19 January 2024 | The new Focus Paper published by the Parliamentary Budget Office (in Italian) analyses the macroeconomic and public finance frameworks provided by the 20 euro area countries in their 2024 Draft Budgetary Plans (DBPs), with a specific focus on the main euro area economies: Italy, France, Germany and Spain. In the case of these countries, the deviation of the forecasts contained in the DBPs from those underlying the 2023 Stability Programmes (SPs) and from the European Commission’s autumn forecast 2023 is also examined. A section of the Paper also describes the fiscal stance prevailing in the countries in 2023-24 and, based on the European Commission’s forecast, illustrates compliance with fiscal rules and with Council recommendations for 2024. Tables and charts complete the Focus (available for download at: https://en.upbilancio.it/comparison-between-the-2024-draft-budgetary-plans/).

The DBPs are submitted by Governments by October each year. They are then analysed by the European Commission and assessed by the end of November. The European Commission assesses whether the rules of the Stability and Growth Pact (SGP) are complied with and whether the recommendations approved by the Council of the European Union (EU) have been taken into account when designing the budgetary policy; the Commission may ask the Member State concerned to revise the document and then issue a new assessment. The Eurogroup then examines the DBPs in light of the opinions expressed by the Commission, and publishes its conclusions.

This analysis is mainly based on the European Commission’s assessments of the DBPs released on 21 November 2023.

GDP growth

The DBPs of euro area countries estimate real GDP growth at an average of 0.9 per cent for 2023, rising to 1.7 per cent in 2024. Growth in 2023 is positive for all countries except Estonia, Austria and Lithuania, while it is nil in Finland. According to the DBPs, growth in all euro area countries should be above 1 per cent in 2024, with an average of 1.7 per cent.

Real GDP growth in the main euro area economies started to lose momentum in the course of 2023, with a carry-over effect on 2024 as well. According to the respective DBP estimates, the German and Spanish economies should grow more than expected in the 2023 SPs (0.4 per cent in Germany, 2.4 per cent in Spain) and less than expected in 2024 (1.6 per cent in Germany, 2 per cent in Spain).

The Commission’s autumn forecast for growth is lower than that contained in the DBPs. Real GDP in Germany is projected to be in negative territory in 2023 at -0.3 per cent, while it is expected to return to a 0.8 per cent growth in 2024. In Spain, only 2024 has a lower forecast, at 1.7 per cent. In the case of France, real GDP growth in 2023 is expected to remain in line with the figure projected in the SP (1 per cent), although it is projected to weaken to 1.4 per cent in 2024. The Commission points to a lower forecast only in 2024, at 1.2 per cent. Regarding Italy, the growth of economic activity is expected to be lower than indicated in the SP both in 2023, with the Government forecasting real GDP to grow at 0.8 per cent (0.2 percentage points lower than that indicated in the SP), and in 2024, when growth is forecast to fall from 1.5 per cent in the SP to 1.2 per cent in the DBP. The deterioration of growth prospects for Italy is also confirmed by the European Commission’s autumn forecast, where growth is set at 0.7 per cent in 2023 and 0.9 per cent in the current year.

Inflation

Inflation estimates for the main euro area economies average 5.7 per cent in 2023 and 2.9 per cent in 2024. However, the inflation forecasts show different trends and are still characterised by a high degree of uncertainty.

In Germany, the inflation rate is forecast at 5.7 per cent in 2023 and 2.3 per cent in 2024, values in both cases lower than those predicted in last April’s SP. The European Commission estimates higher values, at 6.3 and 3 per cent. In the case of France and Spain, inflation is forecast to grow by 5.7 per cent and 5.9 per cent respectively in 2023, with values higher than those estimated in the SP, while in 2024 inflation is expected to register lower or similar levels (2.5 per cent in France, 3.6 per cent in Spain). The inflation rate in Italy is expected to reach 4.5 per cent in 2023, i.e. below that forecast in the SP. In 2024, inflation is expected to stand at 2.9 per cent, a level similar to previous estimates.

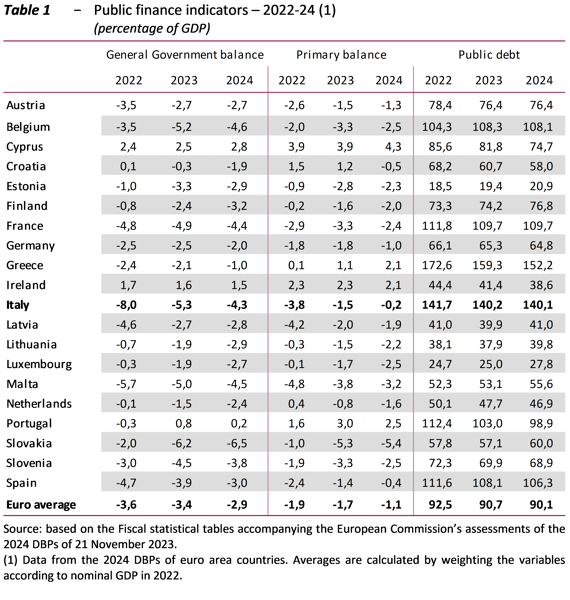

Deficit

Regarding the nominal deficit-to-GDP ratio estimated in the DBPs, an overall average of 3.4 per cent is projected in 2023, while in 2024 the average drops to 2.9 per cent. Regarding the primary deficit (revenue minus expenditure net of interest on debt), according to the DBPs an average deficit of 1.7 per cent of GDP is projected in 2023, falling to 1.1 per cent in 2024.

According to the DBPs, nine countries (including Italy) are expected to have deficits above 3 per cent of GDP, while three countries anticipate a budget surplus. Slovakia’s DBP contains the highest deficit-to-GDP ratio (6.3 per cent in 2023, 6.5 per cent this year), while Cyprus’ DBP forecasts the highest surplus-to-GDP ratio (2.5 per cent in 2023, 2.8 in 2024). Among the main euro area economies (Germany, France, Italy and Spain), the nominal budget deficit targets previously planned in the Counties’ respective SPs were confirmed in France and revised downwards in Italy and upwards in Germany.

The deficit-to-GDP ratio projected for 2023 in the German DBP is significantly better than in the last estimate of April’s SP, going from about 4.3 per cent to about 2.5 per cent of GDP, while in 2024 it is expected to be slightly worse than the previous estimates. However, the new measures to support businesses in the fight against high energy prices announced by the Government put these targets at risk, while the recent ruling by the German Constitutional Court on the debt brake mechanism envisaged by Germany’s numerical fiscal rules may require the Government to take further consolidation measures for 2024 and beyond.

Among the main euro area economies, only Italy’s DBP forecasts a worsening of the primary deficit in 2023 and 2024 compared to what was planned in the SP and projects an above-average deficit, second only to that of Slovakia. The Italian Government’s estimates revise the net borrowing targets to 5.3 per cent of GDP in 2023 (0.8 percentage points lower than the SP figure), and to 4.3 per cent of GDP in 2024 (0.6 points higher than the previous targets).

France’s DBP projects primary deficit to remain broadly unchanged in 2023 and 2024 compared to the SP targets. The budget balance-to-GDP ratio is also projected to remain close to last spring’s SP targets in Spain, given that the DBP presented by the outgoing government was based on a no-policy-change assumption.

Debt

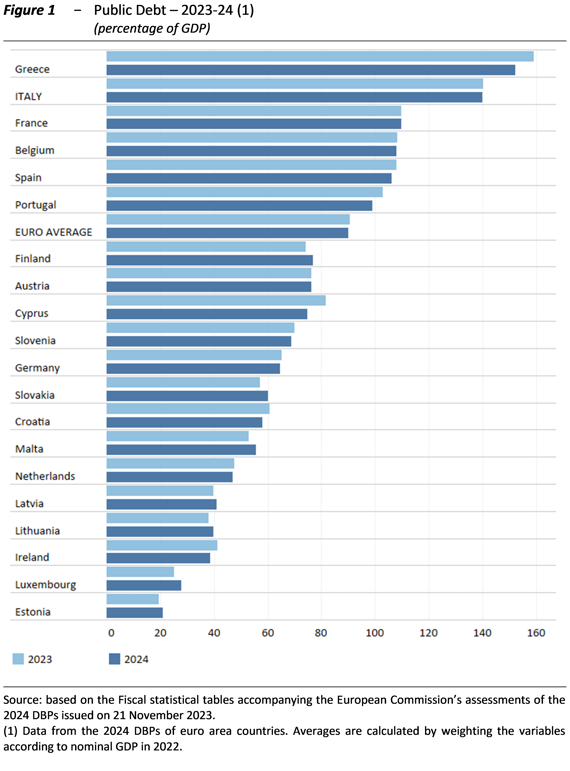

Regarding the debt-to-GDP ratio, the DBPs of euro area countries show an average level of 90.7 per cent in 2023 and a slight decrease to 90.1 per cent in 2024. Twelve countries have a ratio above 60 per cent and six countries are at levels above 100 per cent.

In Italy, the public debt-to-GDP ratio is expected to remain broadly stable compared to 2023, remaining the second highest (140.1 per cent) after that of Greece (152.2 per cent), whereas Estonia continues to project the lowest public debt-to-GDP ratio (20.9 per cent). Italy’s debt-to-GDP ratio for 2023 is lower than published in the Economic and Financial Document last April thanks to ISTAT’s recent upward revision of the estimated level of nominal GDP for 2021 and 2022, which is also carried forward into subsequent years. In 2024, Italy’s debt-to-GDP ratio is expected to decrease only marginally by 0.1 percentage points of GDP with respect to the 2023 estimate.

In France, the debt-to-GDP ratio in the DBP is projected to remain stable although slightly above the values presented in the SP. On the contrary, the debt-to-GDP ratio in all the other main euro area economies is projected to be lower than previously estimated in both 2023 and 2024. Germany’s DBP, contrary to what the SP projected, i.e. that the stock of debt-to-GDP would increase in 2023, reports declining values. The decline is expected to continue in 2024, albeit at a slower rate than previously estimated. Also in Spain, the debt-to-GDP ratio falls in 2023 more than projected in the SP, while in 2024 and under a no-policy change assumption the decline is less than previously reported.

Net expenditure growth and fiscal stance

Given the deactivation of the general escape clause of the SGP at the end of 2023, the European Commission published on 24 May a proposal to the EU Council containing country-specific recommendations with quantitative indications based on a maximum growth rate for net nationally financed primary expenditure. Net primary expenditure is primary expenditure net of cyclical unemployment benefits, one-off measures and EU funded expenditure, as well as net of the incremental budgetary impact of discretionary revenue measures.

Net primary expenditure growth ceilings are differentiated among Member States on the basis of a recommended fiscal adjustment that is different between countries (a change in the structural balance between 0.3 and 0.7 percentage points of GDP) and modulated according to the distance from the medium-term objective (MTO) and an assessment of public debt sustainability. The European Commission forecasts that ten countries, including France and Germany, will exceed the ceiling for net primary expenditure growth in 2024; the Commission forecasts that Austria will have a net primary expenditure growth equal to the ceiling, while the remaining six countries, which include Italy and Spain, will have a net primary expenditure growth below the ceiling.

Taking also into account the declining but still high core inflation, lower energy prices and monetary policy normalisation, it is interesting to observe the fiscal stance of individual EU countries and the overall fiscal stance of the euro area in 2023-24, as calculated on the basis of the Commission’s fiscal stance indicator (growth rate of primary expenditure net of cyclical unemployment benefits, one-off measures, pandemic-related temporary emergency measures and discretionary revenue measures). On average, this was restrictive over the two-year period, after three years of expansionary policies. Five countries, including France, Germany and Italy, are expected to have a restrictive policy stance in 2023 and 2024. The indicator for Italy is projected at 1.6 points of GDP in both 2023 and 2024, due to the discontinuation of the past years’ anti-crisis measures and a reduction in private investment subsidies. Nine countries, including Spain, are expected to have an expansionary policy in 2023 and a restrictive one in 2024. Only the Netherlands is expected to have a restrictive policy in 2023 and an expansionary one in 2024. The European Commission, in its overall assessment of the DBPs, sees a contraction of the fiscal stance in the euro area amounting to 0.5 points of GDP in 2023 and 0.6 points in 2024.

EU Council recommendations and compliance

In addition to the recommendation on the ceiling of the growth rate of net nationally financed primary expenditure, the European Commission also assessed compliance with the following EU Council recommendations for 2024: gradual winding down of measures to counteract the effect of high energy prices, using the savings to reduce the deficit; preservation of nationally financed investment; ensuring the effective absorption of EU funding.

According to the European Commission, among the main euro area countries, Spain and Germany fully comply with the 2024 recommendation on the growth rate of net nationally financed primary expenditure. However, the Commission considers Italy’s DBP ‘not fully in line’ with the Council’s recommendations, while France’s DBP presents risks of non-compliance and the Country was invited to take any necessary corrective action.

Regarding the measures aimed at mitigating the effect of high energy prices, the EU Council recommended to discontinue these measures as soon as possible and by 2024, and to use the resulting savings to reduce the deficit. Among the main euro area economies, only Spain is expected to fully comply with this recommendation. Italy only partially complies with the Council’s recommendation concerning the support measures to curb high energy prices, as the Country plans to discontinue such measures by 2024 while not using the resulting savings to reduce net borrowing. France and Germany also only partially comply with the Council recommendation as they will not completely phase out the support measures by this year.

Regarding the recommendation to preserve nationally financed investment in 2024, the assessments on the autumn forecast, despite the restrictive stance already mentioned, show an increase in 2024 in Germany (from 2.5 per cent of GDP in 2023 to 2.6 per cent in 2024) and in Italy (from 2.7 per cent in 2023 to 3 per cent this year). In France, the impact on GDP of nationally financed investment is expected in 2024 to maintain the same level as in 2023, while in Spain a reduction is expected, although only due to the timing of the programming of EU funds and to national co-financing.

In conclusion, only Spain’s DBP is overall in line with all the Council recommendations described above. The Commission invited Germany to reduce the energy support measures as early as possible in 2023 and 2024, while Italy was asked to stand ready to take the necessary measures within the national budgetary process to ensure that the budgetary policy in 2024 is in line with the Council recommendations. France was also invited to take the necessary measures within the national budgetary process to ensure that fiscal policy in 2024 is in line with the Council’s recommendations.