An overview of the budget strategies in the 2023 Stability and Convergence Programmes of EU countries

The Focus Paper published by the Parliamentary Budget Office (PBO) analyses the macroeconomic and public finance scenarios presented by EU Member States in the 2023 Stability and Convergence Programmes (SCPs). Furthermore, the Paper examines the predominant stance of fiscal policies and their consistency with the rules of the Stability and Growth Pact, which is expected to be fully reactivated in 2024. Finally, it outlines the recommendations addressed by the EU Council to the euro area and the main Member States.

EU countries’ GDP grew on average by 3.6 per cent in 2022

In 2022, despite the conflict in Ukraine and the ensuing energy crisis, real GDP grew in all EU countries, with the sole exception of Estonia, on average by 3.6 per cent. Among the major euro area countries, the biggest positive surprise in 2022 was the GDP growth recorded in Italy, standing at 3.7 per cent – higher than the EU average – and in Spain, while GDP growth in Germany was far below the forecast of the 2022 Stability Programme.

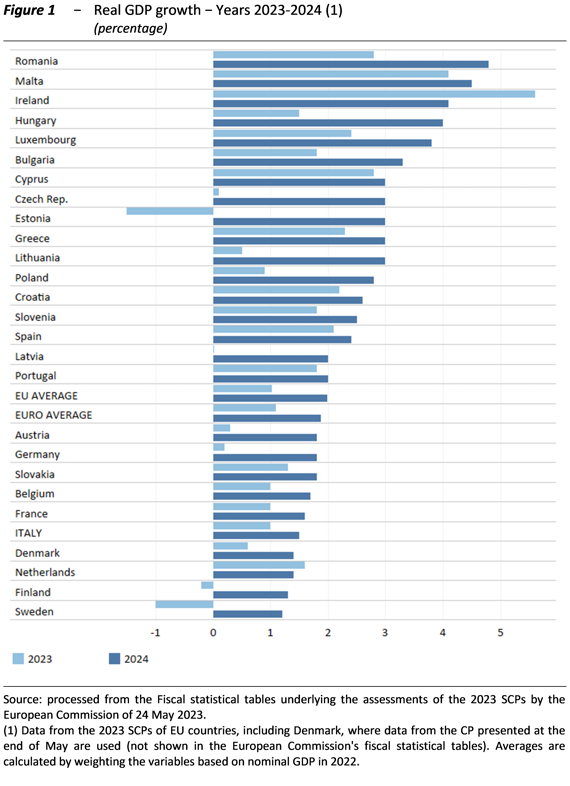

SCPs expect sluggish growth in 2023 with recovery in 2024

In 2023, the forecasts of the Stability and Convergence Programmes for all EU countries show positive GDP growth (1 per cent on average for EU countries, 1.1 per cent for euro area countries), except for Sweden, Finland and Estonia; Latvia is expected to record virtually no GDP growth. In 2024, SCPs expect a return to positive GDP growth in all EU countries, averaging 2 per cent (Figure 1).

Inflation forecast still high in 2023, declining sharply as from 2024

In 2022, inflation − as measured by the GDP deflator growth rate − was high, although heterogeneous across countries, averaging 4.7 per cent among euro area countries and 5.5 per cent among EU countries. In 2023, The SCPs’ inflation estimates still appear very heterogeneous across countries, averaging 5.7 per cent among EU countries and 5.3 per cent among euro area countries. The SCPs suggest the inflation rate will decrease in 2024, averaging 3 per cent for EU countries and 2.8 per cent for euro area countries.

Lower-than-expected government deficits in 2022…

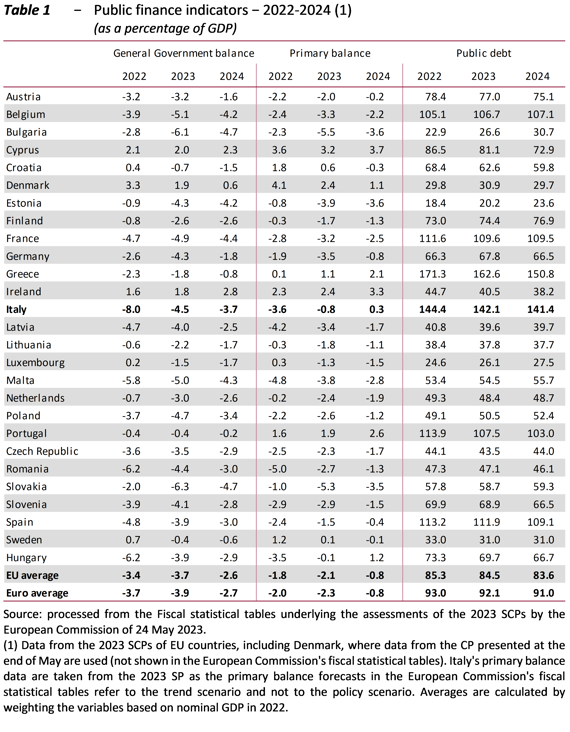

In 2022, the general government deficit-to-GDP ratio averaged over 3 per cent in both EU (3.4 per cent) and euro area countries (3.7 per cent). In Italy the deficit was higher, standing at 8 per cent of GDP, mainly due to the financial effects of the Superbonus and Façade Bonus. As a matter of fact, if we rule out the impact of their reclassification, the deficit would have been broadly in line with its forecast (5.7 per cent of GDP compared to 5.6 per cent projected in the 2022 Stability Programme). In general, the deficits recorded in EU countries were in line or below the forecasts of the 2022 SCPs, except for Italy, Malta and Hungary.

… yet still above 3 per cent of GDP on average in 2023

In 2023, a general government deficit-to-GDP ratio of more than 3 per cent is expected for both the average of EU countries (3.7 per cent) and euro area countries (3.9 per cent). In seventeen countries, including Italy, the deficit is expected to stand at or above 3 per cent of GDP (Tab. 1).

In 2024, both averages of EU and euro area countries are projected to show a general government deficit-to-GDP ratio below the 3 per cent threshold (2.6 per cent for EU countries and 2.7 per cent for euro area countries). Italy’s SP still has a budget deficit target above the 3 per cent threshold (3.7 per cent).

Public debt gradually decreasing, yet still averaging above 60 per cent of GDP

In 2022, public debt averaged 85.3 per cent of GDP in EU countries and 93 per cent of GDP in euro area countries. Thirteen countries recorded debt above the 60 per cent of GDP threshold, of which six with debt above 100 per cent of GDP, including Italy, which recorded the second highest public debt (144.4 per cent of GDP) after Greece. However, compared with the forecast of the 2022 Stability Programme, Italy’s figure is 2.6 per cent of GDP lower, mainly due to the more favourable contribution of the stock-flow adjustment component (aside from the effect due to changes in the accounting criteria of some construction bonuses).

In 2023, EU countries expect an average public debt standing at 84.5 per cent of GDP (92.1 per cent on average in euro area countries). Public debt is above the 60 per cent of GDP threshold in thirteen countries and above the 100 per cent level in six countries. Italy’s SP still shows the second highest public debt in the EU (142.1 per cent of GDP), after Greece. In 2024, the average ratio in EU and euro area countries, is projected to only slightly decrease (to 141.4 per cent in Italy).

In 2024, European monitoring will be based on the growth of net primary expenditure

The analysis conducted by the PBO also focuses on detailing compliance with the 2024 budget rules according to the European Commission’s forecast and the EU Council’s recommendations on budgetary policy for euro area countries.

Given the deactivation of the general escape clause of the Stability and Growth Pact at the end of 2023, the country-specific recommendations of the EU Council are based, in line with the proposed reform of the European governance framework, on a quantitative ceiling on the growth of net nationally financed primary expenditure consistent with an adjustment of the structural budget balance ranging between a minimum of 0.3 per cent of GDP and a maximum of 0.7 per cent, based on debt sustainability considerations. In 2024, Italy is projected to have a net nationally financed primary expenditure growth of 0.8 per cent and an expenditure growth ceiling of 1.3 per cent, consistent with a fiscal adjustment of 0.7 per cent of GDP; the projected growth of net primary expenditure thus appears to be in line with the recommendation of the Council.

Moreover, countries with debt above 60 per cent of GDP, such as Italy, are recommended to continue pursuing a medium-term fiscal strategy of gradual and sustainable consolidation, combined with investments and reforms capable of fostering better productivity and higher growth. Finally, the Council recommended Italy to further reduce taxes on labour and to make the tax system more efficient while preserving progressive taxation schemes and improving fiscal equity.

Restrictive fiscal stance in the next two years

A specific section of the Focus Paper describes the predominant fiscal stance in the various countries and overall in the euro area in 2023-2024. The analysis shows that the fiscal stance indicator for the euro area estimated by the European Commission suggests a restrictive fiscal stance in both 2023 and 2024, mainly driven by the gradual phasing out of most of the measures to support households and businesses in the face of price rises caused by the energy crisis.

Text of document (in Italian)