In the February Report on Recent Economic Developments, the Parliamentary Budget Office (PBO) updates the forecasts formulated in November for the performance of the Italian economy in the period 2022-2024. The projection for annual GDP growth, estimated by the PBO at 3.8 per cent for 2022 on the basis of available quarterly data, is confirmed at 0.6 per cent for 2023 and revised slightly upwards for 2024 (to 1.4 per cent). However, the scenario is overshadowed by various sources of uncertainty, especially of an international nature, first and foremost the war between Russia and Ukraine.

Gas prices decline to their summer 2021 values. EU inflation appears to have peaked

Although the conflict continues, energy commodity prices are declining for the time being. At the end of January, natural gas prices returned to the level registered in September 2021, at around €55/MWh, after peaking at almost €350 at the end of August 2022. The decline was possible thanks to the diversification of energy sources and the especially mild weather experienced in the autumn, factors that enabled European countries to limit their drawdown of gas stocks compared with previous years.

As energy prices began to normalise, inflation peaked on both sides of the Atlantic: in June in the United States (at 9.0 per cent) and in October in the euro area (at 10.6 per cent). Inflation fell to 6.5 per cent in December in the United States and to 8.5 per cent in January in the euro area, and inflation expectations now appear to have stabilised between 2.0-2.5 per cent in both areas.

GDP: in 2022 Italy outpaces France and Germany

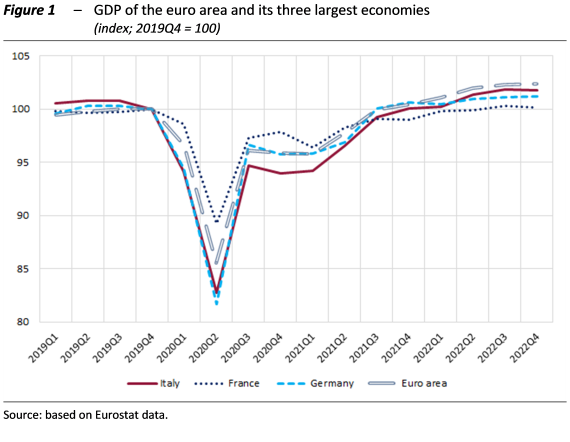

Italian GDP expanded by 0.5 per cent in the summer compared with the second quarter, followed by a decline of 0.1 per cent between October and December. GDP was almost two percentage points greater than at the end of 2019, more than in Germany and France (Figure 1). The overall performance for last year has had a carry-over impact on GDP growth for 2023 by 0.4 percentage points.

Savings are funding consumption while rising interest rates are slowing investment

After the jump registered in the spring (2.5 per cent), private consumption grew at the same rate in the third quarter as well. The increase was mainly funded by savings, since purchasing power was virtually stagnant. The increase in nominal incomes (1.9 per cent) was largely eroded by the rise in prices (1.6 per cent). The erosion of purchasing power largely impacted on the household consumption in the autumn.

Investment grew in the first three quarters of 2022 but at a gradually slower pace, easing from 3.8 per cent in January-March to 0.8 per cent in the summer quarter. In the year’s second half, the increase in official interest rates and the termination of quantitative easing tightened credit conditions. Growth in lending slowed, partly in response to weaker economic conditions, for both firms (4.8 per cent in November compared with the previous three months, from 9.8 per cent in October) and households (including both home loans and consumer credit).

Uncertainty rising among firms

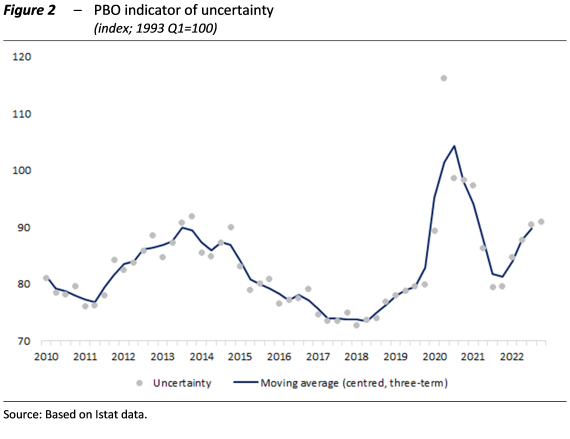

According to the index developed by the PBO (Figure 2), uncertainty increased further in Italy at the end of 2022. However, the situation differs between households and firms: uncertainty declined among consumers, but this was more than offset by the increase registered in the business segment.

Consumer price inflation falls, but core inflation continues to rise

The consumer price index fell in December (to 11.6 per cent, from 11.8 per cent in November) and then more sharply in January (to 10.1 per cent), suggesting that the peak has passed for Italy as well. However, the decline is attributable to the more volatile components of the index, especially energy, while core inflation continues to rise, albeit marginally, thereby slowing the disinflation process.

Last year, economic policy measures attenuated inflation by about one percentage point, and the measures adopted with the latest Budget Act will continue in this direction at least until the end of the first quarter.

PBO forecasts for the Italian economy

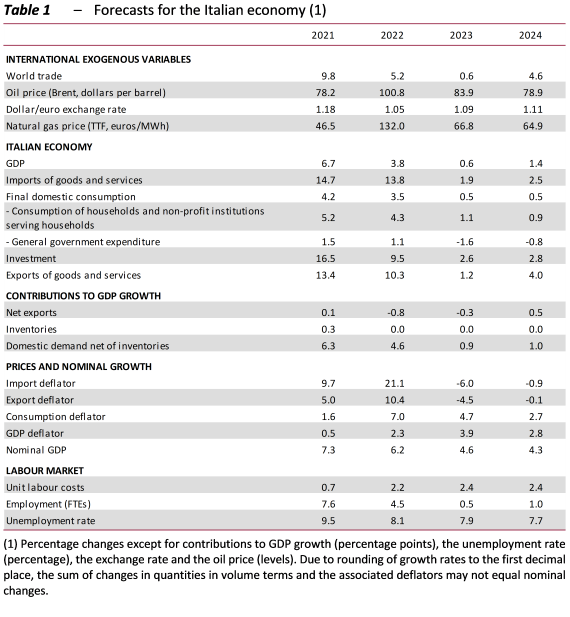

Domestic demand will drive Italian economic activity. On average, in 2023 and 2024, household expenditure is expected to rise by about one percentage point (Table 1). However, this is slower than in the last two years due to the loss of purchasing power induced by inflation. The savings rate should continue its gradual decline from its peak in 2020.

Investment growth is also projected to slow (2.7 per cent in the average of the two years), with spending on construction (3.2 per cent) slowing less than that for machinery and equipment (2.3 per cent).

The growth of exports, which provided strong support to economic activity last year, is expected to slow, aligning with that in international trade, leaving Italian firms with substantially unchanged foreign market shares. Imports are expected to decelerate even more sharply.

Employment is expected to grow by 0.5 per cent this year before doubling in 2024, just below the pace of expansion in economic activity.

Finally, inflation is expected to decline gradually due to the easing of tensions on commodity markets (energy and non-energy). However, inflation continues to outpace the growth in compensation of employees, causing a significant loss of purchasing power.

The forecasts assume the full implementation of the investment programme envisaged under the NRRP; energy inflation and shortages of certain materials could be an obstacle to achieving this.