The Chairman of the Parliamentary Budget Office (PBO), Giuseppe Pisauro, submitted a memorandum (in Italian) concerning the bill ratifying Decree Law 137/2020 (the “Relief Decree”) being examined by the Budget Committee and Finance and Treasury Committee of the Italian Senate. Decree Law 137/2020 seeks to provide relief not only to the activities most directly affected by the restrictions imposed with the Prime Minister’s Decree of 24 October, but also to lend support to those indirectly affected by the restrictions (both categories are specified in Annex 1) and to continue to aid families and businesses still struggling with the adverse effects of the first wave of the pandemic.

Financial effects of Decree Law 137/2020

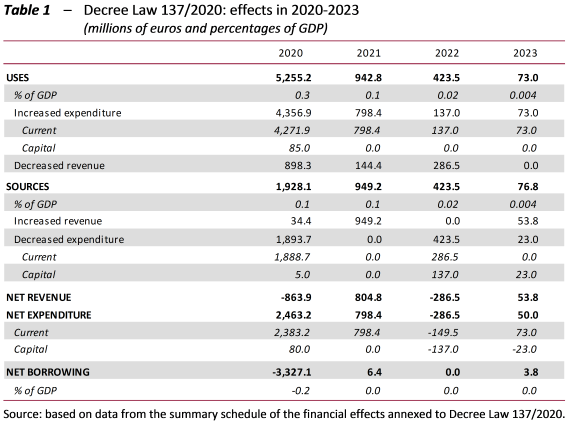

The “Relief Decree” entails a deterioration of €3.3 billion in general government net borrowing (equal to 0.2 per cent of GDP) in 2020, while it has a barely positive or zero impact on the same balance in subsequent years (Table 1). Therefore, as a result of the decree, the deficit in 2020 will rise from the 10.5 per cent of GDP indicated in the 2021 Draft Budgetary Plan to 10.7 per cent.

In terms of net borrowing, the measures envisaged in the decree involve uses of approximately €5.3 billion (0.3 per cent of GDP) in 2020, €0.9 billion (0.1 per cent of GDP) in 2021, €0.4 billion in 2022 and just €73 million in 2023. With the exception of 2022, these uses involve an increase in current spending: over 80 per cent in 2020-2021 and 100 per cent in 2023. Only 2020 is largely financed in deficit. As a result, the resources funding the uses for this year are smaller than the uses and amount to €1.9 billion, essentially involving a decrease in current expenditure. For the following years, the amount of resources is virtually the same as uses, with funds being raised entirely through an increase in revenue in 2021 and entirely through a decrease in expenditure in 2022, while both sources are involved in 2023.

The main measures of Decree Law 137/2020

Measures for firms: the new grant. – The decree extends and strengthens the measures supporting firms adopted in previous decrees. Most of the measures are of a sectoral nature and are targeted at firms that would directly and indirectly suffer the greatest financial harm as a result of the new restrictions and limitations imposed with the Prime Minister’s Decree of 24 October. Overall, expenditure is estimated to increase by €4.4 billion in 2020 and €0.1 billion in 2021. The measures receiving the greatest funding include the disbursement of a new grant (€2.5 billion in 2020) and the refinancing of a number of sectoral measures introduced in previous decrees (€1 billion in 2020 and €0.5 in 2021). In addition, the decree extends further exemptions and suspensions of tax and contribution payments (€0.9 billion in 2020, with the recovery of €0.4 billion in 2021).

The new non-refundable grant will be paid to holders of VAT numbers whose main business is in the specific economic sectors (53) listed in the annex to the decree. Total expenditure on this measure will amount to an estimated €2.5 billion in 2020, reaching almost 470,000 beneficiaries.

The support is similar to that introduced with Article 25 of the May decree, extending it to include beneficiaries with a turnover of more than €5 million. The sectors involved include those directly affected by the limitations imposed with the Prime Minister’s Decree (for example, restaurants, film production, video and television programmes, ticketing and booking services for cultural, tourist and sporting events, the operation of sports facilities, the recreational and entertainment sector and the organisation of parties and ceremonies), and those that, while not subject to specific restrictions, are particularly exposed to the slowdown in economic activity, such as taxis or limousine services, or hotel and accommodation services.

In line with the provisions of the May decree, the amount of the grant is parameterised on a base value defined as a percentage of the loss recorded in April 2020 compared with the same month of 2019, differentiated into three turnover classes. Once the base value has been determined, the grant is then re-proportioned by 100, 150, 200 or 400 per cent depending on the sector to which the beneficiary belongs based on an assessment of the severity of the economic impact of the restrictions.

As regards the scale of the re-proportioning, most of the sectors (38 out of 53) will receive a grant equal to double that envisaged in the May decree. These include most of the sectors directly affected by the new restrictions. A smaller grant, equal to 150 per cent of the base value, is paid to bars and ice cream parlours, as well as to businesses in the hotel and accommodation sector. In this case bars and ice cream parlours, although directly affected by the reduction in hours, will presumably suffer less harm than the restaurant sector (for which the base grant is re-proportioned by 200 per cent), which could explain the smaller grant. For the hotel and accommodation sector, which is not affected by the restrictive measures, the current slowdown in activity should generate smaller losses than in April as it is currently the low season. For taxis or limousine services, for which the percentage is 100 per cent, losses could be generated indirectly by the suspension of trade fairs and conferences and more generally by the restrictions on business and leisure travel, but the contraction in business would be less severe overall than that experienced in April. The only businesses for which the base grant is multiplied by 400 per cent are discos, dance halls and similar venues, which have experienced a longer period of closure.

It should also be borne in mind that, given that a minimum and maximum grant have been set, the actual percentage compensation for the loss of turnover suffered and the turnover classes to which they refer will differ in relation to the legal nature of the beneficiaries, their sector of economic activity and the different percentage of lost revenues in April 2020 compared with the same month of 2019.

As noted, the grant is accompanied by other sectoral support measures for businesses, certain exemptions from the payment of taxes and contributions and the suspension of payments of contributions and premiums for mandatory insurance and, finally, measures that are not specifically targeted at activities affected by the restrictive measures (for example, contribution relief for non-agricultural private-sector employers who do not make recourse to wage supplementation programmes).

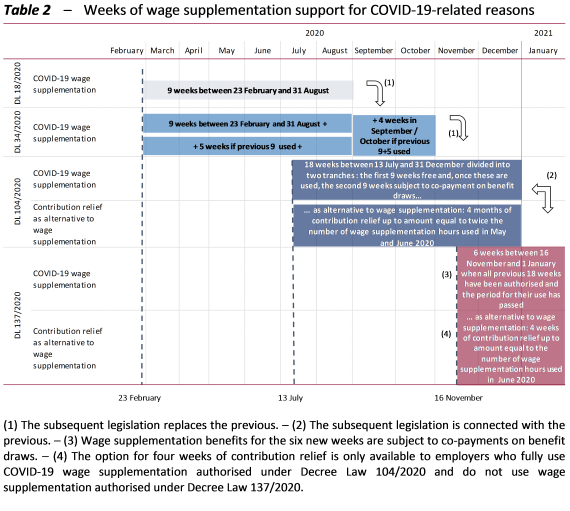

Income support. – Decree Law 137/2020 takes up the provisions of the previous decrees of March, May and August and revises the rules governing wage supplementation benefits for COVID-19-related reasons. It establishes that between 16 November 2020 and 31 January 2021, employers can use a maximum of 6 weeks of wage supplementation through the ordinary wage supplementation programme, the exceptional wage supplementation programme or the bilateral funds. Any periods of support already authorised on the basis of the previous decrees for use from 16 November onwards shall be merged into the new 6 weeks (Table 2).

Employers already authorised to use all 9 weeks of the second tranche of COVID-19 wage supplementation under Decree Law 104/2020 can, upon expiry of the period to which the authorisation refers, apply for new weeks of benefits. Employers operating in the sectors affected by the restrictions envisaged under the Prime Minister’s Decree of 24 October do not have to wait for the start of the period under which the second tranche can be drawn.

Use of the new 6 weeks of wage supplementation benefits is subject to a co-payment on benefit draws, identical to that introduced for the second tranche granted under the August decree. Businesses that have experienced a reduction in turnover of more than 20 per cent, those who started operations after 1 January 2019 and employers operating in the sectors affected by the restrictions imposed with the Prime Minister’s Decree of 24 October are not subject to this co-payment.

Non-agricultural employers who do not apply for the new 6 weeks of wage supplementation are now eligible for contribution relief for a maximum of 4 weeks, usable by 31 January 2021 in an amount equal to the hours of wage supplementation used in June 2020.

In line with the set of measures adopted, the moratorium on layoffs (individual and collective) for economic reasons has been extended until 31 January 2021.

Overall, the new wage supplementation programme essentially extends by a few weeks the same “package” of measures for the protection of employment initiated with the previous decree. From this perspective, Decree Law 137/2020 can be seen as a “bridge” pending the deployment of future measures, hopefully of a more structural and long-term nature, which could be launched soon.

In terms of financial effects, the Technical Report accompanying the decree puts the estimated expenditure authorisation for the new wage supplementation benefits at around €2.1 billion, of which €0.6 billion in 2020 and €1.5 billion in 2021, while the impact on net borrowing would be €1.3 billion in 2021. These amounts are not reported in the financial schedule of Decree Law 137/2020 because they are already incorporated in the public finance trend scenario in the 2021 Draft Budgetary Plan. The co-payment due for use of wage supplementation benefits would raise just over €69 million, while contribution relief would generate a tax expenditure of about €62 million.

Overall, the assessment of the financial effects appears prudential for several reasons. First, the estimate is based on the data for previous beneficiaries of wage supplementation in June without taking account of the downward trend in the use of the wage supplementation for COVID-19 reason observed in the subsequent months (in terms of direct payment beneficiaries). Furthermore, within this pool of beneficiaries, it is assumed that all employers eligible for the exceptional wage supplementation programme and benefits through bilateral funds use all of the additional 6 weeks. Finally, compared with the information drawn from Revenue Agency data on company turnover, the share of employers who will not have to make any co-payment is assumed to remain high.

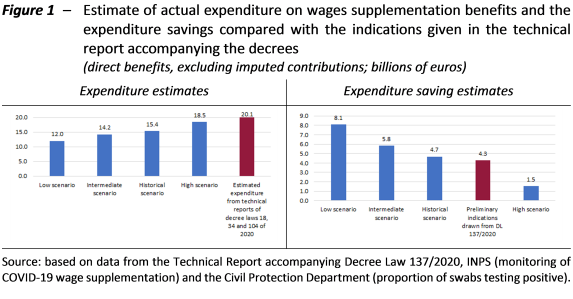

It should also be noted that the Technical Report accompanying Decree Law 137/2020 contains initial indications of possible expenditure savings compared with overall commitments that could be realised for wage supplementation usable by the end of the year as provided for in the anti-crisis decrees. This would amount to a reduction of about €4.3 billion compared with authorisations in terms of net borrowing (therefore excluding imputed social contributions).

The memorandum seeks to verify this possibility by formulating a preliminary estimate of the possible savings in the use of wage supplementation benefits based on INPS monitoring data as of 15 October. The estimate considers four possible scenarios for developments in expenditure in October, November and December on the basis of different assumptions about the spread of COVID-19.

All the scenarios assume that expenditure in October is the same as in September, appropriately supplemented by adjustment payments not registered in the monitoring and taking account of normal adjustments to the monitoring data over time. The four scenarios differ in the forecasts for wage supplementation in the last two months of the year. The “historical” scenario uses wage supplementation benefits observed in March and April for November and December, two months being when the spread of the virus first began (March) and then peaked (April). The other three scenarios link the November and December estimates to the “low”, “intermediate” and “high” projections prepared by the Civil Protection Department for the proportion of positive swab tests out of total tests.[1]

Figure 1 summarises the results of the estimates and the comparison with the initial indications given in Decree Law 137/2020 (expenditure in the left panel; the expenditure savings in the right panel). Based on these preliminary estimates, the expenditure savings for wage supplementation benefits to be used by the end of 2020 could reach a maximum of €8.1 billion in the most optimistic scenario, €5.8 billion in the intermediate forecast, €4.7 billion in the historical scenario (essentially in line with the indications in Decree Law 137/2020) and €1.5 billion in the most pessimistic projection, which represents an extreme case of the out-of-control evolution of the disease that could occur in the absence of adequate countermeasures.

One-off allowances. – Decree Law 137/2020 provides for a new one-month allowance for certain marginal categories of payroll employees and the self-employed that have been affected most severely by the crisis. These are mainly fixed-term, seasonal and temp workers in the tourism sector. However, the measure is not specifically limited to people affected by the restrictions laid down in the Prime Minister’s Decree of 24 October. The decree partially modifies – mainly expanding – the pool of beneficiaries of the allowances introduced or extended by the August decree (Decree Law 104/2020). The expenditure authorisation for the one-off allowances granted under Decree Law 137/2020 is €683.1 million. The decree funds the increased spending for the measures introduced by drawing on unused resources from the one-off allowances for the months of March, April and May.

In the section on allowances, the memorandum delineates a picture of the expenditure actually incurred for the allowances for March, April and May as well as the expected expenditure for the two additional payments granted under the August decree and the decree under review here. The time profile of expenditure for one-off allowances, initially decreasing and then stable, is determined by the gradual elimination after April of the allowances for professionals and free-lance contract workers enrolled in the INPS separate pension fund, the elimination from May of allowances for self-employed workers enrolled in the special pension funds for artisans, retailers, direct farmers, tenant farmers and sharecroppers and that for agricultural employees and by the broadly unchanged continuation of allowances for workers in the tourism sector.

Emergency Income programme. – Decree Law 137/2020 extends the period covered by the Emergency Income programme, introduced with the May decree, to include November and December 2020. These two additional months are granted automatically, without further eligibility requirements, to all Emergency Income beneficiaries receiving benefits for October under the August decree. This pool of beneficiaries is expanded by households that in September 2020 met the income and wealth requirements of the measure, which are similar to the existing requirements. The additional requirements initially provided for in the May decree and the amount of the benefit are also unchanged.

The Technical Report estimates that 404,000 households could qualify for the Emergency Income for November and December. Just over 300,000 households would receive the benefit automatically as they were already beneficiaries in October, to which 100,000 additional households would be added. The total resulting expenditure for both months covered for by the decree would be about €452 million, funded under the expenditure authorisation for the Emergency Income programme in the May decree. The cost of the additional monthly payments does not require additional appropriations beyond the funding initially envisaged in Decree Law 34/2020. In fact, the initial appropriation turned out to be amply overestimated compared with amounts actually disbursed in June-August and October. The number of households that actually received the Emergency Income during the initial period (June-August) was about one-third of those estimated in the Technical Report accompanying the May decree.

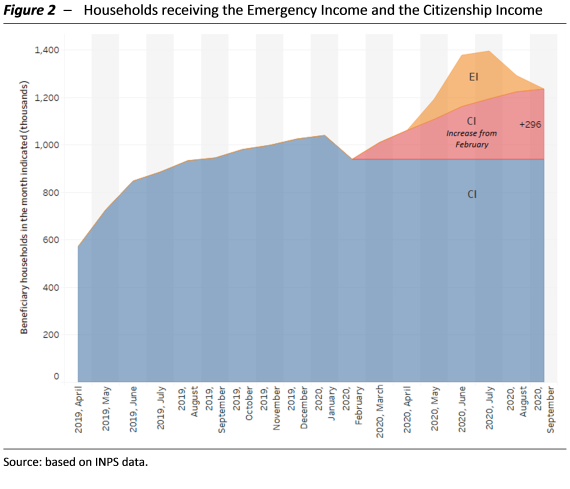

The relatively low take-up of the Emergency Income is partly explained by the simultaneous increase in the number of beneficiaries of the Citizenship Income programme, given that the potential beneficiaries of the two schemes overlap to some extent (PBO estimates released at the hearing on the May decree showed that more than half of the potential beneficiaries of the Emergency Income would also qualify for the Citizenship Income, which, for various reasons, they did not apply for). As the Annual Report of INPS points out, about 46 per cent of the beneficiaries of the Emergency Income had previously been denied enrolment in the Citizenship Income programme for exceeding the income/wealth limits or for non-compliance with the requirement for residency in Italy, which were among the main constraints that were eased under the Emergency Income programme. At the same time, households receiving the Citizenship Income increased significantly from the initial months of the pandemic (Figure 2), rising from about 940,000 in February 2020 to over 1.2 million in September (296,000, an increase of more than 30 per cent). This increase was due both to the deterioration in economic conditions and the temporary lifting of work requirements, which may have encouraged people previously unwilling to meet such obligations (for example, undeclared workers) to apply for the Citizenship Income.

Considering both Emergency Income beneficiaries and the new Citizenship Income beneficiaries, the number of beneficiaries of anti-poverty welfare benefits increased by about 590,000 during the pandemic, for a total cost of about €710 million.

Healthcare measures. – After the investment of resources in strengthening the National Health Service (NHS) provided for under the previous decree laws, the measures introduced in the healthcare field with Decree Law 137/2020 are focused on improving the identification and tracking of COVID-19 cases in order to contain the spread of the pandemic and limit its economic consequences. Their impact on general government net borrowing is negligible.

More specifically, responsibility for administering rapid antigen swab tests was assigned to general practitioners and paediatricians and it was decided to establish a national health surveillance hotline at the Ministry of Health, supplementing similar regional systems. The service will cost €1 million in 2020 and €3 million in the first six months of 2021.

Although information on the implementation of the reorganisation and consolidation measures for the regional health services during the pandemic is difficult to find, fragmented and often not published by official sources, attempts have been made to report some preliminary evidence on what has been achieved. With regard to tracking, the available data show that a total of 10,458 staff in the regions are dedicated to contact-tracing, corresponding to 1.7 trackers per 10,000 inhabitants, exceeding the minimum threshold of 1 tracker per 10,000 inhabitants. However, the ratio differs considerably between the regions and in some it remains below the target. The number of intensive care beds has increased in recent months in almost all regions and nationally, reaching 13.4 beds per 100,000 inhabitants, compared with a target of 14 beds indicated in the May decree. The results are again not uniform across the regions, and in most cases the effort to achieve the target has not been completed. As for expanding staff, as of 23 October 2020, 36,300 personnel had been recruited, of which 7,650 doctors, 16,500 nurses, 7,739 unlicensed assistive personnel and 57 social workers, according to data released by the Ministry of Health.

[1] See PBO (2020), “Report on Recent Economic Developments – October 2020”, pages 21-23.