The 2019 Budget Act modified the budget balance rule for local authorities, making it possible from this year to use extensively budget surpluses from previous years and resources raised from new borrowing for additional spending. The Focus Paper “Spendable surpluses of local authorities under the new budget balance rules” illustrates the changes introduced in the budget balance requirement, and estimates the potential impact in terms of the increased spending capacity of local authorities and its geographical distribution.

The changes introduced with the Budget Act, which were implemented in advance in October 2018 with a Circular (No. 25 of 3 October) issued by the State General Accounting Office (Ragioneria generale dello Stato, RGS), follow a number of rulings of the Constitutional Court (including rulings 247/2017 and 101/2018 ) and establish that local authorities shall make sole reference to the budget-balance requirement, governed by Legislative Decree 118/2011. This rule requires accounting balance between all revenue ‒ including that deriving from borrowing and any surpluses from previous fiscal years (with some limitations for authorities running a budget deficit) ‒ and all expenditure, as well as budget balance on current account. The new rule applies from 2019 to all local authorities except for the ordinary statute regions (OSRs), for which it will apply as from 2021.

Taking account of the nature of the different items that make up the surpluses ‒ not all of which can be used to finance new spending ‒ the total amount of spendable surpluses of the local authorities affected by the rule change (excluding OSRs) is estimated at over €15 billion. Of these, the most readily spendable portion, i.e. that compatible with the cash holdings of each authority, can be quantified at about €11.6 billion. Moreover, in order to assess the potential short-term effects, it is helpful to quantify the share of the surpluses pertaining to local authorities that were especially penalised by the previous legislation (Law 243/2012), i.e. authorities with a low level of “overshooting” (i.e. the excess of the surplus with respect to the balance required under the previous budget rule): these entities, despite having significant surpluses on their balance sheets, could not spend them owing to the lack of financial flexibility imposed by the need to comply with the budget-balance rule, which has now been lifted. The spendable surpluses of this subset of local governments, who could conceivably deploy the resources more rapidly, can be estimated at around €4.1 billion.

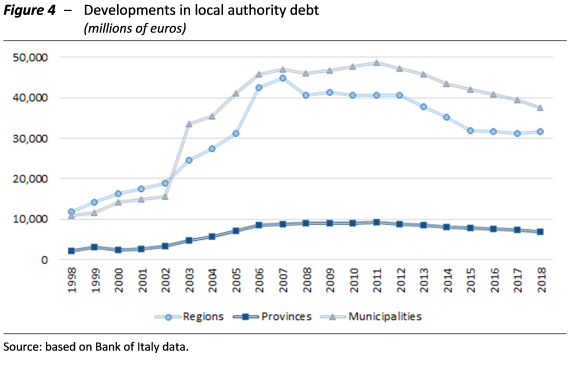

Data for local authorities from the General Government Payments Information System (Sistema Informativo delle Operazioni degli Enti Pubblici, SIOPE) can be used to conduct an initial, albeit partial, assessment of the effects of the new accounting rules on the dynamics of payments connected with investment expenditure. This exercise appears to confirm an acceleration in investment expenditure starting from the last quarter of 2018. This acceleration can be reasonably attributed ‒ at least in part ‒ to the RGS circular referred to earlier, which made it possible to use surpluses from previous years. In fact, starting from October 2018, a reversal can be observed in the trend of monthly municipal payments for investment spending. While in the first nine months of 2018 total investment decreased by 5.9 per cent compared with the corresponding period of 2017, that for the period between October 2018 and February 2019, taken as a whole, increased by 17.8 per cent over October 2017-February 2018 (Figure 1).

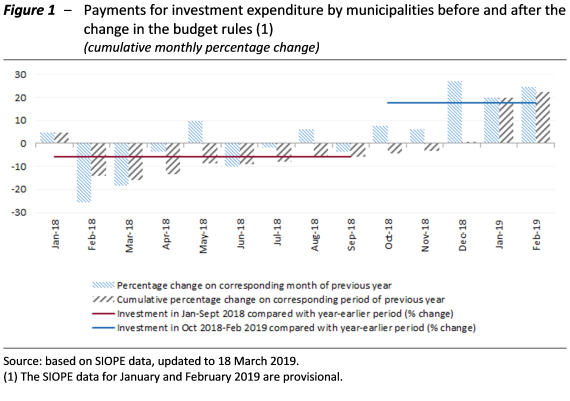

Focusing now the attention on the geographical distribution of surpluses, the newly available resources are mainly concentrated in the North of the country (Figure 2). About half of the total spendable surpluses is attributable to the North (€7.8 billion out of a total of €15.1 billion). The concentration is even higher (55 per cent) if we only consider amounts for which the local authorities have liquidity available for immediate use (that is, those authorities for which available cash resources are sufficient to cover immediate spending). Finally, considering the spendable surpluses of only the authorities with liquidity and with the lowest level of overshooting (i.e. entities most severely squeezed by the previous budget-balance requirement), the largest share is especially concentrated in the North-eastern regions of the country, as well as in individual regions of the other macro-areas (notably Sardinia and Lombardy, but also at the provincial level in Campania).

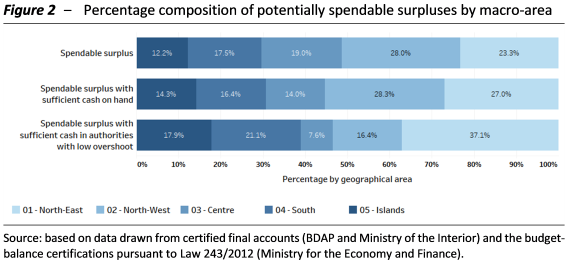

Turning the attention to municipalities, Figure 3 shows the distribution of spendable surpluses of municipalities with available liquidity, expressed as a ratio of revenue: this indicator, being independent of the budget size, is useful for comparing municipalities of different financial scale. The red areas indicate local entities that have no or negligible spendable surpluses (less than 1 per cent of revenue), which are located mainly in the lower peninsular area (Centre-South), with a smaller presence in the North and Sardinia (Sicily is poorly represented in the sample, as are the areas of Central Italy hit by earthquakes). The blue-shaded areas represent municipalities whose spendable surpluses are more than 10 per cent of revenue: these areas are prevalent in the North, in Sardinia and in part of Puglia.

The yellow-shaded areas, which fall between these two thresholds, are those whose spendable surpluses can be considered of normal size, functional to the efficient management of the administration’s cash flows (and therefore not necessarily available for investment spending). These areas are more evenly distributed, although with a slight prevalence in the Centre-North.

The uneven distribution of surpluses accumulated in the accounts of local governments, which have now become available, could therefore contribute to increasing geographical divergences.

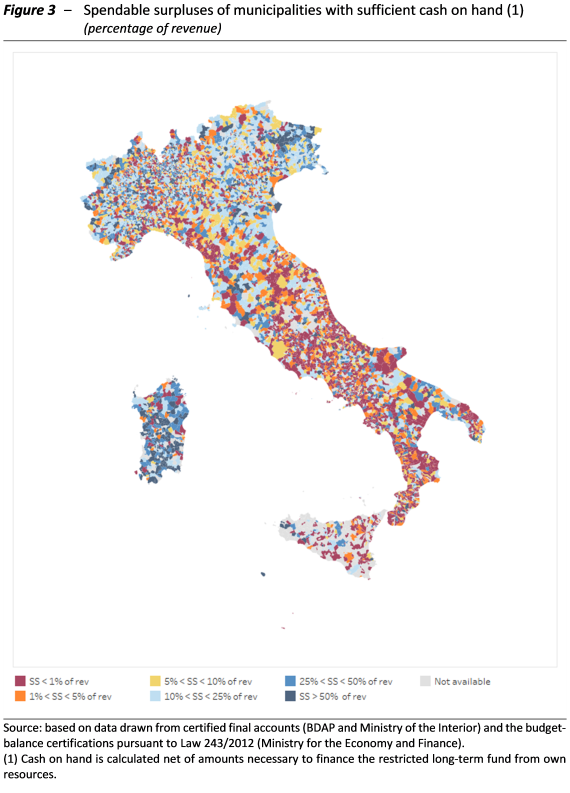

Finally, the new budget-balance rule makes it possible for each government to finance investment with new borrowing, with the sole limitations being that the servicing of existing debt must be sustainable, i.e. compliant with budget balance on current account (which is impacted by loan repayments), and it must comply with the ceiling on interest expenditure as a proportion of current revenue. Historical trends in the debt of the various sectors of local government show a period of rapid increase (2002-2007), attributable to the issuance of bonds and the use of financial derivatives. After 2007 local debt first stabilise and then decline, reflecting in part the constraints of the domestic stability pact and, subsequently, the budget-balance rule under Law 243/2012, which discouraged new borrowing (Figure 4).