The Chairman of the Parliamentary Budget Office (PBO), Giuseppe Pisauro, submitted a memorandum (in Italian) to the Budget Committee and Finance and Treasury Committee of the Senate concerning the bill ratifying Decree Law 41/2021 (the “Support Decree”) containing measures to support businesses and economic activity, workers and households, health and local services impacted by the COVID-19 emergency. In addition to discussing the measures contained in the legislation and their impact on the main public finance aggregates, the memorandum offers a number of specific analyses of the main interventions, which generally continue those introduced in earlier anti-crisis decrees.

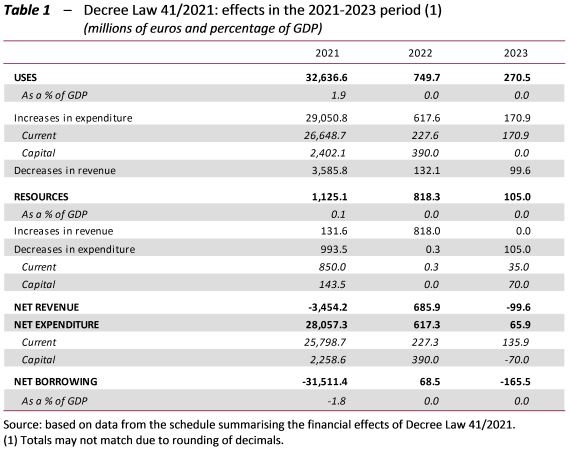

The measures contained in the Support Decree increase general government net borrowing by €31.5 billion in 2021 (1.8 percentage points of GDP) and only about €165 million in 2023, while they slightly reduce borrowing by about €68 million in 2022 (Table 1).

The impact on 2021 differs if measured in terms of the borrowing requirement and the net balance to be financed (NBF) of the State budget. More specifically, the impact on the borrowing requirement is €32.7 billion, while for the NBF the annex to the Decree distinguishes between the impact measured on a commitment basis (€37.4 billion) and on a cash basis (€49.2 billion). These financial effects are consistent with the request for a deviation of the deficit presented in the Report to Parliament of 15 January 2021, which was authorised by Parliament on January 20.

There is a lack of transparency concerning specific measures with a significant impact on the borrowing requirement and/or the NBF but not on the general government net borrowing. In the absence of further information, it is believed that some of these measures could also impact the latter balance. In particular, this risk concerns the increase in the component – not specified in the decree – of the reserve fund for cash authorizations that does not regard the closiing of treasury advances granted pursuant to Decree Law 137/2020.

Some of the most significant measures contained in the Support Decree are analysed below.

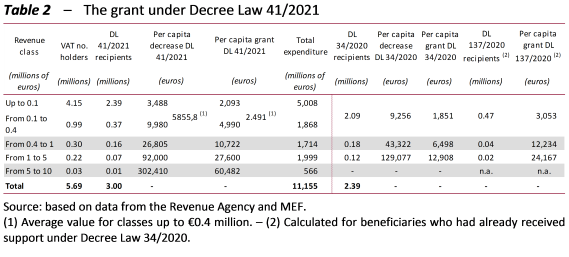

Grants and sectoral support measures. – The quantitatively most significant measure is undoubtedly the grant for all VAT number holders with revenues of up to €10 million in 2019 which in 2020 experienced a reduction in turnover of more than 30 per cent compared with the previous year. The amount of the grant, which can also be requested in the form of a tax credit to be used as an offset, is equal to a percentage – differentiated into five different revenue classes – of the average monthly reduction in turnover between 2020 and 2019. The estimated expenditure for this measure is approximately €11.2 billion for 2021 and increases the volume of resources allocated to grants since the start of the pandemic to almost €23 billion (equal to 16.4 per cent of the estimated contraction in GDP between 2019 and 2020).

Some general considerations emerge from the qualitative and quantitative analyses of the new grant.

- The pool of potential beneficiaries is larger than those under previous relief measures. Compared with the May decree (Decree Law 34/2020), the grant can also be paid to professionals and larger companies (with revenues of between €5 and 10 million), which according to the most recent data available (2018 VAT returns) represent, respectively, about 19 per cent and 0.6 per cent of the 5.69 million VAT number holders involved and between 1.5 per cent and 17 per cent of their turnover. Compared with the Relief Decree (Decree Law 137/2020), the beneficiaries are no longer identified on the basis of their ATECO economic activity classification codes, but rather the measure returns to a size criterion. According to recent estimates by the Ministry for the Economy and Finance (MEF) that have appeared in the press, 3 million beneficiaries would be eligible – compared with 2.4 million under Decree Law 34/2020 – of which about 80 per cent with a turnover of up to €100,000.

- The grant is based on the average monthly reduction recorded in 2020 compared with 2019, rather than that registered in April 2020 alone compared with the corresponding month of 2019. The new benchmark reduction is smaller, for all size classes, than that used for previous grants. At present, this new criterion should approximate the loss of turnover of companies in the early months of 2021, eliminating a number of problems that emerged with using April alone as the reference month. The latter, for example, might not capture real distress at companies that do not have stable monthly revenues or, conversely, might be too circumscribed and overestimate the effects of the crisis for some, as it uses a month characterised by the almost total closure of economic activity and stringent restrictions on the movement of people.

- With regard to the size of the new grant, a comparison between the MEF estimates that appeared in the press regarding the new measure and data from the Revenue Agency on previous measures indicates that the new per capita grant is larger than that under the May decree but smaller – except for the €1-5 million turnover class – than that under the Relief Decree (Table 2).

- Ex post, significant differences may emerge between beneficiaries in the total amount of grants they receive for the same reduction in annual turnover. Some beneficiaries will have received only the first two grants, others only the grant under the Support Decree and still others will have received all three types of support. This reflects the different eligibility criteria adopted.

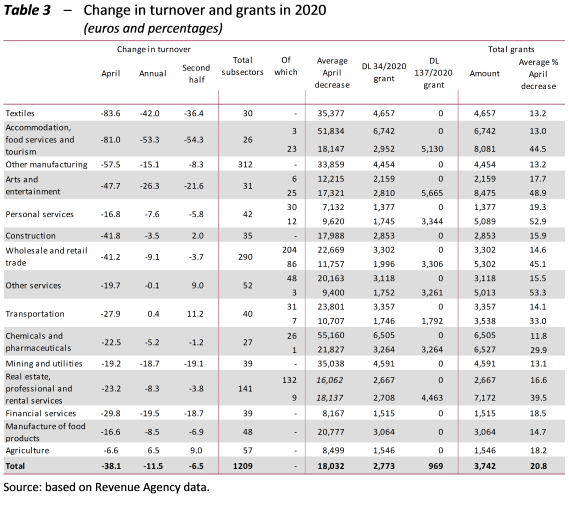

For certain sectors that recorded significant average declines in turnover in April – textiles (-83.6 per cent), accommodation, food services and tourism (-81 percent) and arts and entertainment (-47.7 per cent) – the reduction on an annual basis is smaller but still significant (Table 3). Many companies in these sectors (those with the ATECO codes targeted by the Relief Decree), except those in textile industry, have already received the two grants envisaged under the earlier decrees, covering on average a higher percentage of lost revenue in April (44.5 and 48.9 per cent, respectively, in the accommodation and food services sectors and in the arts and entertainment sectors, but with peaks of 60 per cent for companies with a turnover of up to €400,000). Firms in sectors that were ineligible for grants under the Relief Decree, on the other hand, only received the grant provided for under the May decree, recouping a significantly smaller percentage of their lost revenue (for example, 13.2 per cent in the textile sector). The new grant would therefore also make it possible to compensate many enterprises that were ineligible for support under the Relief Decree due to their classification in an ineligible ATECO category. For other sectors that were equally hard hit in April – other manufacturing, wholesale and retail trade and construction – the reduction in turnover they suffered on an annual basis is smaller, and it is possible that many such companies are ineligible for the new grant.

Looking ahead, it will be important to correlate the total amount of grants received by individual beneficiaries (individuals and legal entities) with the actual loss of turnover registered in the past period and, on the basis of these findings, to evaluate the appropriateness of some equalization mechanism to ensure that, on the one hand, no VAT number holders were excluded from the benefit despite having suffered significant declines in turnover and, on the other, that no one obtained what could be even a substantial relief despite having registered much smaller losses or even no reduction at all.

It should also be borne in mind that a grant based solely on the reduction in turnover produces different outcomes in terms of its coverage – even partial – of firms’ costs. Firms’ costs differ considerably in relation to their structural and sector characteristics: some of them may have a greater capacity than others to adapt costs to variations in turnover. Furthermore, the public support policies for businesses adopted since March 2020 made it possible to reduce certain variable costs, such as labour costs, more effectively than fixed costs. Consequently, the very weak link between the size of the grant and the scale of the costs that companies must still bear after receiving support under the various support programmes means that the degree to which costs are covered and the impact on profitability will differ depending on the different structural characteristics of the company.

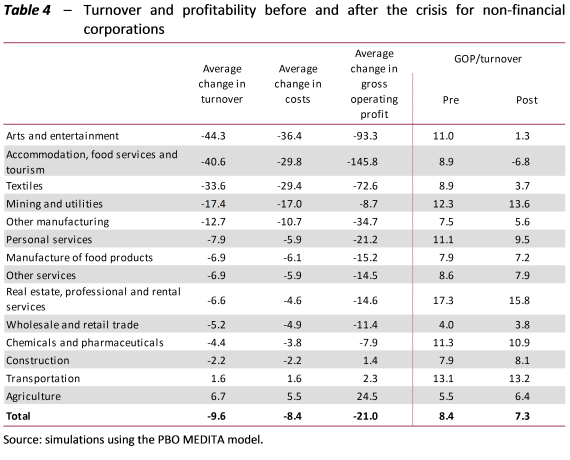

An initial assessment of how the changes in turnover during 2020 affected the profitability of companies, taking account of their adaptation strategies and government cost support policies, was conducted for non-financial corporations only using the PBO’s MEDITA microsimulation model. Within the simulation, changes in turnover and the elasticity of the various cost components with respect to the latter and, by difference, the profitability of companies are defined exogenously at a sectoral level. The main government policies introduced since March 2020 to support the costs of businesses are considered, but not the grants provided so far.

In general, company profitability is unchanged (neutrality) when the average change between 2019 and 2020 in costs (fixed and variable) is, thanks to the adaptation initiatives taken by companies and the government support policies adopted during 2020 (wage supplementation, tax credits for rent and lease payments, flexibility of depreciation rates, exemption from IMU (property tax) and IRAP (regional business tax), etc.), identical to that in turnover. When the average decrease in costs is smaller than that in turnover, companies see their profit margin decline, and this is the case for most of the companies considered in the simulation, with significant differences in the magnitude of this decrease between sectors (Table 4). For all the companies considered, costs decreased by an estimated 8.4 per cent and profitability (measured by gross operating profit) contracted by 21 per cent, compared with a decline of 9.6 per cent in turnover. For sectors most affected by the restrictions (arts and entertainment, accommodation, food services and tourism, and textiles), the reduction in costs and gross operating profit differs significantly from that in turnover. These three sectors are those that suffered a reduction in turnover of more than 30 per cent, the threshold beyond which firms are eligible for the new grant (which, as noted, is not included in the simulations reported in Table 4).

Accordingly, these preliminary analyses show that the support measures implemented during the pandemic partially covered the costs still borne by companies despite the reduction in turnover associated with the restrictions imposed on economic activity, but this coverage differed among sectors.

Finally, the Support Decree envisages for a series of specific sectoral measures, following through on the measures adopted since March 2020 with the anti-crisis decrees. More specifically, it refinances – for a total of €0.7 billion – a number of funds for grants to the entertainment, cinema and audio-visual sectors, publishing, museums and cultural establishments and trade fairs. It also extends a range of measures providing for exemptions from the payment of taxes and contributions, totalling €1.9 billion. Finally, it establishes a fund of €0.7 billion to provide financial support for winter tourism operators and a fund of €0.2 billion to be allocated to the sectors most affected by the restrictive measures (retail companies operating in city centres and event organisers).

Measures for the labour market. – In line with the measures adopted since March 2020 and in the 2021 Budget Act, the Support Decree refinances, among other programmes, the COVID-19 wage supplementation mechanism (with a number of important changes), the moratorium on layoffs and the one-off allowances for certain marginal categories of payroll employment and self-employed work.

The COVID-19 wage supplementation programme has been extended – without the co-payment for benefit draws – distinguishing between employers. Those normally insured under the ordinary wage supplementation programme (CIG) can receive other 13 weeks of support, in addition to the 12 already granted under the Budget Act, for a total of 25 weeks usable by June. Those covered by the bilateral funds or without coverage will be eligible for 28 weeks of support between April and December, in addition to the 12 already granted under Budget Act for use by June, for a total of 40 weeks. Furthermore, payroll employees in agriculture have access to another 120 days of COVID-19 CISOA (the wage supplementation system for agricultural workers), which can be drawn between April and December, in addition to the 90 already made available under the Budget Act for the months between January and June. The extension of COVID-19 wage supplementation is estimated to cost about €6 billion, of which €3.7 billion of direct benefits and €2.3 billion of imputed social contributions. The option of electing to receive contribution relief as an alternative to COVID-19 wage supplementation has been discontinued.

Similarly, the moratorium on individual and collective layoffs for economic reasons has also extended on a differentiated basis: until 30 June for employers insured under the CIG programme and until 31 October for those covered by bilateral funds or the uninsured and for agricultural workers.

What will happen after 1 July when layoffs are again possible? The recovery of a normal pace of economic activity, together with the possibility – especially for firms in industry and construction – of drawing on ordinary CIG with the ceiling on the cumulative duration of benefits reset to zero would help to reduce the number of employees who could be fired.

A rough estimate of the number of people at risk of losing their job can be obtained from the data on terminations and activations of payroll positions from the INPS Observatory on Employment. Compared with 2019, 2020 saw about 300,000 fewer terminations motivated by the economic difficulties of the employer. If we focus on the two economic activity categories that account for the majority of those covered by the CIG programme (“mining and quarrying, manufacturing, electricity, gas, steam and air conditioning supply, water supply, sewerage, waste treatment and remediation activities” and “construction”), the reduction in terminations amounted to about 130,000 positions. If from 1 July employers want to wind down the accumulated stock of terminations that did not take place, these 130,000 workers could be at risk. This estimate is supported by certain descriptive statistics reported in the recent joint report from the Ministry of Labour, Istat, INPS, Inail and Anpal “Il mercato del lavoro nel 2020”.

However, we must bear in mind that 2020 also saw a significant decline in the activation of payroll positions that far exceeded the concomitant reduction in terminations: almost 1.4 million, which become about 280,000 if we focus on the sectors mentioned previously. More generally, the balance between terminations of payroll employees for all reasons (not just economic) and the corresponding activations was a negative 241,000 positions in 2020, compared with a positive 180,000 in 2019.

It would appear that the moratorium on layoffs has indeed altered the decisions that companies have taken about the composition of their workforce, but has not created an overhang that must necessarily be eliminated as soon as possible. This would suggest that from 1 July the relatively normal turnover of payroll employees could resume, perhaps slightly more intense than in previous years, but without any rapid elimination of all the jobs that, theoretically, should have been terminated in 2020. From this perspective, the number of people at risk of losing their job could be even smaller than expected and would depend primarily on the robustness of the economic recovery over the course of the year. This will also apply when, at the end of 2021, the moratorium on layoffs is also lifted for other employers.

People in a number of marginal categories of payroll employment and self-employment who have been hit more severely by the crisis are eligible for a new one-off allowance of €2,400 under the decree, which has expanded the number of eligible beneficiaries with respect to the Relief Decree. In addition, a variable allowance is available for workers who have seen their jobs terminated, reduced or suspended in the sports sector.

The Support Decree fully espouses the strategy employed since August in the previous decrees. It also retains the procedure for the automatic renewal of allowances for those who had already received them in the past and the extension of the allowances to those affected by the crisis in subsequent periods. The increase in the allowance – in most cases it rises from €1,000 to €2,400 – appears to be prompted by the continuation of restrictions and the fact that the Support Decree was presented almost four months after the last Relief Decree. Therefore, any explicit or implicit reference to the concept of monthly payments has been lost. Total expenditure is estimated by the Technical Report at €1.3 billion.

Citizenship Income and Emergency Income. – In anticipation of an increase in disbursements due to the continuing impact of the pandemic and without making significant amendments, the decree increases the spending limit for the Citizenship Income by €1 billion for 2021, bringing it to about €8.4 billion. This is a 14 per cent increase in spending in 2020, which was already impacted by the economic effects of the pandemic.

In the early months of 2020, the number of beneficiaries had declined by about 80,000 compared with December 2019 due to the obligation for beneficiaries to submit a new equivalent economic status (ISEE) declaration, which expired on December 31 of the previous year. From March to September, in reflection of the pandemic, the number of beneficiaries progressively increased to about 1.26 million. October experienced a sharp reduction in the number of beneficiaries (approximately 340,000 individuals) due to the suspension of a monthly payment for those who, having received benefits since April 2019, had reached the limit of 18 months. This reduction was only reversed in January 2021, due both to possible delays in restoring eligibility for the benefit and additional suspensions of recipients reaching the limit of 18 months in the following months. Due in part to these fluctuations in beneficiaries, total expenditure for the Citizenship Income in the pandemic year remained below the expenditure ceiling initially estimated in Decree Law 4/2019 (about €7.2 billion).

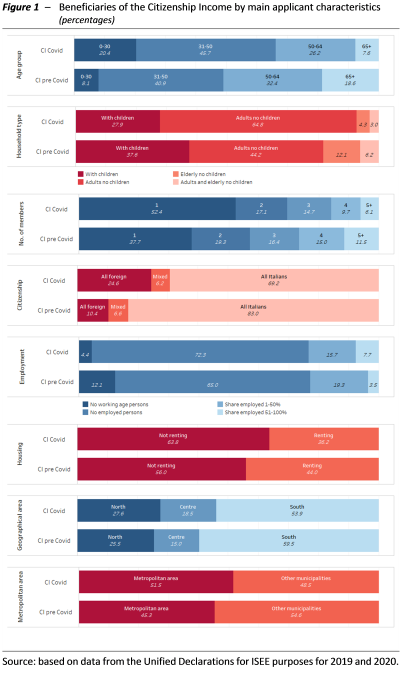

An analysis of a sample of administrative microdata offers a comparison of the main characteristics of households receiving the Citizenship Income before the start of the pandemic (2019 and first three months of 2020) with those who successfully applied for it later (Figure 1). The comparison shows that there was a significant increase in beneficiaries in the younger age groups during the COVID-19 period, with more marked effects among those under 30 years old (+12.3 percentage points, to 20.4 per cent). Conversely, the number of beneficiaries over the age of 65 decreased by a similar amount (from 18.6 per cent to 7.6 per cent). About 65 per cent of the new beneficiaries have no children and more than half live in single-person households. Despite the restrictive eligibility criteria for foreigners, their share increased by 14.2 percentage points compared with 2019. The demand for the benefit is mainly attributable to a deterioration in employment conditions: the share of the unemployed among recipients during COVID-19 is 72.3 per cent (it was 65 per cent in the pre-pandemic period).

For 2021, based on the analyses conducted by the Citizenship Income and Pension Observatory, it appears that the maximum level of total monthly benefit payments (€691.3 million) was recorded in January, with approximately 1,272,000 beneficiaries. Considering this pool to be potential beneficiaries for the remainder of the year, total outlays would amount to around €8.3 billion, in line with the new spending authorisation provided for under the Support Decree. However, the deep uncertainty surrounding the economic outlook impacts the overall estimate for this spending in 2021: while, on the one hand, the improvement in economic conditions could, albeit with some lag, decrease the size of the beneficiary pool, on the other hand, the end of the moratorium on layoffs could drive new benefit applications.

With regard to the Emergency Income programme, the decree law provides for the payment of three monthly payments for March, April and May 2021, confirming the amount and modifying some eligibility requirements.

Suspension of tax assessments and cancellation of tax liabilities. – In addition to reintroducing measures already adopted in 2020 regarding taxation and tax collection, the decree introduces significant changes concerning assessments entrusted to collection agents. On the one hand, the measures enable taxpayers to better cope with the economic and social hardships associated with the spread and continuation of the pandemic. On the other, they also enable more effective planning of the resumption of collection activities at the end of the emergency, also in consideration of the assignment of new assessments in 2021 that are now pending. Finally, the decree introduces another measure that, on the one hand, consists in an amnesty and, on the other, would improve the handling of positions that are by now unrecoverable.

The main measure regarding tax collection consists in the cancellation of all liabilities with a residual amount of up to €5,000 for assessments regarding the 2000-2010 period, even if they qualify for the forms of facilitated settlement of tax arrears (so called “Rottamazione ter”, “Definizione agevolata delle risorse proprie UE”, “Saldo e stralcio”) for assessments sent for collection in 2000-2017. The measure – which replicates with some differences a similar provision contained in Decree Law 119/2018 – is targeted exclusively at taxpayers who in 2019 had a taxable income not exceeding €30,000 and is similar to other mechanisms that in recent years have introduced facilitated terms for the settlement of assessed tax liabilities and provided for the full cancellation of such liabilities.

A number of observations on the provisions contained in the Support Decree are in order with regard to collected assessments, forgiven liabilities and residual positions.

With regard to the former, data for the last three years show that while ordinary collection has remained virtually unchanged (just over €6 billion), facilitated collections and ordinary instalment agreements have declined, sometimes quite significantly, compared with amounts collected in 2017 (the former going from about €6.5 billion to €3.9 billion, the latter from around €3.3 billion to about €2.5 billion), the year in which the facilitated settlement options were introduced. Many taxpayers, after applying for facilitated settlement, then fail to complete the payment of the full amount due. A preliminary examination of the data suggests that there is a risk that the introduction of facilitated settlement mechanisms, which essentially represent a sort of tax amnesty, may also lead in perspective to a reduction in ordinary collections.

With regard to the forgiveness of tax liabilities, the imposition of a ceiling on both the size of forgivable liabilities and the taxable income of eligible taxpayers limits the pool of beneficiaries. However, two aspects must be considered: first, considering the maximum debt eligible for forgiveness, the principal amount of assessments for unpaid taxes, especially for relatively old positions, could be very low; second, the focus on individual positions means that taxpayers with multiple positions below the threshold could potentially benefit from the cancellation of significant amounts, also in relation to their declared income. The forgiveness mechanism envisaged in the Support Decree therefore benefits debtor taxpayers, but also enhances tax collection activities: all positions below the threshold – including those that are highly unlikely to be recovered – would otherwise have to go through all recovery operations, bearing in mind the time this will require and the impact on the accumulation of a backlog of other delinquent positions. The cancellation of liabilities for which the percentage recovery would be relatively low would enable tax authorities to focus their efforts on positions for which collection rates are higher. However, a decree intended to support businesses, workers and households in dealing with the economic hardships imposed by the pandemic does not appear to be the most suitable tool for introducing measures involving the cancellation of tax arrears that, in addition to representing an amnesty, are designed to improve tax collection activities.

With regard to residual positions, the introduction of facilitated settlement and cancellation of the oldest arrears would make it possible to reduce the “assessment backlog”. Data on the backlog of pending assessments sent to tax collection agents between 2000 and 30 June 2020 indicate that the residual value of outstanding arrears amounts to €987 billion, of which the Revenue Agency – Collections estimates that the “net backlog”, i.e. positions for which there is some expectation of collection, is only €74 billion. Of this, about €14 billion regard assessments sent for collection between 2000 and 2010. Collection of the remainder, net of those being settled under instalment agreements that have not been revoked, could be pursued with further recovery actions, although these are likely to be highly complex and not produce much additional revenue. The cancellation of low-value claims may not significantly reduce the value of the assessment backlog but could substantially reduce the number of pending assessments. Also bearing in mind the fact that current legislation requires that recovery be pursued for every single assessment sent for collection, the cancellation of the numerous low-value positions would enable collection efforts to be focused more effectively on a smaller number of high-value positions, for which collection rates are also higher.

The question of how to manage the residual backlog of assessments thus involves very different issues, which would merit a comprehensive reform measure that, above all, provides for the introduction of mechanisms for the automatic cancellation of arrears in order to reduce the backlog of assessments in line with the actual probability of collection, in addition to modifying the mechanism for acknowledging the impossibility of recovering positions sent for collection.

Any intervention that introduces forms of facilitated settlement or cancellation of tax arrears cannot ignore the effects that amnesties and other such measures have on the effectiveness of the tax authorities’ assessment, control and collection efforts and on tax evasion. The evaluation of this sort of approach should not be limited to merely assessing the revenue effects of participation in facilitated settlement programmes, but rather should also consider indirect impacts, i.e. the impact that expectations about future amnesties could have on the effectiveness of ordinary tax collection, ordinary enforcement mechanisms and the voluntary compliance system.

Measures for healthcare. – The resources for healthcare measures envisaged in the Support Decree are mainly aimed at expanding the vaccination campaign and the acquisition of drugs for the treatment of COVID-19. More than €3.7 billion have been allocated for this objective, including the intervention of the special commissioner in this area. In particular, an attempt is being made to broaden the categories of personnel involved in the administration of vaccines, eliminating a number of obstacles that had hampered their participation. The remuneration provided for the different categories, however, is not uniform and it is not certain that in all cases they will prove to be sufficient to stimulate participation in the vaccination campaign. In the case of pharmacies, the intention is to partially remunerate their involvement in the vaccine effort with an increase in margins on pharmaceutical products. Although experimental, this reform, which is also intended to prevent the closure of pharmacies following the reduction in turnover in recent years, would require a specific measure, not linked to the emergency.

Information on the availability of vaccines in Europe and Italy reveals a significant delay compared with other countries, such as the United Kingdom and the United States. Hence the concern about the failure of some pharmaceutical companies to make good on their delivery promises, but also the effort to increase vaccination capacity envisaged in this decree in relation to the increase in the number of doses expected from the second quarter.

Measures for local authorities. – Continuing the line taken with the decree laws adopted in 2020 and the 2021 Budget Act, the decree envisages a number of measures to support local authorities. These mostly involve the refinancing and extension of measures launched in recent months. In particular, these include an increase for 2021 of the fund for the exercise of the basic functions of local authorities (by €900 million for municipalities and €100 million for provinces, to be allocated by 30 June 2021) and in the fund for the exercise of the functions of the regions and autonomous provinces (by €260 million for special statute governments only, to be allocated by 30 April 2021). The fund to support local public transport companies also receives an additional €800 million in appropriations (exclusively intended to offset the reduction in ticket revenues in the sector).

In addition, local authorities are recipients of additional specific resources. Two funds are dedicated to the regions and the autonomous provinces, the first to support particularly hard hit categories of beneficiaries and the second to reimburse part of the extraordinary expenditure incurred to purchase of healthcare goods. The measures for municipalities include partial reimbursement of the reduction in tourist and landing tax revenues as well as a doubling of the fund to offset the effects of the exemption of retailers and itinerant businesses from payment of the TOSAP and COSAP public land occupation fees.

Measures for education. – For 2021, the decree reserves a total of €413.5 million for education, of which €335 million for schools and €78.5 million for the emergency needs of universities, Institutions for high education in art, music and dance and research entities. The measures adopted extend those enacted previously. During the health emergency, resources were appropriated for specific funds for education, each of which is governed by its own allotment criteria, often defined in concert with other ministries. An overall analysis of the distribution of funding received by schools would offer useful information for evaluating the policies adopted. However, this is not possible due to the lack of data in this regard.