The Chair of the Parliamentary Budget Office (PBO), Lilia Cavallari, spoke today at a hearing (in Italian) of the Budget and Finance Committees of the Chamber of Deputies, meeting in joint session to consider the bill ratifying Decree Law 50/22 (the “Aid Decree”). After addressing the financial aspects of the decree and trends in Italian inflation, the PBO Chair examined the main measures contained in the decree and their impact on households and firms.

The main elements of the document submitted to the Committees are as follows.

The financial impact of the Decree Law. – Together with measures approved with a previous decree, Decree Law 50 implements the provisions of the 2022 Economic and Financial Document (EFD), which specified areas for which urgent measures were required. However, the legislation is even broader in scope, funding additional measures, some of which are of significant financial scale.

The measures contained in the Decree Law increase general government net borrowing by a declining amount over the next four years: €8.4 billion (0.4 percentage points of GDP) in 2022, €4.2 billion (0.2 points) in 2023, €3 billion (0.1 points) in 2024 and €2.2 billion (0.1 points) in 2025. Considering the increase in the deficit subsequent to Decree Law 38/2022, the above amounts are consistent with the request for the rise in the deficit authorised by the Parliament on 20 April. The policy objectives set out in the EFD are therefore confirmed. Any additional requirements that may arise during the year will have to find additional funding in order to comply with those objectives.

The resurgence of inflation. – In Italy, consumer price inflation, which was low in 2021 (an average of 1.9 per cent), exceeded the 2.0 per cent threshold in the autumn and then jumped upwards in 2022, reaching 6.5 per cent in March, its highest level in the last thirty years. Although the current inflationary spike is largely fuelled by the rise in energy prices (which however slowed in April to 39.5 per cent, from over 50 per cent the previous month), core inflation, which excludes the prices energy and unprocessed food, is also rising (2.4 per cent in April, from 1.9 per cent in March), primarily reflecting the rise in the prices of transportation and domestic utilities. The carry over for 2022 is already slightly above 5.0 per cent for the headline index and 2.0 per cent for core inflation.

Inflation expectations measured by Bank of Italy and Istat surveys of firms and households are at an all-time high. In the spring, the number of firms expecting rising prices exceeded half of the sample interviewed, and even consumers, initially more cautious, now mainly expect prices to accelerate. The increase in inflation expectations at longer term fuels the risk of current inflation taking root. This risk is not negligible, especially in the light of an analysis of the persistence of inflation, i.e. the speed with which price inflation, having been perturbed by a shock, returns to its previous equilibrium level. Examining the trend in consumer prices in Italy from the 1970s onwards, we find that the persistence of inflation declined from the 1980s onward, but in the last decade it has begun to increase again. This trend could signal a risk that the current inflationary phase will take longer than expected to subside.

Measures to mitigate the impact of rising energy prices. – The Aid Decree contains various provisions to shield (for a limited period) households and firms from the impact of the increase in energy prices. These measures closely replicate those already introduced for the same purposes beginning in April 2021 (the Support Decrees) and continuing with the 2022 Budget Act and subsequent decrees.

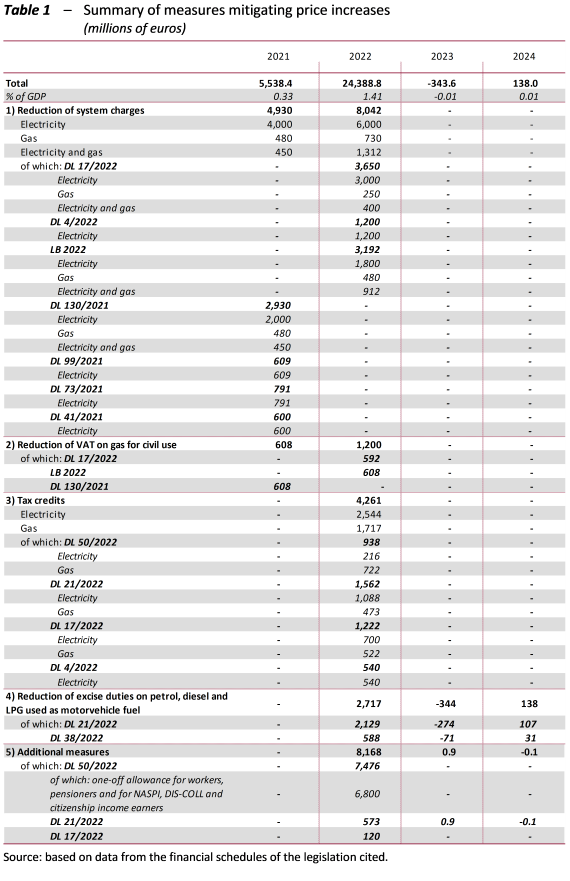

A reconstruction was presented of the total resources appropriated with the various provisions for 2021-2024, including the Aid Decree. They amount to €29.7 billion (of which €24.4 billion in 2022). Of these, €8.8 billion are targeted at households, €7.4 billion at businesses and €13.5 billion at both (Table 1).

The measures in favour of households can be grouped into three categories: 1) measures targeted at specific categories of beneficiary and expressly intended to contain the impact of the increase in energy costs (modification and expansion of social energy allowances); 2) measures aimed at certain beneficiaries that are not expressly intended to contain the effects of the increase in energy prices but which mitigate the effect of energy price inflation on income (a one-off allowance allocating €6.8 billion to employees and self-employed workers, professionals, pensioners and other categories of individuals in financial distress with an income below a specified threshold); and 3) general measures to limit energy price increases for all users, including households and firms (offsetting of general system charges for both electricity and gas, a reduction of VAT on gas for civil and industrial uses to 5 per cent and a reduction of excise duties on petrol, diesel and LPG used as fuels). The measures in support of households and firms also include a number of minor provisions, such as the public transport subsidy.

The measures for firms include provisions covering all economic activities and others reserved for specific sectors. As for households, the former include measures offsetting general system charges, the reduction of VAT on gas, the reduction of excise duties on fuels. Additional measures include a reduction in system charges for low-voltage non-domestic users, and tax credits for the purchase of gas and electricity and measures to support liquidity. Measures targeted specifically at certain sectors include tax credits for energy-intensive industries and those with a high consumption of natural gas, as well as measures for road transport, agriculture and fishing and the sports sector.

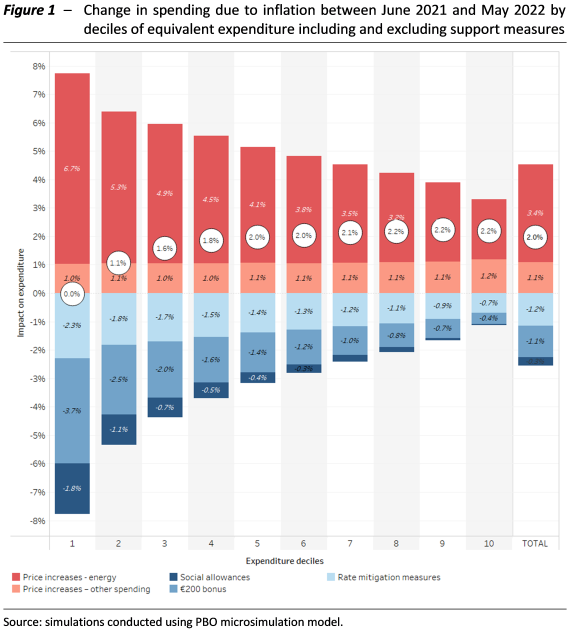

The impact of rising prices on households and the effects of the measures. – The PBO Chair provided the Budget and Finance Committees with a preliminary assessment of the impact of price increases on households and of the mitigation measures taken by the Government so far. The exercise, conducted using the PBO microsimulation model, sought to quantify for a representative sample of Italian households the combined impact on household budgets of the increase in spending linked to the rise in prices in the last twelve months for all consumer items and of the various support measures deployed by the Government starting from the third quarter of last year. During the year, the effects of the reduction in the rate components for energy, the expansion of social bonuses and the one-off allowance of €200 were examined.

The distributional analysis found that the impact of the price increases was greatest for households considered poor in terms of consumption (the lowest deciles of equivalent expenditure), which mainly reflected the greater weight in their expenditure basket of items that have experienced the largest increases (Figure 1). Rate increase mitigation measures are also the most generous for the poorest households but do not fully offset the increase in the prices of energy commodities. The support measures provided in the form of monetary transfers also have a larger impact for low-consumption households, both because they are granted to households with more limited economic resources (as measured using the equivalent economic status indicator – ISEE – for social bonuses and income for the €200 allowance) and because, being generally disbursed as a lump sum, they are naturally progressive as expenditure increases.

The combined action of the measures impacting utility rates, social bonuses and the one-off allowance tends to offset less of the burden of price increases as equivalent family spending rises. More specifically, the simulation exercise suggests that the mitigation interventions fully offset the increases in expenditure attributable to last year’s inflation for households in the first expenditure decile. For households in the other deciles, the offsetting effect is partial. Overall, the change in net expenditure was smaller than the average (2 per cent) for the first four deciles.

The impact of inflation on expenditure (gross of support measures) also increases with the age of the head of household. This again reflects the greater weight in the expenditure basket of older persons, all other conditions being equal, of expenditure items relating to housing and food. However, the differentials are much smaller than those observed for deciles of equivalent expenditure. The distribution of support measures reduces the gap between the elderly and young people without however fully offsetting the difference, while the gap with the contiguous class of 50-65 year-olds is virtually eliminated.

Measures for firms. – The decree on the one hand introduces support measures for firms and on the other provides for an extraordinary tax on excess profits for those operating in the energy industry. The former increase government expenditure in 2022 by €1.4 billion (0.1 per cent of GDP), while the latter are expected to increase revenue by €6.5 billion in the same year, in addition to the €4 billion raised with the same measure introduced with Decree Law 21/2022.

The main measures for firms include a strengthening of tax credits already provided for in Decree Law 17/2022 and Decree Law 21/2022 to offset the higher costs actually incurred as a result of the rise in the prices of electricity and natural gas in the first and second quarters of 2022. These measures channel an additional €0.9 billion in aid to firms. Overall, including the provisions of previous decrees, transfers to firms for spending on energy would amount to €4.3 billion in 2022 (17.6 per cent of total measures to counter energy price increases, equal to €24.4 billion). Electricity-intensive industries, which account for 50 per cent of total electricity expenditure, receive 58 per cent of the aid to contain electricity costs, while gas-intensive industries, which account for 88 per cent of total gas expenditure, receive more than 82 per cent of the associated aid.

A second group of measures is designed to sustain the liquidity of firms. The measures are compliant with the criteria of the Temporary Crisis Framework recently approved by the European Commission to address the new international crisis and allow Member States to support industries directly or indirectly affected by the war in Ukraine and to provide aid to businesses to offset at least part of the increase in energy costs. The measures use the instruments already established in 2020 – “Guarantee Italy” and the extraordinary public guarantee scheme for SMEs through the Central Guarantee Fund – and retained in 2021 to support corporate liquidity during the COVID-19 health emergency.

A third group of measures is of a more general nature – supporting economic recovery and the productivity and internationalisation of businesses – and provides for an increase in the tax credit for investments in intangible assets and technology and digital training (Training 4.0).

Part of the costs of the decree for aid to families and firms is funded with an increase in the tax on excess profits introduced with Decree Law 21/2022 on companies in the energy industry that have potentially benefited from the increase in energy prices and rates. Compared with the provisions of Decree Law 21/2022, the Aid Decree: 1) increases the rate from 10 to 25 per cent; 2) extends to seven months (October 2021 – April 2022) the period for calculating the tax base given by the increase in the balance between output and input invoices net of VAT; and 3) establishes that the payment can be made in two instalments instead of one (a 40 per cent payment on account by 30 June and the balance by 30 November 2022). Revenues of €6.5 billion are expected from these changes, in addition to the €4 billion expected under Decree Law 21/2022. Considering earlier measures, with some €24.4 billion in relatively generalised aid provided to firms and households, a total of €10.5 billion in greater tax revenue is expected from a specific industry. This underscores the significant redistributive nature of the public intervention in response to a crisis that has had highly asymmetric effects among economic sectors.

The overall scale of the tax on excess profits (over 30 per cent of total corporate income tax revenue and 25 per cent of the sum of the corporate income tax and the regional business tax revenue for the 2019 tax year), the characteristics of its tax base and its concentration on a narrow industry depart significantly from the precepts of the ordinary taxation system.

The design of the tax on excess profits (a temporary measure applied only to the increase in the balance between output and input invoices over a specific period of time) appears to avoid the constitutionality issues raised with regard to the “Robin” tax, which was an IRES surtax levied on larger companies of the energy sector in 2008-2014, in a period of similar price and rate increases. Furthermore, the new tax, which has been levied to meet revenue and redistributive objectives to mitigate the social impact of the increase in energy prices, would appear to be compatible with the measures considered eligible in the European Commission’s RePowerEU Communication of 8 March 2022.

However, a number of general issues emerge.

-

- The tax on excess profits seems to be part of extraordinary public finance arrangements justified by the exceptional nature of the energy price increase and the need to offset the asymmetrical effects that this has had on corporate profits and household purchasing power. This has necessarily produced a targeted measure. Based on an analysis conducted with the PBO’s MEDITA microsimulation model, the estimated number of companies in the sectors affected by the tax on excess profits is just under 11,000, representing just over 1 per cent of total non-financial corporations (about 980,000 companies). Despite the presence of many small enterprises (over 98 per cent), in 2019 medium-large companies accounted for over 80 and 70 per cent of turnover and value added, respectively, and over 50 per cent of the total IRES and IRAP tax base.

- The current structure of the tax could raise equity and efficiency issues.

First, a question arises concerning the adequacy of the tax’s base in approximating the excess profits of energy companies generated by price increases. From an economic standpoint, the balance between output and input invoices net of VAT corresponds to the value added of production, which in addition to profits includes the remuneration of the other factors of production. The increase in value added therefore represents a good proxy for excess profit only to the extent that this is not also attributable to an increase in the remuneration of the other factors. However, even if the increase in value added is entirely attributable to the growth in profits in economic terms, other discrepancies could emerge with respect to the increase in profit measured in accordance with financial reporting or tax rules governing IRES, which means that the tax on excess profits will have a differentiated impact on statutory profit. The use of the IRES tax base would probably have made it possible to make the tax on excess profits more commensurate with corporate accounts, but would have required the calculation to be performed for an annual period and the use of a mechanism for payments on account involving forecasts that would have introduced additional complexity and uncertainty to the estimation of the revenue needed to fund the aid concurrently being channelled to households and firms.

A second issue is the matter of identifying the “normal period” to be taken as the baseline for measuring the increase in profit. The choice of the period between October 2020 and April 2021 raises a number of concerns given that it was still impacted by the health emergency and may lead to an overestimation of the contingent increase in profits. The risk of an overestimation could be reduced by opting for a baseline period that was less affected by the health emergency, such as the same months of 2019/2020 or an average of the two periods. However, it is difficult to predict the final effect of a change in the baseline period if the revision of the tax base was accompanied by an adjustment of the tax rate to ensure the necessary revenue to fund the measures.

Third, the tax base could be influenced by tax components that do not fall within the definition of profit in an economic or statutory sense. These include, for example, excise duties which form part of the basis of output transactions. If there is an increase in quantities sold, the increase in excise duties collected expands the tax base of the tax on excess profits even though it is paid to the tax authorities. The cut in excise duties implemented in April operates in the opposite direction, reducing the windfall tax, even with the same quantities sold.

Finally, a widely debated issue, which also raised constitutional questions, concerns the non-deductibility of the windfall tax from IRES and IRAP. If it could be deducted, the tax on excess profit would merely represent an advance on the payment of taxes and would result in a significant reduction in the actual revenue raised (about €3 billion). The effect could, however, be offset by increasing the rate, leaving the burden on businesses unchanged.

Measures for local authorities. – The decree increases by €170 million (€150 million for municipalities and €20 million for provinces and metropolitan cities) the extraordinary transfer for 2022 already established for local authorities in Decree Law 17/2022. For 2022, a total of €420 million have been allocated to local authorities, of which €350 million for municipalities and €70 million for provinces and metropolitan cities. These are additional emergency transfers above and beyond the resources already transferred to local authorities through the Fund for the performance of the basic functions of government (the “Fondone”) during 2020 and 2021 to counter the effects of the pandemic, which the authorities can use to cover the increase in electricity costs. This overlapping of purposes could make it challenging – with today’s governance structure in which central government can implement discretionary measures to help fund essential service levels and performance of the basic functions of local government in response to developments in the business cycle – to evaluate the correspondence between the additional funding allotted and the effective and differing needs of the various local authorities.

Another provision of the decree law establishes a fund of €80 million for each of the years from 2022 to 2024 for the provinces and metropolitan cities of the ordinary statute regions, Sicily and Sardinia that have experienced a reduction in 2021 compared with 2019 of their revenue from provincial registration fees (IPT) or the tax on motor vehicle liability insurance (RCA). However, the decree establishes that the allocation of funds shall not be based on lost revenue but rather on the resident population at 1 January 2021. Furthermore, it is not clear why it was decided to establish an additional fund rather than act through the two specific ordinary funds established with the 2021 Budget Act, which replaced all previous transfers and funds for current expenditure in order to give a definitive structure to local government finance. In general, the need to provide support to provinces and metropolitan cities that have experienced a significant loss of revenue from their main taxes underscores a critical problem with the current structure of financial relations between central government and provinces and metropolitan cities. The appropriation by the central government of part of the revenue of the provinces and metropolitan cities, which currently takes place in the form of a fixed net contribution to the public finances, could be obtained by directly reserving a share of IPT and RCA revenue for central government. In this way, the adverse effects of any reduction in tax bases (such as that covered by the measure under review here) would be shared between local authorities and central government.

General observations. – In line with the measures that preceded it, Decree Law 50/2022 can be broadly characterised as an urgent measure, mainly aimed at the short-term alleviation of the effects of the increases in commodity prices on households, firms and public tenders. The need for such an intervention is justified by the speed with which our terms of trade have deteriorated in recent months and by the uncertainty that clouds global conditions and the economic outlook.

The decree combines the previous measures aimed at mitigating the increase in prices and rates, both generally and selectively, with a one-off, lump-sum transfer directly supporting the income of a relatively large number of intended beneficiaries. Although the measure is aimed at individuals and does not appear particularly selective in terms of income, the sample simulations conducted by the PBO suggest that it could contribute significantly to offsetting the impact of price and rate increases on lower-consumption households, who use a larger proportion of their income on energy. Those simulations show that, on the whole, the measures taken since Decree Law 73/2021 have fully shielded the purchasing power of households with lower expenditure capacity and in any case limited the loss of purchasing power to around 2 per cent on average.

The uncertainty about the evolution of economic conditions, the risks of possible new strains in the financial markets and the state of the public finances have prompted the government to avoid increasing borrowing and the debt any further. Funding the measure therefore required not only use of the resources made available with the EFD but also recourse to new expenditure cuts, in particular with the defunding of the Development and Cohesion Fund, and to revenue increases with the special tax on excess profits levied on companies operating in the energy sector.

The latter is justified by the asymmetrical impact that the rise in energy prices has had on households and energy-intensive businesses, on the one hand, and energy companies, on the other. The design of the tax on excess profits, which uses a tax base that is only partially correlated with that used for the taxation of corporate profits, was influenced by the urgency of raising the necessary revenue to fund the support measures this year. Within these constraints, the resolution of a number of specific issues, such as the possible overestimation of excess profits as a result of the use of a baseline period that was still impacted by the pandemic or the inclusion of excise duties in the tax base of output transactions, should be accompanied by an increase in the rate.

Looking forward, even if adverse economic and geopolitical scenarios do not materialise, the possibility that inflation could be more persistent than expected in the baseline scenarios of macroeconomic forecasters cannot be ruled out. Economic policymakers may therefore have to face persistently high nominal dynamics in the coming quarters. It therefore appears necessary to combine these urgent measures with an acceleration of reform aimed at easing the structural constraints of the Italian economy and jointly addressing the new challenges of energy independence and the ecological transition.