- Geopolitical uncertainty remains high, uncertainty about prices and interest rates should not be underestimated.

- Italy’s GDP grows faster than the euro area average for the third year (0.9 per cent in 2023)

- Growth in the first quarter of 2024 is estimated at 0.2 per cent quarter-on-quarter, with a wide ‘range’

- Inflation remains lower than the European average, despite the rise in March

- Manufacturing remains weak; uncertainty in the economy due to changes in the Superbonus incentive

- Consumer and business confidence rise, consumer spending remains uncertain

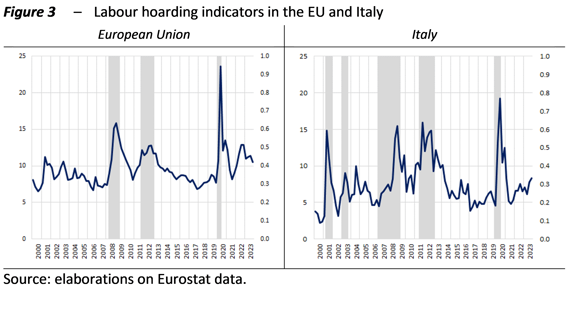

- Employment in Italy is doing well, there are no wage tensions and labour hoarding is low

- There are downside risks in the medium term, due to instability in the international environment

12 April 2024 | Today the Parliamentary Budget Office (PBO) published its April Report on Recent Economic Developments, which analyses the performance of the Italian and international economy based on the latest available indicators and short-term trends.

The international context: uncertainty factors not to be underestimated

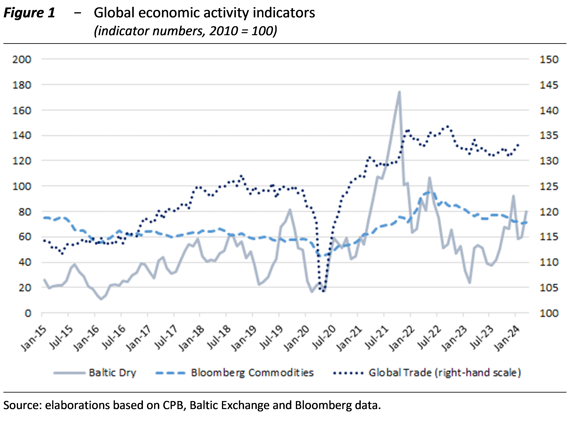

The international scenario remains unstable and uncertain due to the various conflict situations taking place on several geopolitical fronts. Intercontinental transport and thus trade in goods are slowing down; the prices of some commodities, especially crude oil, are also affected. Tensions surrounding shipping in the Red Sea seem to be having a limited impact on rising prices for now. Despite these obstacles, world trade forecasts point to a strengthening in the coming quarters, even though demand remains weak (Figure 1). Inflation is forecast to decline further assuming the easing of price tensions for energy and agricultural goods; inflation in recent months has fallen at different rates in the US and the euro area, where prices fell faster.

Monetary policy is expected to ease in the coming quarters, the exact timing will depend on macroeconomic data as they become available. Overall, the uncertainty surrounding the global scenario is such that new upside risks for inflation cannot be ruled out.

The Italian economy: moderate growth but still above the European average

The GDP of the Italian economy grew by 0.9 per cent in 2023, for the third consecutive year above the euro area average (0.4). Growth in Italy was mainly driven by the services and construction sectors, with private consumption and investments, both in construction and capital goods, contributing to demand. In the final part of the year, the economic cycle was moderately expansive, although almost entirely driven by the construction sector, in view of the expected future downsizing of the Superbonus initiative.

In the short term, the economy is still expected to expand slightly. According to PBO estimates, Italy is projected to grow at a moderate pace in the first quarter of 2024: GDP is forecast to increase by 0.2 per cent (Figure 2), a quarter-on-quarter growth rate similar to that of the two previous periods but with potential for wide swings both upwards (0.4) and downwards (0.0). Forecast uncertainty is also high due to the recent revision of national accounts data and the difficulty of quantifying investment in the construction sector. However, the January construction output figure was very high.

Downside risks also remain prevalent in the medium term, mainly due to high geopolitical tensions.

Household consumption, businesses and employment

Household consumption grew by 1.2 percentage points in 2023 compared to the previous year. The purchasing power shrank in the autumn, eroded by rising prices against a virtually stable nominal disposable income. The indicators processed by the PBO for the first quarter of 2024 showed a slight easing of uncertainty for households and businesses.

On the business and investment front, capital accumulation in 2023 slowed down after the strong growth of 2021-22; however, capital accumulation last year was strong, especially about equipment, machinery and construction. In the first part of 2024, businesses appear more inclined to invest and, according to the PBO indicator on difficulties in accessing the credit market, there is an improvement in opinions on accessing credit, after the high tensions observed last year.

As for trade, 2023 was marked by a slowdown to 0.2 percent in Italy’s exports, which nevertheless remained above those of its main euro area partners when compared with pre-pandemic values. Qualitative surveys overall point to a strengthening of trade with the rest of the world in the short term. On the import side, a negative -0.5 percent change was recorded in 2023, although imports showed a slight quarter-on-quarter recovery at the end of 2023.

Value added in the tertiary sector declined in the final quarter of 2023 but still increased by 1.6 percent over the year overall, almost twice as fast as GDP. In the short term, services activity is expected to strengthen.

Manufacturing has been weak for two years, but the outlook is favourable. In the early months of 2024, the manufacturing PMI showed signs of recovery and broke through the 50 marks in March, entering positive territory. The construction PMI index, which had been growing at a very high pace in previous periods, deteriorated in March, especially for civil engineering works.

Employment continues to strengthen, especially permanent employment. New jobs were created mainly in the services sector, which contributed more than 2/3 of the total positions created in 2023. Preliminary information for the first two months of 2024 shows slightly growth and confirms the trend seen in previous quarters. The gap between labour supply and demand in major manufacturing sectors remains wide.

According to the PBO’s Report on Recent Economic Developments, wage tensions and the phenomenon of labour hoarding, i.e., companies’ keeping of workers in excess of production needs even in periods of weak demand, are lower than in other European countries. The lower recourse to labour hoarding in Italy (Figure 3) appears consistent with the indications of economic surveys among companies, which report fewer production constraints due to labour shortages in Italy.

Inflation recedes but is still persistent in core components

After the marked decline in inflationary pressures in the latter part of 2023, price dynamics in the services and food sectors remain high. Core inflation in Italy is roughly stable at around 2.5 percent.

In March, inflation picked up temporarily to 1.3 percent but remained lower than in Europe. Acquired inflation for 2024 stands at 0.6 percent for the overall index and 1.3 percent for the core component. Market expectations outline better prospects and less uncertainty about inflation returning to values not exceeding 2 percent.