An overview of public finance strategies in the 2021 Stability and Convergence Programmes of EU countries

An overview of public finance strategies in the 2021 Stability and Convergence Programmes of EU countries

The Focus Paper “An overview of public finance strategies in the 2021 Stability and Convergence Programmes of EU countries”, (in Italian) which is also available in interactive form, compares public finance outcomes and strategies among EU countries, as described in the assessments of the Stability and Convergence Programmes (SCPs) by the European Commission.

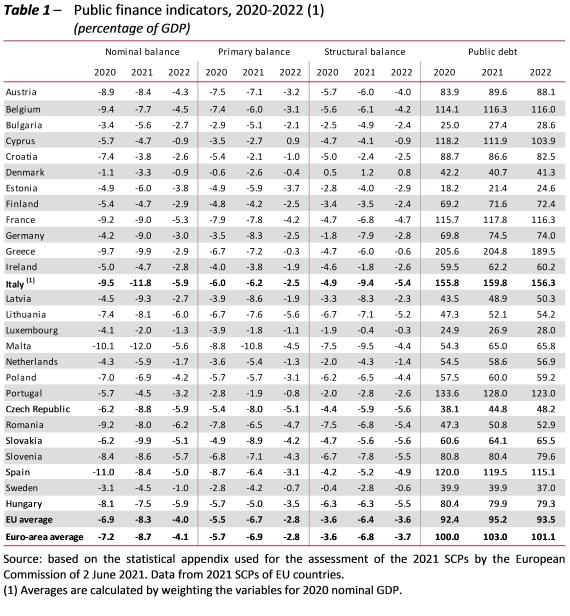

The first part of the Focus is dedicated to a comparison of the main fiscal indicators for 2020, 2021 and 2022 for all EU countries. The second part focuses on the fiscal strategies of the main economies of the euro area (excluding Italy), i.e. France, Germany and Spain.

Public finance results and strategies should be read in light of the European Commission’s decision to activate the General Escape Clause of the Stability and Growth Pact (SGP) for 2021 and 2022 to enable the Member States to bear the costs necessary to address the COVID-19 emergency, including temporary deviations from the adjustment path towards the medium-term objective (MTO), provided that this does not compromise medium-term fiscal sustainability.

A number of salient points drawn from the brief analysis of the main public finance indicators contained in the SCPs (Table 1) can be highlighted.

- In 2020, EU countries recorded an average nominal deficit of 6.9 per cent of GDP, while euro area countries recorded an average nominal deficit of 7.2 per cent of GDP. In 2021, an average deficit of 8.3 per cent is forecast for EU countries and one of 8.7 per cent for euro area countries. In 2020 Italy’s deficit/GDP ratio (9.5 per cent) was the fourth largest, while it is forecast for 2021 to be 11.8 per cent of GDP, second only to Malta (12 per cent).

- In 2022, the SCPs expect the nominal deficit to be equal to 4 per cent of GDP on average among EU countries, and 4.1 per cent in euro area countries. Italy’s target deficit/GDP ratio (5.9 per cent) would be the third highest along with Hungary and the Czech Republic.

- The SCPs show nominal deficits in 2021-2022 improving by an annual average of 1.5 points of GDP among EU countries and by 1.6 points among euro area countries. The budget balance for Italy would improve by 1.8 points of GDP, more than both averages.

- In 2020, EU countries recorded a primary deficit of 5.5 per cent of GDP on average, while euro area countries posted one of 5.7 per cent of GDP. According to the SCPs, primary deficits in 2022 will be equal to 2.8 per cent of GDP in the EU and in the euro area. Italy recorded a primary deficit slightly above average (6 per cent of GDP) in 2020, while for 2022 it is projected at 2.5 per cent, slightly lower than both averages. Italy also expects the primary balance to improve by 1.8 points of GDP, slightly more than both the EU average and that for the euro area (1.4 points of GDP in both cases).

- The COVID-19 crisis had a significant impact on the stock of debt as a percentage of GDP: the ratio increased from 78.3 per cent in 2019 to 92.4 per cent in 2020 for EU countries on average and from 85.1 per cent to 100 per cent in 2020 for euro area countries. The SCPs show that in 2022 the public debt of EU countries is expected to rise to 93.5 per cent of GDP, while that of the euro area is set to rise to 101.1 per cent of GDP. Italy, which recorded the second highest public debt in relation to GDP in 2020 (155.8 per cent, compared with 134.6 per cent in 2019), would maintain the same position in 2022 with a public debt equal to 156.3 per cent of GDP.

- According to the SCPs, the average annual increase in public debt expected in 2021-2022 both among EU countries and euro area countries is about 0.6 points of GDP. Italy shows an average increase in public debt just below both averages (0.3 points of GDP).

- In the three countries examined in the second part of the Focus (Germany, France and Spain), the COVID-19 epidemic triggered a deep recession in 2020 (GDP contracted by 10.8 per cent in Spain, 7.9 per cent in France and 4.8 per cent in Germany), with significant impacts on deficit and debt, which expanded due both to the operation of automatic stabilizers and the adoption of major discretionary measures. For all three countries, the continuation of the epidemic between the end of 2020 and the first half of 2021 produced a deterioration in macroeconomic and public finance forecasts for 2021-2022. For this reason, the Council of the EU recommended the three countries to maintain an expansionary fiscal policy in 2022 and to reduce the stimulus measures only when the overall macroeconomic scenario improves permanentely, ensuring the long-term sustainability of public finances. For France and Spain, the suggestion is forthe stimulus to be mainly based on the use of the resources available under the Recovery and Resilience Facility (RRF), in order to limit the impact on the public finances.

- The National Recovery and Resilience Plans (NRRPs) presented to the Commission by Germany, France and Spain make full use of the RRF grants (€69.5 billion for Spain, similar to the €68.9 billion estimated for Italy; €40 billion for France; and €25.6 billion for Germany). As a percentage of 2020 GDP, the RRF subsidies would amount to approximately 6.2 per cent for Spain, 1.7 per cent for France and 0.8 per cent for Germany (4.2 per cent in the case of Italy).

- The German SCP indicates that the long-term impact of the measures associated with the RRF could increase GDP by about 2 percentage points compared with the baseline scenario (i.e., in the absence of the measures envisaged in the NRRP). The French government estimates the cumulative effect of the implementation of the Plan in the period 2020-2025 to 4 additional points of GDP compared to the baseline scenario; in the long run, GDP would be about 0.9 percentage points higher. According to the Spanish SCP, a simulation of the macroeconomic effects of the measures implemented under the NRRP points to a multiplier effect greater than unity in the short term (already in 2021), while in the long term it would have an impact of about four-tenths of a point of GDP.

Text of document (in Italian)