The Chairman of the Parliamentary Budget Office (PBO), Giuseppe Pisauro, testified today at a joint session of the Budget Committees of the Senate and Chamber of Deputies as part of the preliminary consideration of the 2019 Economic and Financial Document (EFD) published on 10 April by the Ministry for the Economy and Finance (MEF).

In his remarks Pisauro analysed the content of the EFD, explaining the reasons, in the light of available information, for the PBO’s endorsement of the 2019-2022 policy scenario (after having previously endorsed the trend macroeconomic scenario). The macroeconomic forecasts of the MEF and those of the PBO panel (Cer, Prometeia and Ref, in addition to the PBO itself) are consistent on the whole. The real GDP growth (0.2 per cent in 2019 and 0.8 in all three subsequent years) falls within the range of variation of the panel’s forecasts, and only in 2021 does it lie at the upper bound of that interval. Nominal GDP growth, a variable that more directly have impacts on the public finances, lies within the forecast range, thanks in part to the deflator, which remains below the upper bound of the panel estimates.

In the short term, the available indicators appear to signal the first tentative signs of recovery in the first quarter, despite the mixed findings of economic surveys. However, the medium-term macroeconomic scenario for the Italian economy remains exposed to considerable risks, mainly on the downside, which counsel caution in forecasts. These include risks associated with a further deterioration in the international environment; risks associated with financial imbalances that could induce a rapid increase in the returns demanded by international investors, penalising economies, such as Italy, whose public and private issuers have low credit ratings; and risks generated by uncertainty about economic policies, which impacts the consumption and investment decisions of households and firms.

Fiscal developments and the puzzle of the 2020 budget. – With regard to fiscal developments, the Chairman of the PBO pointed out that the EFD acknowledges that the deficit for 2018 exceeded forecasts and that the trend public accounts are on a less favourable trajectory as a result of the deterioration in the economy. In the absence of corrective measures, the deficit is expected to increase to 2.4 per cent of GDP in 2019 (the figure confirms the cut of the €2 billion in spending provisions as part of the corrections to the budget package at the end of December 2018), before falling to 2 per cent in 2020 and 1.8 per cent and 1.9 per cent in the following two years.

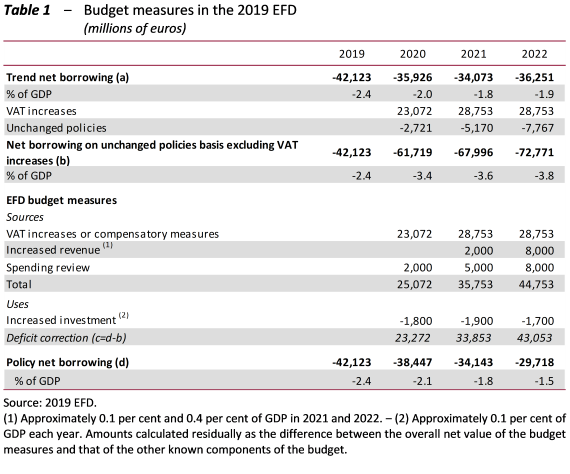

The EFD indicates that the deficit on an unchanged policy basis and excluding the VAT increase provided for in the safeguard clauses (€23.1 billion in 2020 and €28.8 billion as from 2021) is projected to rise as a percentage of GDP, from 2.4 per cent in 2019 (€42 billion) to 3.4 per cent in 2020, 3.6 per cent in 2021 and 3.8 per cent (€73 billion) in 2022 (Table 1). In this scenario, excluding the expected privatisation proceeds (which would be difficult to achieve), the public debt to GDP ratio would continue to rise even after 2019, reaching more than 135 per cent in 2022, up from 132.2 per cent in 2018.

The resources needed to ensure the gradual reduction of the policy deficit in the EFD are represented by: i) alternative sources of funds to the VAT increases provided for in the safeguard clauses; ii) funds appropriated to finance unchanged policies (€2.7 billion in 2020, €5.2 billion in 2021 and €7.8 billion in 2022) and to increase investment (about €2 billion a year); and iii) resources necessary to achieve a further correction of the deficit in line with the EFD policy objectives (€2 billion in 2020, €7 billion in 2021 and €16 billion in 2022). Funding measures will therefore have to raise around €25 billion in 2020, rising to around €36 billion in 2021 and about €45 billion at the end of the period.

Additional initiatives announced in the EFD, such as the plan to continue the process of reforming income taxes (the flat tax mechanism) and the general simplification of the tax system, to be implemented “in compliance with the public finance objectives specified in the document”, would require the identification of further compensatory measures.

The autumn budget therefore resembles a complex puzzle, which will require the clear definition of political priorities, careful assessment of the design of the policies themselves in order to avoid distortions in the economy and adequate transparency of the redistributive impact of the measures to be adopted.

A number of risks associated with the deficit and debt reduction measures. ‒ On the basis of the few indications provided in the EFD on the budget measures, securing the resources needed to achieve the policy objectives will be based on four main pillars, in addition to increases in indirect taxes: the spending review, the reduction and rationalisation of tax expenditures, countering tax evasion and privatisation receipts. Each of these approaches has problems.

Taking account of developments in primary expenditure in nominal and real terms since 2010 onwards (primary expenditure has increased by a total of €50.4 billion in nominal terms, while it has decreased by €14.7 billion in real terms), recourse to expenditure cuts is challenging for a number of reasons. More specifically: 1) in the area of public employment, measures to contain expenditure such as a new freeze on turnover would run up against the already reduced number of staff and the aging of employees; these factors have inevitable repercussions for the overall efficiency of government administration and the use of technological innovation, in the absence of reforms of the functioning of government, whose effects nevertheless take a considerable time to unfold; 2) the risk that further cuts in health spending will affect the quality of the services delivered or the scope of public involvement in this sector; 3) the welcome commitment of the Government to increase the financial resources for investment available to central and local governments, including addressing the critical issues connected with the application of the new legislation governing public tenders; 4) the additional increase in pension expenditure with the application of the quota 100 mechanism (sum of age and years of contributions) and in other social benefits following the introduction of the citizenship income.

The reduction of tax expenditures raises a number of issues that need to be addressed. ‒ Their elimination should be preceded not only by a quantification of the overall financial impact and the beneficiaries involved, but above all by an ex-post analysis of the redistributive effects that the elimination of each subsidy mechanism would generate. Furthermore, some tax relief measures that span several years (for example, those for building renovations or those for interest on primary-residence mortgages) would continue to cause revenue losses in future years even if eliminated, and would therefore not be immediately available to fund other measures.

Finally, the resources to achieve net borrowing targets for 2021 and 2022, mainly generated by measures to fight tax evasion, would be equal to 0.1 percentage points of GDP in 2021 and 0.4 points in 2022. Overall, the magnitude of the increase in revenue expected from the fight against tax evasion in 2022 seems rather ambitious when assessed in the light of the results currently achieved by the Revenue Agency. More specifically, just over €19 billion were collected in 2018, of which €16 billion deriving from “ordinary” control activities (i.e. as a result of assessments issued by the Revenue Agency, promotion of compliance and enforced collection) and the remaining €3 billion from “extraordinary” recovery measures (for example, the facilitated settlement of tax disputes and outstanding assessments, voluntary disclosure, etc.). It would therefore be a question of significantly increasing (by up to 50 per cent or so) the amount of revenue recovered from “ordinary” collection activity.

The 2019 EFD retains the assumption, adopted in the 2019 DBP, of privatisation receipts equal to 1 percentage point of GDP in 2019 and 0.3 points in 2020, equal to about €17.8 and €5.5 billion respectively. Comparing the privatisation receipts envisaged in the 2015-2018 EFDs and the corresponding actual figures, however, it is clear that the only year in which the results met expectations was 2015 (when receipts amounted to €6.6 billion). In the years before 2015, receipts of more than €10 billion were recorded on only three occasions (1997, 1999 and 2003), while in those following 2015, the results obtained were significantly below expectations: in 2017-2018, with forecast receipts of 0.3 points of GDP per year (around 5 billion euro each year), actual figures amounted to €58 million in 2017 and €2 million in 2018. In light of the increase in the forecast for privatisation receipts, the PBO therefore reiterates even more strongly its previously expressed conclusion that the public finance policy scenario is exposed to the real risk that the privatisation programme may prove to be totally or partially unworkable.

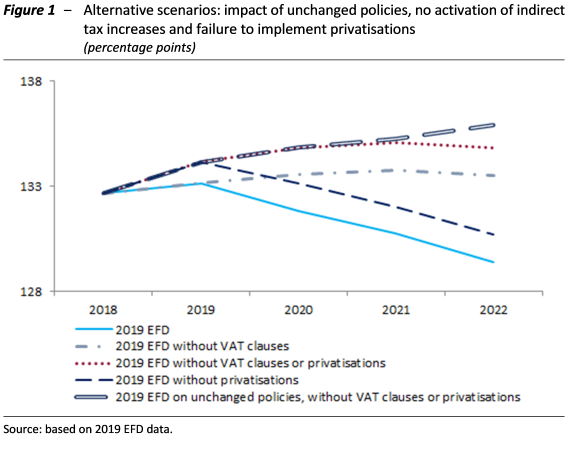

Developments in the public debt in selected alternative scenarios. ‒ The PBO performed a number of simulations to analyse the sensitivity of the debt/GDP ratio in the EFD policy projection in alternative scenarios (Figure 1). In the extreme case in which trend net borrowing increased by the effects of unchanged policies is not financed through the activation of the safeguard clauses and the budget measures envisaged in the EFD and the debt is not reduced as a result of privatisation proceeds, the debt ratio would increase to 134.7 per cent in 2021 and 135.4 per cent in 2022.

Compliance with the rules and the new medium-term objective (MTO). ‒ Despite the more unfavourable than expected nominal deficit targets, the policy scenario in the 2019 EFD envisages, due to more pessimistic macroeconomic assumptions, a slightly more ambitious structural adjustment path towards the MTO compared with the policy scenario in the Aggiornamento del Quadro Macroeconomico e di Finanza pubblica [Update of the macroeconomic and public finance scenario] published in December 2018. Nevertheless, deviations from the required adjustments persist for almost the entire planning horizon, both for the structural balance rule and the expenditure benchmark. In both cases, the European Commission, using its spring 2019 forecasts, will conduct an overall evaluation to determine whether the preventive arm of the Stability and Growth Pact has been complied with and assess the possibility of opening a significant deviation procedure. In addition, there is no compliance with the debt reduction rule in 2018 or in the planning period, despite the decline in the debt/GDP ratio envisaged by the Government for the 2020-2022 period.

Italy’s new medium-term objective (budget balance under Italian legislation) is indicated in the EFD starting from 2020. It is equal to a structural surplus of 0.5 percentage points of GDP, a more stringent target than that declared in previous policy documents, which called for budget balance. Note that previous documents, in specifying structural balance as the MTO, had set a more ambitious MTO than the minimum determined using the EU methodology, which until the recent revision produced an MTO for Italy equal to a structural deficit of 0.5 per cent of GDP. The revision of the MTO under the European method is therefore equal to 1 percentage point of GDP and is due both to the deterioration in the public finance scenario and to the increase in the forecast for long-term developments in public expenditure linked to the aging of the population.