With the strengthening of the world expansion, the recovery in Italy has also gained pace. In the October Report on recent economic developments, the Parliamentary Budget Office (PBO) has revised its outlook for the second half of 2017 upwards from its previous forecasts.

The recovery accelerates in the second half of the year: +0.5% in the third quarter, +0.3% in the fourth

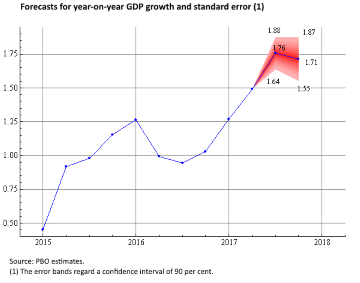

The favourable indications offered by cyclical data suggest that growth will have accelerated in the third quarter of the year, followed by a slight slowdown in late 2017. According to the PBO, GDP may have risen by about 0.5 per cent quarter-on-quarter in the third quarter of 2017, with a slowdown expected for the fourth quarter (with a quarter-on-quarter increase of about 0.3 per cent), consistent with a moderation in domestic demand and a slowdown in exports, which would reflect the appreciation of the euro in the past few months. The year-on-year growth rate would be about 1.8 per cent in the third quarter, before subsiding to 1.7 per cent (see figure) in the last three months of the year. These developments point to an increase in GDP for 2017 as a whole of 1.5 per cent (both adjusted for calendar effects and unadjusted), in line with the forecast in the Update.

The favourable indications offered by cyclical data suggest that growth will have accelerated in the third quarter of the year, followed by a slight slowdown in late 2017. According to the PBO, GDP may have risen by about 0.5 per cent quarter-on-quarter in the third quarter of 2017, with a slowdown expected for the fourth quarter (with a quarter-on-quarter increase of about 0.3 per cent), consistent with a moderation in domestic demand and a slowdown in exports, which would reflect the appreciation of the euro in the past few months. The year-on-year growth rate would be about 1.8 per cent in the third quarter, before subsiding to 1.7 per cent (see figure) in the last three months of the year. These developments point to an increase in GDP for 2017 as a whole of 1.5 per cent (both adjusted for calendar effects and unadjusted), in line with the forecast in the Update.

Growth driven by domestic demand: consumption resilient, while investment recovers

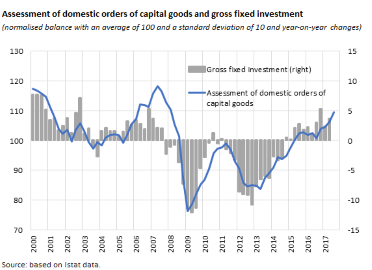

T he recovery is being driven primarily by domestic demand. Consumption spending, despite broad stagnation in disposable income, seems to be stimulated by the improvement in the labour market and the increase in household confidence. Investment is recovering after the contraction seen early in the year: economic surveys signal an acceleration in capital accumulation in the second half of 2017, buoyed by the stronger outlook for demand and tax relief measures. Istat surveys show a jump in domestic orders of capital goods in September, which have returned to a level close to that registered at the start of 2008 (see figure). The results of the Bank of Italy’s Survey on Inflation and Growth Expectations in September point to a broad expansion of investment plans in the various sectors in the second half of the year.

he recovery is being driven primarily by domestic demand. Consumption spending, despite broad stagnation in disposable income, seems to be stimulated by the improvement in the labour market and the increase in household confidence. Investment is recovering after the contraction seen early in the year: economic surveys signal an acceleration in capital accumulation in the second half of 2017, buoyed by the stronger outlook for demand and tax relief measures. Istat surveys show a jump in domestic orders of capital goods in September, which have returned to a level close to that registered at the start of 2008 (see figure). The results of the Bank of Italy’s Survey on Inflation and Growth Expectations in September point to a broad expansion of investment plans in the various sectors in the second half of the year.

Inflation remains weak

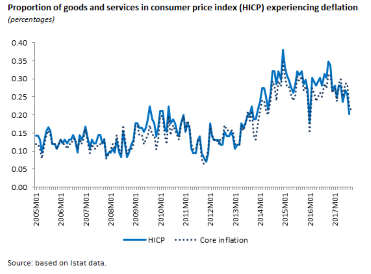

In the more favourable general environment, inflation has yet to revive, reflecting the moderate pressure of production costs. The weak price pressures are accompanied by an only modest increase in the inflation expectations of households and firms. The Istat survey of price expectations reveals a slight increase in household inflation expectations, even though most consumers are forecasting slower inflation. Firms are expecting inflation to rise, with the share of those expecting sales prices to rise in the next 12 months increasing (with the balance rising to 6.4 points, up from 5.6 in August) in the intermediate and capital goods sectors. By contrast, expectations of price rises among producers of durable and non-durable consumer goods diminished.

In the more favourable general environment, inflation has yet to revive, reflecting the moderate pressure of production costs. The weak price pressures are accompanied by an only modest increase in the inflation expectations of households and firms. The Istat survey of price expectations reveals a slight increase in household inflation expectations, even though most consumers are forecasting slower inflation. Firms are expecting inflation to rise, with the share of those expecting sales prices to rise in the next 12 months increasing (with the balance rising to 6.4 points, up from 5.6 in August) in the intermediate and capital goods sectors. By contrast, expectations of price rises among producers of durable and non-durable consumer goods diminished.

Uncertainty remains low, close to the level prior to the 2008-2009 crisis

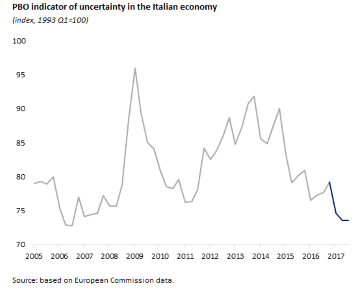

Additional positive news comes from the PBO uncertainty indicator, which in the third quarter stabilised at the low average level seen in the second quarter, in line with those recorded in the years prior to the 2008-2009 crisis (see figure). Favourable signals also come from the composite economic indices prepared by various institutions, such as the ITA-coin indicator of the Bank of Italy, which accelerated in September for the third consecutive month, and the Istat leading indicator, which rose again in September.

Additional positive news comes from the PBO uncertainty indicator, which in the third quarter stabilised at the low average level seen in the second quarter, in line with those recorded in the years prior to the 2008-2009 crisis (see figure). Favourable signals also come from the composite economic indices prepared by various institutions, such as the ITA-coin indicator of the Bank of Italy, which accelerated in September for the third consecutive month, and the Istat leading indicator, which rose again in September.

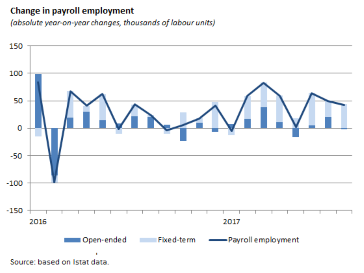

Employment returns to pre-crisis levels, driven by the fixed-term component

The strengthening of economic activity has been accompanied by a further improvement in labour market conditions. Thanks to the acceleration recorded in the summer months, employment has returned to its pre-crisis levels. This recovery was driven by a pronounced increase in workers on fixed-term contracts , which between January and August rose at a pace (+10.8 per cent) that was about five times greater than the growth recorded by that component in 2016. The contribution of open-ended employment was much smaller (an increase of 0.6 per cent, about one-third the figure registered last year). The substantial recovery in employment has not been accompanied by a corresponding increase in working hours, which remain well below their pre-crisis levels. This signals a persistently high level of under-utilisation of the labour factor, accompanied by a significant degree of underemployment (considering the underemployed in addition to the inactive population willing to work and the unemployed), which although gradually declining remain very high (about 23 per cent).

The strengthening of economic activity has been accompanied by a further improvement in labour market conditions. Thanks to the acceleration recorded in the summer months, employment has returned to its pre-crisis levels. This recovery was driven by a pronounced increase in workers on fixed-term contracts , which between January and August rose at a pace (+10.8 per cent) that was about five times greater than the growth recorded by that component in 2016. The contribution of open-ended employment was much smaller (an increase of 0.6 per cent, about one-third the figure registered last year). The substantial recovery in employment has not been accompanied by a corresponding increase in working hours, which remain well below their pre-crisis levels. This signals a persistently high level of under-utilisation of the labour factor, accompanied by a significant degree of underemployment (considering the underemployed in addition to the inactive population willing to work and the unemployed), which although gradually declining remain very high (about 23 per cent).

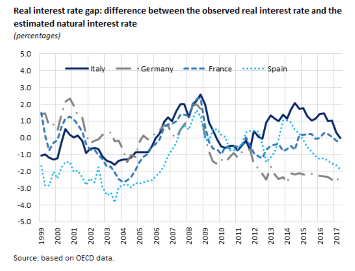

The divergence in monetary conditions in the euro-area countries is a significant factor in the normalisation of ECB policy

The Report devotes a box to the divergences between monetary conditions in the euro-area countries during the crisis. Monetary conditions are measured in each economy as the difference (real interest rate gap) between the actual real interest rate observed and the so-called natural interest rate, i.e. the interest rate that balance supply and demand for funds in a fully employed economy. This difference enables us to gauge the monetary policy stance: a positive value indicates a restrictive stance, while a negative value indicates an expansionary stance. Considering the four main euro-area economies, the estimates show (see figure) that as from 2011 the real interest rate gap began to diverge significantly. More specifically, in Italy that indicator turned positive and increased until 2014, indicating a tightening of monetary conditions that contributed to depressing the economy. Only since 2015 (with the quantitative easing of the ECB) has the real interest rate gap declined in Italy. The differences in monetary conditions in the euro area are declining but are far from eliminated, which represents a factor that will presumably be assessed in the ECB’s monetary policy decisions.

The Report devotes a box to the divergences between monetary conditions in the euro-area countries during the crisis. Monetary conditions are measured in each economy as the difference (real interest rate gap) between the actual real interest rate observed and the so-called natural interest rate, i.e. the interest rate that balance supply and demand for funds in a fully employed economy. This difference enables us to gauge the monetary policy stance: a positive value indicates a restrictive stance, while a negative value indicates an expansionary stance. Considering the four main euro-area economies, the estimates show (see figure) that as from 2011 the real interest rate gap began to diverge significantly. More specifically, in Italy that indicator turned positive and increased until 2014, indicating a tightening of monetary conditions that contributed to depressing the economy. Only since 2015 (with the quantitative easing of the ECB) has the real interest rate gap declined in Italy. The differences in monetary conditions in the euro area are declining but are far from eliminated, which represents a factor that will presumably be assessed in the ECB’s monetary policy decisions.