The Report on Recent Economic Developments for October examines recent developments in the international and Italian economies and their short-term outlook. In an environment characterised by the end of the long expansion, rising trade tensions and widespread uncertainty, economic conditions continue to deteriorate, although a recession does not currently appear imminent.

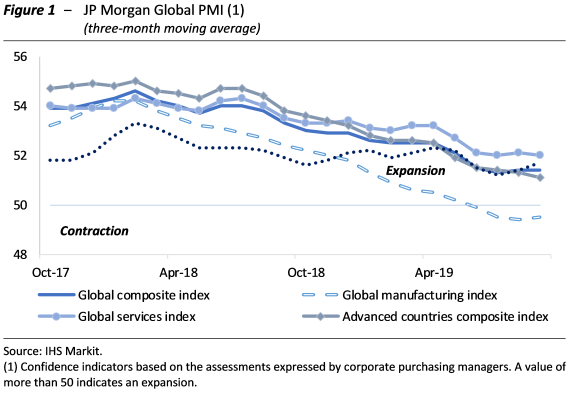

World trade slows and the deceleration of the global economy intensifies ‒ According to the most recent economic indicators, the deceleration in world economic activity continues, involving both the emerging and advanced countries. In September, the Markit Purchasing Managers’ Index (PMI) for manufacturing fell to its lowest level in the last three years (Figure 1) and although a global recession is not expected in the baseline scenarios, many analysts point to various signs of fragility in the world economy.

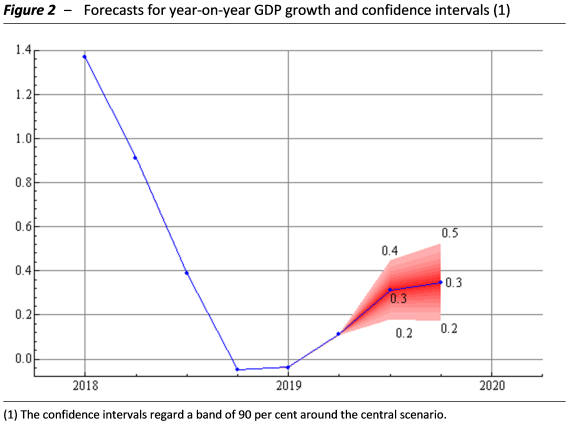

The slowdown has involved the United States (in the second quarter GDP rose by just 2.0 per cent on an annualised basis, compared with 3.1 per cent for the previous period) and, in an even more pronounced manner, the euro area (0.2 per cent GDP growth quarter-on-quarter in the second quarter, half the pace registered in the final part of 2018). According to data from the Central Planning Bureau (CPB), the change in world trade growth in May-July was virtually nil compared with the previous three months (Figure 2). For 2019 as a whole, the major international institutions forecast a modest increase with respect to the historical average. For the fifth time, the IMF has revised its forecasts for global GDP growth downwards, lowering its projection to 3.0 per cent, from 3.9 per cent in July last year (and 3.2 per cent in July 2019).

The IMF also conducted a simulation which found that the set of trade policy measures adopted by the United States, together with retaliation by trade partners and indirect effects (on confidence, interest rates for firms and productivity), could reduce output in 2021 by about two percentage points for China and about half a point for the United States, Japan and the euro area.

Italy’s growth stalled with risks on the horizon – After contracting between the spring and summer of 2018, Istat’s revision of quarterly accounts data shows GDP growth resuming in the first two quarters of 2019. This produced a slight improvement in growth already achieved for this year (0.1 per cent). The small increase in economic activity is the result of the essential stagnation of consumption, a moderate expansion of investment and resilient exports (despite the weakening of global trade).

The latest economic indicators point to very moderate output growth. PBO estimates indicate that industrial activity was almost unchanged on average in the third quarter compared with the previous period. Over the same period, the diffusion index fell to 51.1, although just over half of manufacturing sectors were expanding, while the composite index of business confidence was essentially unchanged in July-September compared with the second quarter. The uncertainty of households and firms continues to rise: although remaining below the highs registered in 2013-2014 in the third quarter of the year, the PBO indicator began to deteriorate from the end of 2018.

The short-term models of the PBO suggest that economic activity in the second half of the year will continue to expand at the moderate pace seen in the first half: in the third quarter, GDP is estimated to have increased by 0.1 per cent on the previous quarter (0.3 per cent year-on-year; Figure 2) within a confidence band of between -0.1 and 0.2 per cent. Weak economic performance is expected for the final part of the year as well (with quarter-on-quarter GDP growth of 0.1 per cent, for the fourth quarter in a row), albeit with a broader margin of uncertainty. This would produce an increase in GDP for 2019 of 0.2 per cent, marginally above the growth envisaged in the forecasting exercise recently conducted by the PBO for the endorsement of the Government’s forecasts in the Update to the 2019 Economic and Financial Document. Expectations for slow growth in the second half of 2019 impact the carry-over effect on next year, which would be barely positive (0.1 per cent).

Major downside risks, mainly of an external nature, cloud these forecasts at both the short and medium term. The international economy could weaken further in response to trade tensions, the slowdown of the Chinese economy, Brexit and financial imbalances. In the event of more unfavourable international conditions, the risk aversion of investors would increase rapidly and the scope for global economic policy-makers to intervene could be limited.

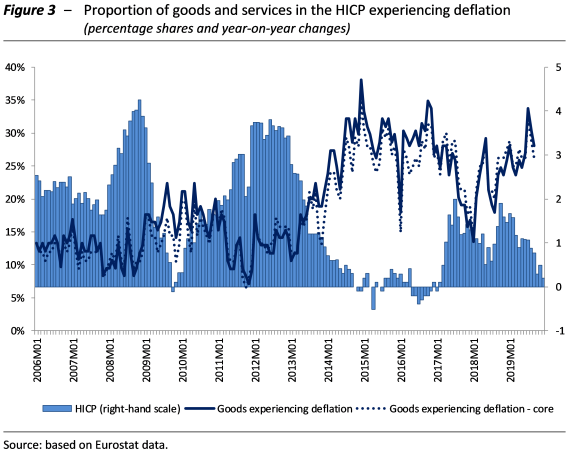

Where has inflation gone? Euro-area inflation continues to decline: in September, inflation fell below 1 per cent (0.8 per cent), the lowest since the end of November 2016. In Italy, after a moderate revival in the spring, consumer price inflation returned to very low values, significantly below those for the euro area, including core inflation. In September consumer price inflation measured by the national consumer price index (NIC) fell to 0.3 per cent (0.2 per cent for the HICP), the lowest figure since November 2016 (Figure 3; core inflation was only slightly higher, at 0.6 per cent).

The weakness of prices spread across expenditure items and appears to reflect the absence of pressures in the upstream segment of the production process. According to Istat surveys, the expectations of firms and households remain cautious: the former are stable for the next 12 months, while the latter have risen moderately.

Since the 2008-2009 crisis, the determinants of inflation have become more difficult to identify and inflation itself has been very low overall. This has had a profound effect on economic policies. Central banks reacted proactively to low inflation, including by introducing unconventional instruments. Low nominal inflation also represents a challenge for governments, especially for countries with a large public debt, for which nominal GDP is crucial in determining the sustainability of the public finances.

In the last decade, average annual consumer price inflation has almost halved (to 1.3 percent) compared with 2000-2008 (2.5 per cent). The decline in inflation was more pronounced than that observed for the euro area, especially as regards the GDP deflator, for which the downward trend has been stronger in the last two years. In fact, two consecutive negative differentials were recorded with respect to the euro area (for a cumulative total of 0.7 percentage points), something that had never happened since the start of the monetary union.

The moderation of prices in Italy is the reflection of a combination of different factors: domestic demand factors specific to the Italian economy; external factors (international trade, prices of raw materials, oil and exchange rates); and supply factors (the efficiency of production processes and production costs). The PBO conducted a counterfactual analysis to attempt to estimate the effects of shocks to these three factors on the GDP deflator. While the findings should be assessed with caution, the simulations found that the main determinants of low inflation were primarily of external origin.