1st August 2025 | Italian GDP is expected to grow by 0.5 per cent, both this year and in 2026, according to the August economic outlook, in which the Parliamentary Budget Office (PBO) updated its forecasts published in April. Compared with the latter there are slight downward revisions, due to the negative surprise recorded in second-quarter GDP and the significant appreciation of the euro. The risks of forecasts are generally on the downside, due to protectionism and possible delays in the implementation of the National Recovery and Resilience Plan (NRRP).

International scenario: protectionism increases uncertainty and volatility in the markets

Conflicts in Ukraine and the Middle East persist, causing volatility in energy commodity markets. Protectionism is also intensifying, with the United States raising customs duties on certain Asian countries, Brazil and the European Union (EU); an agreement has been reached with the EU on 15 per cent tariffs, the specific details of which are still to be clarified. The appreciation of the euro with respect to the dollar, which peaked in early July (at 1.18) before falling back slightly in recent days, is acting as an ‘implicit tariff’ on European exports. The latest forecasts from the International Monetary Fund (IMF) point to a slowdown in global trade, both this year and in 2026.

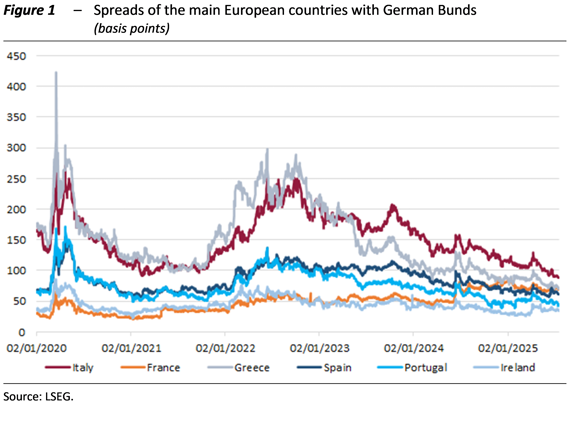

In the euro area, inflation is gradually easing, reaching 2.0 per cent in June, in line with the European Central Bank (ECB) target. Central banks are anticipating geopolitical uncertainty and becoming more cautious about monetary easing. At their meetings last month, both the ECB and the Federal Reserve (Fed) kept their official interest rates unchanged. The weakening of the dollar in the first half of the year was associated with capital flows to Europe, where yield spreads between euro area sovereign bonds narrowed: the spread between Italian 10-year BTPs and German Bunds (Figure 1) reached a local minimum below 90 basis points last month.

Italy’s GDP declined in the second quarter

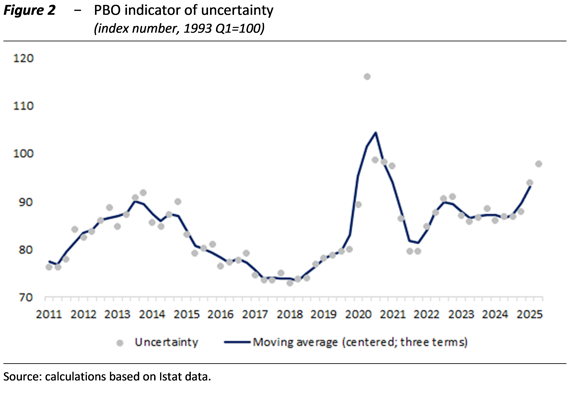

After growing by 0.3 per cent in the first quarter, the Italian economy slowed in the spring, the first slowdown in two years. According to preliminary data released by Istat at the end of July, GDP fell by 0.1 per cent, affected by the negative contribution of foreign demand, which more than offset the positive contribution of domestic demand. In the first half of 2025, private spending continued to grow moderately, supported by the consolidation of the labour market. However, the economic environment is marked by considerable uncertainty, which has increased significantly according to the PBO indicator (Figure 2), leading to cautious household spending and a high propensity to save.

In the first quarter of the year, investment rose by 1.6 per cent, confirming the pace observed in the final part of 2024. However, the outlook for capital accumulation appears uncertain. Qualitative surveys conducted in the spring point to unfavourable conditions for investment activity. At the same time, the share of firms reporting obstacles to production declined compared with the first quarter, amid credit conditions that remain relatively favourable according to the PBO indicator.

On average in the first three months of the year, the acceleration in exports led to a positive contribution of net foreign demand to GDP growth (0.1 percentage points in the first quarter), bucking the trend observed in 2024. However, the recovery in foreign sales appears to be temporary, as it was aimed at bringing forward the transit of goods to the United States ahead of the new tariffs; this front-loading of exports likely came at the expense of sales in the second quarter, causing the contribution of net foreign trade to deteriorate.

The PBO’s forecasts for Italy’s GDP have been revised downwards

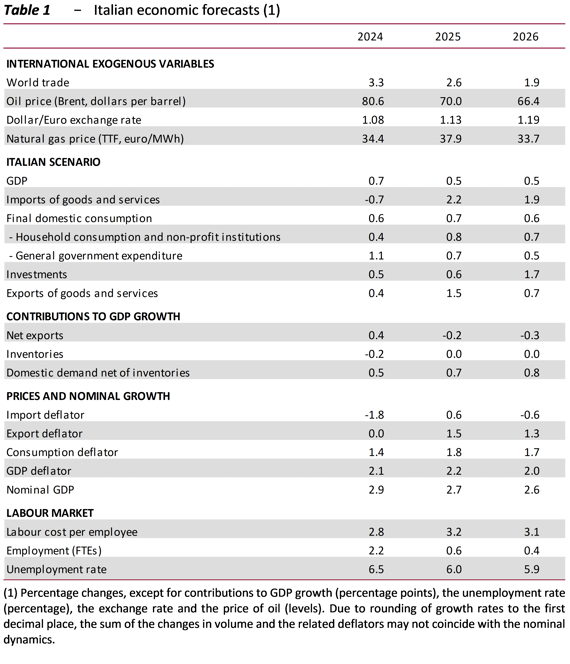

According to the PBO’s updated estimates, Italy’s GDP is expected to grow by 0.5 per cent in 2025, supported by good employment dynamics in a context of moderate inflation (Table 1). GDP growth is also expected to remain at 0.5 per cent in 2026: stronger investment, driven by the NRRP, would be offset by a deterioration in foreign trade due to the strengthening of the exchange rate and protectionism.

The scenario has been updated to take account of the most recent developments in international exogenous variables and the latest information on cyclical patterns. With regard to public finances, full use of the resources of the European Next Generation EU (NGEU) programme is assumed. On international trade, the forecast assumes a 10 per cent US tariff on the EU; this is based on the policy defined prior to the recent political agreement, because the forecast only includes measures that are fully defined and approved. The implications of the recent agreement will be assessed on the basis of its actual content once the texts have been fully clarified and made public.

Compared with the macroeconomic scenario formulated by the PBO in April, when the 2025 DFP forecasts were endorsed, the projections for economic activity have been revised downwards slightly for this year (by 0.1 percentage points), incorporating the unexpected slowdown in GDP in the second quarter. The lower GDP growth for 2026 (by 0.2 percentage points) was mainly affected by the sharp appreciation of the euro, which reduces price competitiveness and slows net exports.

Employment, measured in terms of full-time equivalent units (FTEs), is expected to increase on average over the two-year period 2025-26 by 0.5 per cent, broadly in line with output, incorporating a reduction in hours worked. Inflation, measured by the household consumption deflator, is expected to rise moderately over the two-year forecast period (to 1.8 per cent on average), reflecting contrasting impulses mainly from external factors.

The macroeconomic outlook for the Italian economy remains subject to risks, mainly on the downside. The main risks are international in nature, with particular reference to geopolitical tensions in Europe and the Middle East, as well as uncertainty surrounding the implementation of protectionist policies by the US administration. There are also significant uncertainties within the domestic economy, primarily concerning the timing of the implementation of the NRRP.