24 October 2023 |

Uncertainty over rising geopolitical tensions weighs on global economic outlook; the first effects of the Middle East conflict on gas markets appear

After the setback in GDP during the spring, activity in Italy remains weak; the 0.8 percent GDP growth forecast for 2023 is confirmed

Employment increases without wage tensions; however, hours worked drop

Strong decline in inflation expected in October; household and business confidence worsens

Slowdown in investments in all major sectors: access to credit weighs heavily

The PBO introduces a new indicator on the difficulties in accessing credit

The international context, already fragile in recent years, is becoming more unstable due to the escalation of the Israeli-Palestinian conflict and the consequent rise in tensions over raw materials and energy prices. The heightened uncertainty makes forecasting more difficult.

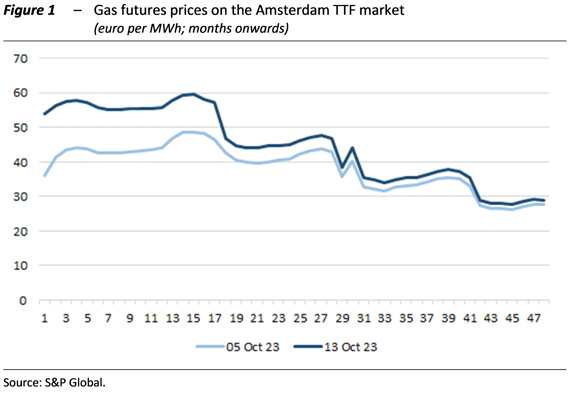

The destabilising effects of the new conflict on the international economy led to an increase in the quotations for methane futures on the Dutch market, which rose by some USD 20 on the one-month maturity (Figure 1).

In Italy, GDP slowed down in the spring, falling by 0.4 per cent over the previous period; however, the carry-over annual GDP growth for 2023 is positive, at 0.7 per cent. Household and business confidence is worsening. The decline in household purchasing power in the spring reflected the drop in disposable income. In the third quarter, consumers became increasingly cautious in their spending habits, and the confidence index stood at 106.2, about two and a half points lower than its June peak. Uncertainty is also weighing on businesses, which are holding back investment due to deteriorating credit conditions. Since the end-of-summer survey, conditions for investment have worsened, and companies foresee a moderate expansion of investments in 2023 compared to 2022. Across all production sectors, the composite index of business confidence, obtained by aggregating the sectoral climates published by Istat, fell again in the third quarter. During the same period, the uncertainty measured by the Parliamentary Budget Office (PBO) index intensified again, more so among businesses than households.

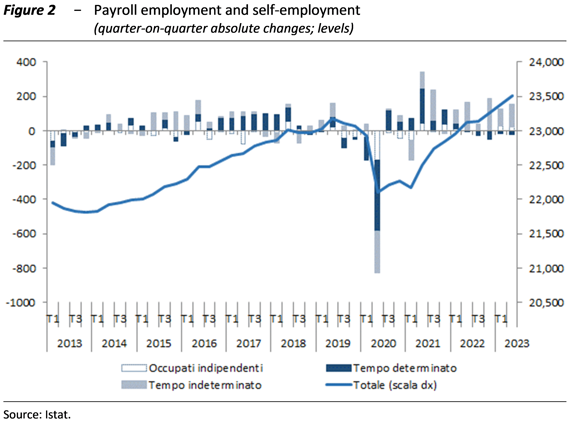

In the second quarter of the year, employment grew and no strong wage pressures were registered, although hours worked decreased. The decline in labour input in the second quarter followed that of GDP (-0.4 per cent compared to the previous three months) and mainly affected the industrial sector. According to the Labour Force Survey, however, the number of employed people increased, driven mainly by permanent workers and, more marginally, by the self-employed. Fixed-term contracts decreased for the fifth consecutive quarter. The number of jobseekers in the second quarter dropped considerably, resulting in a decrease in labour utilization (hours worked). The gap between labour supply and demand remained wide; the vacancy rate increased slightly in the manufacturing and construction sectors, while it remained stable in the services sector (Figure 2).

According to preliminary data, the number of employed people increased slightly over the summer and the unemployment rate continued to fall in the two months of July and August (to 7.4 per cent, two tenths less than in the previous quarter).

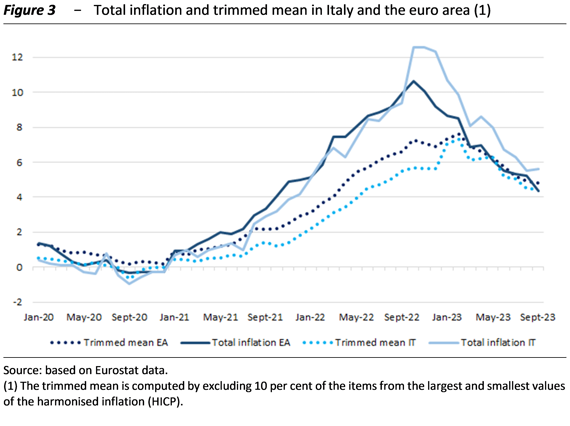

Inflation continued to fall and food prices slowed for the first time in almost two years, although they remained high. Overall, the carry-over annual growth of consumer prices for 2023 remained stable, both for the headline (5.7 per cent) and the core component. The Italian inflation differential with respect to the euro area is narrowing compared to the beginning of the year, falling to 0.9 per cent in the third quarter from 1.5 per cent in the first. Excluding a number of more volatile items and including the sharply declining October figure, the underlying trend in Italy is lower than in the euro area (Figure 3).

Qualitative surveys still point to an easing of inflationary expectations. Inflation is expected to fall sharply in October, thanks to a significant base effect, tied to the surge observed last year in energy goods; this decline should affect Italy more than its European partners. The effect could be mitigated by new tensions in the Middle East.

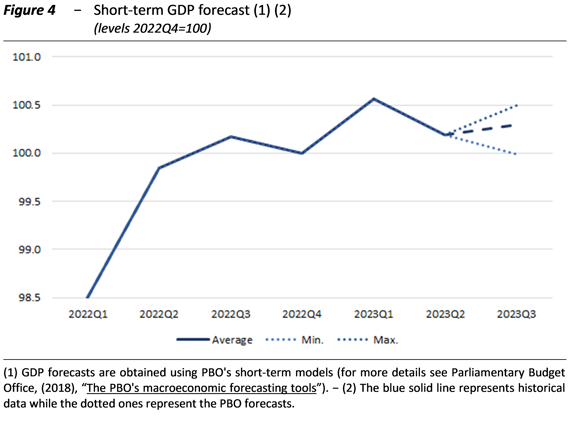

On the whole, the available economic indicators point to a moderate recovery in production activity in the second half of the year, although household and business confidence is worsening. Based on PBO models, Italy’s GDP in the third quarter was expected to change only moderately: declining slightly according to the qualitative surveys or recovering moderately according to supply indicators (Figure 4).

In 2023 as a whole, also thanks to a gradual improvement in production activity in the latter part of the year, GDP is expected to increase by 0.8 per cent, as already projected in the endorsement exercise for the forecasts of the latest Update to the Economic and Financial Document.

In the medium term, the forecast risks are on the downside. Potential adverse shocks on the international scenario are accompanied at national level by concerns regarding the progress of the National Recovery and Resilience Plan (NRRP).

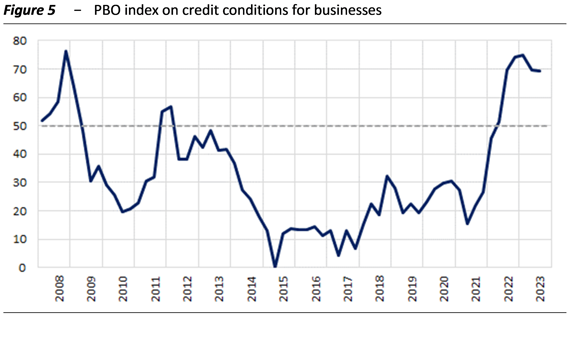

The PBO has adopted a new access to credit indicator using a combination of publicly available quantitative and qualitative data, calculated for the Italian economy over the period between the first quarter of 2008 and the third quarter of 2023. The indicator measures the imbalance between credit supply and demand conditions. Index values above 50 suggest restrictive credit conditions, while lower values suggest favourable credit conditions (Figure 5).

The indicator marks the 2008-09 recession as the most difficult time to access credit experienced by the Italian economy in the last 15 years. The recovery phase in 2010 was matched by a relatively expansive supply of credit until the second recessive episode of 2012-14, which culminated with the outbreak of the sovereign debt crisis. The indicator then settled at low values (below 30), confirming that obstacles in obtaining bank financing are less stringent when economic growth is sustained or monetary policy is accommodating. Between the end of 2022 and the beginning of 2023, the indicator reached a new historical peak, almost similar to the one recorded in 2008.