The Focus Paper “The 2021 Budget Act: an analysis of the definitive legislation” (in Italian) provides a summary examination of the final version of the 2021 Budget Act (Law 178/2020) approved by Parliament on 30 December 2020.

The budget package produces an increase in the general government deficit compared with the unchanged legislation figures for 2021 and 2022 by 1.4 and 0.6 percentage points of GDP respectively (equal to €24.5 billion and €11.8 billion in absolute value), followed by a decrease of 0.2 percentage points in 2023 (€3.6 billion in absolute value).

The budget strategy for 2021 and subsequent years, as outlined in the measure approved by Parliament, also takes account of the possibility of using European Union (EU) funds under the Next Generation EU (NGEU) programme, consisting of the set of financial instruments to support the recovery and resilience of the EU economies adopted in response to the pandemic crisis.

In 2022 and 2023, the estimated impact on the public finance aggregates reflects the fiscal feedback effects[1] induced by the budget measures, including those deriving from the use of the grants available under the NGEU programme.

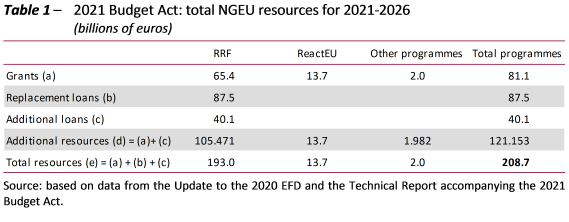

With regard to NGEU funds, the Budget Act envisages the use of all the resources available to Italy, which are estimated to total around €209 billion. More specifically, €121.2 billion would be used for additional measures, while the remaining €87.5 billion would represent an alternative source of financing for measures already present in current legislation (Table 1). The total funds for additional measures consist of grants of €81.1 billion and additional loans of €40.1 billion. The grants are in turn divided between those provided through the Recovery and Resilience Facility (RRF) in the amount of €65.4 billion, those under the ReactEU programme of €13.7 billion and those disbursed under other programmes totalling €2 billion.

[1] This feedback effect is estimated using forecasting models and it represents the impact on the public finance aggregates (and in particular on revenue) of the higher GDP growth spurred by the budget stimulus – including the use of European funds (grants only).

Text of document (in Italian)