07 October 2024 | The Parliamentary Budget Office (PBO) has endorsed the macroeconomic forecasts of the 2025-29 Medium-Term Fiscal Structural Plan (MTFSP). The positive outcome was announced by PBO President Prof. Lilia Cavallari, who spoke today before the Joint Budget Committees of the Chamber of Deputies and the Senate on the contents of the MTFSP.

President Cavallari outlined the reasons that led to a positive outcome of the endorsement of both the trend macroeconomic scenario (Quadro Macroeconomico Tendenziale, QMT) and the policy macroeconomic scenario (Quadro Macroeconomico Programmatico, QMP) of the MTFSP, the strategy outlined by the MTFSP and the developments in the main public finance aggregates. Below are the main contents of the hearing.

The MTFSP in the context of the new EU fiscal framework scenario. – On 30 April, the EU’s new economic governance came into force. The legislation provides for economic and budgetary planning to be carried out through the preparation by the Member States of Medium-Term Fiscal Structural Plans. The Plans replace the Stability Programmes and the National Reform Programmes, spanning over four or five years depending on the duration of the national legislature. For Italy, the MTFSP contains a five-year horizon covering the period from 2025 to 2029.

The MTFSP must define a policy path of net primary expenditure financed from national resources (“net expenditure”) to be approved by the Council of the EU on a recommendation of the European Commission. For Member States with a public debt in excess of 60 per cent of GDP or a deficit in excess of 3 per cent of GDP, the net expenditure path will have to ensure that, at the end of the consolidation period – which can last four years, or seven years if accompanied by binding reforms and investments – the public debt in relation to GDP is on a plausibly declining path and the deficit remains below 3 per cent of GDP in the medium term. The budgetary adjustment must also ensure compliance with common numerical debt and deficit safeguards, as well as with the correction of the excessive deficit for countries, such as Italy, in excessive deficit procedure. Net expenditure is the relevant indicator for monitoring compliance with the adjustment path.

In the MTFSP, the Government announced its intention to request that the budget consolidation period be seven years, thus making the adjustment under the new rules more gradual. In the MTFSP, the Government pledges to implement the adjustment for the next five years as envisaged by the new EU governance. For the purpose of drawing up the Plans, on 21 June the European Commission sent countries that did not meet the thresholds defined in the European Treaties a “reference trajectory” for net expenditure. Subsequently, Italy conducted a technical dialogue with the Commission in order to ensure the conformity of the Plan with the new criteria of the SGP.

To justify the call for a more gradual budgetary adjustment, the Government outlined in the MTFSP the reform and investment measures it intends to take. The areas to be reformed chosen by the Government are justice, public administration (new competences and expenditure planning), tax system and business environment.

The European Commission will now have to assess whether the Plans, in particular the net expenditure paths, comply with the requirements of the new European regulation. If the assessment is positive, the Plans will be adopted by the Council; for Italy, the Plan will be binding for five years. To monitor the implementation of the net expenditure path and reform and investment commitments, Member States will have to submit an Annual Progress Report by 30 April.

Global economy and projections on MTFSP exogenous variables. – The prolonged war in Ukraine and the extension of conflicts in the Middle East make the international environment extremely unstable and uncertain. The fights also involve countries that play a key role in oil extraction, therefore, depending on the military scenarios, there could be significant fluctuations in the prices of energy commodity markets. However, global inflation is decreasing and the monetary authorities have been reversing the monetary policy stance with the first cuts in official interest rates. The assumptions on the exogenous variables of the MTFSP and the differences from the expectations of the Economic and Financial Document (Documento di economia e finanza, DEF) 2024 appear consistent with market developments and the most recent expectations of international institutions. However, uncertainty and risks have increased due to the extent of ongoing conflicts and the prospects of trade restrictions.

Italian economy and revisions of national accounts data. – In 2023 Italy’s GDP slowed to 0.7 per cent, a rate in line with the pre-pandemic dynamics. On 4 October, ISTAT released the quarterly accounts consistent with the new annual accounts; in the first half of 2024, Italian GDP growth remained moderate (0.3 and 0.2 per cent in Q1 and Q2, respectively), but the change for the year was down due to revisions to 2023. The carryover growth for 2024 is now estimated by ISTAT at 0.4 per cent from the 0.6 indicated on 2 September; the revision is solely due to different economic dynamics over the past year. Since the quarterly accounts are adjusted for working days and the annual accounts do not take the same correction into account due to the calendar, GDP growth in 2024 should be higher than the quarterly series by a couple of tenths of a percentage point. By contrast, the carryover in nominal GDP for 2024 was marginally improved with the new accounts, by virtue of an upward revision on the dynamics of the GDP deflator that more than offset the filing on the real GDP component. Recent employment dynamics have also been improved in the latest quarterly ISTAT data.

Endorsement of trend macroeconomic forecasts. – On 9 September, the PBO endorsed the trend macroeconomic forecasts prepared by the Ministry of Economy and Finance (Ministero dell’Economia e delle finanze, MEF) prior to the revision of the national accounts data, published by ISTAT on 23 September. The endorsement followed the PBO’s communication of comments on an initial provisional version of the MEF forecast, which was followed by the preparation of a trend macroeconomic framework (Quadro Macroeconomico Tendenziale, QMT) incorporating the PBO’s requests. The MEF subsequently updated the QMT to take into account the new historical data, which the PBO reviewed and re-endorsed.

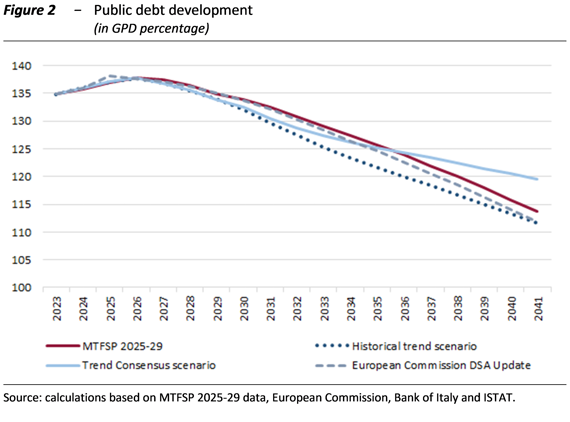

Policy macroeconomic forecasts endorsement exercise. – The manoeuvre does not affect the 2024 so that the policy forecast differs from the 2025-29 period trend forecast, the period on which the endorsement of the policy macroeconomic scenario (Quadro Macroeconomico Programmatico, QMP) focuses. The PBO Council endorsed the MTFSP QMP on the basis of the following findings: a) the change rate in GDP (Figure 1) does not exceed the upper end of the PBO panel’s forecast, is slightly higher than the PBO’s estimate in the 2025-26 two-year period, but still aligns with the panel median and the PBO’s expectations in the following three-year period; b) the change in nominal GDP, the variable that most directly affects public finance developments, is in several years close to that of the PBO and on average over the period is in line with the panel median; c) the QMP end-of-period real output level does not exceed the highest panel level and exceeds the PBO level to an acceptable extent; d) the impact of the public finance manoeuvre on GDP growth is similar to that foreseen by the PBO and overall does not exceed that estimated by three panel members.

Quarterly accounts revisions and macroeconomic forecasts endorsement. – After the MEF published the MTFSP, ISTAT released new quarterly national accounts data, so this information was not considered in the PBO endorsement exercise. With the new data, the forecast for real GDP growth of 2024 is subject to downside risks by a couple of tenths of a percentage point, while the estimate for nominal GDP remains fully valid. The repercussions on public finance estimates could be negligible, as public accounts are monitored in October and the changes in the national accounts are modest and of the opposite sign (real GDP worsens, but nominal GDP is confirmed and employment improves). However, there is no impact on the statistical drag of the forecasts for the coming years.

Macroeconomic risk factors of the forecasts. – The macroeconomic scenario of the Italian economy is exposed to various risks, mainly stemming from international factors or the evolution of economic and monetary policies. Also taking into account the latest publication of quarterly national accounts data, the risks now appear to be tilted to the downside in both the short and medium term.

Geopolitical tensions and world trade’s fragility. – The geopolitical situation has deteriorated rapidly in recent days due to the extension of the actors involved in the fights in the Middle East. The ongoing wars affect international trade and commodity prices, and the repercussions could quickly escalate over the forecast horizon. World trade projections are crucial, as the projected strengthening is not expected to be uniform, either geographically or sectorally. In Europe, the stalemate of the German economy persists, and the trade barriers and fragmentation already in place may increase.

Investment dynamics and the NRRP. – Investment is the most uncertain variable in the macroeconomic scenario. In the medium term, some critical issues may emerge from the development of projects financed by the NGEU programme, especially considering the concentration of interventions in the next two years, which may cause supply bottlenecks. The start of the European Central Bank’s lowering of official interest rates may provide a positive impulse for growth, but the exact timing of the next reductions and the transmission of the effects depend on many factors. Quantifying the impact is therefore difficult, also because of the high levels already achieved by capital accumulation in recent years in Italy.

Market risk aversion and monetary policies. – Equity prices remain high, while risk premiums on bonds have decreased compared to the autumn despite the volatility observed in recent months. Risk aversion on the part of market participants is relatively low, but could change rapidly; the upcoming actions of central banks, potential changes in global economic policies, also as a result of the various election deadlines this year, as well as the evolution of ongoing conflicts will be decisive.

Climate and environmental risks. – Environmental risks remain significant, particularly those related to adverse weather conditions. In addition to affecting food and energy prices, extreme weather events can damage the productive capacity of various economic activities, from agriculture to tourism. Moreover, the increased frequency of extreme events induces both Governments and private operators to increase resource allocations to manage emergencies, reducing the room for expansionary measures.

Public finance trend scenario. – Compared to 2024 Economic and financial document (DEF), the 2025-29 MTFSP revises the deficit downwards in each year of the 2024-27 period by an average of 0.7 per cent of GDP. The updated forecasts show a trend net borrowing of General Government of 3.8 per cent of GDP in 2024 to 2.9 in 2025, 2.1 in 2026 and 1.5 in 2027. The trend deficit drops below 3 per cent of GDP as early as next year, one year earlier than projected in the DEF. For the first time since 2019, a return to a primary surplus is planned during this year, again one year ahead of the DEF. The primary surplus is estimated just positive in 2024, at 1 per cent of GDP next year, rising to 1.8 in 2026 and to 2.5 in 2027.

In addition to the effects of the revision made by ISTAT to the final figures of the national accounts, the Plan’s forecasts are essentially affected by the results of the in-year monitoring of public accounts, the financial effects of the reshaping of expenditure related to the NRRP, and the relatively favourable trend in interest rates resulting from the easing of monetary tightening. The monitoring showed an improvement in revenue compared to expectations, especially for direct taxes. The carry-over to subsequent years of what emerged for the current year – assuming that the increase in 2024 is structural in nature – explains much of the improvement in the trend deficit compared to last April’s DEF. The forward reshaping of NRRP expenditure may be partly a consequence of the status of implementation monitored in 2024: analysis of the differences in trend forecasts compared to those of the DEF reveals changes in the time profile and revisions in the composition by economic items suggesting a shift of resources financed by EU grants in favour of current expenditure. With regard to the update of interest expenditure, compared to what was planned last April, an increasing-over-time reduction in the years from 2025 is estimated, resulting in a lower total outlay in the three-year period 2025-27 for more than 13 billion.

There is a lack of information in the public finance trend scenario of the MTFSP, which could have absorbed more of the standard contents of the Update to the Economic and Financial Document (NADEF), as called for in the Parliament’s Concluding Document on the new European governance survey. In particular, there is a lack of information on the unchanged policy scenario and on the reshaping of the time profile of the NRRP implementation.

It is desirable that the future changes to national public finance legislation will consider the need to preserve the completeness of the information to be provided to Parliament and the public on the frameworks and contents of economic and budgetary planning.

Public finance policy scenario. – The MTFSP’s deficit-to-GDP targets are 3.3 per cent in 2025, 2.8 in 2026 and 2.6 in 2027, lower than the 2024 DEF trend forecast in 2025-26, while in 2027 the current target is higher than last April’s forecast. The reduction of the policy deficit relative to GDP continues in 2028 and 2029, when it is expected to stand at 2.3 and 1.8 per cent, respectively. Although it entails a widening of net borrowing relative to the unchanged legislation scenario, the Plan confirms the objective of bringing the deficit down below 3 per cent in 2026 thereby setting the conditions for exiting the excessive deficit procedure of the Stability and Growth Pact in 2027. The dynamics of the debt-to-GDP ratio over the 2025-27 three-year period is not significantly different from that projected in the 2024 DEF.

The policy path of net expenditure envisages a growth of 1.3 per cent in 2025, which increases in the following two years to 1.9 per cent in 2027 and decreases again in the final two years of the programme to 1.5 per cent in 2029. This path is in line with the trajectory of net expenditure sent by the European Commission. It implies a challenging and protracted budgetary adjustment that would ensure a plausible reduction in debt to GDP over the medium term, while preserving public investment. In 2025-26, the consolidation effort will be mitigated by investments financed by EU grants linked to the NRRP (in addition to the usual cohesion funds), which do not impact the General Government deficit or the net expenditure indicator. From 2027 on, the reforms and investments envisaged in the Plan, especially those useful for extending the adjustment period, are expected to make a significant contribution to growth.

The commitment to lower the debt-to-GDP ratio is reinforced by the anticipation of the adjustment and may help reduce the spread on Italian Government bond interest rates. The alignment to the spread on Spanish sovereign bonds would result in debt burden savings of more than EUR 23 billion for the 2025-29 period.

The implementation of the Plan is subject to certain elements of uncertainty. First, the Plan assumes the full implementation of the NRRP and the continuation of the commitment to reform and investment throughout the entire policy horizon. There are also risks of a general and systemic nature arising from demographic transition, impact of climate change and energy transition, and geopolitical uncertainty.

The MTFSP provides only general information on the measures of the manoeuvre and in particular on the financing measures; for more details waiting for the mid-October Draft Budgetary Plan is needed.

Medium-term budgetary planning would require highlighting the strategy to achieve the consolidation objectives with more detailed indications on the expected dynamics of the main expenditure programmes and revenue sources and the link with the implementation of investments and reforms. This would further strengthen the credibility of the recovery effort.

Impact of MTFSP reforms: focus on General Government efficiency. – The budgetary adjustment period can be extended from 4 to 7 years, if accompanied by investments and structural reforms to foster growth and debt sustainability. The Plan outlined reforms in five “action areas”: 1) justice; 2) implementation of tax reform, promotion of voluntary compliance at reduced costs and combating evasion; 3) improvement of the business environment; 4) merit and new skills in General Government; 5) improvement of the planning and governance of public expenditure. However, the commitments in terms of targets, timeframes and indicators to be achieved required by the European Commission’s guidelines on the content of MTFSP are not specified.

In order to illustrate the growth effect of the reform programme contained in the Plan, a simulation of the macroeconomic impact of one of the reform areas that should allow the adjustment period to be extended, namely General Government efficiency, was conducted. According to these simulations, the Plan’s total reforms concerning the General Government (some of which have already been implemented because they are included in the NRRP) impact on GDP would be 1.4 percentage points by 2031, while in the long run (2050) their impact would reach 1.9 percentage points.

Policy debt evolution and impact of Eurosystem programmes on the Italian government bond market. – After declining in 2021-23, the debt-to-GDP ratio in the Plan’s policy scenario is expected to rise by a total of 3.1 percentage points in 2026, and then decline at an increasing pace from 2027 to 2029, when it would stand at 134.9 per cent, close to the end of 2023 value and just above the pre-pandemic level of 2019. The debt dynamic until 2026 is significantly affected, through their impact on the stock-flows adjustment, by considerable tax offsets related to the tax incentives for the construction sector in recent years. On the contrary, the reduction of the Treasury’s cash holdings and the continuation of the privatisation plan should contribute favourably to debt dynamics.

Gross issues of Government bonds net of Eurosystem programmes in 2024 can be estimated at EUR 483 billion, which is EUR 35 billion higher than in 2023. Gross issues of Government bonds are estimated at EUR 505 billion, up from 2023. This is due both to the increase in the Government sector’s borrowing requirements, albeit better than the DEF 2024 expectations, and to a higher amount of bonds to be redeemed in the year. The portfolio of securities held by the Eurosystem for monetary policy purposes continues to shrink. In the first seven months of 2024, the amount of Italian Government bonds held by the Eurosystem fell by about EUR 25 billion compared to the end of 2023. In the first half of the year, Eurosystem reinvested the entire repaid capital on maturing securities under the Pandemic Emergency Purchase Programme; in the second half of the year, reinvestment will be partial.

In 2024, the net flows of bonds that private investors should absorb, equal to the net issue of Government bonds net of Eurosystem programmes on the secondary market, are estimated to increase up to approximately 135 billion. In the first half of the year, there was an increase in the share of Government bonds held by households and companies and by foreign investors; in June of this year, these shares were 15 and 29 per cent, respectively.

Sensitivity of the debt-to-GDP ratio. – A sensitivity analysis of the MTFSP debt-to-GDP ratio with respect to several macroeconomic assumptions was conducted. Using the PBO’s forecasts for GDP growth rate, GDP deflators and consumption for the 2024-29 period, the debt-to-GDP profile would, in the 2024-26 three-year period, be similar to that projected in the MTFSP while in the remaining years it would be lower. At the end of the planning period in 2029, the debt-to-GDP ratio in the PBO scenario would reach a value of 133.9 per cent, one percentage point of GDP below the Government’s policy forecast.

In addition, a sensitivity analysis of debt-to-GDP dynamics was conducted with respect to interest rates on sovereign bonds. In the MTFSP, the Government used a new assumption regarding the rate structure underlying the forecast of interest expenditure. In particular, the Italian yield curve was derived by adding, for each maturity, a spread to the forward curve of German rates. From a prudential perspective, it is important to assess what the debt-to-GDP evolution path might be if the assumption on the interest rate structure were similar to that adopted in previous policy documents, i.e. using the Italian forward rate curve derived in August. Under this assumption, the debt-to-GDP ratio of the PBO scenario would be higher, compared to the MTFSP forecast. In 2029 the debt would reach 136.5 per cent of GDP, more than one percentage point above the Government estimate.

Finally, by means of stochastic simulations on the macro-financial variables that influence the dynamics of the debt-to-GDP ratio, a probabilistic analysis was conducted that shows a high probability of an increase in the debt-to-GDP ratio in the first years of the Plan, while this probability decreases significantly from 2027. In the 2024-26 three-year period, the probability of the debt-to-GDP decline compared to previous year is modest (around 40 per cent in 2024 and 17 per cent in 2025 and 2026), while from 2027 the probability of the debt-to-GDP decline increases significantly and would be around 80 to 90 per cent.

Excessive deficit procedure against Italy. – After the deactivation of the general safeguard clause at the end of 2023, last June the European Commission proposed the opening of the excessive deficit procedure based on reports under article 126.3 of the Treaty on the Functioning of the EU (TFEU). The Commission’s assessment considered the new economic governance, where the deficit criterion remained unchanged compared to the past, while verification of compliance with the debt criterion was revised, basing it on compliance with the net expenditure path agreed with the Council. Since the Commission is unable to assess compliance with this criterion for this year, the decision on the existence of an excessive deficit was based solely on the deficit criterion.

The European Commission assessed that Italy did not meet the deficit criterion (the same assessment applied to Belgium, France, Malta, Poland, Slovakia and Hungary). Following the Commission’s recommendations, on 26 July the Council of the EU adopted the decision establishing the existence of an excessive deficit for Italy, as well as Belgium, France, Hungary, Malta, Poland and Slovakia. In order to ensure consistency between the correction obligations under the EDP and the adjustment path to be endorsed in the MTFSP, the Council will decide on the necessary corrective actions for deficit reduction after the autumn package of the European semester.

European Commission’s reference trajectory and policy path of MTFSP net expenditure. – The new EU economic governance stipulates that, prior to the submission of MTFSPs, the European Commission should provide countries with debt exceeding 60 per cent of GDP or with deficits exceeding the 3 per cent of GDP threshold with “reference trajectories” of net expenditure. The Commission’s reference trajectory is derived from adjustments in the structural primary balance, over a four- to seven-year horizon, that ensure a “plausible” reduction (even under adverse scenarios) in public debt as a share of GDP in the ten years following the end of these adjustments, in the absence of further measures and taking into account the additional costs of demographic ageing. The reference trajectory also ensures that the public deficit in relation to GDP is below 3 per cent of GDP in the same decade. The reference trajectories are also prepared in such a way as to ex ante respect the numerical “safeguards” common to all EU countries, i.e. the “debt sustainability safeguard” and the “deficit resilience safeguard”, and to be consistent with the correction path provisions in the event of an EDP.

Over the 2025-31 seven-year period, the minimum required adjustment of the structural primary balance underlying the reference trajectory for Italy is 0.62 percentage points on average. Despite the required budgetary adjustment of 0.6 percentage points per year over the 2025-27 three-year period, the net borrowing (4.4 per cent of GDP in 2024) would remain broadly stable due to the increase in interest expenditure and the unfavourable effect of fiscal consolidation on economic growth. From 2028 to 2031 the net borrowing would begin to decline gradually and, despite the projected increase in interest expenditure, would reach 3 per cent of GDP in 2030 and 2.6 per cent in 2031 at the end of the adjustment period.

The reference trajectory of net expenditure indicates that the upper limit of the growth rates of this indicator should average 1.5 per cent over the 2025-2031 period. The cap on net expenditure growth is 1.6 per cent in 2025 and 2026, 1.5 per cent in 2027, 1.4 per cent in 2028, 1.3 per cent in 2029-2030 and 1.4 per cent in 2031.

The MTFSP’s planned adjustment of the structural primary balance averages 0.53 percentage points over the 2025-2031 period, almost 0.1 percentage points lower than the European Commission’s reference trajectory; however, the starting budgetary position of 2024 is better in the MTFSP than the Commission’s spring forecast. At the end of the adjustment period, i.e. in 2031, the structural primary balance indicated by the MTFSP is thus very similar to that estimated by the Commission (3.2 per cent in the Plan and 3.3 in the reference trajectory). In the MTFSP, 2025 and 2026 are characterised by more ambitious adjustments than in subsequent years due to the Government’s objective to bring the deficit below 3 per cent of GDP in 2026 so as to exit the EDP as early as 2027. This actually allows for less adjustment in subsequent years (the so-called “frontloading”).

The net expenditure growth planned in the MTFSP averages 1.5 per cent, in line with the European Commission’s reference trajectory, but the annual profile presented by the Government is different. Given the target of bringing net borrowing within the 3 per cent of GDP threshold in 2026, the Government’s planned net expenditure growth rate is lower than the Commission’s target for 2025. In 2026 the two rates coincide at 1.6 per cent. From 2027, the Government’s growth rates are higher on average by about 0.3 percentage points up to 2029.

The budgetary adjustment path outlined in the MTFSP respects the debt and deficit numerical safeguards of the new regulation on the preventive arm. In the Plan, debt reduction averages one per cent of GDP over the 2027-2031 period, thus respecting the debt numerical safeguard. The new regulation of the preventive arm also provides for a resilience safeguard on the deficit, which is respected by the MTFSP’s budgetary planning, as the annual adjustment of the planned structural primary balance is always more ambitious than 0.25 percentage points, i.e. the minimum structural adjustment required of countries with a structural deficit of more than 1.5 per cent and in the case of a seven-year adjustment path.

The planning of public investments financed from national resources fulfils the numerical criterion for the extension of the adjustment period under the new European framework. MTFSP indicates that between 2027 and 2029 public investments financed from national resources will average 3.3 per cent of GDP, which is higher than the average of domestically financed public investment during the NRRP period estimated at 2.9 per cent of GDP.

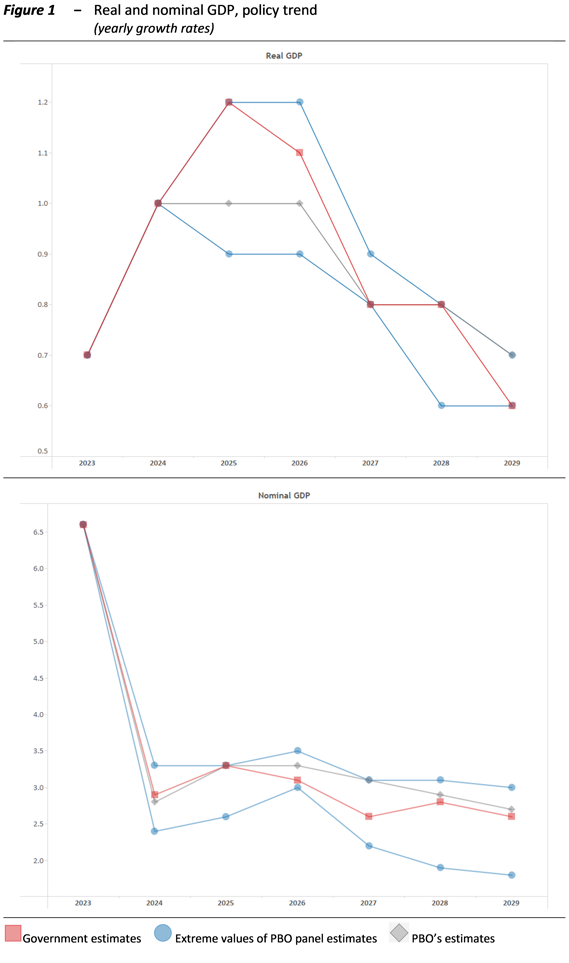

Medium-term debt-to-GDP projections in the context of Stability and Growth Pact rules. – In order to assess whether the structural adjustment of the MTFSP is sufficient to ensure compliance with the requirements of the new SGP scenario also using alternative macro-financial assumptions: two medium-term scenarios using the DSA framework developed by the PBO and a third scenario in which the DSA simulation exercise underlying the European Commission’s reference trajectory is updated with more recent actual data and forecasts. The two medium-term scenarios developed with the PBO’s DSA framework include alternative assumptions concerning, in particular, potential GDP growth evolving according to a trend dynamic. In the third scenario updating the Commission’s DSA, potential GDP growth is derived from the PBO based on the common production function methodology used at the European level underlying the determination of reference trajectories.

The analysis shows that, in line with the MTFSP ’s medium-term projections, in all scenarios considered the debt-to-GDP ratio would show an increasing trend in the first years of the forecast horizon and a gradually more pronounced decline in the following years (Figure 2). The debt-to-GDP ratio would decrease in the years 2031-2041 consistent with the provisions of the SGP that require debt to be on a continuously decreasing path in the ten years following the end of the budgetary consolidation period. Like the MTFSP’s projections, in the scenarios using the PBO’s DSA framework the deficit is projected to fall below the 3 per cent of GDP threshold from 2026, allowing Italy to exit the EDP as early as in 2027. In contrast, in the DSA update scenario, which assumes, consistent with the European Commission’s reference trajectory methodology, a more significant feedback effect of the budgetary adjustment on GDP levels, net borrowing would fall below 3 per cent of GDP in 2029. In line with the SGP provisions, in all scenarios considered net borrowing would remain below the 3 per cent of GDP threshold in the absence of further budgetary intervention after 2031.