The Chairman of the Parliamentary Budget Office (PBO), Giuseppe Pisauro, testified (in Italian) today at a joint session of the Budget Committees of the Senate and Chamber of Deputies as part of the preliminary consideration of the 2021 Economic and Financial Document (EFD). The Chairman discussed the reasons, in the light of available information, for the PBO’s endorsement of the 2021-2024 policy macroeconomic scenario and then analysed developments of the main public finance aggregates, which incorporate the new measures to counter the consequences of the pandemic and the revised National Recovery and Resilience Plan (NRRP) that the Government is about to issue.

The following are the salient aspects of the document filed with the Committees.

The macroeconomic scenario and the endorsement process – With the launch of vaccination campaigns in many countries, the international economy strengthened in the initial part of this year: in April, the International Monetary Fund revised upwards its forecasts for the world growth (6.0 per cent in 2021 and 4.4 per cent in 2022) from its January projections (with increases of 0.5 and 0.2 points respectively).

In 2020, Italy’s GDP contracted by about nine percentage points, an unprecedented development in peacetime. In the final part of last year, the second wave of the pandemic caused GDP to contract further, with a larger decrease than that recorded in other euro-area countries. The available indicators appear to signal the first tentative signs of recovery in the short term, despite the mixed developments among sectors. According to PBO estimates, GDP was virtually unchanged in the first few months of the year, despite the restrictions on economic activity. The growing inelasticity of GDP growth to mobility constraints is also beginning to be seen in other economies, indicating that households and firms are adapting to the health emergency through alternative modes of consumption, work and production.

The trend macroeconomic framework of the EFD was developed in March on the basis of international exogenous variables (described in section 1.1 of the memorandum) and a public finance scenario that incorporates the provisions of the NRRP (in the version reflected in the 2021 Budget Act) and Decree Law 41/2021 (the Support Decree). From these premises, the MEF expects a return to growth this year, to 4.1 per cent, after the collapse in activity due to the pandemic in 2020. Next year GDP would accelerate further, to 4.3 per cent, while in the following two years output growth would slow, approaching rates closer to the historical pre-COVID-19 average.

The trend macroeconomic scenario is the base for the policy scenario, which involves much greater borrowing than the trend this year (with a deficit of 11.8 per cent of GDP instead of 9.5 per cent) in order to finance the support and recovery measures contained in a pending decree law, the unchanged policies and the reformulation of the NRRP. The policy deficit is slightly larger than the trend deficit in 2022 and 2023, while it is equal to the latter in 2024 thanks to compensatory measures that have yet to be specified.

These measures have an expansionary impact of about 1 percentage point overall in 2021 and 2022 on the growth projection in the EFD’s policy macroeconomic scenario, bringing the growth rate to 4.5 per cent this year and 4.8 per cent next year. In 2023 the effect of the new budget policies would be substantially neutral, while in the final year of the forecast it would be slightly restrictive (-0.2 percentage points) as the fiscal stimulus wanes.

The PBO, in accordance with the procedure provided for in the framework agreement with the MEF and with the support of the panel of independent forecasting institutes composed of CER, Oxford Economics, Prometeia and REF.ricerche, assessed the macroeconomic scenarios published in the EFD for the 2021-2024 forecasting period. On 31 March, the PBO notified the MEF that it had endorsed the trend macroeconomic forecasts. Subsequently, the policy macroeconomic scenario endorsement exercise was conducted, which also ended with the endorsement.

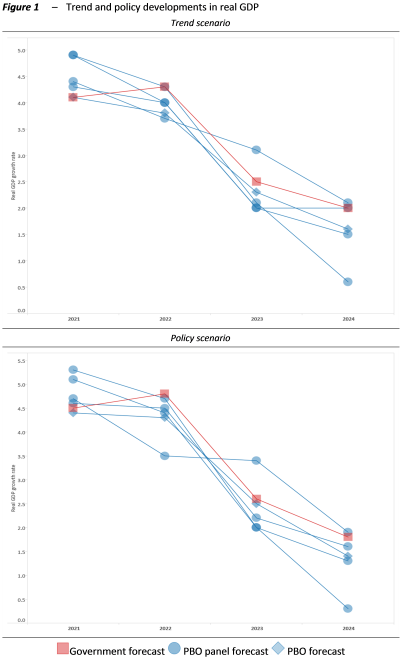

The forecasts of the MEF and those of the panel turned out to broadly consistent, despite a number of modest divergences (Figure 1). The PBO Board endorsed the policy macroeconomic scenario of the EFD on the basis of the following findings: a) the rate of real GDP growth is in line with the upper bound of the panel forecasts, with the exception of a small overshoot in 2022; b) nominal GDP growth, the variable that most directly impacts public finance developments, remains close to the panel median in three out of four years; and c) the impact of the budget package on GDP growth is similar to that estimated by the PBO. The real GDP growth rate this year is below the median panel forecast, while it is close to the upper bound in 2022, representing a risk for the EFD forecast. Even comparing the policy macroeconomic scenario of the MEF with the projections recently formulated by leading institutional and private forecasters, the macroeconomic scenario of the EFD is acceptable, albeit ambitious for the coming years.

The macroeconomic scenario for the Italian economy remains exposed to various sources of uncertainty, which are outlined in section 1.5 of the memorandum, primarily attributable to the evolution of the pandemic in Italy and the rest of the world: the risks are mainly on downside, in both the short and medium/long term.

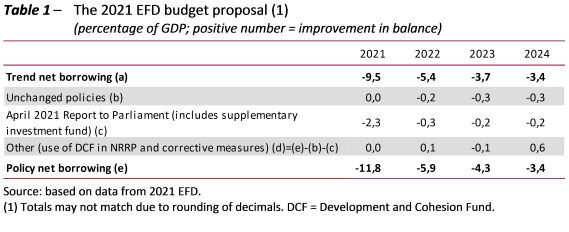

Public finance trends, the new NRRP and the policy scenario – The trend public finance forecasts show the deficit in 2021 remaining at the level registered last year (9.5 per cent of GDP), but then beginning to decline in 2022 before narrowing to 3.4 per cent of GDP by 2024 (Table 1).

The forecast improvement in the public finances over the four years is attributable to various factors: the expected end of the health emergency, the extraordinary nature of most of the measures adopted so far to counter the impact of COVID-19, and the positive feedback effects on revenue of the expansionary impact of the measures in the National Recovery and Resilience Plan (NRRP) on the tax base.

Compared with the trend scenario, the policy public finance scenario envisaged in the EFD shows a deterioration in the public finance balances in 2021-2023 (Table 1), with deficits of 11.8, 5.9 and 4.3 per cent of GDP in 2021, 2022 and 2023 respectively, before matching the trend figure in 2024. The updated policy public finance scenario in the EFD also indicates that the budgetary objectives have been revised with respect to those established last autumn: the return of the deficit to 3 per cent of GDP slips from 2023 to 2025 and the adjustment path towards the MTO has been recalibrated so that the debt-to-GDP ratio could return to the pre-crisis level (134.6 per cent) by the end of the decade.

In addition to updating the macroeconomic scenario underlying the accounts, the factors explaining the differences in the policy public finance scenario compared with the updated trend developments are essentially four: i) the refinancing of unchanged policies; ii) the request to Parliament for a budget deviation in order to implement additional support and recovery measures this year; iii) the revision of the NRRP and the addition of national resources; and iv) compensatory measures in 2024.

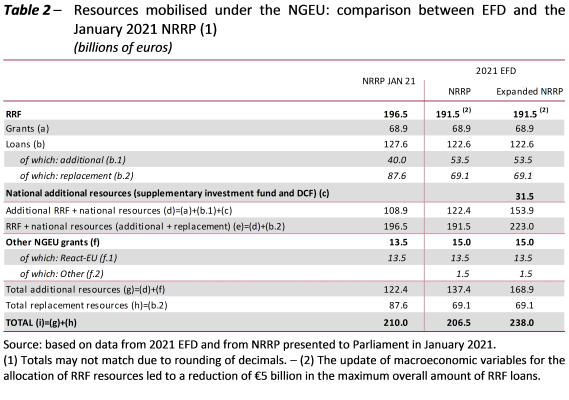

The refinancing of unchanged policies amounts to over €16 billion in 2022-2024, while the deviation requested by the Government to Parliament in conjunction with the EFD would largely be used to finance emergency measures, with borrowing of €40 billion in 2021. Furthermore, the EFD provides for a significant increase in resources for additional projects under the NGEU compared with the January version of the NRRP. Over the 2021-2026 period, additional resources under the “expanded NRRP” (i.e. the intervention plan including the national resources that will supplement those from the NGEU programme) provided for in the EFD amount to €168.9 billion, an increase of €46.5 billion (Table 2, row (g)) compared with last January’s proposal. This increase is equal to the sum of €31.5 billion of additional national resources (Table 2, row (c)), €13.5 billion of RRF loans transformed from “replacement loans” (i.e. NGEU loans financing already-planned projects) into “additional loans” (i.e. NGEU loans financing new projects) and €1.5 billion of additional grants (Table 2, row (f)). Consequently, total NGEU resources (including replacement loans) rise to €238 billion.

In view of the new policy objectives, the Government states that in 2024 it will be necessary to specify compensatory measures ‑ compatibly with developments in the pandemic and macroeconomic conditions ‑ already with the next Budget Act in order to keep the policy balance at the same level as the trend balance. Taking account of the new requirements, the compensatory measures should amount to at least 0.6 per cent of GDP. The information reported in the EFD on the nature of these measures is generic, limiting itself to mentioning measures to rationalize current expenditure and combat tax evasion and references to tax system reform measures consistent with the most recent international guidelines (environmental taxes and taxation of the profits of multinationals).

The information contained in the EFD can serve as the basis for a number of general comments.

First, the EFD envisages a considerable increase in resources earmarked for public investments in a context in which the trend scenario already envisages a rapid expansion, with an average annual growth rate of more than 10 per cent from 2021 to 2024. This will require the government entities involved to upgrade their structures to handle the implementation of such an ambitious programme. If the objectives of the strategy were achieved, it would make it possible to obtain an obviously desirable outcome: returning investments in absolute value to around the level (close to €60 billion) registered in 2009, after which capital expenditure began to decline, and then exceed that level (up to around €70 billion) in 2023-2024.

Second, the link between the public finance policy framework and the accompanying bills announced in the EFD (for example, those on the reform of the social safety net, the strengthening of territorial assistance and tax reform) remains to be clarified. If they were to involve additional spending (as would seem likely for several), they must be funded appropriately.

Finally, it is important to emphasise that there are significant downside risks to developments in the macroeconomic scenario, primarily related to the evolution of the pandemic and the possible need for further restrictions and support for firms and households. These risks could obviously change public finance trends, producing a further rise in the deficit and the debt.

Developments in the debt and the role of ECB purchases – In 2020, the ratio of public debt to GDP reached 155.8 per cent. This value, albeit very high, is slightly lower than the 158 per cent estimate published in the 2020 DBP, thanks to lower borrowing and a slightly smaller decline in nominal GDP than forecast last autumn.

After the sharp rise in interest rates following the health emergency, the expansionary monetary policies of the ECB and the EU’s initiatives for economic recovery reduced market volatility in 2020, at the same time triggering a generalised decline in yields on government securities. On average for the year, the yield at issue fell to 0.59 per cent compared with 0.93 per cent in 2019, and the average cost of debt fell to around 2.4 per cent (2.5 per cent in 2019). General government interest expenditure fell to €57 billion in 2020 (3.5 per cent of GDP), €3 billion less than the previous year.

According to the EFD’s policy scenario, the debt-to-GDP ratio should increase to 159.8 per cent this year, 4 percentage points higher than in 2020. In subsequent years, the ratio is expected to decline, falling to 156.3 per cent in 2022, 155.0 per cent in 2023 and 152.7 per cent in 2024. Accordingly, the expected reduction over the forecast horizon of the EFD is equal to 3.1 percentage points of GDP.

In 2020, the Eurosystem’s purchases of financial assets on the secondary market were substantial. A total of about €175 billion in Italian government securities were purchased in the secondary market, of which €47 billion under the Asset Purchase Programme (APP) and €127 billion under the Pandemic Emergency Purchase Programme (PEPP). As a result of these purchases over the last 5 years, the distribution of debt among the various holders has changed considerably. In particular, the share held by the Bank of Italy went from 4.8 per cent in 2014 to 21.6 per cent at the end of 2020, while there was a decrease in the share of all other holders.

In 2021, gross issues of government securities are expected to total €597 billion, greater than last year. On the basis of a number of assumptions, Eurosystem purchases of Italian government securities on the secondary market in 2021 are projected to amount to about €189 billion (of which €42 billion for reinvestment of principal repayments on maturing securities), or 32 for per cent of total forecast gross issues of the Treasury on the primary market.

The PBO has also assessed the sensitivity of the policy path of the debt-to-GDP ratio presented in the EFD with respect to a scenario based on alternative assumptions concerning the inflation rate and real growth that reflect the macroeconomic forecasts formulated by the PBO. Under these assumptions, the level of the debt-to-GDP ratio for this year would be broadly similar to that estimated by the EFD, with an increase compared with 2020. Over the 2022-2024 period, the debt-to-GDP ratio would trend higher in the PBO scenario than in the EFD scenario, exceeding the latter by almost 3 percentage points in 2024, when the debt-to-GDP ratio would be 155.5 per cent. This reflects the fact that nominal GDP growth in the PBO macroeconomic forecasts is always lower than that assumed in the EFD policy scenario (with differences between 1 and 7 tenths of points per year), the result of slower real growth in each year and lower price inflation (except for 2024).

The measures to bolster the liquidity of firms during the COVID-19 crisis have significantly increased the overall stock of government guarantees granted to businesses. Between 2019 and 2020, the total stock of such guarantees rose from €85.8 billion to €215.5 billion (from 4.8 to 13.0 per cent of GDP), while the increase attributable to measures related to the health emergency was €117.7 billion (7.1 per cent of GDP). The growth of public guarantees can pose a risk to the sustainability of the public finances. In the event of enforcement of the guarantee, government would be forced to repay the residual principal amount covered by the guarantee. It will be important in the coming years to monitor developments in these amounts and especially the value of the expected losses underlying the forecasts indicated in the EFD, which should be reported separately.