9 March 2023 | The Focus Paper “The 2023 budget package: an analysis of the version approved by Parliament” briefly examines the final versions of the 2023 Budget Law, approved by Parliament on 29 December 2022 and of Italian Decree-Law 176/2022, converted with amendments by Italian Law 6/2023, and concerning urgent support measures in the energy sector and public finance.

Compared to the trends under unchanged legislation, the package should have resulted in a worsening of the net borrowing of the General Government (PA) by 0.5 percentage points of GDP last year (EUR 9 billion), by one percentage point in the current year (EUR 20.8 billion) and by 0.1 points in 2024 (EUR 2.1 billion); for 2025, instead, the package should improve the deficit by 0.2 percentage points of GDP (EUR 4.9 billion). The effects on the balances with respect to the initial version presented by the Government to Parliament have thus been substantially confirmed.

The overall package entails decreasing net revenue compared to the trend scenario for each of the four years and increasing net expenditure in the first two years and decreasing in the subsequent two, especially in 2025.

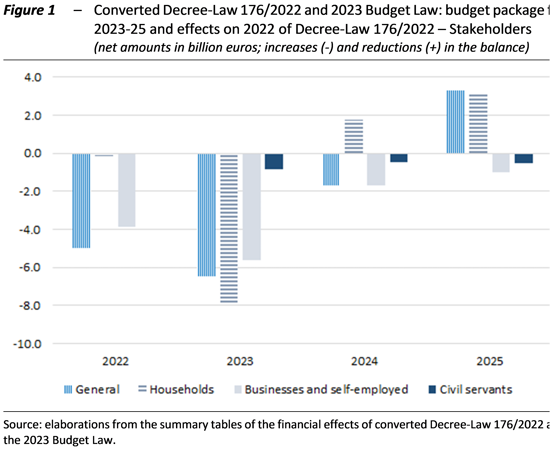

The recipients of the various measures can be classified into four categories: households, enterprises and the self-employed, civil servants, as well as a group of so-called “general” interventions, as they are aimed at several subjects at the same time (Figure 1).

In 2022-23, the measures having the greatest impact are those concerning the “general” group (with net benefits of EUR 5 billion in 2022 and EUR 6.5 billion in 2023) and those concerning the group comprising businesses and the self-employed (with net benefits of EUR 3.9 billion and EUR 5.6 billion in both years); this is due to measures aimed essentially at tackling high energy prices. In 2023, the household sector, which is the largest net beneficiary (with EUR 7.9 billion), is also among those benefiting from the interventions. In 2024 and 2025, only measures concerning households are found to improve the balance in both years (by EUR 1.8 and EUR 3.1 billion respectively) while “general” measures improve it in 2025 (by EUR 3.3 billion). In the same two-year period, businesses and the self-employed will continue to benefit from various measures.

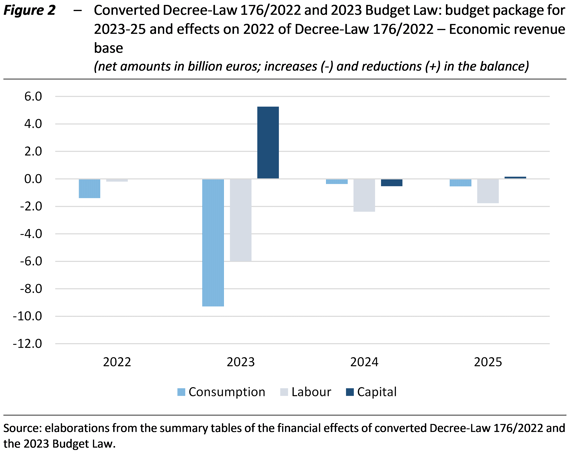

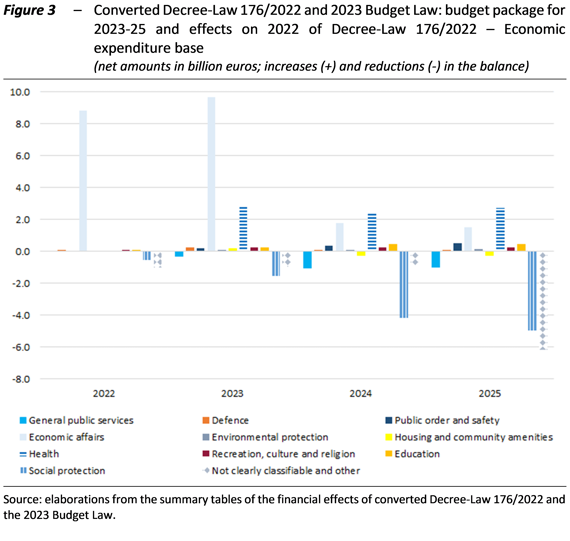

For a breakdown of net revenue and net expenditure by economic thematic areas, a number of classifications adopted at European level can be considered: on the one hand, the allocation of taxes according to tax base categories (consumption, labour, capital) (Figure 2) and, on the other hand, the COFOG functional classification of expenditure (Figure 3).

Looking at the relative importance of the different tax instruments used in the budget package, taxes on consumption and labour decrease in each of the years under review (Figure 2), especially in 2023 (by EUR 9.3 billion and EUR 6 billion net, respectively), while, except in 2024, taxes on capital increase, again especially in 2023 (by EUR 5.3 billion net).

Looking instead at the relative weight of the net expenditure items of the budget package (Figure 3), the higher net expenditures concern the COFOG classification functions on economic affairs, mainly in 2022-23, and health from 2023. The lower net expenditures, used to cover and reduce the deficit, are concentrated – for all four years – on the social protection function and on a group of expenditures that cannot be clearly classified at the current state of information; with regard to the latter, the savings are substantial, especially in 2023 and 2025, and are essentially contained in Section II of the Budget Law.

After parliamentary approval, the overall stance of the budget package remained largely unchanged, although several new measures were introduced. Compared to the initial drafts, the impact of the changes resulted in marginal improvements in the balance, as a consequence of similar reductions in net revenue and net expenditure.

The amendments to Decree-Law 176/2022 are due to the transposition – with financial effects almost exclusively on 2022 – of the contents of Decree-Law 179/2022, containing urgent measures on excise duties on fuels and support to territorial entities and the territories of the Marche Region affected by extreme meteorological events.

As far as the budget law is concerned, the changes introduced during the parliamentary procedure can be classified into three categories (especially in Section I).

• New provisions with a substantial financial impact, accompanied in some cases by specific financing modalities: among the most relevant is the extension to 2023 of certain tax credits in favour of the South of Italy (for about EUR 1.5 billion) for the purchase of capital goods intended for certain production facilities, financed through the reduction of the Fund for Development and Cohesion of the 2021-27 programming period.

• Regulatory or estimate changes to existing measures in the draft budget law: among the most financially relevant changes are those concerning labour and social policies and social security.

• Small-scale interventions financed by drawing on funds increased or introduced in the draft law: in most cases, these are interventions of a localised and micro-sectoral nature, which were essentially financed through the use of resources from the Fund for non-deferrable expenditure and the Fund to cover interventions falling within the competence of Ministries in line with the objectives set out in the budget package.

Under Section II of the Budget Law, changes were made in terms of both re-financing and, most importantly, de-financing (for financing purposes) compared to the draft budget law, while there were no substantial changes in terms of rescheduling.

Text of document (in Italian)