The Chairman of the Parliamentary Budget Office (PBO) Giuseppe Pisauro spoke today at a hearing (in Italian) before the Finance Committee of the Chamber of Deputies and the Finance and Treasury Committee of the Senate, meeting in joint session as part of the fact-finding inquiry on the reform of personal income taxation (IRPEF) and other aspects of the tax system.

After reviewing the historical evolution of the personal income tax system and the current characteristics of personal income tax, the Chairman of the PBO focused on the main issues facing the current system. IRPEF reform should seek to address these critical issues, in particular those concerning the current structure of the tax (high and irregular effective marginal rates for medium and medium-low incomes, erosion of the tax base and of the tax, low transparency and considerable complexity, widespread tax evasion on self-employment and business income) and those associated with the tax benefit system as a whole. In designing the reform, the need to preserve the medium/long-term sustainability of the public finances and to promote growth by reducing disincentives to work and to the accumulation of human and physical capital must be considered. The characteristics of the other segments that make up the Italian tax system and the repercussions that changes to the current structure of IRPEF would have on the financing of the regions and municipalities should also be borne in mind.

As regards the objectives of the reform and the current financial framework, the most recent official policy documents (Update to the 2020 Economic and Financial Document and the proposal for the National Recovery and Resilience Plan sent to Parliament on 15 January this year) affirm the intention to reform the tax system, in particular personal income taxation, with a view to simplifying the system and making it more transparent, improving equity and efficiency and combating tax evasion. The objectives explicitly mentioned include the reduction of effective tax rates on income from payroll employment and self-employment, especially for taxpayers with low and medium-low incomes, in order to increase the employment rate, reduce undeclared work and incentivise the employment of women and young people. To date, the resources appropriated for the tax reform are those provided for in the Budget Act for 2021-2023, which established a special fund to finance these measures with resources equal to €8 billion in 2022 and €7 billion from 2023. Of these, however, an annual amount of between €5 billion and €6 billion is specifically earmarked to finance the unified allowance for dependent children, which is currently being defined. At present, therefore, between €2 billion and €3 billion in 2022 and between €1 billion and €2 billion from 2023 are available for the tax reform. From 2022, additional resources for the fund may be generated by the increase in permanent revenues deriving from an improvement of tax compliance, a phenomenon that is particularly challenging to estimate given that it is very specific, linked to individual behaviour and of uncertain scope.

The volume of resources currently allocated for the reform appears insufficient to finance the objectives indicated in the official policy documents. The current state of the public finances, which have been heavily burdened by the measures deployed in response to the COVID emergency, and the need to preserve their sustainability in the medium to long term preclude the possibility of deficit financing. Additional resources for the redesign of personal income taxation could, however, be derived from:

- a reallocation of the tax burden within IRPEF by increasing the levy on higher incomes to offset the loss of revenue from the reduction in tax on low and medium-low incomes that the reform is intended to achieve;

- a revision of the taxation of income that over time has been removed from the tax base for personal income tax, channelling it back into the progressive taxation system. A not insignificant role in recovering resources could also be played by a revision of the land registry, a reduction in tax expenditures and more effective measures against tax evasion;

- a recomposition of overall taxation, shifting it from the factors of production towards consumption, implementing a recommendation repeated each year by the European Commission in its country-specific recommendations, which would foster growth by reducing distortions in the tax system;

- a reduction in tax expenditures, although this appears difficult to achieve in light of the cuts already made in recent years for the purpose of fiscal consolidation and in view of the new spending requirements that have arisen in connection with the pandemic, which will continue to influence public policies in the coming years.

Once the financial framework has been set, it is important to define the direction of reform that one wants to undertake: whether to question the foundations of the existing IRPEF (comprehensive or dual taxation, individual or household taxation, degree of progressivity of the tax) or to retain the architecture of the current system while correcting its main problems (the distortive effects of high effective marginal rates, the vertical and horizontal inequity of the tax, the complexity of the system, the multiple objectives and the mix of tax credits and spending instruments). These choices, together with those concerning the purposes that the tax is intended to pursue, should be made in the light of the equity and efficiency of the overall tax system and the role that IRPEF plays today as the main source of funding for expenditure.

As for the model of taxation, the current system is a hybrid, having moved away from both the comprehensive approach, in which all categories of income are subject to a single form of progressive taxation, and from the pure dual approach, in which income from employment is taxed progressively and income from capital is taxed proportionally, generally at a rate equal to the lowest rate in the progressive system. The choice of the taxation model, and therefore of the size of the tax base, is essential in establishing the ability to pay and taxing it appropriately. This is the basis of the operation of a progressive taxation system. The choice that therefore arises is whether or not to recover forms of income that have gradually been removed from the IRPEF tax base or to move closer to a dual system. In this case, we are not referring to income from financial assets, which has never been taxed progressively due to its mobile nature and sensitivity to tax competition (although today this has been attenuated by mandatory information exchange between countries), but rather to the income of professionals and sole proprietors and real estate rental income.

As regards the former, maintaining the single-rate mechanism (regime forfettario) introduced in 2019 for holders of VAT numbers (professionals and sole proprietors) with revenues of up to €65,000 should be reassessed. This mechanism, unlike the previous preferential systems (simplified mechanism for certain categories of low-turnover workers and other flat-rate mechanisms), is not structured as a preferential system for taxpayers employed in a profession or operating a small, unstructured business, but rather as actual tax relief involving about 60 per cent of self-employed workers and sole proprietors, creating inequality in the system, curbing the growth of companies and encouraging the under-reporting of revenues (if revenue exceeds €65,000, the taxpayer is no longer eligible for the mechanism and reverts to progressive taxation). To restore the fairness of the system and to make taxation neutral with respect to the legal form of a firm, one option would be to reintroduce a mechanism such as the business income tax system (IRI) ‑ which was abolished before entering force ‑ under which income from a business activity would be taxed at a single rate of 24 per cent (the same rate at which corporations are taxed), ensuring the neutrality of taxation with respect to the legal form of the firm, while the personal income of professionals or sole proprietors, i.e. the portion of profits drawn from the professional activity or the enterprise, would be subject to progressive taxation (restoring the horizontal equity of the tax). In this way, the tax system would more resemble a dual system and the capitalisation of small businesses would be incentivised.

It would also be advisable to consider reintegrating rental income into the IRPEF tax base. The original motivations for taxing such income at a separate flat rate was to encourage the emergence of tax base, foster the supply of housing and increase market accessibility. However, as noted by the Department of Finance of the Ministry of Economy and Finance (MEF), the measure produced a net cost for the State budget given that the deadweight effect connected with taxpayers who already declared rental income (lower tax, exemption from local supplementary taxes and from stamp duty and registration fees) was greater than the benefits produced by expanding the tax base and reducing tax evasion. However, no analysis is available on the ex-post effectiveness of the flat-rate tax (cedolare secca) in reducing rents.

If the current structure of the tax, i.e. a hybrid system, were to be maintained, it would still be advisable to standardise the tax rate of the different separate taxation mechanisms at a level at least equal to that of the first income tax bracket, or at the tax rate on financial income, so as to avoid distortions of individual decisions about different forms of investment.

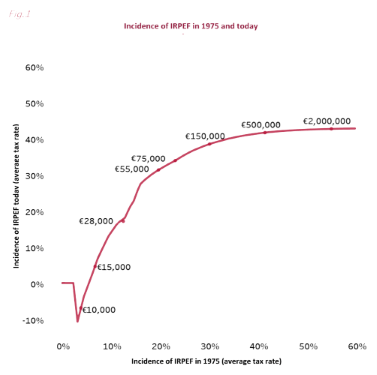

As regards the tax structure, particular attention should be paid to the incidence of income tax (average effective rate) and the irregularity of the tax rate on an additional unit of income (effective marginal rate). Compared with the original design, the incidence of personal income tax (the curve of effective average rates) today is lower at both ends of the income distribution and higher for medium and medium-high incomes (Figure 1). Several factors have influenced this evidence: 1) the high inflation of the 1970s and 1980s, which, in the absence of adequate indexing, produced an increase in tax across the entire income scale; 2) the gradual reduction in the number of income brackets and the lowering of rates for the highest incomes (the highest was 72 per cent) and the increase in those for low incomes, which began in 1983; and 3) the reduction in the taxation of low incomes that has occurred since the second half of the 2000s, which enabled a recovery of purchasing power in a period in which real gross wage growth was particularly weak. Hence the “compression” of the curve of effective average rates, which translates into high marginal rates for the central brackets due to the rapid increase in tax incidence for incomes above the minimum taxable amount. This phenomenon mainly concerned payroll employees and was exacerbated with the introduction of the IRPEF tax credit for lower income taxpayers, which increased the irregularity of marginal rates.

an additional unit of income (effective marginal rate). Compared with the original design, the incidence of personal income tax (the curve of effective average rates) today is lower at both ends of the income distribution and higher for medium and medium-high incomes (Figure 1). Several factors have influenced this evidence: 1) the high inflation of the 1970s and 1980s, which, in the absence of adequate indexing, produced an increase in tax across the entire income scale; 2) the gradual reduction in the number of income brackets and the lowering of rates for the highest incomes (the highest was 72 per cent) and the increase in those for low incomes, which began in 1983; and 3) the reduction in the taxation of low incomes that has occurred since the second half of the 2000s, which enabled a recovery of purchasing power in a period in which real gross wage growth was particularly weak. Hence the “compression” of the curve of effective average rates, which translates into high marginal rates for the central brackets due to the rapid increase in tax incidence for incomes above the minimum taxable amount. This phenomenon mainly concerned payroll employees and was exacerbated with the introduction of the IRPEF tax credit for lower income taxpayers, which increased the irregularity of marginal rates.

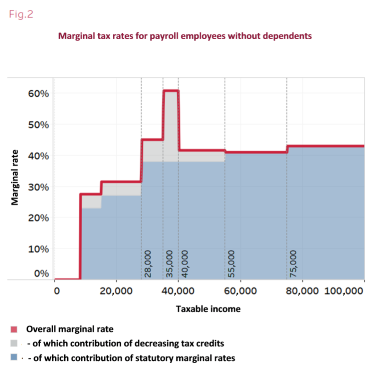

Today, the effective marginal rate reaches 45 per cent for incomes between €28,000 and €35,000 (7 percentage points higher than the statutory marginal rate for the reference bracket) and 61 per cent from €35,000 to €40,000 (23 points higher than the statutory marginal rate) and overall affects more than 20 per cent of payroll employees employed 12 months a year (Figure 2). These marginal rates are then impacted by the effects of local supplementary taxes, tax credits for dependents (an increase of about 1 point in the marginal rate for each dependent child) and other components of the tax-benefit system. Such high and irregular marginal rates have multiple adverse repercussions, including their impact on marginal work decisions, on the cost of the inflation adjustment of wages (fiscal drag) and, more generally, on the very functioning of the comprehensive personal income tax system, when the inclusion in taxable income of typically “additional” income, such as rental income, generates a very significant additional tax burden.

points higher than the statutory marginal rate) and overall affects more than 20 per cent of payroll employees employed 12 months a year (Figure 2). These marginal rates are then impacted by the effects of local supplementary taxes, tax credits for dependents (an increase of about 1 point in the marginal rate for each dependent child) and other components of the tax-benefit system. Such high and irregular marginal rates have multiple adverse repercussions, including their impact on marginal work decisions, on the cost of the inflation adjustment of wages (fiscal drag) and, more generally, on the very functioning of the comprehensive personal income tax system, when the inclusion in taxable income of typically “additional” income, such as rental income, generates a very significant additional tax burden.

A priority, non-deferrable objective of IRPEF reform must therefore be to eliminate the irregular pattern of effective marginal rates to reduce the resulting distortive effects. It is an objective that, depending on the financial resources available, can be achieved with a variety of changes to the tax structure. This hearing offers an example of an intervention to eliminate the most pronounced irregularities in marginal rates without involving radical changes in the current system, flattening the reduction associated with tax credits for payroll employees and the IRPEF bonus (tax credit) and reducing the tax rate differential between the second and third income tax brackets. The erratic behaviour of the effective marginal rates would thus be smoothed, with a maximum reduction between €35,000 and €40,000 of over 17 percentage points. The cost of the operation would be around €3 billion, with the greatest savings for employees with an income of €40,000 (3 points of marginal rate). In terms of distribution, households in the highest deciles of equivalent income would benefit (only 8 per cent of payroll employees employed for 12 months have an income greater than €40,000), with the maximum relief being registered in the ninth decile (0.4 percentage points).

The IRPEF reform is also an opportunity to make the tax system less complex and more transparent than it is currently by reducing and rationalising tax expenditures (tax exclusions, deductions and credits other than those by type of income and dependents). Such measures have a range of purposes, varying from strengthening individual ability to pay, supporting worthy expenditure, providing incentives to renovate buildings or supporting certain sectors and, in some cases, combatting tax evasion. The proliferation of some of these items (many of which of modest overall size but which, as they affect a very small number of taxpayers, have significant unit amounts) is a reflection of the use of the personal income tax system to implement policies that have nothing to do with its primary objective of income redistribution and which, if still considered effective, could be pursued through the expenditure side, thereby contributing to the simplification and transparency of the system and mitigating the problem of taxpayers with insufficient income to tax advantage of the preferential measures. A step in this direction was achieved by allowing taxpayers to transfer tax credits for energy upgrading and renovation of buildings to third parties, including financial intermediaries, effectively disconnecting the incentive from IRPEF. In any case, the decision to retain such tax credits or the ability to transfer the credits should be preceded by an assessment of the advisability of continuing these incentive policies, both in terms of their effectiveness and their redistributive impact, since by far the greatest benefits go to higher income taxpayers, who are responsible for the largest share of subsidised spending. With regard to the former aspect, it should be emphasised that such incentive measures are effective when they are introduced for a limited period of time. The same holds for tax expenditures introduced to counter tax evasion, which should be maintained for the time necessary to bring tax base into the system and then eliminated, especially in the case of tax base that is not mobile. If this does not happen, both types of tax measures over time turn into forms of tax erosion, producing a significant impact only on revenue.

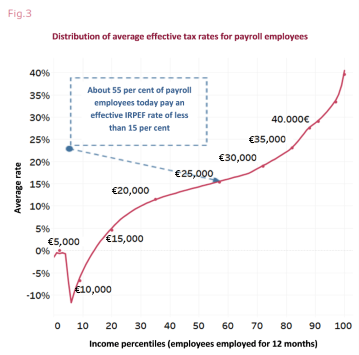

Continuing with the issue of the complexity and transparency of the system, the IRPEF reform could be an opportunity to introduce a clearer tax calculation mechanism in order to make it easier for taxpayers to perceive the effective incidence of the tax (average effective rate), which is made more difficult by a tax calculation mechanism based on brackets and rates and on tax credits that decrease as income rises. The average rates currently levied on taxpayers cannot be calculated immediately from the structure of statutory rates and brackets. Figure 3 shows the distribution of the average tax incidence (average effective rate) for payroll employees employed 12 months a year. Without considering tax credits or deductions for dependents or qualifying expenditure, more than half pay less than 15 per cent of their taxable income, a circumstance that is not immediately and clearly inferable from the structure of the statutory tax rates and the complex calculation of deductions and tax credits.

Continuing with the issue of the complexity and transparency of the system, the IRPEF reform could be an opportunity to introduce a clearer tax calculation mechanism in order to make it easier for taxpayers to perceive the effective incidence of the tax (average effective rate), which is made more difficult by a tax calculation mechanism based on brackets and rates and on tax credits that decrease as income rises. The average rates currently levied on taxpayers cannot be calculated immediately from the structure of statutory rates and brackets. Figure 3 shows the distribution of the average tax incidence (average effective rate) for payroll employees employed 12 months a year. Without considering tax credits or deductions for dependents or qualifying expenditure, more than half pay less than 15 per cent of their taxable income, a circumstance that is not immediately and clearly inferable from the structure of the statutory tax rates and the complex calculation of deductions and tax credits.

One option would to clearly and directly give the average effective tax rates that taxpayers would apply directly to their income to determine their tax liability. This can be achieved in several ways. One is to design the effective average rates as a continuous function, similar to the system used in Germany and, in the past, in Italy as well, with the “complementary income tax”. Income tax brackets and rates, deductions by type of income and the personal income tax credit would be abolished. The merits of such an approach consist, first of all, in the introduction of a smooth curve of average rates and, consequently, of effective marginal rates and, secondly, in greater transparency for the taxpayer. Furthermore, the rate curve could be adjusted more easily and directly, giving legislators the ability to achieve their redistributive objectives explicitly and flexibly.

Another aspect to evaluate in designing the IRPEF reform is whether it should have a role in the context of anti-poverty policies and how to coordinate it with other existing instruments. The current IRPEF structure does not lend itself to supporting households at risk of social exclusion for at least two reasons: the tax unit is the individual, while the reference unit for policies to combat poverty can only be the household. Except in the case of the IRPEF tax credit above its activation threshold (€8,145 of income), there is no negative tax/refundable tax credit mechanism for those with insufficient income to pay taxes, with the consequence that the poorest households are excluded from benefits channelled through the tax system. The most appropriate tools for this purpose are cash transfers based on the equivalent economic status indicator (ISEE), which takes account of household income and assets. Anti-poverty mechanisms could also benefit from rationalisation along the lines of that envisaged in the enabling legislation for the reform of child benefits now being drafted, which provides for the reorganisation of the household benefit instruments on the taxation side (essentially tax credits) and the expenditure side (family allowances and similar benefits), with the introduction of a single expenditure mechanism with benefits based on the ISEE that would be extended to include those previously unable to receive support as they did not have sufficient taxable income and self-employed workers who are currently ineligible for family allowances.

Finally, the IRPEF reform could also be an opportunity to reassess the current system of local supplementary taxes, which allows each region or municipality to autonomously set their own tax rates (within a specified range using criteria established by the Parliament), also differentiating them by income brackets. This system has produced a highly varied system of supplementary taxes around the country, with differentiated progressive effects at the local level combining with those established at the central level, resulting in excessive local variability in the progressivity of personal income tax. If the redistributive capacity of taxation should be decided at the central level, the IRPEF reform should also include supplementary taxes, with a drastic simplification of their structure, allowing regions and municipalities to set a constant supplementary tax rate for all levels of income selected from within a range established at the central government level. Alternatively, supplementary taxes could be replaced by surtaxes, which have the advantage over of being neutral with respect to the progressive structure of the underlying tax.