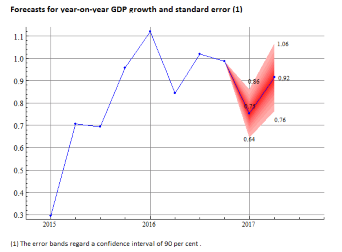

The Report on recent economic developments of the Parliamentary Budget Office forecasts that Italy will close the second quarter of 2017 with GDP growth of 0.3 per cent, a slight acceleration on the 0.2 per cent posted in the first quarter.

The recovery is continuing at a moderate pace: GDP up 0.2 per cent in the first quarter and 0.3 per cent in the second

The recovery is continuing at a moderate pace: GDP up 0.2 per cent in the first quarter and 0.3 per cent in the second

The recovery, boosted by a return to growth for the industrial sector, should continue at the same slow pace seen in the second half of 2016. The year-on-year growth rate would be about 0.8 per cent in the first quarter, rising to 0.9 per cent in the second.

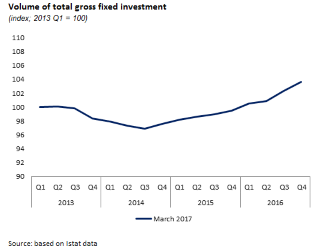

Consumption falters, while investment sustains the economy

Consumption falters, while investment sustains the economy

In recent months, the growth of the Italian economy has been buoyed by the good performance of world trade, which thanks to the growth in Italy’s key export markets has driven our exports. The deterioration in the household confidence and the decline in purchasing power in the final three months of 2016 (-0.9 per cent compared with the average for the summer months) impacted consumption. This trend was accompanied by more robust growth in investment, reflecting the recovery in corporate profitability and the partial improvement in conditions for access to credit (in March, the percentage of firms reporting they had not been granted credit fell to 4.6 per cent, the lowest level since 2008). Surveys show that the recent trend in investment should continue in 2017, providing a significant boost to domestic demand and, therefore, GDP growth.

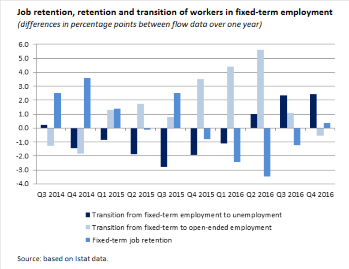

Employment: impact of contribution relief wanes

Employment: impact of contribution relief wanes

The slowdown in employment growth that emerged in the second half of 2016 continues. In January-February employment expanded slightly compared with the fourth quarter of 2016 (+0.1 per cent), mainly driven by the growth in fixed-term payroll employment (0.5 per cent), while open-ended payroll employment and self-employment were virtually unchanged. Examining flow data, in the fourth quarter of 2016 the flow of transitions from fixed-term employment to open-ended positions turned negative for the first time since the beginning of 2015 (-0.5 percentage points on a year earlier). This followed on the sharp deceleration in such transitions that had already been observed in the third quarter of 2016. At the same time, there was a rise in the retention rate for fixed-term payroll employment, which turned slightly positive (with a difference of 0.4 percentage points between transitions registered between the fourth quarter of 2015 and the fourth quarter of 2016 and the analogous transitions one year earlier). Flows from fixed-term employment to unemployment also increased. These trends, together with the growing proportion of fixed-term employment (14.3 per cent of total employment in the first two months of 2017, compared with 13.6 per cent in the same period of 2016) appears to reflect the reduced attractiveness of open-ended hiring as a result of the gradual dissipation of the effects of contribution relief measures.

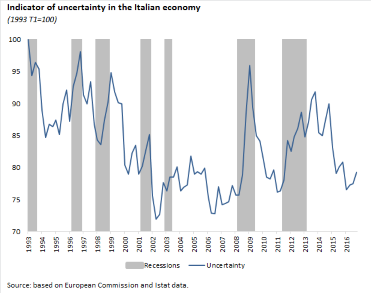

An indicator to measure uncertainty

An indicator to measure uncertainty

he scope for an improvement in the Italian economy depends to a large extent on the uncertainty in the economy, which may prompt firms to postpone more difficult or risky spending decisions and increase the risk aversion of banks. In an attempt to measure uncertainty, the PBO has developed an uncertainty indicator based on the wealth of information available in Istat’s monthly surveys of firms and consumers, which provide information on their expectations for economic developments or their own financial situation. After the decline registered in 2015 and in the first part of 2016, the uncertainty indicator regained some ground more recently, while remaining relatively low, especially when compared with the previous peaks reached during the so-called first recession (in 2009) and in the initial stages of the current recovery (2014). This contrasts partially with other indicators (based, for example, on the frequency with which the word “uncertainty” appears in newspapers or on developments in financial variables), which indicate larger increases in uncertainty (or risk) for the Italian economy.