Alberto Zanardi, a member of the Board of the Parliamentary Budget Office (PBO), testified today before the Parliamentary Committee for Fiscal Federalism as part of a hearing on the draft ministerial decree on the procedure for calculating and estimating fiscal capacities for 2018 for municipalities in ordinary statute regions.

Fiscal capacities, the calculation of which has undergone a number of revisions compared with 2017, contribute, together with the standard funding requirements currently in the process of being approved, to determining the Municipal Solidarity Fund (MSF), the equalization mechanism introduced with Law 42/2009, which is used to allot resources transferred to individual municipalities for redistributive purposes.

After discussing the rationale for the revisions (updating the database to 2015 and methodological changes in the calculation of the municipal property tax and the municipal services tax and so-called residual capacity), and a number of criticisms of them, Zanardi assessed the quantitative repercussions of the revisions on 2018 fiscal capacities for municipalities as a whole and the amounts allotted to each.

The changes produce variations in capacities that can be broken down into two components. One common component reduces total fiscal capacity by about 11.8% (-€3.4 billion) compared with 2017. This is accompanied by a specific component that impacts individual municipalities to differing extents.

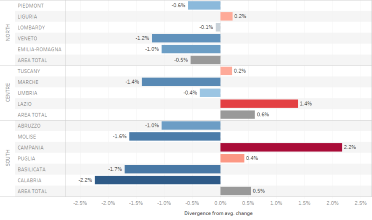

With regard to the specific component, we find, for example, that the fiscal capacities of municipalities in Calabria decrease by 2.2 points more than the average

With regard to the specific component, we find, for example, that the fiscal capacities of municipalities in Calabria decrease by 2.2 points more than the average

(-14%). The opposite occurs in Campania and Lazio, where fiscal capacity contracts by less than the average (-9.6% and -10.4%, respectively).

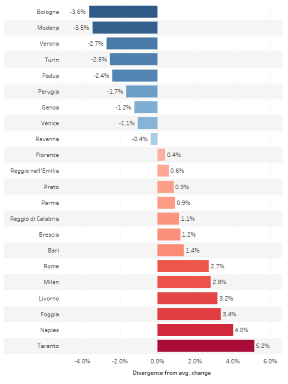

Shifting the focus to large cities, we find that the greatest reduction in fiscal capacity occurs for Bologna, Modena and Verona. Conversely, the reduction in fiscal capacity is smaller than average for the large cities of southern Italy and for Rome and Milan.

What repercussions could the changes have for estimating fiscal capacities as part of determining the MSF? Zanardi explained that a specific calculation will only be possible after the determination, now under way, of the standard funding requirements for 2018. In any event, the reduction in total fiscal capacity weakens the equalisation function of the system, attenuating the impact of the increase in the weight of the standard funding requirements in the MSF envisaged for 2018.

It would be advisable to conduct a joint assessment of requirements, fiscal capacities and the MSF mechanism in order to capture the overall equalising effect properly.