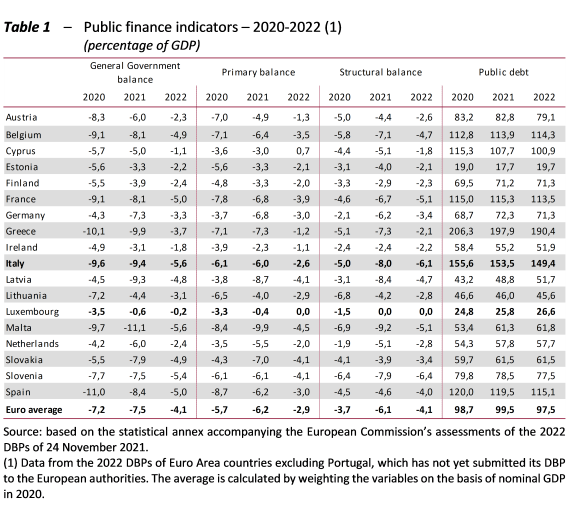

In the first part of the Focus, the objectives for the main public finance aggregates contained in the Draft Budgetary Plans (DBPs) for 2021 and 2022 are compared. The targets are set out in Table 1. The second part gives a more detailed description of the strategy presented in the DBPs of the main Euro Area economies, namely Germany, France and Spain and that of other high-debt countries, including a comparison with Italy’s targets.

In interpreting public finance strategies, note that in the Communication “Economic policy coordination in 2021: overcoming COVID-19, supporting the recovery and modernising our economy” of 2 June 2021, the European Commission considered that the conditions for the continued application in 2022 of the general escape clause, activated in 2020, had been met, a position it confirmed during the assessment of the 2022 DBPs. The escape clause, which is expected to be deactivated in 2023, states that in a severe economic downturn involving the Euro Area or the European Union as a whole, Member States may be allowed to temporarily deviate from the adjustment path towards the medium-term objective (MTO), provided that this does not endanger fiscal sustainability in the medium term.

The main conclusions drawn from the concise analysis contained in the Focus are the following.

-

- In 2021, the DBPs forecast average nominal deficits of 7.5 per cent of GDP, which are expected to fall to 4.1 per cent in 2022. In 2021 Italy’s target deficit (9.4 per cent of GDP) would be the third largest after that of Malta and Greece, while in 2022 it would be tied for largest with that of Malta, at 5.6 per cent. Between 2020 and 2022, the expected average annual reduction in nominal deficits is 1.6 points of GDP, slightly slower than the annual average for Italy (2 points of GDP).

-

- Primary deficits are projected to average 6.2 per cent of GDP in 2021, while in 2022 they will amount to 2.9 per cent, with an average annual reduction of 1.4 points of GDP in the 2020-2022 period. In Italy, the primary deficit in both years would be slightly lower than the average for the Euro Area: 6 per cent of GDP in 2021 and 2.6 per cent in 2022. Italy’s objective is an average annual improvement in the primary balance of 1.8 points of GDP, slightly higher than average.

-

- Among Euro-Area countries, public debt is expected to average 99.5 per cent of GDP in 2021 and 97.5 per cent in 2022. At 153.5 per cent and 149.4 per cent of GDP, respectively, Italy would have the second highest public debt in both years, only lower than that of Greece. Between 2020 and 2022, Italy is expected to register an average annual reduction of 3.1 points of GDP, exceeding the average of 0.6 points of GDP.

-

- Compared with the April Stability Programmes, the forecasts contained in the DBPs point to a more rapid recovery for the Euro Area this year (from 4 to 5.4 per cent). The growth rate expected for 2022 is up by three-tenths of a point (to 4.3 per cent). This faster recovery is not uniform across countries: for 2021, government forecasts improve by more than 1 percentage point for Italy (from 4.5 to 6 per cent) and France (from 5 to 6.3 per cent), while the upward revision is smaller for Germany (from 3 to 3.5 per cent), and there is no change for Spain (at 6.5 per cent). As for price developments, the forecasts in the DPBs indicate stronger inflation than that indicated in the Stability Programmes.

-

- Overall, the countries that have accumulated a level of debt exceeding 110 per cent of GDP – due in part to COVID ‑ represent more than half of the Euro Area economy and 60 per cent of its population. Despite the recovery, in 2021 their deficit would be between 8 and 10 per cent and in 2022 it is expected to remain around 5 per cent.

-

- In all the main countries, the substantial decline in the deficit in 2022 compared with 2020-2021 is linked to the decrease in the impact of automatic stabilisers and the extraordinary measures adopted to contain the health and economic impact of the emergency, in line with the return to pre-COVID levels of activity. Generally, part of this improvement has been channelled into new discretionary measures of a more structural nature aimed at reviving the countries’ respective economies, accompanying the initiatives envisaged in their Recovery and Resilience Plans.

-

- Greece, Italy and Spain would see their stock of debt decrease as soon as this year: by a few decimal points in the case of Spain (-0.5 percentage points) and by multiple percentage points in the case of Italy (-2.1 percentage points) and Greece (-8.4 per cent). In 2022, the three countries would see their debt/GDP ratios drop further (and faster).

-

- The Council recommendations issued last summer called on high-debt countries to pursue a fiscal stance that considers carefully the medium/long-term sustainability of public finances, but is still capable of supporting the recovery, while keeping investment financed by national resources unchanged and making full use of the resources of the Recovery and Resilience Facility (RRF) to finance additional investment. In the case of Italy, it was also recommended to control the growth of nationally financed current expenditure. It was suggested that countries with smaller debt loads should keep their budgetary stance at least as expansionary, reiterating the call for the full use of RRF resources for new investment and for maintaining nationally financed investment.

- In its assessment of the 2022 DBPs last November, the European Commission found that the fiscal stance adopted by Euro Area countries is substantially in line with its recommendations. However, Italy, whose fiscal stance is more expansionary than the average, has been asked to take steps to control the growth of nationally financed current expenditure.