1st March 2023 | The Chair of the Parliamentary Budget Office, Lilia Cavallari, spoke today at a hearing before the Budget Committees of the Chamber of Deputies and the Senate as part of the examination of the Communication published on 9 November by the European Commission on “Orientations for a reform of the EU economic governance framework”.

According to Cavallari, the Stability and Growth Pact reform proposals put forward by the Commission contain overall a number of positive elements. In particular, an important new aspect of the proposal by the European Commission concerns the participation of Member States in defining their own budgetary adjustment path, as called for by the PBO in last year’s hearing on the reform of EU economic governance.

In addition, the departure from rigid numerical rules applying to all countries and the increased focus on the “plausible” decline of debt as a ratio of GDP over the medium term, taking into account the characteristics of each country, is particularly welcome.

With regard to budgetary procedures, the approach proposed by the Commission should favour multiannual public finance planning, as often called for by the PBO and the Network of Independent Fiscal Institutions of the EU.

Another positive aspect is the proposal to also consider the costs associated with the ageing of the population when defining the necessary budgetary adjustments. This is one of the phenomena that will have the greatest impact on public finances in the coming years, although estimates of these costs are uncertain mainly due to the volatility of demographic scenarios.

The decision to focus on a single annual policy target, the indicator of net primary expenditure financed from national resources, also has some advantages, especially since fiscal policy will no longer be based on several indicators that often provide conflicting signals. Another advantage is that the indicator is not affected by unexpected and temporary increases or decreases in revenue. However, the indicator will be calculated net of the cyclical component of unemployment expenditure, which varies considerably across countries, favouring (in the event of an unfavourable cycle) those countries where social safety nets are particularly well developed. In the case of Italy, the possibility of including in cyclical expenditure also those items that are currently not considered as directly related to unemployment expenditure (as, for example, was the case for the citizenship income) should therefore be considered.

The fact that the national fiscal structural plan will include commitments not only on the public finance side, but also on the reform and investment side, will provide an incentive for more investment. Reforms and investments can strengthen debt sustainability due to their impact on economic growth. It is likely and desirable, therefore, that the “budget space” created by the extension of the adjustment path will be fully used to increase public investment. In addition, it is desirable that the favourable impact of reforms and investment be taken into account in the GDP growth projections used in the sustainability analysis to determine the required fiscal adjustment path.

Two other aspects mentioned in the Communication, however, would require clarification: 1) the flexibility provided for in the event, for example, that the cycle turns out to be significantly better or worse than initially expected; 2) the possibility for Member States to change the adjustment plan if a new Parliament is elected.

Although the Communication only briefly mentions it, in order to achieve a more effective economic governance in the euro area, it remains a priority to make progress towards building a euro-area budgetary capacity, an instrument to be used to finance investments related to the strengthening of European public assets (e.g. ecological and energy transition) and to conduct policies to stabilise the economic cycle for the euro area as a whole.

Public finance: possible scenarios under the rules proposed by the European Commission

Building on the projections made on the occasion of the hearing on the Update of the 2022 Economic and Financial Document, and assuming that the national fiscal-structural plans are implemented from 2025 onwards, the PBO has developed a number of scenarios for the medium-term evolution of the debt-to-GDP ratio and for the main public finance aggregates consistent with the orientations for the new framework proposed by the European Commission.

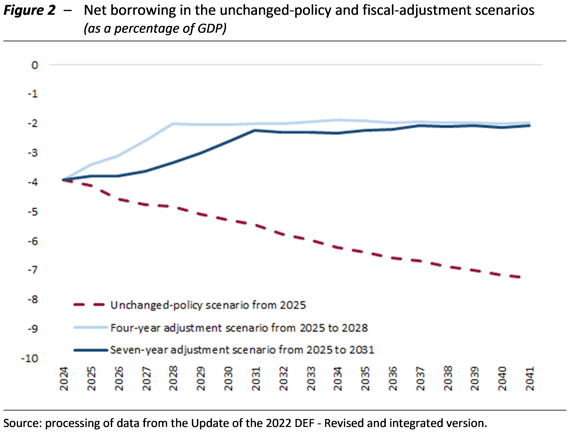

According to these projections, while in the unchanged-policy scenario (which assumes an unchanged structural primary balance after 2024 and the impact of age-related expenditure in the medium term) the debt-to-GDP ratio is expected to rise gradually (Figure 1), in fiscal-adjustment scenarios the ratio is expected to fall (see https://www.upbilancio.it/wp-content/uploads/2023/03/Tavole scenari illustrativi.xlsx for the values of the debt-to-GDP trajectories and its main components). An adjustment over four years would produce a more pronounced decline than an adjustment over seven years, mainly due to the faster reduction in the ratio of interest expenditure to GDP, bringing the debt-to-GDP level at the end of the projection period (2041) to around 115 percent in the first case and around 121 percent in the second.

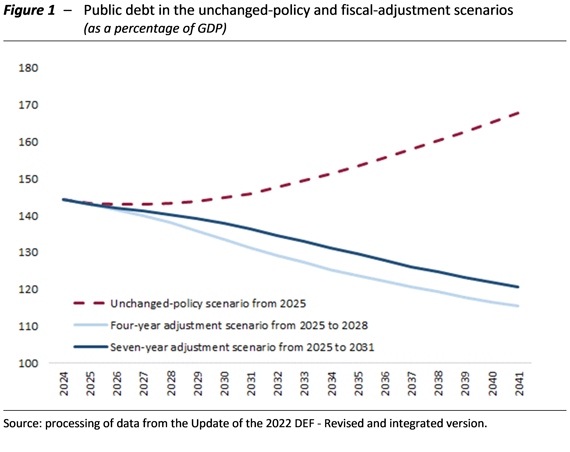

With regard to the overall deficit (Figure 2), it is projected to worsen significantly in the unchanged-policy scenario, from about 4 percent of GDP in 2024 to about 7.3 percent in 2041. On the contrary, in the four-year adjustment scenario, the value is projected to stay below 3 percent of GDP from 2027 and reach 2 percent in 2028, at the end of the consolidation plan. Thereafter, the deficit is expected to remain around 2 percent of GDP. Under the seven-year adjustment scenario, the deficit as a ratio of GDP is projected to reach 3 percent in 2029 and 2.2 percent at the end of the consolidation plan (2031), a level that remains broadly unchanged until 2041.

Lastly, in the seven-year adjustment scenario, the impact on GDP growth is expected to be less pronounced, although spread over a longer period of time, resulting in a minimum GDP growth rate of about 1 percent at the end of the adjustment period (2031); on the other hand, in the four-year adjustment scenario, the growth rate is expected to fall to about 0.7 percent at the end of the adjustment period (2028). In both scenarios, GDP growth in the medium term is assumed to be equal to that of potential output (1.1 percent).