The Flash “The distributive effects of price increases and household support measures” (in Italian) (for which an infographic (in Italian) is also available) provides an assessment of the impact on the budgets of the Italian households of the increase in prices occurred since the second half of 2021 and of the support measures implemented by the Government in the period June 2021 – September 2022. The findings of the distributional analysis are then compared with those of a previous analysis for the period June 2021 – May 2022 to identify how the impact of higher inflation on spending has changed in the last four months, especially for households with lower levels of expenditure, including and excluding support measures.

Support measures to shield households against price increases

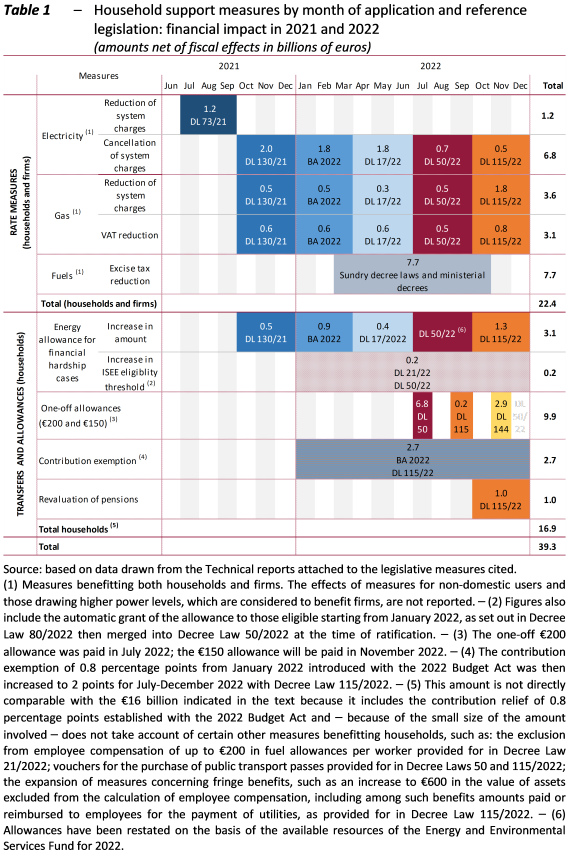

Overall, the measures adopted so far in 2021-2022 have a total value of €62.8 billion: €22.4 billion involve measures benefiting both businesses and households and €16 billion concern interventions targeted specifically at households, while the remainder is reserved for firms only.

Measures involving households can be grouped into three types. First, general measures have been rolled out to contain energy prices, impacting taxes or the regulated components of prices. More specifically, this has involved the reduction of excise duties on fuels, the reduction of VAT on gas for civil and industrial use to 5 per cent and the reduction of general system charges for both electricity and gas (Table 1).

The reduction in the rates of excise duty on fuels, implemented with various measures for the period from 22 March to 31 October 2022, is equal to 25 cents for petrol and diesel, which corresponds to a discount of 30.5 cents before VAT. Official assessments calculate a total gross cost (for measures comprising households and firms) of €7.7 billion.

The 5 per cent reduction in VAT on gas for civil and industrial use was initially implemented in September 2021 (Decree Law 130/2022) and reintroduced for this year with various measures, for an estimated total cost of €3.1 billion.

General system charges represent costs connected with activities of general interest for the electricity and gas systems. They are included in utility bills as fixed and variable components. The government reduced or eliminated these charges for domestic uses and low-voltage users in 2021, subsequently extending the relief for all of 2022, for a total cost of €11.6 billion.

A second group of measures supports households with various forms of monetary transfers to ease the pressure of inflation on household budgets. Some of the measures are specifically intended for households in financial hardship, such as the expansion of energy allowances, while other more general measures cover a broader range of beneficiaries, such as the one-off €200 and €150 allowances, the contribution relief, the advance payment of the definitive balance of the 2021 pension inflation adjustment and the 2 per cent revaluation of pensions paid between October and December 2022.

The energy allowances, which were introduced in 2007 and were initially available on request before becoming automatic, are a tool to reduce spending on electricity and natural gas by households facing financial hardship (measured on the basis of the equivalent economic status indicator – ISEE – which takes account not only of the size of a household but also its income and assets) or households where a member is coping with a serious health condition (for specific pathologies). The allowances for financial and physical hardship have been expanded in both their amount and pool of eligible beneficiaries. From September 2021, the size of allowances for households with an ISEE of less than €8,265 per year, large households (with at least four children and an ISEE of less than €20,000 per year), recipients of the Citizenship Income or Pension, and people in poor health that are required to use electro-medical equipment has been increased. In 2022 the ISEE threshold for households with fewer than four children was raised to €12,000 and the energy allowance for financial hardship was also granted, retroactively from January 2022, to households that had submitted the ISEE certification after that date. The cost of the expansion of the allowance programme is officially assessed at €3.3 billion from October 2021 to December 2022.

Both the one-off allowances (the €200 payment introduced with Decree Law 50/2022 and the €150 payment provided for under Decree Law 144/2022) are intended to supplement the income of a wide range of workers and pensioners, with eligibility determined on the basis of individual income (less than €35,000 per year for the former and €20,000 for the latter). The total cost for 2022 is €9.9 billion.

The 2022 Budget Act introduced an exceptional reduction for 2022 of 0.8 percentage points in the social security and welfare contributions paid by workers with a monthly salary of up to €2,692 (€35,000 per year), with no change in the rate of calculation of pension benefits. Decree Law 115/2022 increased the contribution relief to 2 points for the second half of 2022. The net cost of the measures for 2022 is an estimated €1.5 billion and €1.2 billion respectively.

Exceptionally, Decree Law 115/2022 provides that 2 per cent of the revaluation of pensions shall be paid on a temporary basis in the last quarter of 2022, for a total net cost of €1 billion in 2022. In addition, the legislation also establishes that the payment of the definitive balance of the 2021 pension inflation adjustment shall be brought forward to 1 November 2022 at a rate of 0.2 per cent, which entails additional net expenditure of €0.4 billion in 2022 and a corresponding reduction in costs for 2023, not included in Table 1.

The analysis reported in this Flash – which was conducted using the PBO microsimulation model – considered the rate measures and monetary transfers involving households between June 2021 and September 2022 indicated in Table 1. Also included were the €150 allowance paid in November and the 2 per cent increase in pensions up to €35,000 per year in the last quarter of the year, which represents a partial 2022 inflation adjustment in advance of the ordinary revaluation as from 1 January 2023.

Inflation developments differ across the various sectors

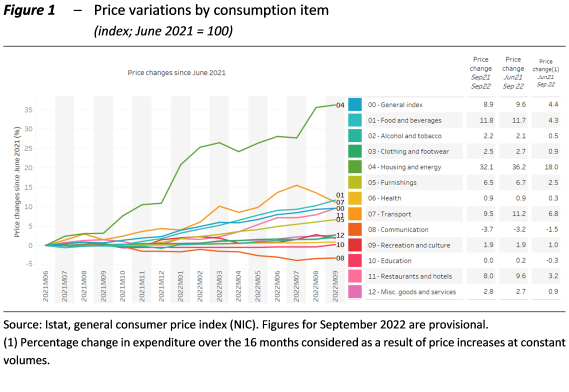

Between June 2021 (when the first inflation tensions began to emerge) and September 2022, the general consumer price index rose by 9.6 per cent, but the trend in inflation differed considerably depending on the category of goods considered (Figure 1). The item experiencing the fastest growth was housing costs, which includes spending on energy utilities (+36.2 per cent). The rise in the price of energy goods was also reflected in the transport aggregate (+11.2 per cent), while the prices of food products have risen by a total of 11.7 per cent. In the last four months, housing costs have continued to increase sharply. By contrast, transport prices continued to rise until July before falling in the last two months, while food prices have risen every month at an almost constant rate.

Household spending up 3.7 per cent in 16 months

Inflation has a differentiated impact on expenditure as the level of consumption varies for two reasons. First, as the level of expenditure increases, the share of spending allocated to the various items of consumption changes. Second, for energy and fuel bills, changes in rates and taxes are not proportional to consumption: since the weight of the various rate components (energy, transport, system charges, taxes) is not uniform as quantities consumed vary, the change in each of them has a different impact on utility bills for users who consume different amounts of energy.

For the purposes of the analysis, actual expenditure is obtained by applying the Istat general consumer price index (NIC) to the consumption baskets of the individual households in the sample at a high level of disaggregation (4-digit COICOP, 112 expenditure items). For energy goods (fuel, gas and electricity), prices and rates were applied to an estimate of household consumption expressed in terms of quantity (litres of fuel, kWh of electricity and cubic metres of gas). The reconstruction of expenditure on the basis of consumption and the rate structure made it possible to take account of differences in the incidence of the components of the prices of energy goods as a function of the level of consumption. Similarly, the reconstruction of the rate components enables us to analyse the distributional impact that mitigation policies have had in reducing certain of these components.

To estimate the impact of rate mitigation measures (reduction of fuel excise duties, system charges for electricity and gas and VAT on gas), the expenditure that would have been incurred if these measures had not been applied was estimated. To this end, only the measures available until the end of September 2022, the final month covered by the analysis, were considered. The main monetary transfers to mitigate the impact of inflation on households included the expansion of the electricity and gas social allowances, the one-off allowances of €200 and €150, the contribution relief of 0.8 percentage points from January to June 2022 and 2 points from July to September 2022 and the revaluation of pensions by 2 percentage points. The corresponding benefit was estimated for the individual households in the sample on the basis of information on their financial situation (employment status, income and ISEE) drawn from administrative sources. The distribution of the ISEE from administrative sources was supplemented by considering an increasing take-up in 2022, justified by the expected increase in the number of new households that will submit an ISEE in 2022 due to the introduction of the single allowance for dependent children.

Overall, since June 2021 households have benefited from an estimated €27 billion in additional resources.

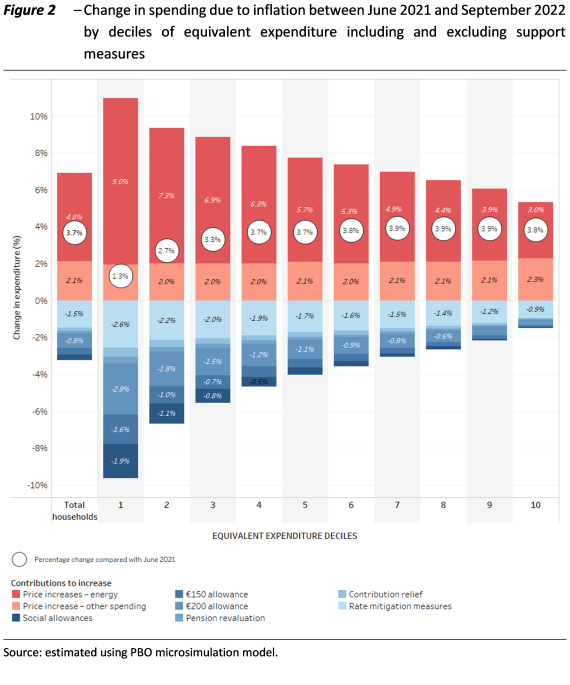

Figure 2 illustrates (white circles) the change in household expenditure in the sixteen months between June 2021 and September 2022 due to price developments and the impact of rate and transfer support measures, broken down by household spending capacity deciles. The bars, which represent the contributions to the increase in expenditure, indicate the impact of developments in the prices of energy goods (fuel, electricity and gas) and the other goods included in the basket that would have occurred in the absence of support policies (red bars) and the effect of those policies (blue bars), highlighting the associated distribution.

Over the entire period considered (June 2021 – September 2022), average household expenditure, taking account of the support measures, increased by an estimated 3.7 per cent. Without these measures, the average impact on household budgets would have amounted to 6.9 per cent, of which 4.8 points attributable to the energy sector. Overall, therefore, the support measures (blue bars) limited the increase in expenditure due to inflation by about 46 per cent (3.2 points).

Support measures have a significant redistributive impact

In general, inflation has a regressive impact: for the lower deciles of equivalent expenditure, the burden has been significantly greater than for the rest of the population. For the first decile, inflation in the absence of support policies would have increased expenditure by about 10.9 per cent, 4 points above the national average and more than double the impact experienced by the tenth decile. This is a consequence of the fact that the largest price increases involved basic necessities (electricity, gas and food), which account for a larger proportion of the spending of the poorest segments of the population.

For this same reason, energy price mitigation measures (reduction of excise duties, system charges and VAT) are progressive. The support measures implemented in the form of transfers, subject to different forms of means testing and largely disbursed as a fixed amount, are even more markedly progressive.

Overall, the action of the support measures offsets the regressive impact of inflation, producing a significant net redistribution: the impact of inflation on households in the first decile is reduced by about 88 per cent (9.6 points), being about one-third of the average (1.3 points compared with 3.7).

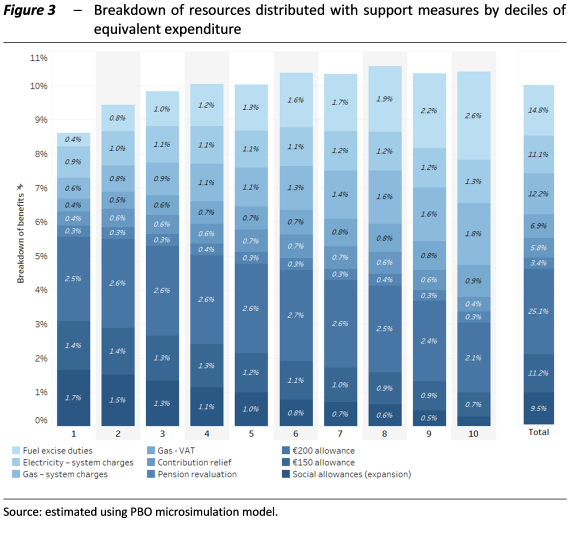

Even the higher deciles still receive significant resources (for example, 10.4 per cent go to the tenth decile; Figure 3). This is explained by the fact that these deciles consume more energy and therefore derive a greater absolute benefit from price reduction measures. For example, the reduction in excise duties on fuels benefitting the tenth decile accounted for about 2.6 per cent of the total resources distributed, while the benefit for the poorest decile does not exceed 0.4 per cent. The same phenomenon can also be seen for the reduction of system charges on electricity and gas and the cut in VAT on gas, although the effect is smaller.

What changed between June and September 2022

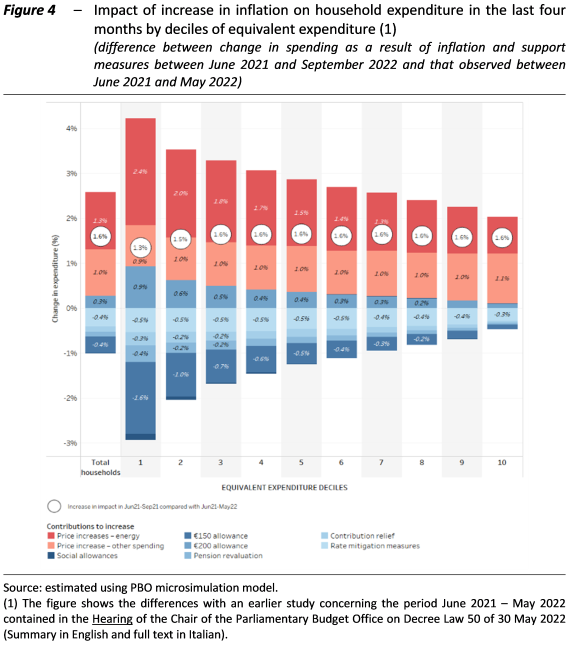

In the first year of rising inflation (June 2021 – May 2022), the estimated gross impact of higher prices (without taking account of offsetting measures) came to about 4.6 per cent of expenditure, about 2.3 points lower than that registered at the end of September 2022, just four months later. Net of rate mitigation measures and transfers, the impact over the twelve months averaged about 2.1 percentage points, just over half that observed at the end of September (3.7 per cent), even considering the new one-off allowance of €150, the increase in contribution relief, the revaluation of pensions and the increase in the discount on consumer gas prices. The increase in the burden on households that emerged in the summer months (1.6 points) is attributable to a combination of factors: the persistence of energy prices at close to peak levels (+1.3 points), the progressive spread of price increases to other expenditure segments (+1 point), and the dilution of the impact of the first one-off allowance of €200 over a longer period of time (+0.3 points) (Figure 4).

These effects were partially offset by the new €150 allowance (-0.4 points), utility rate reductions (-0.4 points), the increase in contribution relief (-0.1 points) and the revaluation of pensions (-0.1 points). The net increase was distributed across all households, with a slightly smaller impact only in the two lowest deciles (+1.3 points in the first and +1.5 points in the second).

Given the persistence of inflation, household purchasing power has fallen rapidly: the impact on the first decile was substantially offset between June 2021 and May 2022, but in the last four months inflation added a burden (for the entire period) of about 1.3 per cent of expenditure. The weight of electricity and gas specifically affects households with lower spending levels. The price increases experienced by these items in the last four months have exceeded, even in this segment of the population, the impact of the €150 allowance, the expansion of contribution relief and the revaluation of pensions.

The effects of a different mix of support policies

The simulation model also enables an assessment of the distributive effects of a different mix of support policies for any given level of resources, such as, among other possible, a reduction in rate mitigation measures, which attenuate the price signals necessary for the efficient use of resources, balanced by an increase in compensatory transfers. For example, the transformation of about 50 per cent of the reduction in excise duties on fuels into a transfer could reduce the expenditure burden for the first decile by 0.6, 0.9 or 1.3 percentage points depending on whether the monetary compensation is disbursed in a manner similar to the €200 allowance, the €150 allowance or the new social allowances, respectively. In the latter case, therefore, the restructuring of the policy mix with a shift of charges from the reduction in the excise duties on fuels to an increase in the social energy allowances would have fully offset the impact of inflation on spending by households in the first decile. A less pronounced distributive impact would be obtained by replacing rate mitigation measures for electricity and gas (system charges and VAT reduction) with compensatory transfers of equal value, which would have made it possible to reduce the burden on the first decile by a maximum of 1 percentage point.

Summary

Text of document (in Italian)