The Focus Paper offers an overview of the Draft Budgetary Plans that the euro-area countries are required to submit by October each year to the European Commission and the Eurogroup. The DBPs are analysed by the Commission, which by the end of November publishes its opinions on the budget strategies for the coming year, assessing compliance with the rules of the Stability and Growth Pact (SGP) and whether the budget policies are consistent with the recommendations issued in July by the EU Council.

The Focus – the associated data can be downloaded from the interactive visualisation – is organised into two parts: the first is devoted to a comparison of the main public finance aggregates contained in the DBP of each country, while the second analyses the strategy presented in the DBPs of the main euro-area economies (excluding Italy) ‑ Germany, France, Spain, the Netherlands and Belgium – underscoring differences with respect to the objectives in their respective Stability Programmes and summarising the opinions of the Commission and the conclusions of the Eurogroup.

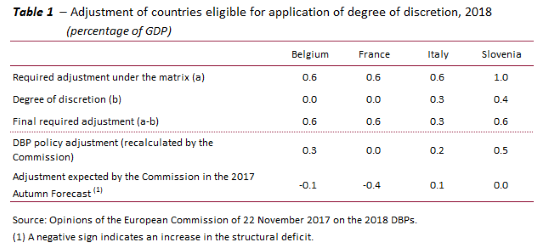

In this round of opinions and following a specific analysis, the Commission for the first time decided to apply – clarifying that it was for 2018 only – its “degree of discretion” in determining the required structural adjustment in 2018 for those countries, such as Italy, Slovenia, Belgium and France, that would be called upon to make a significant correction of their public finances, i.e. at least 0.5 percentage points of GDP, within the preventive arm of the SGP.

In order to exercise greater discretion in using the “matrix” governing the adjustment path toward the medium-term objective (MTO) in relation to cyclical conditions in the individual countries, the Commission conducted a careful analysis of the cyclical position of each Member State in order to reconcile the need for fiscal adjustment with support for the recovery. The criteria used in applying this degree of discretion were as follows: no discretion is warranted when short-term fiscal sustainability challenges are identified or the recovery is considered sufficiently robust; and an adjustment of at least half of the requirement from the matrix is warranted when the recovery appears still fragile or a too large fiscal tightening could jeopardise it. Full compliance with this adjustment is essential, in particular for Member States not respecting the debt reduction benchmark.

The analysis of cyclical conditions prompted the Commission to conclude that no easing of the requirements was necessary for France and Belgium, while the required adjustment was reduced from 0.6 to 0.3 for Italy and from 1 to 0.6 for Slovenia. The fact remains that for all of these countries the policy adjustment indicated in their DBPs for 2018, recalculated by the Commission, is smaller than required, and in the case of France is in fact equal to zero, compared with 0.6 points (Table 1). In the Commission’s Autumn Forecast for France and Belgium, the projected adjustment results in an increase in the structural deficit (of 0.4 and 0.1 percentage points respectively).

The main observations drawn from the analysis performed in the Focus are as follows (Table 2).

- In 2017-2018, the nominal deficit, which is also impacted by the cyclical position of the economy and by interest rates, is expected to improve by 0.3 percentage points of GDP for the euro area compared with 2016, with an average nominal deficit of 1 per cent of GDP in 2018. Italy has a target for the average annual improvement of 0.5 percentage points, slightly larger than the average, and a 2018 deficit of 1.6 per cent, the third largest. In 2018, the country with the highest deficit target is France (2.6 per cent), while that with the highest surplus target is Cyprus (1.3 per cent).

- In 2017-2018, the DBPs indicated an average annual improvement of 0.2 percentage points of GDP in primary balances (which are also affected by the cycle, as well as by discretionary fiscal policy measures), which in 2018 would average 1 per cent of GDP. Italy’s objective for the annual average improvement was slightly higher than average (0.3 percentage points), with a target for the primary surplus of 2 per cent, about twice the average. For 2018, Cyprus and France respectively had the highest targets for the primary surplus (3.8 per cent) and the primary deficit (0.8 per cent). Latvia has the largest annual deterioration (0.7 percentage points), while Spain had the largest annual improvement (1 percentage point).

- With regard to the public debt, in 2017-2018, all the countries taken as a whole would post an average annual reduction of about 1.6 percentage points of GDP, lowering the figure to 86.5 per cent in 2018. Excluding Greece, Italy is again the laggard in the euro area, with a debt equal to 130 per cent of GDP; its reduction would also be smaller than average at 1 per cent. Estonia, with a debt/GDP ratio of 8.6 per cent leads the way, while the country with the largest expected average annual decline in the ratio is Cyprus (7.3 percentage points).

- The structural balances as recalculated by the Commission on the basis of the indications provided by the countries in their DBPs show no change between 2016 and 2018 (but there is an improvement of 0.1 percentage points considering only the countries that have not achieved their MTO), the year in which the structural deficit averages of 1.1 per cent. Italy’s structural deficit in 2018 is larger than average at 1.9 per cent, while the average annual structural deterioration is 1 percentage points, less ambitious than the overall average and, in particular, than that of the countries that have not achieved their MTO.

- The countries with the largest forecast structural surplus next year are Germany and Luxembourg (0.5 per cent), while the country to post the largest structural deficit would be Spain (2.5 per cent). Ireland registers the largest expected average annual improvement (0.7 percentage points), while Luxembourg posts the largest deterioration (0.8 percentage points).

- The euro-area countries are estimated to have had a neutral fiscal stance in 2017, while in 2018 the start of a positive phase of the cycle would be accompanied by a slightly expansionary impulse, mainly due to Germany’s partial use of its fiscal space, having projected a structural primary surplus of 0.6 percentage points. The current policy scenarios therefore point to a moderately expansionary stance in 2018 instead of the neutral position recommended by the European Commission, lagging behind the recommendation of the Commission for 2017.

- Among the main euro-area countries, Germany continues to exceed its MTO in 2017-2018 as well, as does the Netherlands, which expects to achieve a debt/GDP ratio of less than 60 per cent as from 2017. France confirms its commitment to reduce the deficit/GDP ratio below the threshold of 3 per cent in 2017 and intends to adopt a budget policy based on expenditure cuts in real terms to finance permanent tax reductions. According to the forecasts in the DBP and those of the Commission, Spain should also reduce its deficit/GDP below 3 per cent in 2018, while Belgium is a risk of a significant deviation in 2017 and 2018. According to the Commission’s forecasts, Belgium is not expected to comply with the debt reduction benchmark in either 2017 or 2018.