The Chairman of the Parliamentary Budget Office (PBO), Giuseppe Pisauro, sent the Senate Budget Committee a memorandum (in Italian) concerning the bill ratifying Decree Law 104/2020 (the “August Decree Law”) containing measures to revive and support the economy currently under examination by Parliament. The memorandum examines the provisions of the measure, focusing on their financial impact and the primary effects on the sectors and categories concerned.

The financial effects of the decree. – The August Decree Law envisages a package of measures that extend (while supplementing and partially amending) measures enacted previously to support employment and income, refinance measures for growth and for local authorities, allocate greater resources for school and healthcare and postpone some tax payments to 2021-2022. Financial operations involve State acquisition of participations in companies, while other interventions are targeted at certain industries, first and foremost tourism, which has been especially hard hit by the COVID-19 emergency.

The impact of the decree for 2020 is equal to €24.9 billion (€5.3 billion in 2021 and €0.8 billion in 2022) in terms of general government net borrowing, €30.8 billion in terms of the general government borrowing requirement (€5.8 billion in 2021 and €0.7 billion in 2022) and €30.9 billion in terms of the net balance to be financed of the State budget (€6.9 billion in 2021 and €1.2 billion in 2022).

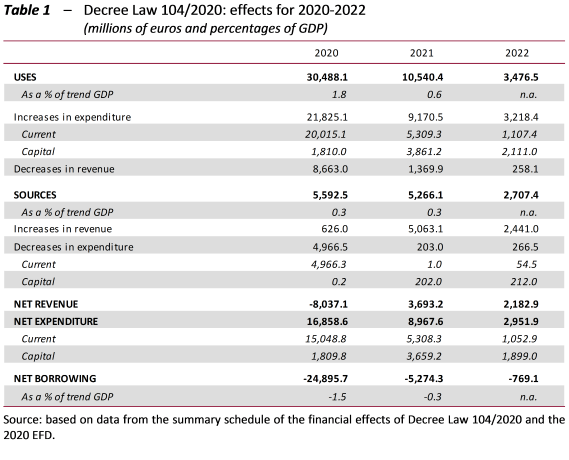

As a percentage of GDP, the decree will increase net borrowing by 1.5 per cent in 2020 and 0.3 per cent in 2021 (Table 1).

Together with the amounts already provided for in Decrees 18, 23 and 34 of 2020, the measures will increase net borrowing by €100.2 billion in 2020, €31.4 billion in 2021 and €35.5 billion in 2022.

The provisions of the decree essentially focus on 2020. In subsequent years, a decline in the impact on expenditure will be accompanied by a positive impact on revenue due to the postponement of payment of certain taxes and contributions as a result of the suspensions established for this year. The increase in net expenditure gradually declines in magnitude, going from €16.9 billion this year to €9 billion in 2021 and then €3 billion in 2022. The impact on net revenue, which is a negative €8 billion in 2020, becomes positive in the following two years, amounting to €3.7 billion in 2021 and €2.2 billion in 2022.

With regard to uses, for 2020 the resources are mainly targeted at supporting workers, local authorities and providing tax and social security relief. Over 80 per cent of uses are directed towards these purposes, in the respective amounts of €9.5 billion (31.3 per cent of uses), €9.6 billion (31.5 per cent, of which €4.1 billion in accounting items, however) and €6.2 billion (20.2 per cent). Less substantial measures regarded schools, universities and emergency support (€1 billion) as well as support for and revival of the economy (€3.4 billion). The decree, which is largely financed in deficit, generates resources through reduced current expenditure in 2020 (however, about 83 per cent of these resources ‑ € 4.1 billion – regards to purely accounting recording of financial operations with the regions).

The main measures provided for in the August Decree are as follows.

Labour market and income support. – The decree law extends, with important changes, the tools already introduced with the earlier Decree Law 18/2020 and Decree Law 34/2020. In particular, the decree extends the COVID-19 justification for access to the Wage Supplementation Fund (CIG) for a further 18 weeks (in two tranches of 9 weeks), the ban on layoffs and the NASPI and DISCOLL unemployment benefits, broadens the scope for renewing expiring fixed-term employment contracts, introduces new one-off allowances for some types of workers not covered by the wage supplementation scheme and, finally, introduces contribution relief with the aim of encouraging new hiring and reducing labour costs for employers.

The most important measure is the extension of COVID-19 wage supplementation. All non-agricultural employers will have an additional 18 weeks for the period between 13 July and 31 December 2020. The first 9 are totally free of charge to firms. Once drawn down, access to the second 9 weeks is conditional on a co-payment by firms that registered a loss of turnover in the first half of 2020 of less than 20 per cent compared with the corresponding period of 2019 – previously not envisaged for COVID-19 wage supplementation – equal to a percentage (9 or 18 per cent) of the total remuneration due to a worker for the suspended working hours. Any periods of wage supplementation already authorised for use from 13 July onwards are included in the first tranche of new weeks of support now available.

The Technical Report assumes that the new 18 weeks will be fully drawn by 90 per cent of the users of wage supplementation in May. Moreover, INPS data can be used to identify the 30 per cent of recipients of COVID-19 wage supplementation in May employed by businesses that, in the absence of the special COVID-19 justification, would have hit the ceiling on the cumulative duration of ordinary CIG benefits (the so-called “unblocked”). Only the benefits relating to this subgroup are included in the increased expenditure originating with the August Decree. The remainder are included in the trend scenario prevailing prior to the COVID-19 decrees. On this basis, the number of beneficiaries of COVID-19 wage supplementation would total more than 2.2 million, with an increase in expenditure, including family allowances, of just over €8.2 billion, of which about €3.2 billion in imputed contributions.

Taking account of the resources already allocated by the previous decrees and the results of the most recent INPS monitoring, the overall resources dedicated to COVID-19 wage supplementation appear to exceed demand. In particular, INPS data shows that, compared with forecast expenditure of €12.8 billion (net of imputed contributions) for wage supplementation usable until the end of October under Decree Law 18/2020 and Decree Law 34/2020, in the quarter most affected by the emergency and the lockdown (March-May), actual expenditure, without considering any disbursement delays, was €3.8 billion, less than a third of the total. In the light of the data on the hours authorised by month of accrual reported in the Technical Report accompanying the decree, it appears unlikely that the amounts drawn in the coming months will be at levels comparable to those of the March-May period. Even if there were to be a resurgence of the COVID-19 pandemic in September-October, the gap between appropriations and actual expenditure would seem to leave ample room for further recourse to wage supplementation even without the appropriations provided for in Decree Law 104/2020.

The prudence of the forecasts can, however, be justified both by the uncertainty that still surrounds developments in the pandemic and the timing and robustness of the recovery and by the need to start preparing the ground for when, between mid-November and the end of December 2020, both the extraordinary safety net measures and the ban on layoffs will expire. It is crucial that any budgetary capacity that may arise not be dispersed in commitments for other purposes.

Decree Law 104/2020 has two innovative features in its measures to support employment compared with the previous decrees. First, it tightens the eligibility requirements for the new support, thanks to the introduction of the co-payment for new drawings on COVID-19 wage supplementation benefits and the targeting of the new one-off allowances at the most precarious workers and professionals who suffered the greatest losses in their turnover. Second, it introduces measures – contribution relief – intended to stimulate new employment and reward staff retention and the continuation of production to accompany the measures aimed at supporting income in the event of the interruption/suspension of work (wage supplementation and allowances) and regulatory instruments (the ban on layoffs). It will be important to carefully monitor the effects of the contribution relief in order to gain insight into the tools that should be adopted to continue to support the economy in 2021.

Firms. – The measures envisaged for firms are mainly extensions and refinancing of those adopted in response to the health emergency in March-May 2020 (Decree Law 18/2020, Decree Law 23/2020 and Decree Law 34/2020). In general, the measures are increasingly selective, being targeted at the companies and sectors most severely affected by the crisis, and can be grouped by main purpose: revival and financing of businesses, liquidity support measures, exemptions and suspensions of the payment of contributions and taxes, support for business costs, and measures in favour of specific sectors (restaurants, tourism-culture, publishing, the automotive industry and transport).

To help meet the liquidity needs of firms, the measures strengthen existing instruments by refinancing the Guarantee Fund for SMEs to ensure its full operation and by extending the duration of the extraordinary automatic moratorium on loan repayments.

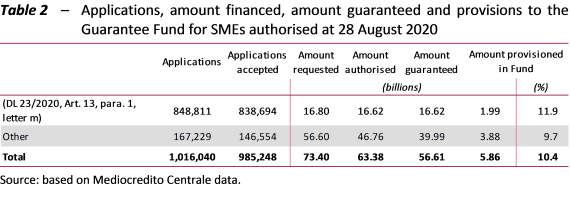

Table 2 summarises daily MISE data on the operations of the Guarantee Fund. As of 28 August, the Fund has accepted 985,248 applications totalling about €63.4 billion in loans, which correspond to €56.6 billion of guarantees (on average, 89.3 per cent of the loan value); an additional €10 billion in financing with the corresponding State guarantees are awaiting authorisation.

Provisions allocated to the Fund (€5.9 billion) amount to around 10 per cent of total guarantees granted. Taking into account that the previous anti-COVID-19 decrees appropriated €6 billion for the Fund – in addition to limited pre-existing resources – the refinancing provided for under the decree law (equal to €7.3 billion in 2023-2025) was necessary to ensure the operational continuity of the Fund given that available resources had nearly all been drawn down.

It should be borne in mind that even with no increase in the guarantees granted, the provisioning requirements for the Guarantee Fund could rise. Every two months the Fund manager must supplement the assessment of the probabilities of borrower default based on the economic-financial module alone with an assessment deriving from the loan performance module based on data from the Central Credit Register of the Bank of Italy acquired at the time of presentation of applications for guarantees. Heretofore this adjustment procedure was activated by the Fund manager for 107,762 transactions, those completed in the first two bimesters (i.e. between 10 April and 9 August). Considering almost all of these transactions (for 207 it was not possible to proceed), the adjustment entailed an increase in net provisions to the Fund of €0.1 billion (from €3.7 billion to €3.8 billion), corresponding to about 2.7 per cent of the initial provision. Transactions with a very high risk of default rose from 0.5 to 4.5 per cent of total transactions examined in the first two bimesters, and provisions to the Fund increased from 1.7 to 15.6 per cent of the total.

The coming months could see even larger percentage changes in provisions to the Fund than the original adjustment (equal, as noted, to about 2.7 per cent of the initial provision) in reflection of both the completion of the bimonthly adjustment based on the performance module for the probabilities of borrower default and any general revision of the latter that the Fund manager could decide on the basis of economic developments that could presage an increase in the risk of default or bankruptcy of borrowers. Moreover, from 2023, the year in which the loans received will begin to be repaid, the actual financial difficulties of the companies most affected by the crisis will manifest themselves fully, which could increase default percentages above those assumed in determining provisions to the Fund, thus raising funding needs in subsequent years.

The decree also provides for the extension to 31 January 2021 of the extraordinary moratorium on payments of the debts of micro-enterprises and SMEs without additional charges to the public finances.

On the basis of the weekly survey conducted by the Task force established to promote the implementation of the liquidity support measures adopted by the Government, through 7 August, 1.3 million applications for a moratorium had been received from non-financial companies for loans totalling €196 billion. The data reveals a sharp imbalance in the type of suspensions requested, since over 80 per cent (€158 billion) concerns the suspension of payments on mortgages and other instalment loans. On the assumption that the resources of the Fund are sufficient to finance the extension of the moratorium, this imbalance could mean that the Fund would not have sufficient resources to provide guarantees for this category of transaction without violating the requirement to distribute the Fund in the proportions provided for in the law, therefore requiring the redistribution of resources. In particular, Article 56 of Decree Law 18/2020 required that the available funds be divided equally (33.3 per cent) among the guarantees for the three types of debt exposure eligible for the moratorium: a) revocable credit lines and advances against receivables; b) bullet loans falling due before 30 September 2020; and c) mortgages and other instalment loans.

Health and education. – The measures for the health sector are mainly aimed at restoring services (outpatient care, hospital care, screening) whose delivery has been delayed as a result of the COVID-19 emergency and, more generally, reducing waiting lists. The Technical Report accompanying the decree law, which draws on the latest monitoring data from the Ministry of Health on intervention strategies to reduce waiting lists, estimates a decrease in hospitalisations in the first half of 2020 of approximately 40 per cent compared to the same period of 2019 and one of 36 per cent in diagnostic testing and specialist visits.

To recoup the accumulated backlog, the regions may adopt a number of extraordinary measures in 2020 in derogation from the constraints on personnel expenditure (additional services provided by personnel operating in a private capacity while using public facilities, the hiring of healthcare personnel on fixed-term contracts, expanding internal specialist contract work) and, to this end, specific resources have been appropriated that increase funding of the National Health Service (NHS) by €478 million this year. In order to access the resources, the regions must submit a Regional Operational Plan for the reduction of waiting lists.

The decree law contains two annexes. Annex A is based on the estimates of the Technical Report, which assesses, by region, the costs of measures to recoup the backlog of activities postponed due to the pandemic, separating hospital admissions from outpatient and screening services, starting from the reduction in services in the first half of 2020 and calculating the costs in terms of private professional activity in public facilities. These charges represent the spending ceiling for the extraordinary instruments envisaged by Decree Law 104/2020 for each region and total €478 million. Annex B allocates the €478 million of increased NHS funding among the regions, including special statute regions, on the basis of their share of the current unallocated healthcare budget for 2020. For regions whose amount in Annex A is greater than that in Annex B, the lower spending ceiling indicated in the latter shall apply. Conversely, regions that receive an amount, established in Annex B (based on budget shares), that exceeds that reported in Annex A (which reflects the estimated cost of restoring services not delivered in the first half of the year) can use the difference for measures to reduce waiting lists other than the extraordinary measures provided for by Decree Law 104/2020. Accordingly, only regions that experienced a smaller reduction in service performance would have resources to reduce ordinary waiting lists not connected with the COVID-19 emergency.

The increase in the National Emergency Fund, equal to €580 million in 2020 (€550 million in terms of net borrowing) and €300 million in 2021, is intended to finance both the tasks and actions in the healthcare sector envisaged in Decree Law 18/2020, which provided for the appointment of a Special Commissioner, and the additional ones introduced with Decree Law 76/2020 in the schools sector.

The other interventions in the education sector are mainly aimed at facilitating the opening of the 2020-21 school year with teaching in classroom. To this end, the decree expands the epidemiological emergency fund (€400 million in 2020 and €600 million in 2021). In addition, the decree reorganises the timing of projects for the extraordinary maintenance and energy efficiency upgrading of the schools of the provinces and metropolitan cities envisaged in the 2020 Budget Act (with an increase of €125 million in 2021, €400 million in 2022, and €300 million in 2023 and 2024 and the elimination of resources for the years after 2029).

The new financing for the COVID-19 epidemiological emergency fund is targeted at a variety of objectives, but above all (€363 million in 2020 and €552 million in 2021, as well as the €378 million in 2020 and €600 million in 2021 allocated with Law 77/2020) at funding fixed-term positions for teaching and administrative, technical and auxiliary staff. Fifty per cent of the allocation among the regional school offices will be based on the number of students and 50 per cent proportionally on the basis of applications submitted by those offices. In the absence of reliable data on the actual condition of the schools and the associated level of crowding, it was decided to combine an allocation criterion based on the number of students, which obviously takes account of the demographic situation but not the characteristics of the available spaces, with one based on the requirements communicated by the individual schools to the regional school offices. While this second allocation criterion may capture actual needs in terms of reducing the overcrowding of facilities, it may also reflect the differing capacities and speed of local authorities and schools in translating needs into actual requests and of the regional school offices in assessing applications and channelling the needs of schools using uniform criteria. The differences between the results of applying one or the other criterion are substantial. In particular, measuring the difference in percentages with respect to the resources distributed in accordance with the number of students, the distribution of the half of amounts available under the needs criterion (i.e. the requests submitted to the regional school offices) primarily favours, compared with the student numbers criterion, the regions of Campania, Puglia, Calabria and Lazio. The most disadvantaged regions are Sardinia, Lombardy, Molise, Veneto and Abruzzo.

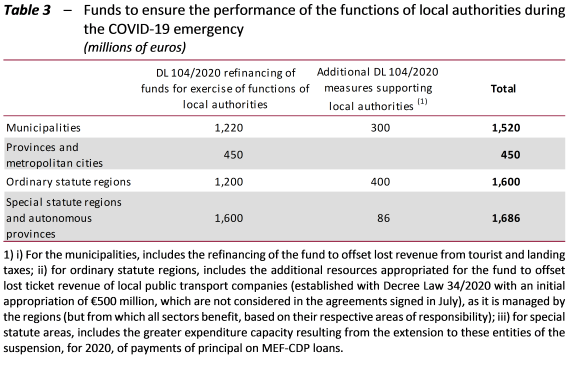

Local authorities. – From a quantitative point of view, the most important measures in support of local authorities seek to restore revenue lost as a result of the COVID-19 emergency and complement those adopted with Decree Law 34/2020 (Table 3). Future measures will provide for additional compensation (or the return of excess amounts transferred) based on final figures. This is also necessary because the agreements on the basis of which the overall resources and the associated allocation were established are mainly of a political nature, considering that the technical analysis is affected by a high degree of uncertainty about the actual loss of revenue as inferred from the available interim data.

These measures are characterised by a certain degree of fragmentation as the legislation establishes a series of specific funds, for example the fund to offset the loss of tourist tax revenue, accompanied by more general funds for each sector with sufficient resources to enable local authorities to ensure the continuity of supply of all the services for which they are responsible. This fragmentation could limit the ability to provide unified support to local authorities.

Another set of measures seeks to incentivise investment spending by local authorities, mostly by bringing forward to 2020-2024 resources that previous budget acts (mainly the 2020 Budget Act) had appropriated for this purpose for the years from 2030 onwards. The resources brought forward to 2020-2024 amount to approximately €4.4 billion, in addition to a further €1.1 billion in new investment spending authorisations introduced with the decree. According to the Technical Report, these measures would have an impact of approximately €1.6 billion on net borrowing in 2021 and €1.9 billion in 2022.