The economy is stagnating, and international tensions are rising.

PBO revises forecasts for Italy downwards

5 February 2025| The Parliamentary Budget Office (PBO) today published its February Economic Outlook, in which it considers the most recent indicators on the international and domestic economy and provides new macroeconomic estimates. The PBO updates its forecasts for Italy’s GDP, which would grow by 0.7 per cent in 2024 and then strengthen modestly in 2025 and 2026, to 0.8 and 0.9 per cent, respectively. The macroeconomic scenario of the Italian economy is confirmed to be subject to risks, mostly downwards.

The international context: rising geopolitical tensions

The year 2025 begins with some global news, particularly on climate change and geo-economic balances, while new protectionist policies of the US Administration are on the horizon, the adverse effects of which could be considerable. The currency and commodity markets are affected by these various factors of uncertainty: natural gas prices have recently risen and become more volatile. International trade remains weak, with heterogeneous dynamics, very modest for advanced countries and booming for emerging countries.

Italian economy stagnates, labour market holds

The Italian economy grew moderately last year, with quarterly GDP averaging about one-tenth of a percentage point. Activity stagnated in the second half of 2024.

In 2024, GDP increased by 0.5 per cent based on the quarterly accounts; since the annual accounts (to be released on 3 March) do not take calendar effects into consideration, the growth should be a couple of tenths of a percentage point higher.

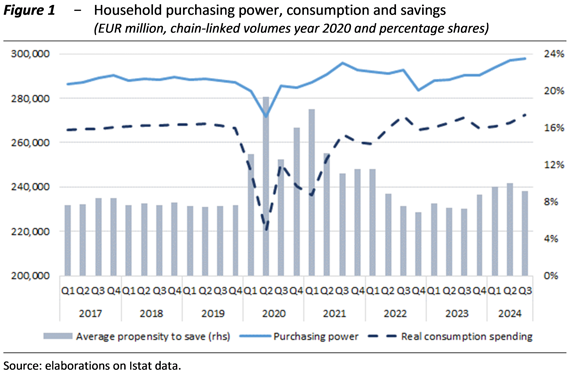

The labour market remains a driving force in the economy, especially with regards to women’s employment, but is beginning to suffer from the production slowdown; wages are gradually recovering from the sharp loss of purchasing power that occurred in 2022-23, and workers’ incomes are rising, although a significant share is still saved (Figure 1).

Capital accumulation in 2024 experienced three consecutive quarterly downturns, but the level of investment is still high. The setbacks of the depletion of incentives for residential construction seem to be partly offset by the support of public investment, with the contribution of NRP projects. The PBO’s indicator on difficulties in accessing credit is improving.

Italian exports suffered a setback last year in the face of global tensions and a weak European economy. In 2025, the loss of foreign market share of Italian companies is expected to come to a halt, although they are very cautious about foreign orders in the short term.

Industry remained sluggish, the tertiary sector showed moderate dynamics and uncertainties impacted construction, which, after slowing down during the year, saw an acceleration at the end. The tertiary sector weakened in the autumn, with a more marked decline in trade. The PBO’s indicator on household and business uncertainty increased in the autumn, driven mainly by the business component.

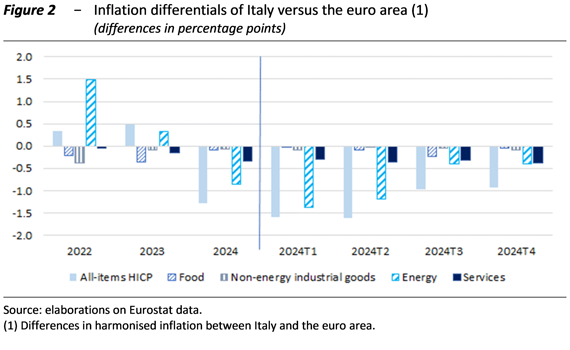

Consumer inflation in Italy in 2024 fell to 1.0 per cent and remained below the European average (Figure 2), especially in the energy component; in 2025 it is expected to rise to around 2.0 per cent, the ECB’s target.

PBO forecast update: GDP would increase by 0.8 per cent in 2025 and 0.9 per cent in 2026

The most recent information on the global economic environment and the domestic economy lead to a revision of the projections on the Italian economy, compared to those formulated by the PBO last October on the occasion of the endorsement of the macroeconomic framework of the medium-term Budgetary Structural Plan (PSB); the revisions for 2025-26 mainly reflect the deterioration of the international exogenous variables in recent months.

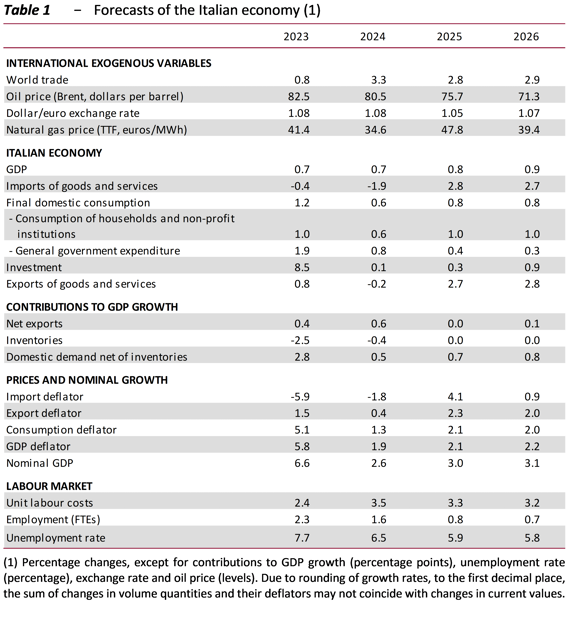

Last year GDP is expected to have increased by 0.7 per cent (Table 1) in the annual data (to be released on 3 March), more than two-tenths higher than in the quarterly series already published by Istat. A slight acceleration is expected for 2025, to 0.8 per cent, with economic activity projected to strengthen gradually thanks mainly to domestic demand components. In 2026, GDP momentum is expected to consolidate again marginally, to 0.9 per cent, assuming no escalation of ongoing conflicts and trade wars, as well as continued normalisation of monetary policy. The forecast incorporates the expenditure profile of the NRP investment programmes, which could, however, be subject to revision, particularly about timing.

The Report also provides two alternative simulations on the two-year period 2025-26 based on assumptions regarding oil and natural gas prices: in a more favourable scenario, GDP growth could be higher by 0.1 percentage points for each of the two years; in the adverse scenario, it would worsen by 0.1 points in 2025 and 0.2 points in 2026.