The abrupt slowdown in Italian economic growth in the second half of 2018 will have a heavy impact on growth this year. According to the PBO’s February Report on Recent Economic Developments, the recovery will not come before the second half of 2019, with growth for the entire year in any case not exceeding 0.4 per cent.

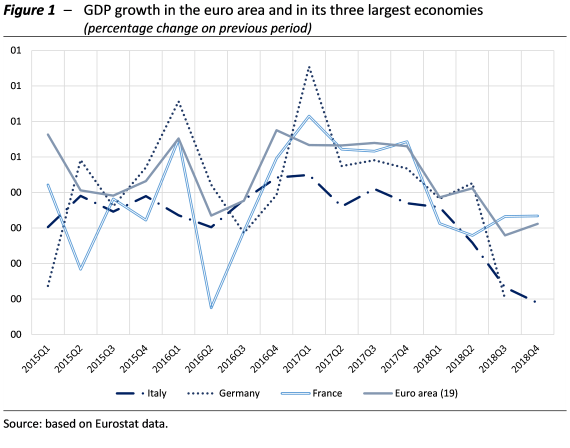

Italy is still bringing up the rear in the euro area – The Italian economy slowed in 2018, decelerating more than the rest of the euro area and Germany, which itself experienced a sharp slowdown (Figure 1). According to preliminary estimates released at the end of January, in the fourth quarter of 2018, economic activity, which had already contracted in the summer, fell by 0.2 per cent on the previous quarter. Overall, GDP is estimated to have expanded last year by 0.8 per cent, or 1.0 per cent unadjusted for calendar effects. The statistical carry-over impact on 2019 GDP growth is a negative two-tenths of a percentage point.

Manufacturing and domestic demand decline – The available qualitative information primarily attributes the contraction of economic activity in the last six months of 2018 to a decline in industrial output, which then also weakened the services sector. In the first three quarters of last year, industrial production declined steadily (on average, by about 0.3 per cent quarter-on-quarter). According to PBO estimates the overall downward trend continued in the fourth quarter at a similar pace.

On the demand side, the domestic component made a negative contribution to growth. Investment was affected by uncertainty and the significant deterioration in the expectations and conditions for investment of firms. Consumer spending was affected by the erosion of purchasing power in the summer and the weakening of household confidence towards the end of the year. Despite a slight recovery in January, the confidence index remains below the average values registered in 2018.

Exports were affected by the deterioration in the international environment last year. Survey information suggests that the weakness continued in the final part of 2018: The Istat survey of confidence among manufacturing firms conducted in December shows a further deterioration in assessments of foreign orders and expectations for turnover on international markets.

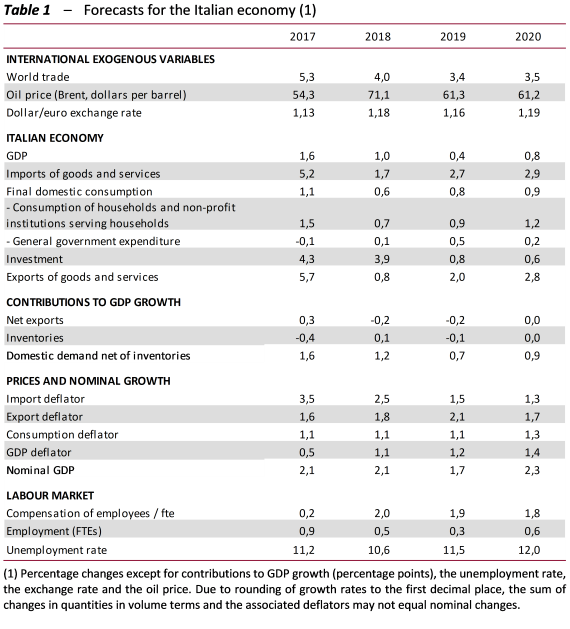

The year begins with a handicap: 2019 GDP growth will not exceed +0.4 per cent – The deterioration in economic growth, which turned negative in quarterly terms in the second half of the year, will have a negative statistical carry-over impact of -0.2 per cent this year. Short-term forecasting models find that activity in the current quarter will remain weak, with GDP growth virtually stagnant or slightly negative. Aggregate demand is expected to gradually strengthen in subsequent quarters, more intensely from the summer, sustained by the expansionary measures envisaged in the budget package. GDP growth is forecast to average 0.4 per cent this year, while in 2020 it is expected to rise to 0.8 per cent (Table 1), a forecast that does not incorporate the effects of a VAT increase.

Forecasts exposed to downside risks – The risks to the forecasting scenario are many and mainly on the downside. Developments in the international variables assume the absence of new restrictions on international trade and any further deterioration in European economic conditions, a generally small impact from existing sources of geo-political instability (Brexit, the political crisis in Venezuela) and the orderly normalisation of monetary policies in the major currency areas. Any strains in these areas could accentuate volatility on the markets, with a depressive impact on international growth and Italian exports. An additional significant risk factor is interest rates on sovereign debt securities. Any increase in their level, especially if persistent, could lead to a tightening of lending terms, with a consequent loss of confidence that would impact the spending decisions of households and firms. Conversely, a decline in yields on government securities would foster a faster expansion of disposable income and productive activity than expected in the baseline scenario of the forecast.

Two possible alternative scenarios for next year – In addition to the baseline projection, the Report considers two alternative scenarios. The first incorporates the effects of the increases in VAT and excise duties next year, as provided for in the 2019 Budget Act. The hike in indirect taxes would increase the household consumption deflator by one percentage point, with a consequent erosion of purchasing power. Private consumption spending in 2020 would be lowered by about half a percentage point; GDP growth would come to 0.6 per cent (0.2 percentage points lower than the baseline simulation).

The second scenario envisages an additional stimulus to private expenditure on capital goods, achievement of which would require removing the main factors that are currently preventing this from happening, such as the deterioration in firms’ expectations, the tensions on sovereign debt securities and the risk of a tightening of lending conditions. An additional boost to private sector investment expenditure of half a percentage point of ex ante GDP in 2019-2020 (about €9 billion per year) would prevent the deceleration in investment this year and would foster an acceleration next year. The macroeconomic impact would increase GDP growth by 0.4 percentage points on average over the 2019-2020 period. The impact on consumer price inflation would be substantially negligible.