14 November 2023 | The Chair of the Parliamentary Budget Office (PBO), Lilia Cavallari, spoke today before a joint session of the Budget Committees of the Senate and the Chamber of Deputies. The hearing concerned the preliminary examination of the 2024-26 Budget Bill. Below is a summary of the brief delivered by the Chair of the PBO.

The macroeconomic scenario and the potential future risks

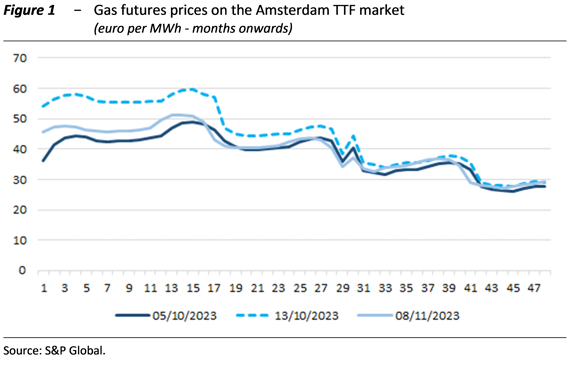

The context around the Budget Bill appears fragile and uncertain, especially when considering the global scenario. The international economy is being shaken by a new war in the Middle East, which undermines global economic prospects and has already caused early spillover effects on the markets, exposing the international economic system to shocks that are difficult to predict and potentially very significant. In recent weeks, energy commodity markets have become even more volatile (Figure 1); despite the negligible contribution of Israel’s gas production, the precautionary shutdown of the Tamar plant may indirectly affect the supply of liquefied natural gas to Europe. Geopolitical tensions are constantly and rapidly evolving and may soon trigger new adverse macroeconomic shocks.

The international economy is weak, while world trade is expected to accelerate next year. In the first half of 2023, world trade was held back by the slowdown in the large manufacturing-exporting economies, such as China and Germany. The cyclical phase is expected to remain weak in the remainder of this year. However, major international organisations are forecasting a strong recovery of international trade in 2024; the International Monetary Fund expects world trade to grow by 3.5 per cent next year compared to 0.9 per cent in 2023.

The expectation of this sharp recovery in global trade represents a key assumption supporting the government’s macroeconomic scenario, especially with regard to Italy’s GDP growth in 2024.

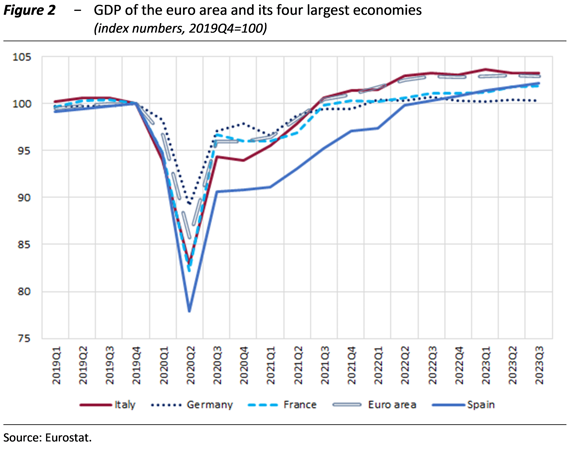

In the third quarter, Italy’s GDP remained stable, both in cyclical terms and if compared to the same period of the previous year; the euro area also experienced a flat cyclical trend, so that the positive GDP differential compared to pre-pandemic levels is still greater in Italy than in the main economies of the area (Figure 2).

The stagnation of production activity in Italy was accompanied by a reduction in inflation, which fell below two per cent. On average, Italian GDP has not expanded for about a year. Production is held back not only by the slowdown in world trade, but also by the sharp deterioration in domestic demand. Household consumption seems to have lost its momentum following the pandemic, while wealth accumulation processes are suffering from the worsening of credit conditions, and public consumption has begun to shrink, after the strong increase recorded in 2022. As regards price trends, consumer inflation more than halved to 1.8% in October; the substantial decline in inflation is largely ascribable to the year-on-year decline in energy prices, which compares with the peaks of 2022. At the same time, food inflation declined at a slower pace, benefiting poorer households.

The official macroeconomic forecasts, validated by the PBO last month during the hearing on the Update of the 2023 Economic and Financial Document (NADEF), remain substantially acceptable for 2023, while the downside risks for next year have clearly increased. Following the presentation of the Draft Budgetary Plan (DBP), Istat released preliminary GDP data for the third quarter of 2023, which were stable with respect to the previous period; however, the projected variation for 2023 is 0.7 per cent, which is only marginally lower than the MEF forecast (0.8 per cent) for GDP in the current year. The government’s growth targets for 2024 are achievable, provided that the expectations of a substantial rebound in foreign demand materialise and that the projects under the NRRP progress apace. The official macroeconomic GDP forecasts are at the high end of expectations compared to those of other institutions and private analysts, which often incorporate more conservative assessments on the development of the projects under the NRRP.

In this context, the NRRP plays a key role in supporting the economy and its implementation can no longer be postponed. According to PBO estimates, the full implementation of the Plan’s projects will boost the economic activity slightly less than expected by the MEF, yet still decisive for development in the next two years. In 2026, when the European RRF programme is expected to be completed, the PBO estimates that the level of GDP will be 2.5 per cent higher thanks to the full implementation of the planned projects. In order for this to be achieved, the interventions must accelerate; the concentration of the projects in the next two years, in addition to reducing the margins for further postponements, could fuel bottlenecks in supply.

Besides potential critical issues related to the full and effective utilisation of NRRP funds and the implementation of the associated reform programme, several external risks remain in the background, such as those relating to the ongoing wars at the borders of Europe, the outlook for the German economy, world trade and the persisting inflation, financial risks and risks related to the stance of monetary policies.

Budget plan and public finance

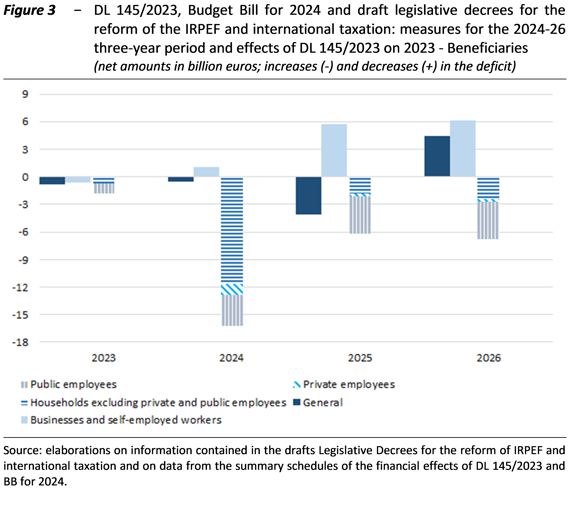

The public finance plan consists of a set of measures: Decree-Law No. 145/2023 of 18 October, the Budget Bill for 2024 and the two draft legislative decrees approved by the Council of Ministers on 16 October 2023 and implementing the enabling act on tax reform. Overall, this amounts to approximately EUR 37.6 billion in 2024, 21.6 in 2025 and 18.7 in 2026.

The impact of the plan is consistent with the policy targets set in the 2023 NADEF and the 2024 DBP, i.e. a deficit equal to 5.3 per cent of GDP in 2023, declining to 4.3 in 2024, 3.6 in 2025, and reaching 2.9 in 2026, and a debt-to-GDP ratio declining by 2.1 percentage points of GDP, from 141.7 per cent in 2022 to 139.6 at the end of 2026. Preliminary estimates suggest that the government’s policy targets for 2024 imply a growth in primary expenditure financed by domestic resources and net of discretionary revenue measures of 0.3 per cent, below the 1.3 per cent ceiling recommended by the EU last July.

The main beneficiaries of the measures introduced involve households benefiting from direct measures for private and public employees (Figure 3). Particularly noteworthy are the confirmation of the reduction in social security contributions for private and public employees for next year, the refinancing of the National Health Service (NHS), and the measures provided in the social, pension and parenting support areas. Employees will mainly benefit from the allocation of resources for the renewal of collective labour agreements for the 2022-24 three-year period and the advance of part of the resources for 2024 to December 2023 by way of an increase in the contractual holiday pay.

Measures concerning enterprises improve the budget balance in all years of the 2024-26 three-year period compared to the scenario under unchanged legislation. This is mainly due to higher revenues related to the repeal of the Aid to Economic Growth (Aiuto per la Crescita Economica, ACE) and anti-tax evasion measures.

A significant decrease in labour revenues and a smaller decrease in consumption revenues is projected in 2024. The decline in the former is mainly due to temporary measures to reduce labour social security contributions and to revise the IRPEF (Personal Income Tax). Consumption-related taxes decreased due to the reduction of the television subscription fee and the deferral of the tax on sugary drinks and disposable plastic (so-called sugar and plastic tax).

In 2025-26, revenue relating to all economic fundamentals increases, most markedly on capital. Capital-related revenues increase especially due to the repeal of the ACE and higher estimated revenues as a result of anti-avoidance measures.

General remarks on the measures introduced

In a scenario exposed to domestic and, above all, international risks, the measures introduced appear to be short-term oriented. For the second year in a row, the Government has planned both an increase in the deficit for the first policy year compared to the previous forecast, and the postponement of the achievement of a deficit below 3 per cent of GDP to the final year of the forecasting period.

The use of the available fiscal space exposes the risk of lacking sufficient resources to support the economy in the event of deteriorating cyclical conditions or unexpected events. On the other hand, the need to keep debt-to-GDP ratio on a downward trend may require greater adjustment efforts during more unfavourable cyclical conditions than the current ones.

Budget margins are severely squeezed by debt servicing costs, which is exacerbated by rising interest rates and increased borrowing. A permanent 1 per cent increase of the yield curve on government bonds as from 2024 would lead to an increase in interest expenditure of about EUR 20.5 billion, cumulatively over the 2024-26 three-year period.

The pillar of the Plan, the cut in the tax wedge, is temporarily financed through deficit: any further extension will require the identification of structural coverage measures. Due to inflationary pressures, social security contribution relief measures are effective in supporting the most vulnerable workers and those with medium-low incomes while waiting for contract renewals to be finalised. Being it structured with a relief granted by ranges and not by brackets, it entails significant losses when exceeding the two income thresholds within which it is defined. Should the measure be extended to subsequent years, the application mechanism will have to be adjusted to avoid penalties at contract renewals.

The decision to adopt a legislative decree implementing the tax reform to introduce temporary interventions on the IRPEF and an increased cost deduction for new hires generates uncertainty. Temporary IRPEF-revision interventions and deductions for costs related to employment increases are included in the legislative decree schemes for the implementation of the enabling law on tax reform, which have been conceived to provide for structural measures. Therefore, their confirmation in subsequent years seems implicit. This will require structural coverage. Consistent with the enabling law, the implementing decrees identify structural resources within the tax system that could be used for this purpose. However, these resources, stemming from the repeal of the ACE and the National Minimum Tax, seem to be insufficient to finance both measures in the following years.

Linear cuts are again to be used in the very near future, both at central and local level. In addition to the provisions of the spending review process, Ministries have assumed further savings from linear cuts involving almost all programmes of the state budget. Local Authorities are also required to contribute to the coverage of the measures. The share borne by the Provinces and Metropolitan Cities and Municipalities will hopefully be allocated through the equalisation funds in order to take due account of the standard requirements for all fundamental functions in order to safeguard them as well as the Essential Service Levels (ESLs).

The Plan begins to address some of the critical issues on medium-term expenditure trends stemming from demographic developments. In the field of social security, the measures aimed at preserving the sustainability of the pension system stand out. The re-proposal, although under tighter conditions, of temporary retirement channels with reduced requirements compared to the ordinary ones, goes hand in hand with measures aimed at positively and structurally adjusting the future evolution of pension expenditure, such as bringing forward the restart of the adjustment of the requirements for early retirement to new life expectancy forecasts and the equalisation of the accrual rates for some categories of public employees.

In the health sector, the additional resources are sufficient to maintain the health expenditure-GDP ratio at the pre-pandemic level. However, it is worth noting that, in line with the past, the NHS, despite having low expenditure both in per capita terms and in relation to GDP as well as good health indicators, appeared to be under strain even then.

Among the main expenditure-related measures, household policy interventions stand out for their purposes rather than for their resources. These include: the increase in the contribution for the payment of nursery school fees, intended only for households with specific requirements in terms of the Equivalent Economic Situation Indicator (Indicatore della Situazione Economica Equivalente, ISEE) and household composition, and the establishment of the new Single Fund for the inclusion of persons with disabilities, which is a first step towards overcoming the strong fragmentation of interventions in this area that has characterised the policies adopted in recent years.

In conclusion, it is necessary to strengthen the medium-term orientation of budgetary policy, including through a renewed commitment to the implementation of the NRRP. This implies maintaining balances that ensure a continuous decline in debt-to-GDP ratios and an increased use of structural measures to reassure economic operators and have a positive impact on growth. A medium-term orientation would be consistent with the new EU framework of rules which, if approved, will require drafting a long-term multi-year structural plan, stepping away from the short-term approach of fiscal policy.

The main measures contained in the Budget Bill

The extension of social security contributions relief and the revision of the IRPEF

The confirmation of social security contributions relief drains about half of the resources allocated in the Plan. This measure, introduced in January 2022 as a temporary initiative to mitigate the effects of the inflationary crisis on wages and then confirmed and strengthened several times until reaching its current form, guarantees an important support to low and medium labour incomes, increasing the redistributive capacity of the overall contribution and tax levy.

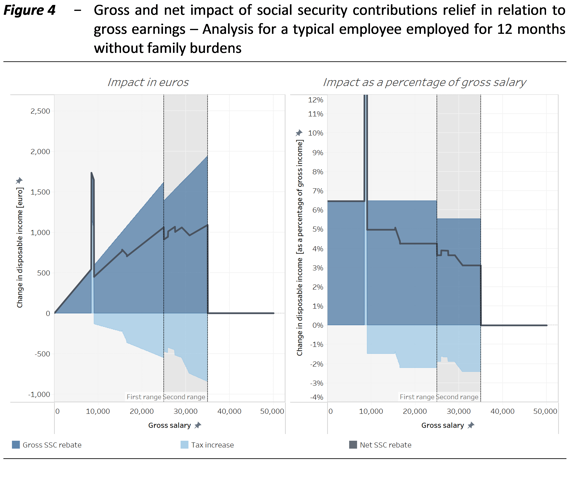

Figure 4 shows the impact of the social security contributions relief scheme on a typical employee (employed for 12 months with no family burdens) considering the retroactive effects of the tax in relation to gross earnings. The left panel shows the change in disposable income in absolute terms, the right panel in terms of incidence on gross pay. The area in dark blue represents the change in employee contributions and the area in light blue the corresponding tax increase calculated according to the scheme not reformed by the draft legislative decree. The line in grey represents the net effect of the two components.

The exclusion of the application of the exemption to the thirteenth month salary (so-called tredicesima) results in a lower effective incidence than the nominal one, amounting to 6.5 and 5.5 points respectively in the two social security contributions relief ranges. The reduction in social security contributions in absolute terms, which increases in proportion to gross salary, reaches a maximum of approximately EUR 1,600 at the upper limit of the first range (EUR 20,000) and just over EUR 1,900 at the upper limit of the second range (EUR 35,000).

However, a large part of the redistributive scope of social security contributions relief is due to its range-based application, which eliminates any benefit above the gross salary threshold of EUR 35,000, with a loss of about EUR 1,100 exceeding this threshold by just 1 EUR. This phenomenon gains importance if the social security contributions relief turned into a permanent measure: on the one hand, there would be a strong disincentive to work and, on the other hand, it would hinder contract renewal agreements, an issue that is particularly relevant in a period of high inflation.

Given the significant cost of the measure and its structural problems, it will be worth reflecting on the need for its reintroduction in the future, also in the light of contract renewals trends and, more generally, of the support to workers at risk of poverty.

As regards IRPEF, the reduction in the number of rates and tax brackets from four to three and a reduction in tax expenditures represent a first step towards the implementation of the enabling law. The intervention is more limited than the social security contributions relief, as it drains less than half of the resources (about EUR 4.3 billion) in absolute values. Moreover, it is financed for only one year, thus being temporary like the social security contributions relief.

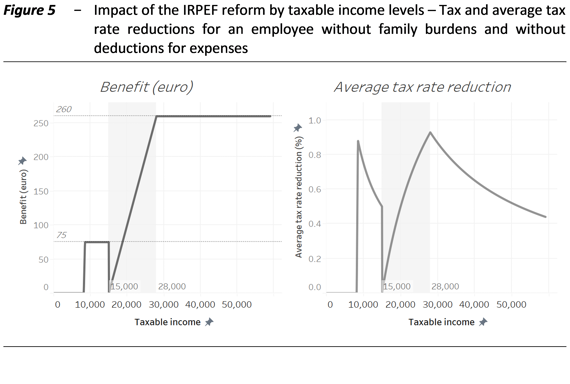

Figure 5 shows the effects on disposable income of the adjustment of tax rates and tax deduction for labour income, in relation to taxable income on a typical employee with no family burdens.

The tax decreases by EUR 75 per year for employment income between EUR 8,000 and EUR 15,000 as a result of the increase in the tax deduction; between EUR 15,000 and EUR 28,000 the benefit increases from zero to EUR 260, an amount granted to all taxpayers with income above that threshold. Beyond EUR 50,000, the benefit may be nil due to the cut in deductions for non-health charges and expenses.

The impact of the benefits on taxable income (variation in the average tax rate) is highest at around 0.9 per cent when reaching EUR 15,000 and EUR 28,000 (top right panel) thresholds. Above EUR 28,000 it gradually decreases, with the benefit remaining stable at EUR 260. Around EUR 50,000, the impact of the benefit related to the tax rate reduction is around 0.5 per cent of taxable income.

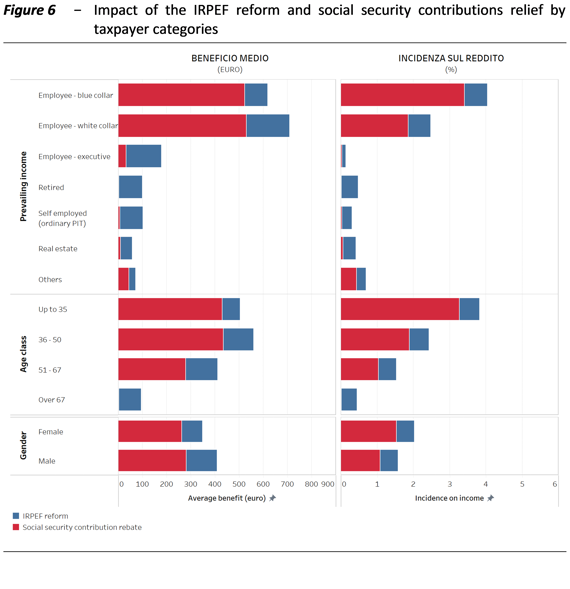

The PBO micro-simulation model allowed reconstructing, on a representative sample of the Italian population, an analysis of the impact of the two measures in order to develop an idea of their different distributional nature.

The analyses show that the intervention on IRPEF has no substantial impacts in terms of redistribution. Where social security contributions relief measures are also included, the impact becomes progressive. The extension of this measure has clashed with the provision under the enabling law, confirming a levy system strongly affected by a serious problem for marginal rates in 2024.

Overall, the largest effect is on blue-collar workers, with an average benefit of 3.4 per cent of taxable income, followed by white-collar workers with a smaller 1.9 per cent, also because not everyone benefits from the measure (Figure 6). As regards social security contributions relief measures, the impact of the benefit on income is greater for workers with lower incomes which are granted homogeneous benefits in absolute value. Conversely, the intervention on the IRPEF has specular characteristics, with a less progressive effect: the percentage increase in income is homogeneous, while the absolute increase is more favourable for white-collar workers. The other categories, not involved in the social security contributions relief measures, with a few exceptions in the case of workers with more than one type of income, substantially benefit from IRPEF reduction. For pensioners the impact of the benefit and, to a greater extent, the absolute benefit are lower than for blue and white-collar workers.

The social security contributions relief measures are more convenient, under an income perspective, for young people, especially those aged up to 35, and although the differentials are much less pronounced, young people are more advantaged in relative terms even in the case of the IRPEF reform. The different redistributive capacity of the two measures is visible, although not evident, when looking at the gender gap, where women are more favoured in terms of benefit incidence.

A final comment should be made on the containment and streamlining of tax expenditures, another objective pursued by the enabling law on tax reform. Overall, the cut in deductions for expenses incurred only slightly contributes to the financing of the reform, reducing the overall burden by just over 5 per cent. Moreover, the introduction of an additional criterion for limiting deductions compared to the one recently introduced (gradual reduction of deductions for incomes above EUR 120,000) does not seem to contribute to the simplification of the regulatory framework on tax expenditures.

The increased deduction for employment

The draft legislative decree implementing the first part of the reform of personal income taxes and other measures on income taxes grants, for 2024, holders of business income and workers engaged in the arts and professions a temporary incentive for new hirings consisting of a 20 per cent increase in the deductibility of labour costs. This measure is expected to generate lower revenues for 1.3 billion in 2025.

It is worth noting that the convenience of the measure and its effectiveness in incentivising new employment depend on the characteristics of existing social security contributions relief measures (relevance of the relief, duration of the benefit, beneficiaries).

Based upon the most recent INPS data, the value of the social security contribution relief was found to be approximately 13.5 and 14.6 per cent of the total social security contributions due in 2021 and 2022, respectively. The relevance of the new relief depends on the company’s tax rate as well as the presence of a sufficiently large tax base. In the case of corporations with tax capacity (with sufficient tax base to claim the deduction), the increase of the deductible cost by 20 per cent translates into a percentage reduction of the actual cost borne by the company of approximately 6.3 per cent, which is equivalent to a social security contribution relief of 7.8 per cent. For corporations subject to IRPEF, the reduction in the labour cost will grow as the marginal rate increases. At a minimum marginal rate of 23 per cent, the cost will decrease by 5.9 per cent, at the maximum rate of 43 per cent the cost will decrease by 15 per cent. This corresponds to a social security contribution relief amounting to 7.4 and 18.7 per cent, respectively. For companies with insufficient tax base to claim the deduction, the benefit in financial terms will be less as it is deferred over time through the loss carry-forward mechanism. However, it is worth reminding that the tax incentive, unlike the social security contribution relief, ensures a greater transparency of the system.

The repeal of the ACE

The draft legislative decree also provides for the repeal of the ACE – the incentive for capitalisation of companies – without prejudice to the existing rights regarding the carry-over of past ACE surpluses and their subsequent use until their full saturation.

The ACE, introduced in 2011, aims to restore the tax neutrality of corporate income taxation with respect to financing sources. It serves to counterbalance the deductibility of interest expenses as remuneration of debt capital and to make financing choices neutral on marginal investment, by also providing for the deductibility of the notional remuneration of equity capital (without separating new shares from self-financing) and thus by taxing extra profits only.

The ACE deduction shows a strong concentration in terms of both sector and use. More than 50 per cent of the annual deduction accruing to corporations mainly occurs in the financial and manufacturing sectors, which together account for about 21 per cent of beneficiary businesses. Only a quarter of the total number of corporations use it, with a fairly stable trend over time but significant sectoral differences.

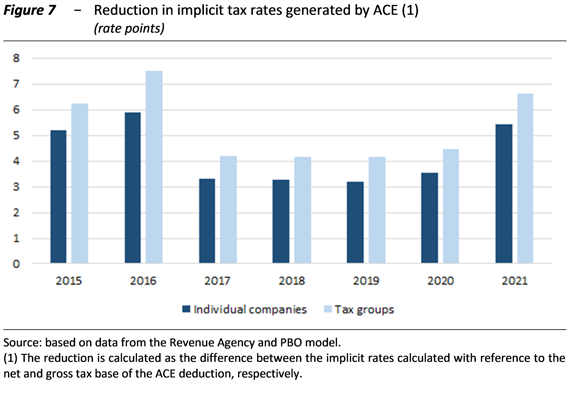

The tax savings resulting from the use of the ACE can be noted by comparing the implicit tax rates calculated with reference to the taxable base net and gross of the ACE deduction. Considering all companies resorting to the ACE, in 2021 the reduction of the implicit tax rate, influenced by the presence of the innovative ACE, reached 5.2 per cent for individual companies and 6.6 per cent for consolidated tax groups (Figure 7). In 2016, simultaneously with the increase in the ordinary remuneration rate to 4.75 per cent, the rate reduction was even higher, reaching 5.8 and 7.5 per cent for individual companies and groups, respectively. However, more recently, the reduction was above 3 and 4 per cent for individual and groups, respectively.

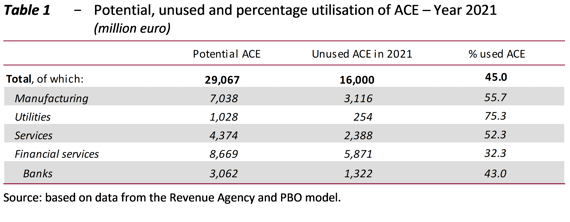

In line with the rate trend, the amount of the deduction accrued annually was particularly high. In 2021, companies accrued a potential deduction of approximately EUR 29 billion, which stems almost equally from both the total capital accrual of the same year and from the unused portions of previous years (past ACE) due to companies’ insufficient tax base.

Over the entire period surveyed, the utilisation rate of the potential deduction fluctuated, also given to the uncertain economic situation, around 40 per cent, with differences between economic sectors. For example, in 2021 utilities used an average of 75 per cent of the potential deduction, manufacturing and services more than 50 per cent (Table 1). Moreover, almost 37 per cent of the total amount of the unused ACE deduction is concentrated in the financial services sector and 19.5 per cent in the manufacturing sector.

The Technical Report estimates that the repeal of the ACE allowed recovering EUR 4.8 billion revenue in 2025 and EUR 2.8 billion revenue in subsequent years. This estimate appears conservative to some extent, while still showing some uncertainties especially in relation to its annual allocation. Specifically, with reference to the latter aspect, it is worth noting how it overlooks the fact that the repeal of the ACE will increase companies’ capacity to deduct all or part of past ACE allowances (accrued over the years) not yet used. As a result, the increased revenue may be smaller in the first years after the repeal, and then increase when fully recovered. Secondly, the official estimates overlook the fact that the announcement of the repeal of the ACE might push businesses to bring forward capital increases, originally planned for the coming years, in order to obtain the benefit of the ACE deduction still in 2023 (to be carried forward to the following years for those businesses with no capacity). These stances might produce lower revenue in 2024 and, as a consequence, lower recovery in the following years.

The repeal of the ACE – never explicitly referred to in the enabling law – is to be framed in the context of the revision of tax relieves, while in fact constituting a structural change in the corporate income tax involving the waiver of tax neutrality when choosing financing sources. Being it only the first piece of a broader reform project, the purpose of its repeal is difficult to identify.

As a matter of fact, the repeal of the ACE restores the stronger tax advantage of debt financing over equity financing. The effective after-tax cost of EUR 1 of financing remains EUR 0.76 in the case of debt and, with the repeal of the ACE, increases from EUR 0.76 to EUR 1 in the case of equity.

We may also note that even the implementation of the first provision of the enabling law, i.e. the application of a reduced tax rate on profits used for investments in the two tax periods following their completion, is expected to imply an incentive mechanism that seems to only partially compensate for the unequal treatment of sources of financing.

Pension-related measures

Pension-related measures move in the direction of strengthening the sustainability of the system. Temporary retirement channels with reduced requirements compared to the ordinary ones are once again adopted, but under tighter conditions. At the same time, specific rules are introduced to structurally influence the evolution of pension expenditure with consolidation effects in the medium-long term.

In particular, the Budget Bill renews the Social Advance Pension Payment (Anticipo Pensionistico Sociale – APE) and Early Retirement Scheme for Women (Opzione Donna – OD) by increasing, in both cases, the age requirement for eligibility and, in the case of the APE, by limiting cumulation with work income.

The Technical Report estimates the APE to be granted to a pool of 12,500 applicants in the first year, with a progressive decrease in subsequent years, thus resulting in higher expenditure worth EUR 85 million in 2024, 168 million in 2025, and then gradually decreasing until it becomes nil in 2029. Estimates appear quite conservative, as they are based on an average benefit of EUR 13,600 gross, an amount close to the maximum payable limit.

The estimates for OD also appear conservative: the highest number of pensions at the end of the year are expected to be 2,200 women in 2024, 3,000 in 2025, 4,000 in 2026, 3,000 in 2027, 2,000 in 2028 and 1,000 in 2029, for a higher expenditure before taxation of 16.1 million in 2024, 44.9 in 2025, 59.8 in 2026, 59.9 in 2027, before gradually decrease and almost disappearing in 2030.

The so-called Quota 103 early retirement mechanism is extended but limited to reduce its attractiveness. Among restrictions there are the full recalculation of contributions, longer time-requirements for application, and the ceiling on accumulation with work income. Rather than an actual possibility of early retirement, the new Quota seems to be conceived as the first step towards the generalised introduction of the possibility of flexible retirement subject to the full recalculation for social security contribution purposes of the pension check. Although the new Quota is likely to have low take-up rates comparable to those of the OD, the Technical Report remains conservative and quantifies a higher number of pensions at the end of the year: 17,000 in 2024, 25,000 in 2025 and 3,000 in 2026. The higher gross expenditure is expected to amount to EUR 112 million in 2024, rise to EUR 804 million in 2025, and then fall to EUR 414 million in 2026. A saving of EUR 151 million is projected in 2027.

The recalculation of the remuneration quota of the pensions granted to members of some public workers’ funds that had partly escaped the homogenisation of the rules started in the 1990s, and the bringing forward of the restart of the adjustment of early retirement requirements to life expectancy, are aimed to achieve a structural containment of expenditure. In the long run, the potential revision of the indexation mechanism carried out by a Board of experts to be set up would also contribute to the structural containment of expenditure. These changes are bound to accumulate over time and generate significant effects between the end of the 2030s and the beginning of the 2040s, when medium to long term projections suggest a peak of pension expenditure as a percentage of GDP (the so-called hump).

Over the longer term, the recalculation of the remuneration quota for some categories of public workers has a significant financial impact: between 2023 and 2043 the cumulative savings are expected to amount to EUR 32.9 billion (EUR 21.4 billion before tax), most of which will be generated in the years in which the pension hump is expected to occur. However, in the coming years (up to 2028-2030) and at the individual level, recalculation requires a “sacrifice” that can be partially offset by the postponement of the retirement age by one or two years. For instance, in 2025, the first year in which there will be pensioners subject to the recalculation on an entire year’s pension, the Technical Report suggest an average gross reduction of EUR 619 for the 72,900 new pensioners enrolled in the CPDEL (Local Authority Employee Pension Fund), EUR 2,767 for the 7,300 enrolled in the CPS (Healthcare Workers Pension Fund), EUR 700 for the 1,000 enrolled in the CPI (Pension Fund for Nurseries Teachers and Officially Recognised Schools) and EUR 1,333 for the 300 enrolled in the CPUG (Judicial Officers Pension Fund). As a percentage of pensions effective as from 2022, used as a proxy for pensions to become effective in the near future, this results in an impact between 4.8 per cent of CPUG and 2.3 per cent of CPDEL if early retirement is taken as a benchmark, and between 4.2 per cent of CPUG and 2.3 per cent of CPDEL if the benchmark is the old age retirement.

By way of examples, these sacrifices are comparable to those involving pensioners receiving allowances between five and six times the minimum pension through the amendment of the indexation mechanism ordered last year for 2023 and 2024. The incidence of recalculation increases as pre-1996 accrued seniority decreases, and more significant percentage corrections will gradually be required until the second half of the 2030s, when the last workers with only one year accrued pre-1996 will retire. Younger workers also have more time to adapt to the change and optimise their professional and savings choices.

The bringing forward of the restart of the adjustment of early retirement requirements to life expectancy, which considering the demographic data disclosed by Istat will have no tangible effect on retirement requirements from 1 January 2025, indicates that the link between retirement age and life expectancy is relevant, at least at this stage, and will not be called into question in the foreseeable future.

The Board of experts, which will assess the indicator to be used for the indexation of pensions and other social benefits, has the crucial task of acting in full awareness of the mandatory trade-off between system sustainability goals and benefit adequacy in the face of scenarios characterised by price tension, while also considering the possibility of redistributing adequate safety nets among income brackets, prioritising the lower ones. If inflation were to realign immediately to the ECB’s target (2 per cent), with the progressive bracket mechanism being reintroduced as from 2025, indexation would require more than EUR 7 billion each year; with a more gradual realignment (e.g. with the resistance threshold at 3 per cent), expenditure could reach EUR 10 billion.

Finally, for “contributory” workers, the minimum amount for eligibility for ordinary old age pension decreases and the minimum amount for eligibility for early retirement increases. These two measures once again confirm a paradigm shift because, on the one hand, they allow workers who turn 67 with a very weak pension position, difficult to improve through further professional activities, to have access to incomes that, while still low, can relieve their needs and, on the other hand, require younger individuals to make an effort to independently strengthen the adequacy of their pensions, thus reducing the burden on public finances and avoid draining resources from welfare institutions, especially those with redistributive purposes intended for individuals who live under precarious economic conditions and have no chances to improve them.

Problems related to low and discontinuous pension contributions of the younger generations persist and, unless things change, they will receive low pensions too. The complexity and scale of the issue suggest that the debate should go beyond the simple changes in the rules and parameters of the pension system, thus embracing broader issues of the labour market, the strengthening of other welfare institutions intended for younger generations, taxation and growth, with inclusive openness for the young. Solutions designed to guarantee safety nets in old age (thirty, forty years from now), besides remaining constantly exposed to the risk of a lack of future financial coverage, overlook the main priority: ensuring the generation of fair work income to plan and build individuals and households’ life. The consolidation of the system, which inspires the Budget Bill’s pension measures, should hopefully be a piece of a long-term agenda to achieve this goal.

Healthcare

The interventions intended for the healthcare sector appear to confirm a return to the settings before the health emergency, when the NHS faced strong pressures despite showing a relatively limited expenditure both in per capita terms and in relation to GDP and good health indicators. The current legislation framework, which shows a reduction in the allocation of resources to public healthcare in the medium term, is supplemented with some funding aimed at approximately restoring the previous policies and addressing the most immediate emergencies. Therefore, the NHS does not yet appear to benefit from a structural strengthening that seemed to have become a shared objective during the health emergency. The Budget Bill provides for an increase in the standard national health requirement of EUR 3 billion in 2024, 4 billion in 2025 and 4.2 billion in 2026 as well as the implementation of several measures. The available information suggests a cautious allocation for 2025 and 2026, while for 2024 a higher expenditure exceeding the increase in funding cannot be ruled out. Moreover, the revision of the pharmaceutical expenditure ceilings, to which the Technical Report does not attribute any budgetary effects, might also drain NHS resources amounting to about EUR 100 million.

By adding the higher financing ensured by the Budget Bill to the trend amounts reported in the NADEF, we understand that the current healthcare expenditure-to-GDP ratio in 2024 is projected to bounce back to 2019 levels, the year before the pandemic, when it stood at 6.4 per cent. In 2026, this share drops by a tenth of a percentage point, partly because the contractual renewals for the three-year period 2025-27 are not yet financed.

In 2024, the expenditure increases mainly concern: the increases relating to the three-year bargaining period ending next year; the economic incentive for the provision of additional services by staff; the increase in resources for acquiring private services, through the changes in the expenditure ceilings and budgets provided for individual purchase items and the revision of the remuneration system for pharmacies.

For the 2025-26 two-year period, resources increase mainly to strengthen personnel in non-hospital care (as an exception to the expenditure ceiling, which is not revised), to update the Essential Service Levels (ESLs), to pursue the priority objectives of the National Health Plan, and to take account for the higher impact of other measures adopted as early as 2024. The strengthening of personnel is therefore only expected as from 2025, and fewer resources will be allocated to this aim compared to those earmarked to acquire services from the accredited private sector.

Some factors may trigger deficits in the budgets of the Regional Health Services (RHS) in 2024. In addition to the discrepancies between the increased funding allocated by the Budget Bill and the measures included therein, the latter are likely to imply a greater financial strain than the estimates of the Technical Report with regard to the pharmaceutical expenditure ceilings. Secondly, thanks to the approval of the rates for outpatient specialist services and prosthetic assistance, the new ESLs introduced in 2017 will become chargeable in the coming years. Thirdly, the dispute with the companies supplying medical devices to the NHS on the reimbursements claimed from them, amounting to half of the overrun of the expenditure ceiling imposed by law (the so-called pay-back), remains outstanding. In the 2025-26 two-year period, the contracts for the 2025-27 three-year period will have to be financed with new resources. Further issues throughout the policy period may be related to shortages of healthcare personnel. Finally, uncertainty about a new upswing in energy commodity prices and their possible impact on the health sector must not be underestimated. An international comparison using OECD data for Italy, France, Germany, Spain and the United Kingdom shows that healthcare spending, at purchasing power parity, increased in 2020 and 2021 both in current and constant prices, driven by the health emergency, while in 2022, against further growth in nominal terms in all countries except the United Kingdom, a reduction in real terms was reported everywhere, with the exception of Spain. This reduction is particularly marked in the United Kingdom (-6 per cent), which recorded the largest increase in the previous two years (+19 per cent), and in Italy (-4 per cent), where, on the contrary, the smallest increase had occurred (+6 per cent).

If the evolution of the purchasing power of healthcare spending in Italy in the current year and in the three-year policy period were to be calculated, we would observe negative variations in 2023, in 2024 and in 2026. However, given the limitation of this exercise when applied to health expenditure, it seems more relevant to resort to an in-depth analysis of the individual expenditure items. Such an analysis would reveal that the recent inflationary surge has affected healthcare spending mainly through increased costs for some specific goods and services. This has been addressed through specifically allocated resources, although the coverage of the higher cost in 2022 over 2021 was heterogenous across different regions (the allocation criterion have since been modified).

However, the control maintained over other expenditure items implied distress for personnel (loss of purchasing power) and pressure for increases in turnover from industry and suppliers. There may also have been some effect on the quantities of health goods and services that the NHS was able to purchase in order to deliver them to citizens. The additional resources allocated to the NHS by the Budget Bill for 2024 only partially cover the salaries from the price increase and provide some response to the demands of the private sector, acting mainly on turnover (except for pharmacies) and thus trying to favour the expansion of services.

Household-friendly measures: disability and nursery school bonus

The Budget Bill provides for the Single Fund for the Inclusion of Persons with Disabilities to replace four separate pre-existing funds on the matter. The establishment of the new Fund represents a first step towards overcoming the pronounced fragmentation of interventions on the matter that has characterised policies in recent years. However, the total endowment of the new Fund is lower than the total value of the resources available in the funds repealed.

Nevertheless, the institutional framework for disability, as well as for other social issues, remains extremely complex and heterogenous and relies on multiple additional sources of funding. Firstly, the Fund for Policies in Favour of Persons with Disabilities is expected to remain separate from the Single Fund. This Fund is earmarked for measures to implement the enabling law on disability but, due to its non-implementation, in 2022 and 2023 the resources were used for other needs of the State budget (to remunerate the overtime work of prison police personnel during the pandemic period and the purchase of anti-Covid medications and vaccines; to provide support to the Third Sector entities in the face of rising energy bills; to support building bonus benefits). A swift implementation of the enabling law on disability is desirable, also to prevent resources earmarked for disability from being diverted to finance other initiatives in the future. Secondly, disability measures are intertwined with other categories of social interventions financed through separate funds. Finally, the local government is involved at different levels to manage services and invest own resources. Such a context hinders an organic management of social policies and amplifies the difficulties in implementing the ESLs.

With regard to children born after 1 January 2024, the Budget Bill raises the contribution for the payment of nursery school fees (nursery school bonus) to EUR 3,600 for households with an ISEE indicator up to EUR 40,000 in which there is at least one child under ten years of age. For these categories of households, the increase in the bonus eliminates the previous differentiation of benefits between the first and second ISEE brackets. In particular, the bonus per child increases by EUR 600 for households with an ISEE up to EUR 25,000 and by EUR 1,100 in the case of ISEE between EUR 25,000 and EUR 40,000.

Likewise, the Budget Bill provides for an increase in the spending ceiling for the measure. In this regard, it is worth reminding that since 2017, when the bonus was introduced, this measure has become increasingly frequent; however, the overall amounts disbursed have remained below those allocated. The Technical Report proposes a conservative estimate and justifies the new allocations both based upon the assumption of a significant increase in the number of beneficiaries under current legislation and upon the higher outlay caused by the increase in the bonus. However, the quantification of the number of beneficiaries appears to be not fully consistent when compared with other information sources and such as to assume a significant expansion of the supply before the implementation of the measures under the NRRP, even taking into account the possibility of overlaps in the use of the same nursery school membership due to drop-outs and consequent new entries. However, signs of a sluggish expansion of the supply in the short term emerge from the data on the reporting of the use of the funds allocated for 2022 in the Municipal Solidarity Fund for the purpose of expanding the nursery school service in the municipalities of Ordinary Statute Regions (OSR) and in those of Sicily and Sardinia.

According to the explanatory report on the measure, the increase in the bonus would allow fully covering the fees borne by all the households concerned, but given the different rates at municipal level, this circumstance seems implausible. Full coverage would be even less plausible with regard to private institutes, as they generally have higher fees than public ones.

Local finance

The main measures of the Budget Bill concerning local finance include the contribution to public finance by local authorities in OSR and Islands, amounting to EUR 600 million per year in the 2024-28 five-year period and the implementation of the Constitutional Court’s ruling No. 71/2023 with reference to municipal funds bound to service objectives for social benefits.

With regard to the contribution to public finance – which adds up to the cut provided for local entities by the Budget Law for 2021 for the 2023-25 three-year period – the main concern is represented by its introduction before the completion of the implementation of fiscal federalism for OSRs and before the full restoration of spaces for financial autonomy for Provinces and Metropolitan Cities, a process that began in 2022 with the introduction of equalisation funds. Even for municipalities, the spaces for financial autonomy appear limited, both because of the poor residual fiscal effort on the main taxes and because of the static nature of the bulk of municipal revenues determined by property revenues linked to cadastral income. To safeguard the fundamental functions and the ESLs, it is desirable for the cut borne by Provinces and Metropolitan Cities and by Municipalities to be distributed through the equalisation funds, so as to take due account of the standard requirements for their fundamental functions.

It is worth noting that further indirect, yet minor, effects arising from other interventions contained in the Budget Bill add up to the negative effects on the resources of local and regional authorities stemming from the cut: the revision of the IRPEF deductions for employees has a detrimental effect on the revenue from regional and municipal surtaxes; the exclusion up to a ceiling of EUR 50.000 of government bonds and postal savings from the asset component of the ISEE might lead to a reduction in extra-tax revenues of municipalities related to the provision of services and benefits of local and regional authorities, of the municipal Tari (garbage disposal tax) and of the regional tax for the right to education; the financing of the renewal of public employment contracts for employees of local authorities will have to be borne with the funds from the Authorities.

Ruling No. 71/2023 of the Constitutional Court establishes the Special Fund for Equal Service Levels through the reshaping of the Municipal Solidarity Fund and the introduction of a sanction – the placement of the Municipality under extraordinary administration – to be imposed on the Authorities that fail to ensure the funded social benefits. With reference to the Special Fund, the related financing is to be gradually re-introduced into the Municipal Solidarity Fund in the 2029-2031 period, at the end of the planned process outlined for overcoming local imbalances, to be then incorporated into the ordinary equalisation mechanism of the Fund. Without corrective measures, the transition from extraordinary to ordinary equalisation distribution criteria might lead to major redistributions of resources. With regard to the sanctions, the introduction of a sanction against authorities failing to implement the service/ESL objectives different from a mere restitution of the allocated resources represents an important step forward that could also benefit the implementation of the service/ESL objectives other than those involved in the financing bound to the Special Fund for Equal Service Levels and also to be borne by entities other than municipalities.

Preliminary data from SOSE on the reporting of service targets in 2022 suggest a potentially very high number of municipalities subject to sanctions, a circumstance that would urge quick corrections in terms of resource allocation and reporting procedures.