The Chair of the Parliamentary Budget Office (PBO), Lilia Cavallari, spoke today at a hearing before the Finance and Treasury Committee of the Senate as part of the fact-finding inquiry into tax incentive instruments, with particular reference to tax credits.

Below are summarised a number of the main topics discussed by Cavallari in her speech.

Although they have been monitored and analysed for years in order to be rationalised and reduced, tax expenditures – that is, any form of exemption, exclusion, reduction of taxable income (deductions) or taxes (deductions and tax credits) – have further increased in recent years, both in number and amount. In the last three years, in particular, they have soared as a result of the measures implemented to counteract the health and energy crisis and, above all, due to the increase in building incentives and business investment incentives.

While the emergency measures are necessarily temporary in nature and are gradually exhausting their effects, the tax incentives for companies and households, on the other hand, have taken on a more structural nature and, especially the most recent ones, will continue to have significant effects in the coming years.

Tax expenditure in the Monitoring Committee Report. – Based on the latest monitoring conducted by the Committee in charge of the annual monitoring of tax expenditures, there are 626 items (160 more than in 2017) which by 2023 will amount to approximately EUR 83 billion, 4.2 percent of GDP (EUR 47.8 billion in 2017; 2.7 percent of GDP). The incentives mainly concern the personal income tax (IRPEF); they mainly take the form of tax deductions and their distribution is highly concentrated. The most quantitatively relevant incentives are directed at recovering and improving the energy efficiency of buildings, supporting business competitiveness and development, as well as social and family policies. Building deductions are particularly relevant, accounting for 14 percent of the total amount of benefits in the monitoring, despite being strongly underestimated.

In terms of composition, the last few years have seen a sharp increase in benefits paid out as tax credits; doubled in number (they account for about 12 percent of the total) and increased fivefold in terms of amount, they amounted to EUR 10 billion in 2022. Moreover, these figures do not take into account the tax credits related to building incentives, which are classified as tax deductions in the Report.

Incentives for companies. – Incentives for companies are generally structural in nature and are aimed at supporting the company’s competitiveness and/or overcoming territorial disparities. The most important incentives in terms of volume are those for investments and, in particular, those in tangible assets (both the ones provided by “Industry 4.0” and the ones in the South of Italy) and to support research and development (R&D) expenditure. In all these cases, the tax credit instrument has taken on a predominant role. Added to this are tax credits related to deferred tax assets (DTA), a highly concentrated measure that almost entirely concerns the banking sector. In the last three years, such measures have also been supplemented by those having an emergency nature.

In total, companies offset almost three times as many tax credits in 2022 as in the three-year period 2017-19 (EUR 22.5 billion against EUR 8 billion). The use of such credits made it possible to increase the usability of the incentives – being freed from tax capacity – and thus to better involve small businesses. In addition, it allowed aid to be delivered more quickly to businesses during emergency times.

A preliminary analysis of the data appears to suggest that direct subsidies to the South of Italy have indeed contributed to reducing the investment gap between southern companies and those in the rest of the country.

Incentives for households: building bonuses and the Superbonus. – The biggest contribution to the increase in tax expenditures in favour of households has been provided by building-related incentives. These initiatives, initially intended as incentives for renovations, were conceived as temporary measures in the form of deductions from the IRPEF tax, with a relatively low rate (41 and then 36 percent), the purpose of which was to support construction activity and also to encourage the emersion of undeclared work and tax base. Extended and enhanced from year to year, they have also included energy efficiency measures since 2007. From 2008 to 2019, the deductions actually used increased from EUR 2.6 billion to EUR 9.2 billion. Starting from the 2020 Budget Law, measures have been progressively introduced which made some of these deductions equivalent to a direct form of expenditure, with the incentive being raised to a value close to or higher than the total expenditure (90 percent for the Facade Bonus and 110 percent for the Superbonus and Sismabonus). This has resulted in a significant expansion of the total number of beneficiaries due to both the increased convenience and the inclusion of those with insufficient tax capacity who were implicitly excluded from the pre-existing incentives.

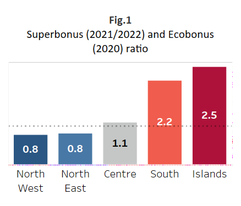

An analysis conducted by PBO reveals a significant change in the composition of the Superbonus beneficiaries compared to the beneficiaries of the original building bonuses. In particular, the share of resources allocated to the South of Italy has more than doubled (Figure 1) and there has been a significant increase in the use of energy saving benefits in lower income municipalities, an indication of the less regressive nature of the Superbonus.

An analysis conducted by PBO reveals a significant change in the composition of the Superbonus beneficiaries compared to the beneficiaries of the original building bonuses. In particular, the share of resources allocated to the South of Italy has more than doubled (Figure 1) and there has been a significant increase in the use of energy saving benefits in lower income municipalities, an indication of the less regressive nature of the Superbonus.

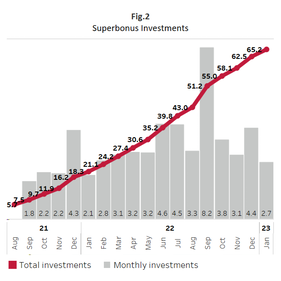

However, having the entire cost of the measure borne by the State without introducing any selectivity criteria has generated significantly higher expenditure than for previously subsidised energy efficiency improvements: the so-called Ecobonus amounted to approximately EUR 4.5 billion in 2020. The investments under the Energy Superbonus alone as of January 2023 amounted to EUR 65.2 billion (Figure 2), of which EUR 49.7 billion have been completed.

The burden on public finance significantly exceeded initial expectations, which were based on an official expenditure forecast of EUR 35 billion for the entire period of validity of the measure. Combined with the other building bonuses (facade bonus, renovation bonus, etc.), the cost of the benefits is set to exceed even the already revised upwards amount of EUR 110 billion reported in the official forecasts dating back to last autumn’s Update of the Economic and Financial Document.

The burden on public finance significantly exceeded initial expectations, which were based on an official expenditure forecast of EUR 35 billion for the entire period of validity of the measure. Combined with the other building bonuses (facade bonus, renovation bonus, etc.), the cost of the benefits is set to exceed even the already revised upwards amount of EUR 110 billion reported in the official forecasts dating back to last autumn’s Update of the Economic and Financial Document.

The deployment of such huge resources has had significant macroeconomic effects: the construction sector actually grew considerably in 2021-22, more than in other European countries, although it should be noted that construction was driven not only by the residential sector but also by the non-residential sector and by public works. According to national accounts data, the contribution to GDP growth of investment in residential construction amounted to two percentage points over the past two years; with the macroeconometric model used by the PBO, it is possible to deduce that half of the contribution is directly attributable to the tax incentive.

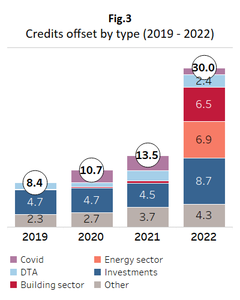

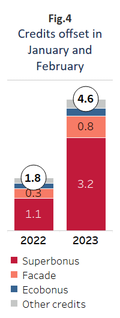

The issue of tax credits. – The combination of tax credits related to building bonuses, investment incentives and the energy crisis is putting the system’s absorption capacity to the test. Credit offsets increased from EUR 8.4 billion in 2019 to EUR 30 billion in 2022 (Figure 3) and are set to increase further to reach a peak in 2024. In particular, the offsetting data for the first two months of 2023 (Figure 4) show a clear increase in building credits compared to the corresponding period of the previous year: the Superbonus credits increased by 2.8 times, facade credits by 2.4 times, while relatively smaller, albeit significant, increases were observed for the Ecobonus (+46 percent) and other building credits (+63 percent). In addition, there was a significant reduction in the share of credits offset by banks and postal services (from 79.9 percent to 59.1 percent) to the benefit of construction and building sector companies (from 8.8 to 17.2 percent), of other companies in the financial and real estate sector (from 8.2 to 9.5 percent) and, above all, of companies in other sectors not directly involved in construction and not belonging to the financial system (from 3 to 14.2 percent).

The issue of tax credits. – The combination of tax credits related to building bonuses, investment incentives and the energy crisis is putting the system’s absorption capacity to the test. Credit offsets increased from EUR 8.4 billion in 2019 to EUR 30 billion in 2022 (Figure 3) and are set to increase further to reach a peak in 2024. In particular, the offsetting data for the first two months of 2023 (Figure 4) show a clear increase in building credits compared to the corresponding period of the previous year: the Superbonus credits increased by 2.8 times, facade credits by 2.4 times, while relatively smaller, albeit significant, increases were observed for the Ecobonus (+46 percent) and other building credits (+63 percent). In addition, there was a significant reduction in the share of credits offset by banks and postal services (from 79.9 percent to 59.1 percent) to the benefit of construction and building sector companies (from 8.8 to 17.2 percent), of other companies in the financial and real estate sector (from 8.2 to 9.5 percent) and, above all, of companies in other sectors not directly involved in construction and not belonging to the financial system (from 3 to 14.2 percent).

By removing the possibility of benefiting from building incentives through an invoice discount and the transfer of the tax credit to third parties, the provisions contained in Decree-Law 11/2023 put an end, except in a small number of cases (previous fulfilment of certain documentary obligations), to the accumulation of new credits, significantly limiting the use of the incentives.

By removing the possibility of benefiting from building incentives through an invoice discount and the transfer of the tax credit to third parties, the provisions contained in Decree-Law 11/2023 put an end, except in a small number of cases (previous fulfilment of certain documentary obligations), to the accumulation of new credits, significantly limiting the use of the incentives.

General considerations. – The analysis of the main incentives granted in recent years to households and businesses may provide some general information useful for the reorganisation of tax expenditure in general and of building benefits in particular.

First of all, there are critical issues related to measures that are not very selective with respect to both the object of the incentive and the beneficiaries. A detailed analysis of the results achieved by the Superbonus incentive in terms of energy savings could make it possible to direct the incentives towards the most efficient interventions in terms of cost/benefit ratio. Moreover, with a view to rationalising tax expenditures, it should be assessed whether a selective energy-saving incentive measure could be more efficient and effective if provided through an expenditure programme.

Lastly, it can be noted that in the case of measures involving a significant amount of resources, an ex post evaluation is crucial, first, to understand whether the collective resources actually deployed in the specific measure reflect the initial estimates of the expected revenue loss and, second, to assess the effectiveness of the measure with respect to the objectives pursued and to guide the new decisions of policy makers. With reference to the first aspect, ex post monitoring and quantification assume relevance both in terms of the soundness of public accounts and in order to update the trends of already existing incentives and to improve the quantification of new measures.