The Report on recent economic developments reviews the evolution of the domestic and international economies, using the available indicators to estimate growth in 2016 and forecast possible performance this year in the light of the international environment and trends in Italy.

The analysis provides the following main indications.

- The Italian recovery is continuing at a moderate pace:

the PBO estimates that GDP expanded by about 0.2 per cent in the fourth quarter of 2016 over the previous period (about +1 per cent on the corresponding period of 2015; see figure to the right). These estimates imply a rise of 0.9 per cent in GDP in 2016, compared with a forecast in the DBP of 0.8 per cent.

the PBO estimates that GDP expanded by about 0.2 per cent in the fourth quarter of 2016 over the previous period (about +1 per cent on the corresponding period of 2015; see figure to the right). These estimates imply a rise of 0.9 per cent in GDP in 2016, compared with a forecast in the DBP of 0.8 per cent.

- This year opened with greater uncertainty, and the forecasts for the first quarter of 2017 point to an increase of 0.1 per cent in GDP on the previous quarter (about +0.7% on the year-earlier period; see figure above). On this basis, the growth that would be achieved this year if GDP remained stable for the rest of the year would be around 0.4 per cent, meaning that to achieve growth of 1 per cent this year the expansion would have to accelerate as from the second quarter, with average quarterly increases in GDP of 0.4 per cent.

The developments in Italy come against a background of improving conditions in the world economy (latest IMF forecasts), reflecting an acceleration in US growth thanks to more expansionary fiscal policies. However, the US economy is a cause for concern at the global level owing to the uncertainty about possible protectionist measures that the Trump administration might adopt and the reaction of the Federal Reserve if inflation should pick up in response to the overheating of the economy.

The developments in Italy come against a background of improving conditions in the world economy (latest IMF forecasts), reflecting an acceleration in US growth thanks to more expansionary fiscal policies. However, the US economy is a cause for concern at the global level owing to the uncertainty about possible protectionist measures that the Trump administration might adopt and the reaction of the Federal Reserve if inflation should pick up in response to the overheating of the economy.

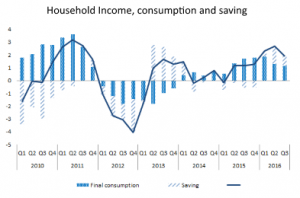

- The engine of the Italian recovery is still domestic demand, but with the leading component shifting from consumption to investment: household spending has slowed (purchasing power fell by 0.2 per cent in the third quarter of 2016), while capital accumulation revived thanks to the support from tax incentives and the improvement in corporate profitability. The gradual recovery of investment should continue in the coming months.

- The PBO estimates that industrial output increased in the fourth quarter of 2016 by 0.5-0.6 per cent over the third quarter and that performance indicators in industry point to continued growth in the first few months of 2017.

- The most recent indications drawn from the Istat Economic Sentiment Indicator (IESI) show a relatively high level of confidence in the sectors of production taken as a whole compared with the long-term average, but one that is moving only very slowly towards full recovery.

- Credit conditions also remain relatively favourable: the PBO estimates that the downgrading of the rating assigned by DBRS to Italian government securities should only have a modest impact on the ability of Italian banks to access refinancing with the ECB and, consequently, on the cost of credit. On the basis of these estimates, the increase in collateral required after the downgrade would be about €4.7 billion, equal to 2.5 per cent of pledged assets, compared with €101 billion in assets that are uncommitted but readily available.

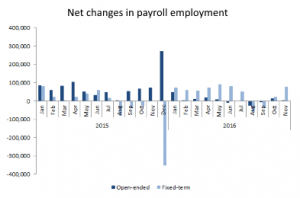

- Employment growth has stabilised

(-0.1 per cent in October-November compared with the previous three months), mainly the result of the gradual deceleration during the year in the creation of new open-ended jobs, which reflecting the fading of the impact of contribution relief.

(-0.1 per cent in October-November compared with the previous three months), mainly the result of the gradual deceleration during the year in the creation of new open-ended jobs, which reflecting the fading of the impact of contribution relief.

- Inflation is rising (from the negative values posted last autumn to 0.5 per cent in December), reflecting the rise in oil prices and the depreciation of the euro against the dollar. However, domestic price pressures remain subdued owing to the weak pressure of demand and substantial wage moderation.