After the timid signs of recovery in the first quarter of the year, the Italian economy stopped growing again. According to the July Report on Recent Economic Developments, it will be necessary to wait for the second half of the year to see some signs of a rebound. However, that revival will be insufficient to significantly shift the hands of the economic barometer from zero for 2019 as a whole. The situation should gradually improve next year, although uncertainty and potential unknowns increase as the forecast horizon lengthens.

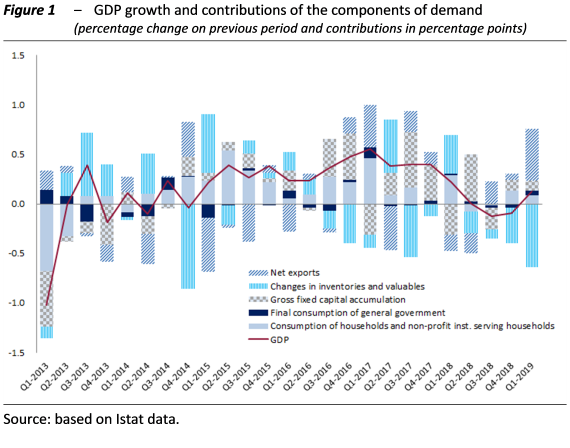

Economic activity stagnates – According to the last available four quarters of national accounts, GDP growth has fluctuated around zero on average (Figure 1). Consumption growth was very slow again in early 2019 (0.1 per cent in the first quarter compared with the previous period). Investment growth is weakening, especially for components other than construction. Exports have been impacted by the deterioration in international trade, but foreign market shares have not been eroded. The most recent economic indicators point to a weak growth: despite the increase in industrial production registered in May, PBO estimates show that industrial activity contracted again in the second quarter (by 0.8 per cent compared with the January-March average).

Overall, the broad stagnation in activity has not ended, with the economy only expected to recover after the middle of the year: the PBO’s short-term models indicate that in the second quarter GDP was unchanged or contracted slightly, while in summer it is forecast to return to growth (0.15 per cent on the previous period).

Positive signals from the labour market – While the pace of economic growth between the end of 2018 and 2019 was modest, significant signs of improvement have been displayed by the labour market. In the first quarter, labour inputs to the productive system, measured in terms of hours worked, increased significantly (0.7 per cent on the previous period). According to the Labour Force Survey, the increase in the number of persons in employment in the first quarter was mainly attributable to open-ended jobs (0.3 per cent), more than offsetting the sharp reduction in fixed-term employment (-1.0 per cent). In the same period the number of persons seeking employment fell further (a decline of 43,000 after an increase of 80,000 in the previous period). The unemployment rate therefore declined, to below 10 per cent in May for the first time since the winter of 2012.

Uncertainty continues to cloud the situation – The improvement in the labour market does not seem sufficient to ease the uncertainty felt by households and firms. Although still below the peaks posted in 2013-2014, the index prepared by the PBO has deteriorated since the end of last year. The composite economic indicators published by various institutions continue to provide adverse signals. In June the Bank of Italy’s monthly coincident indicator of underlying growth, ITA-coin, recorded its tenth consecutive decrease. In the same month, Istat’s leading indicator continued the downward trend under way since the second half of last year.

Forecasts … – In developing the forecasts for the Italian economy in 2019-2020, as the latter are not used to produce an endorsement of the macroeconomic scenarios of the Ministry for the Economy and Finance (MEF) and are more directly comparable with the scenarios prepared by the main international and national forecasting organisations, the forecast for 2020 does not incorporate the effects of the increase in indirect taxes provided for in the safeguard clauses and does not consider alternative funding measures.

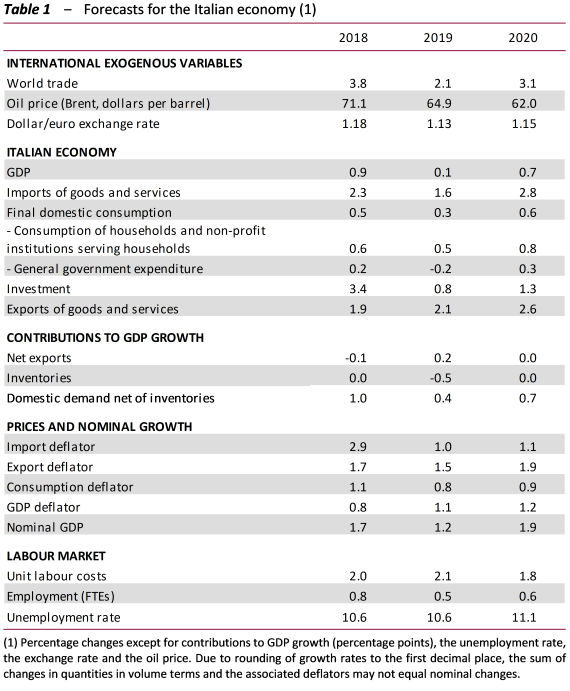

After weakening further in the spring, economic activity is expected to strengthen gradually in the second half of the year, buoyed by the recovery in international trade and the expansionary measures approved with the 2019 budget package. Gross domestic product is projected to increase slightly this year (0.1 per cent) and somewhat more in 2020 (0.7 per cent; Table 1). The latter forecast assumes that the safeguard clauses will be suspended. If this does not occur, real growth would come to 0.4 per cent. Compared with the forecasting scenario published in the Report on Recent Economic Developments last February, GDP growth is three-tenths of a percentage point slower in 2019 and one-tenth of a point next year.

The expansion of the Italian economy is expected to be driven over the forecast horizon by final domestic demand: household consumption will benefit from the income support measures contained in the 2019 budget package and an improvement in the labour market. Employment (measured in terms of full-time equivalent units) is expected to increase by half a percentage point in the two-year forecast period, while inflation, as measured by the consumption deflator, is expected to slow compared with 2018 and remain broadly stable at below 1 per cent in each year of the two-year forecast period. The increase in nominal GDP, a key variable in measuring the debt/GDP ratio, is put at 1.2 per cent for 2019 (from 1.7 in 2018), rising to just under 2 per cent in 2020.

…and risks – The risks to the forecasting scenario are predominantly on the downside. The scenario assumes no further restrictions on international trade or new geopolitical, climate or environmental shocks. Any manifestation of these unfavourable developments would accentuate the volatility of international commodity and foreign exchange markets and impact global growth. In addition, the baseline scenario incorporates the marked reduction in risk premia on sovereign debt issues recorded in the most recent period. However, the persistence of uncertainties over the sources of funding that could be used in the autumn to avoid the indirect tax increases provided for in the safeguard clauses could quickly increase the risk aversion of investors, which could then be transmitted to the confidence of households and firms, as well as to bank balance sheets. Conversely, the timely and credible definition of the budget package for next year would foster a further decline in interest rates, with a significant beneficial impact on household and business expectations.