Drawing on the Recommendations and the set of indicators used by the European Commission to assess the Stability and Convergence Programmes (SCPs), the Focus Paper “A review of budget strategies in the 2022 Stability and Convergence Programmes of EU countries” (in Italian) (also available in interactive form at https://en.upbilancio.it/comparison-between-the-2022-stability-and-convergence-programmes/) (in English) offers a comparison of public finance outcomes and budget strategies of EU countries.

In the “2022 European Semester – Spring Package” Communication, the European Commission provided guidelines on the overall strategy for the formulation of the country-specific recommendations and on the fiscal stance of national policies. Primarily, given the growing uncertainty stemming from the conflict in Ukraine, the downside risks to the economic outlook, the rise in energy prices and the supply chain bottlenecks, the Commission concluded that an extension of the general escape clause to 2023 was warranted. In addition, the European Commission proposed that the more or less expansionary fiscal stance stemming from national policies should be differentiated in relation to the debt/GDP ratios of Member States. Finally, it put forward recommendations concerning structural reforms of national budgetary frameworks, the implementation of the National Recovery and Resilience Plans (NRRPs), energy policy and outstanding and/or newly emerging structural challenges.

The first section of the Focus paper provides a comparison, for all EU countries, of the main fiscal indicators for 2021, 2022 and 2023. The following one describes the fiscal stance indicator used by the European Commission, while the third section focuses on the budget strategies of the main euro area economies – namely France, Germany and Spain – which are also briefly described with regard to Italy.

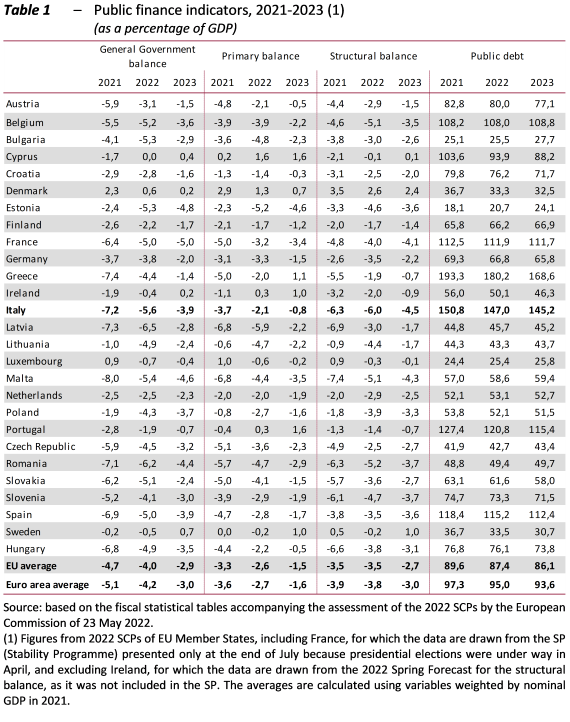

An analysis of the SCPs and the main public finance indicators contained therein (Table 1) highlights a number of key elements.

- In 2021, EU countries registered an average general government deficit of 4.7 per cent of GDP, which rises to 5.1 per cent for euro area countries. These figures are lower than the deficit reported by Italy, equal to 7.2 per cent of GDP.

-

- In 2022, both the EU and euro area Member States forecast an average general government deficit higher than 3 per cent of GDP (4 per cent and 4.2 per cent, respectively), which is expected to decline in 2023 (2.9 per cent and 3 per cent of GDP, respectively). Italy plans to reach a deficit higher than 3 per cent of GDP in both years: 5.6 per cent in 2022 and 3.9 per cent in 2023.

-

- Between 2021 and 2023, the SCP forecasts show an average annual reduction of the general government deficit of 0.9 points of GDP among EU countries and 1 point of GDP among euro area countries, while for Italy the budget balance would improve by an average of 1.7 points of GDP, more than both the European averages.

-

- Public debt in 2021 was above the 60 per cent of GDP threshold for the majority of the EU countries (89.6 per cent on average for EU Member States and 97.3 per cent for the euro area countries).

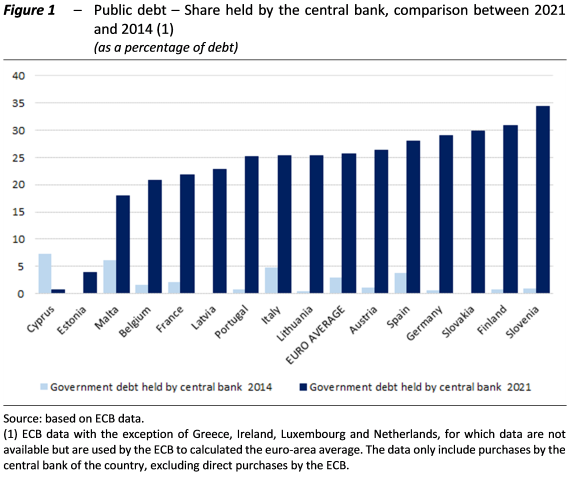

- Following the inception of the Eurosystem’s asset purchase programmes, the share of debt held by euro area central banks (Figure 1) increased significantly, rising from 2.9 per cent at the end of 2014 to 25.6 per cent at the end of 2021. In 2021, the share of Italian debt held by the Bank of Italy was 25.3 per cent, just under the euro area average. The level was lower than that of Germany (28.9 per cent) and higher than that of France (21.8 per cent).

-

- According to the SCPs, in 2022 average public debt among EU countries is estimated at 87.4 per cent of 2022 GDP, while for euro area countries it is 95 per cent. Italy, which last year had a public debt equal to 150.8 per cent of GDP, would continue to have the second highest debt/GDP ratio in both years after Greece: 147 per cent in 2022 and 145.4 per cent in 2023, significantly higher than the average for EU countries (86.1 per cent) and euro area Member States (93.6 per cent) in 2023.

-

- Between 2021 and 2023, the expected average annual reduction in the debt/GDP ratio in both EU and euro area Member States is estimated at 1.8 points of GDP. Italy estimates an average annual reduction in its debt ratio of 2.8 points of GDP, outpacing both European averages.

-

- According to the European Commission’s estimates, on average, EU and euro area countries will have an expansionary fiscal stance in 2022, with an overall fiscal stance indicator of -1.9 per cent of GDP in both cases. The expenditure benchmark for the fiscal stance indicator –e. primary expenditure net of cyclical unemployment-related expenditure, one-off measures and COVID-19 emergency spending (which also includes spending financed with grants under the Recovery and Resilience Facility and other EU funds) – after correcting for changes in discretionary revenue measures, would exceed the benchmark obtained by assuming that the same expenditure aggregate for the previous year increases in line with the medium-term potential GDP growth rate and the growth rate of the GDP deflator. A negative (positive) difference indicates an expansionary (contractionary) fiscal stance. The same indicator for Italy would be equal to -2.8 percentage points of GDP, pointing to a more expansionary fiscal stance than the average. In 2023, a slightly restrictive average fiscal stance is expected for EU and euro area countries, with an indicator of 0.5 and 0.3 points of GDP, respectively. Unlike the average for the EU and the euro area, Italy would still have an expansionary fiscal stance, with an indicator equal to -1.2 points of GDP.

-

- The growth of nationally-financed net primary current expenditure, that the Commission in its 2021 recommendations required Italy to limit, provides in 2022 an expansionary contribution to the overall fiscal stance equal to -1.3 points of GDP. Accordingly, the underlying expenditure aggregate exceeds in 2022 the benchmark obtained by increasing the previous year’s aggregate in line with the medium-term potential GDP growth rate and the growth rate of the GDP deflator. This contribution appears in line with the EU average and is slightly lower than that for the euro area (-1.4 points of GDP). In 2023, for EU and euro area countries, nationally-financed net primary current expenditure would provide a contractionary contribution to the fiscal stance equal to 0.6 and 0.5 points of GDP, respectively, with the corresponding expenditure aggregate below the benchmark. For Italy, this contribution to the fiscal stance would amount to -0.2 points of GDP, making a broadly neutral contribution to the overall fiscal stance.

-

- For the main euro area countries, namely Germany, Spain, France and Italy, the real GDP growth forecasts for 2022 and the following years presented in their respective SPs and in the forecasts of the European Commission remain exposed to considerable uncertainty. With the exception of Germany, whose SP predates the outbreak of the conflict in Ukraine, all countries have significantly lowered the projections formulated in their Draft Budgetary Plans (DBPs) for 2022, but do not take into account the deterioration of the Ukraine crisis and the increased inflationary pressures that have materialized in the meantime. As a result, the forecasts for 2023 appear optimistic compared with the provisional summer forecasts recently published by the Commission.

-

- Despite the deterioration in the growth outlook, the public finances of the main European countries (Germany, France, Italy and Spain) should continue to improve in 2022 and 2023, reflecting the lower impact of automatic stabilisers, the progressive easing of emergency measures imposed to counter the COVID-19 pandemic and increased revenue from rising inflation. On the other hand, this year EU countries have adopted a range of new measures to mitigate the impact of the sudden increase in energy prices on households and firms and to provide assistance to Ukrainian refugees.

- Although still high, the debt/GDP ratios of the main euro area countries (Germany, France, Italy and Spain) are expected to decline over the SP programming horizon, benefiting from the favourable outlook for growth and higher inflation, which is reflected in the GDP deflator. In a low-yield environment, the negative differential between the implicit interest rate and nominal GDP growth (the snowball effect) causes the ratio between the stock of government debt and GDP to decline, whereas a planned primary deficit causes it to rise.

In light of the European Semester Communication and the figures on the fiscal stance, the European Council’s fiscal policy recommendations differ depending on whether or not a Member State is considered a high-debt country. The Council recommends that high-debt countries, such as Italy, France and Spain, ensure prudent fiscal policy in 2023, in particular by limiting the growth of nationally-financed primary current expenditure below medium-term potential output growth. For Germany, a low-debt country, the Council recommends that in 2023 the growth of nationally-financed current expenditure should be in line with an overall neutral policy stance. For all countries, it recommends that fiscal policy should take into account temporary and targeted support to households and firms most vulnerable to energy price hikes and to people fleeing the conflict in Ukraine, while standing ready to adjust current spending to the evolving situation.

Text of document (in Italian)

Interactive form (in English)