The effects of US tariffs on the global economy are slowly showing up.

Italy stagnated in the third quarter, with negative signs for exports

24 October 2025 | Today, The Parliamentary Budget Office (PBO) published its October economic report, which analyses the international and domestic business cycle, short-term trends and forecasts for Italy based on the latest available indicators.

A summary of the most important points is provided below.

World trade appears to be resilient, and the effect of tariffs will unfold over time

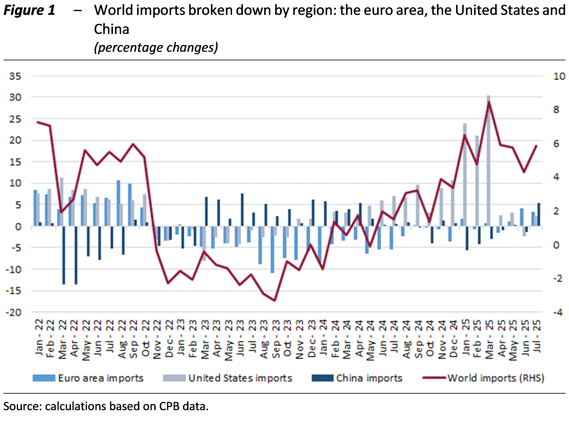

In an unstable international context, trade slowed sharply in the second quarter of 2025 (see Fig. 1), following strong support from imports from the United States in the first part of the year. While the effects of US tariffs are not yet evident in prices, the tariff increase will have an impact over time. Furthermore, when considered alongside the euro’s 13 per cent appreciation against the dollar since the beginning of the year, they represent a clear loss of competitiveness for European exporters. Recent data shows a sharp slowdown in euro area exports since April, with a significant year-on-year decline in exports to the United States and China in August (22.2 and 11.3 per cent respectively). Taken together, tariffs and unfavourable exchange rates could impose an additional burden of around 30 percentage points on American importers compared to 2024. The International Monetary Fund (IMF) has revised upward its expectations for this year but has lowered its GDP growth forecasts for the euro area in 2026. The assumptions underlying these forecasts are highly uncertain, so the estimates could change, even rapidly. Although energy commodity prices are currently stable, but price volatility could increase in the coming months. Central banks (the ECB and the FED) remain cautious about easing monetary conditions, with developments mainly depending on inflation trends. Inflation in the euro area continues to converge towards the European Central Bank’s target of 2.0 per cent, although it is rising, particularly in Germany and Spain. Inflation expectations in the United States remain higher than in Europe, but do not appear to have been strongly influenced by the US administration’s trade war.

Italy’s GDP declining in spring, UPB forecasts a stagnation for the third quarter

After accelerating in winter, Italy’s GDP declined (-0.1) in the second quarter for the first time in almost three years. Production growth remains lower than in the euro area. The volatility of the economic situation in Italy depends on exports, which fell sharply in the second quarter (-1.9 per cent) compared with the previous positive figure in the first months of the year (2.2 per cent); according to the latest information, exports fell significantly in August, especially to the United States.

In the second quarter, consumption growth came to a halt, held back by high savings rates, while gross fixed capital formation was supported by favourable credit conditions and strengthened, particularly in capital goods.

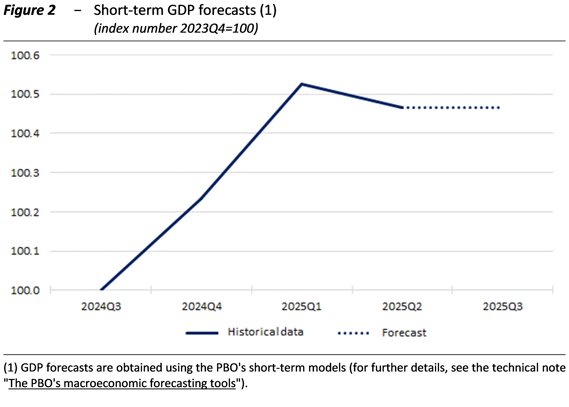

The UPB’s short-term models indicate a weak, virtually stagnant economy in the third quarter, with GDP essentially unchanged from the previous quarter (Fig. 2). Production is expected to gradually strengthen in the final part of the year. The GDP growth forecast for 2025 remains at around 0.5 per cent, as indicated by the UPB when endorsing the macroeconomic scenario of the 2025 Public Finance Planning Document (DPFP), but the outlook is subject to significant risks, mainly due to the fragmented international environment.

The service sector is not recovering, industry is downsizing and uncertainty is high.

On the supply side, economic activity remained virtually stable in the tertiary sector in the second quarter, while industry weakened after a temporary recovery in the winter.

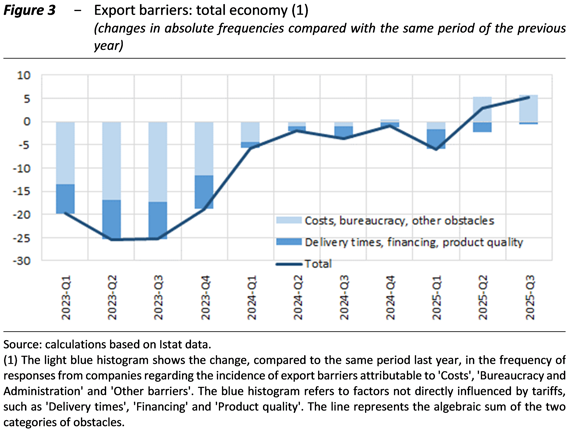

The Report also examines the surveys conducted by Istat on the expectations of Italian manufacturing companies, which reveal growing concerns about obstacles to exports (Figure 3), especially regarding categories affected by tariff barriers. These obstacles are particularly noticeable in the North-East and among companies operating in the beverage, clothing and other sectors associated with Made in Italy.

Household and business confidence remains relatively low (despite a moderate improvement in household confidence in the third quarter) and, according to the indicator compiled by the PBO, uncertainty among households and businesses is close to historic highs, excluding the pandemic phase. On the other hand, the PBO indicator of credit market tensions, based on the imbalance between supply and demand, remained broadly stable in the spring and summer quarters, ending the improvement observed in 2024.

With inflation and employment stable, real wages are still well below 2020 levels

Italian inflation (measured by NIC), stable at 1.6 per cent in September, remains lower than that of the euro area, with a differential that has recently widened marginally.

The labour market saw employment remain stable in the spring months, with a decrease in the number of employees offset by an increase in the number of self-employed workers. The older segment of workers (aged 50-64) grew due to the combined effect of demographic transition and stricter retirement requirements; on the other hand, the decline in the share of younger workers accelerated, while the already substantial segment of inactive workers expanded. According to preliminary indications, employment levels rose slightly in the third quarter, by 0.1 per cent.

The growth in contractual hourly wages slowed in the second quarter, particularly in the private sector, while wages in the public sector accelerated. Overall, wages slowed to 3.2 per cent year-on-year and, to date, real wages remain well below the 2020 average (-8.8 per cent).