathering strength, employment continued to grow in the first part of the year, reflecting the considerable increase in workers on fixed-term contracts, attributable in part to the expiry of the contribution relief for new hiring on open-ended contracts. In the first five months of 2017, employment expanded by an average of 1.1 per cent over the same period of 2016, reflecting the leap in fixed-term employment (8.6 per cent) and a modest expansion in permanent employment (0.7 per cent). The improvement in economic conditions and the good performance of employment encouraged greater labour market participation (with the number of inactive people falling by 473,000 in the first quarter compared with the year-earlier period), slowing the decline in the unemployment rate (11.2 per cent). Despite the improvement in the labour market, underemployment remains extensive and considerably more widespread than indicated by unemployment figures. Summing the potential labour force (inactive people available to work) with the unemployed and the underemployed (about 800 thousand people working few hours than they would like), the underemployment rate in the first quarter of the year was 24.5 per cent of the extended labour force. This phenomenon, which can be found to varying degrees in the rest of the euro area as well, tends to weaken wage pressures. Together with the weakness of oil prices and the appreciation of the euro in recent months, this is acting to keep inflation in Italy and the euro area low, well below the target rate of 2 per cent, as confirmed by the ECB.

With economic activity gathering strength, employment continued to grow in the first part of the year, reflecting the considerable increase in workers on fixed-term contracts, attributable in part to the expiry of the contribution relief for new hiring on open-ended contracts. In the first five months of 2017, employment expanded by an average of 1.1 per cent over the same period of 2016, reflecting the leap in fixed-term employment (8.6 per cent) and a modest expansion in permanent employment (0.7 per cent). The improvement in economic conditions and the good performance of employment encouraged greater labour market participation (with the number of inactive people falling by 473,000 in the first quarter compared with the year-earlier period), slowing the decline in the unemployment rate (11.2 per cent). Despite the improvement in the labour market, underemployment remains extensive and considerably more widespread than indicated by unemployment figures. Summing the potential labour force (inactive people available to work) with the unemployed and the underemployed (about 800 thousand people working few hours than they would like), the underemployment rate in the first quarter of the year was 24.5 per cent of the extended labour force. This phenomenon, which can be found to varying degrees in the rest of the euro area as well, tends to weaken wage pressures. Together with the weakness of oil prices and the appreciation of the euro in recent months, this is acting to keep inflation in Italy and the euro area low, well below the target rate of 2 per cent, as confirmed by the ECB.