20 July 2023 | Alongside conservative macroeconomic forecasts, realistic public finance estimates are an important element for credible fiscal planning and for the implementation of sustainable fiscal policies.

Guidance on the process whereby official macroeconomic and public finance forecasts are formed and on the need for greater transparency as to their realism has been stressed in the EU governance reform framework (Six-Pack and Two-Pack), in particular through the EU Council Directive 85/2011 and the EU Regulation 473/2013. The law establishing the Parliamentary Budget Office (PBO) specifies that the Office carries out analyses, checks and assessments of macroeconomic and public finance forecasts, including through the production of its own estimates. Moreover, in the recent update of the Memorandum of Understanding between the Italian Ministry of Economy and Finance and the PBO, the Office commits to periodically make public ex-post evaluations of the Italian government’s macroeconomic and budget forecasts contained in official planning documents.

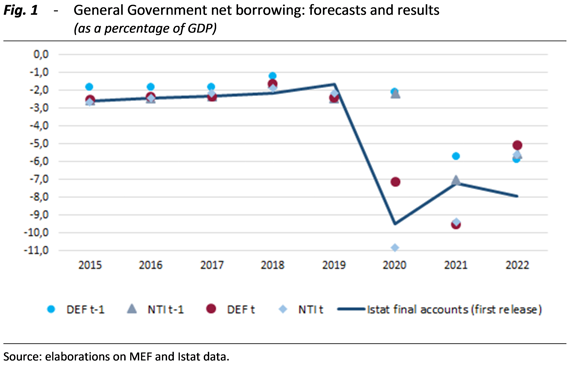

Following the ex-post assessment of macroeconomic forecasts published in last June’s PBO Budgetary Policy Report, this Focus includes a multi-year retrospective analysis of the public finance forecasts by the Italian Ministry of Economy and Finance (MEF) for the 2015-2022 period, as divided into two phases: the 2015-19 five-year period and the subsequent 2020-22 three-year period, crucially influenced by the pandemic emergency and the energy crisis, which caused significant, frequent changes in estimates and targets.

By their very nature, forecasts are subject to margins of uncertainty that can take on greater or lesser dimensions depending on the circumstances, as highlighted by the aftermath of the pandemic and energy crises. Deviations between estimates and results are therefore inevitable aspects of any forecasting process.

In its analysis, for each year t included in the 2015-2022 interval, PBO considered the fiscal forecasts in four official documents: the Economic and Financial Document (Documento di Economia e Finanza, DEF) and the Technical Explanatory Note annexed to the Budget Law (Nota Tecnica Illustrativa, NTI) of the previous year (denoted, respectively, DEF t-1 and NTI t-1), and the DEF and NTI for the same year (denoted. Respectively, DEF t and NTI t). The assessment of forecast errors was conducted with respect to the final data released by Istat at t+1, at the time of the April notification sent to Eurostat.

Regarding the 2015-19 period, the general government (GG) net borrowing results are broadly in line with the targets set in the planning documents prepared close to the the budget laws (NTI t-1), while there is a larger slippage in the DEF t-1. The latter deviations were not so much the result of forecasting errors but were due in particular to the presence – at the time of planning – of the safeguard clauses on indirect taxes (i.e. of increases in VAT and excise duties on mineral oils); these were largely internalised into deficits in the forecasts of subsequent planning documents, also thanks to the flexibility requested and granted in the context of the EU fiscal rules. Excluding DEF t-1, the average error of the MEF forecasts on the main public finance balances over the 2015-2019 period is very similar to that of the European Commission forecasts. Indeed, for the GG net borrowing as a ratio of GDP, the documents following the DEF t-1 do not show a significant systematic error in the forecasts, thus indicating the absence of an optimistic or pessimistic bias.

Analysing the various components of the GG account, it emerges that both primary expenditure and total revenue as a ratio of GDP were slightly higher than expected. In the detail of the individual items, there were underestimates for intermediate consumption and overestimates for social benefits. On the revenue side, there were no systematic errors for direct and indirect taxes. For social contributions, an underestimation is observed on average over the period, while for other revenues – Items of minor importance – an overestimation is observed on average.

As far as the 2020-22 three-year period is concerned, the exceptional nature of the economic crisis linked to the pandemic and the energy crisis linked to the war in Ukraine have led to a reduced reliability of the forecasts of both the MEF and the European Commission.

Analysing the deviations in absolute terms year by year, with reference to the three official documents considered, in the 2015-19 five-year period, it is possible to distinguish between the first three years and the second two. In the first years, the deficit estimates were more or less “in line” with the results, albeit with offsets between the two components of the overall balance (with primary surpluses and interest expenditure both overstated). In 2018-19, on the other hand, there were misalignments with, respectively, an underestimation and overestimation of the deficit with respect to the outturns; these were due, in the first case, to an overestimation of the primary surplus accompanied by an underestimation of interest expenditure and, in the second case, to the opposite situation.

In 2018, the economic downturn was not fully taken into account, resulting in an overestimation of revenue; there was also an underestimation of expenditure, especially capital expenditure, due to the concentration in the year of some expenditures provided for in previous years’ regulations. In 2019, on the other hand, there was a significant underestimation of revenue due to various causes, which also depended on factors beyond the control of the government (an enlargement of the GG perimeter was carried out by Istat; moreover, several times during the year there were trends in some revenue components that were more favourable than expected, in particular with reference to revenues from self-assessed taxation).

In the 2020-22 three-year period, which was characterised by the pandemic and energy crises, after initial underestimates of the 2020 deficit, which were, however, corrected during the course of the year, overestimates occurred in 2021. A particularly significant underestimation occurred in 2022, due to initial, limited, estimates of the effects of building-renovation bonuses and different accounting rules for these measures required by the official statistical institutes (Istat and Eurostat) in the final releases. In 2021, in particular, the favourable revenue trends were not fully achieved, especially of the substitute tax on the revaluation of corporate assets, which turned out to be cheaper than expected for taxpayers, and of VAT, which grew more than expected, probably favoured both by the reduction in the share of expenditure on services – induced by the pandemic and characterised by lower rates and greater evasion – and by the growth in the use of electronic means of payment.