The Focus Paper (in Italian) “An overview of public finance strategies in the 2020 Draft Budgetary Plans of euro-area countries”, illustrates the public finance strategies that euro-area countries submitted last October, on which the European Commission published its assessments on November 20th. The data used in the Focus Paper are also available in interactive format.

In the first part of the Focus, the targets for the main public finance aggregates for the years 2018-2020 included in the Draft Budgetary Plans (DBPs) are compared, especially those relevant for the rules of the Stability and Growth Pact (SGP),. After a brief analysis of the fiscal stance of euro-area countries, the final part of the Focus describes in more detail the strategies laid out in the DBPs of the main economies of the area (excluding Italy), namely Germany, France, Spain, the Netherlands and Belgium. In particular, the Focus highlights the divergences from the targets presented in their Stability Programmes in April and briefly discusses the opinions of the European Commission and the conclusions of the Eurogroup on their DBPs.

In this round of submission of the DBPs, for the first time since 2002 no euro-area country is in the corrective arm of the SGP, thus in an Excessive Deficit Procedure (EDP), and therefore all 19 countries are in the preventive arm. Furthermore, the European Commission has not asked any Member State to resubmit its DBP, as no cases of particularly serious non-compliance with the SGP have been found. Finally, according to the estimates presented in the DBPs, all euro-area Member States expect to achieve a nominal deficit of less than 3 per cent of GDP in 2019, with the exception of France, whose breach of the threshold is nevertheless considered by the European Commission to be temporary, close to the threshold and due solely to the one-off impact of a single measure.

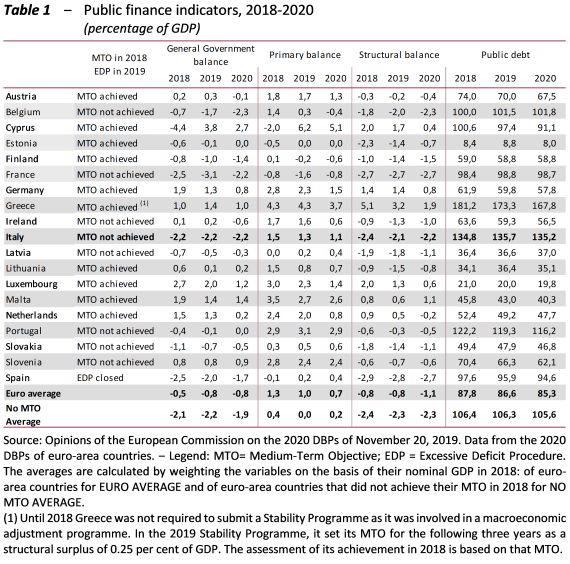

Table 1 compares the main public finance indicators of euro-area countries for 2018-2020 together with the assessments by the European Commission on the achievement of the medium-term objective (MTO) in 2018, based on updated data notified to Eurostat in the autumn of 2019.

These are the main conclusions.

- The average general Government deficit of euro-area countries would be equal to 0.8 per cent of GDP in 2020 (1.9 per cent among the countries that did not achieve the MTO in 2018). The country with the largest deficit target in 2019 is Belgium (2.3 per cent of GDP), while that with the largest surplus target is Cyprus (2.7 per cent). Italy’s deficit target (2.2 per cent of GDP) is the second largest.

- Compared to 2018, annual average general Government balances are expected to deteriorate slightly among euro-area countries by 0.2 percentage points of GDP. The country with the largest expected average annual improvement is Cyprus (3.6 percentage points of GDP), while the countries with the largest expected average annual deterioration are Belgium and Luxembourg (0.8 percentage points of GDP for both). For Italy, the expected average annual change is zero and smaller than for the countries that did not achieve the MTO in 2018.

- The primary balances expected in 2020 average 0.7 per cent of GDP among euro-area countries. The country with the largest forecast primary surplus is again Cyprus (5.1 per cent of GDP), while that with the largest primary deficit target is France (0.8 per cent of GDP). Italy’s target for its primary surplus in 2020 is 1.1 per cent of GDP, greater than the average for both euro-area countries and the countries that did not achieve the MTO in 2018.

- The primary balances forecast for 2019-2020 are expected to deteriorate by an annual average of 0.3 percentage points of GDP. Belgium shows the largest expected average annual deterioration (0.9 percentage points), while Cyprus indicates the largest improvement (3.6 percentage points). Italy reports an expected average annual deterioration (0.2 percentage points of GDP) that is slightly smaller than the euro-area average and slightly larger than the average for the countries that did not achieve the MTO in 2018.

- Average public debt in the euro area is expected to decline from 87.8 per cent of GDP in 2018 to 85.3 per cent in 2020. The country with the largest expected public debt in 2020 is Greece (167.8 per cent of GDP), while Estonia has the smallest forecast public debt (8 per cent). Italy forecasts the second largest public debt in 2020 (135.2 per cent of GDP). Greece is the country with the largest expected average annual decrease (6.7 percentage points of GDP) in 2019-2020, while Belgium reports the largest expected average annual increase (0.9 percentage points). Italy expects to register an average annual increase of 0.2 percentage points of GDP, the fourth largest.

- According to the Commission’s estimates, Belgium, Italy and Finland are the only countries in the euro area whose debt/GDP ratio increases in 2020 compared to the previous year, while in France it remains stable. In Italy, this is mainly due to the unfavourable snowball effect, namely the difference between the average cost of debt and nominal GDP growth, the latter being the lowest in the euro area. Conversely, in other countries the snowball effect is favourable, but is more than offset by persistent primary deficits in France and, less markedly, in Finland. The debt in this country, as in Belgium, is also influenced very negatively by the stock-flow adjustment, in other words the components of the increase in debt that are not included in the general Government net borrowing.

- The average structural deficit among euro-area countries is expected to be 1.1 per cent of GDP in 2020, with an annual average deterioration of 0.1 percentage points in 2019-2020. The country with the largest expected structural surplus in 2020 is Greece (1.9 per cent of GDP), while those with the greatest structural deficits are Spain and France (both at 2.7 per cent of GDP). Italy’s expected structural deficit is 2.2 per cent of GDP (an improvement of 0.1 percentage points on average in 2019-2020), larger than that of euro-area countries and smaller than that of the countries that did not achieve the MTO in 2018.

- Aggregated 2020 DBP data show that euro-area countries, with a slightly positive output gap, will have a barely expansionary fiscal stance in 2019, intensifying ‑ albeit modestly ‑ the following year, essentially due to Germany’s more extensive use of its fiscal space. Accordingly, in both years, the fiscal stance will assume a more expansionary orientation than that deemed appropriate by the EFB. This can be justified, in part, by the worsening macroeconomic forecasts, compared to those made at the time of the EFB assessments.

- Regarding compliance with European fiscal rules, the Commission reports the risk of a significant deviation in annual terms in 2019 and in annual and two-year terms in 2020 for Spain (which this year entered the preventive arm), while the debt rule will not be complied with in either of the two years. France faces the risk of a significant deviation both in 2019 and 2020, while the debt rule will not be complied with in either year. Belgium is not expected to comply with the debt rule in 2019 or 2020. In addition, the Commission indicates the risk of a significant deviation in both 2019 and 2020.

- Germany and the Netherlands continue to overachieve their MTO. In 2019, the debt/GDP ratios of both countries are below the 60 per cent threshold and will continue to decline in 2020. The Commission has recommended that both countries use their fiscal space to raise investment. The Eurogroup agreed with the Commission’s recommendations and said it was satisfied that Germany and the Netherlands have prepared plans to use part of the available resources in 2020 in order to strengthen growth and investment, while preserving the long-term sustainability of their public finances.

Text of document (in Italian)