8 October 2025 | The Parliamentary Budget Office (PBO) has validated the macroeconomic forecasts of the 2025 Public Finance Planning Document (PFPD). The positive outcome was announced by the President of the PBO, Professor Lilia Cavallari, who spoke today before the joint Budget Committees of the Senate and Chamber of Deputies.

The President explained the reasons that led to the positive outcome of the validation, both of the macroeconomic trend framework (QMT) and the programme framework (QMP) of the PFPD, the strategy outlined in the Government document and the dynamics of the main public finance aggregates. The most relevant contents of the report are summarised below.

The global economic situation and the international assumptions of the PFPD. Despite the protectionist policy of the United States, global economic growth in the first half of the year has been stronger than expected. The announcements on tariffs led many exporters to bring forward their sales to the United States in the winter period, but a slowdown was already observed in the second quarter; the trade war will have effects on both production and prices, which will unfold in the near future; protectionism may also trigger structural changes if trade barriers are maintained in the medium to long term.

Developments in the main international variables since the formulation of the Public Finance Document (PFD) in the spring have had mixed impacts on Italy’s economic activity: revisions relating to energy commodities and interest rates are slightly more favourable, while those relating to exchange rates and global trade are significantly worse off over the complete PFPD horizon. The global environment is highly unstable, meaning that exogenous variables could evolve in the coming years in ways that differ significantly from those assumed in the PFPD.

The Italian economic situation. − Last year, Italy’s GDP slowed down to 0.7 per cent, slightly below the euro area trend as in the pre-pandemic period. Istat’s estimate of GDP growth for 2023 was revised slightly upwards in September, but this was offset by a similar downward revision in last year’s release. Italy’s economic activity declined slightly in the spring (-0.1 per cent in seasonal terms), after accelerating in the first quarter; growth for 2025 stands at 0.5 per cent, according to quarterly accounts, which this year benefit from a small upward correction for the calendar, not taken into account in the annual data. The volatility of the economic cycle is reflected in foreign sales: the recovery in the average for the first three months of 2025 (2.2 per cent), as an anticipation of trade before the new tariffs came into force, was followed by a contraction in the spring (-1.9 per cent); according to the latest information, exports are likely to have fallen significantly again in the summer.

Validation of macroeconomic trend forecasts. − On 29 September, the PBO has validated the PFPD’s macroeconomic trend forecasts, which incorporate the annual national accounts data published by Istat on 22 September. The forecasts do not incorporate the new quarterly data, as these were released on 3 October; however, they remain valid as there have been no significant changes in the main macroeconomic aggregates. As usual, the validation of the PFPD’s trend scenario took place after the MEF had prepared a new forecast based on current legislation, which incorporated the requests made by the PBO.

The MEF’s trend forecasts were validated as the main macroeconomic variables are within an acceptable range compared to the PBO panel’s expectations, although in several cases they are at the upper limit. The forecasts assume the full and timely implementation of the PNRR projects and the MEF’s assumptions on the international context. However, the latter is very unstable and fragile, and the PBO notes that the outlook could change significantly over the PFPD horizon.

The trend in public finances. − Compared with the April estimates, the PFPD 2025 revises downwards the trend deficit for each year of the period 2025-27. The updated forecasts indicate a public deficit of 3 per cent of GDP in 2025, 2.7 per cent in 2026 and 2.4 per cent in 2027, down from the forecasts in last April’s PFD. In 2028, the deficit-to-GDP ratio is estimated to fall further, to 2.1 per cent. The primary surplus-to-GDP ratio would increase gradually from 0.5 per cent of GDP in 2024 to 2.2 per cent in 2028.

The deficit would therefore return to 3 per cent of GDP this year; if this is confirmed by the final figures and the balance remains below the threshold in the European Commission’s forecasts for subsequent years, the excessive deficit procedure under the Stability and Growth Pact could be closed one year earlier than initially planned.

The growth rate of the net expenditure indicator in the trend scenario is just above the target set in the Medium-Term Fiscal Structural Plan (MTFSP) for 2026, while it is lower in the two-year period 2027-28. This trend points to the need for a budgetary adjustment compared with the scenario under current legislation in 2026, while there would be room for expansionary policy in 2027-28.

The update of the final data of the general government account by Istat has led to minor changes, mainly affecting 2024. In the new national accounts estimates, the balance improves by almost €1 billion in 2023 and €1.6 billion in 2024, which is not visible in the value of net borrowing as a percentage of GDP to one decimal place, which for the two-year period 2023-24 remains unchanged at its previous values.

For 2025, the improvement in the deficit compared to the PFD stems from higher revenues emerging from monitoring during the year and lower expenditure, particularly for investment grants. The lower deficit in 2026 is attributable to higher non-tax revenues. The reduction in the deficit in 2027 compared to the PFD stems from a marked improvement in revenues, only partially offset by higher expenditure.

The yield curves on government bonds used in the PFPD for the forecast period are slightly more favourable than those estimated last April in the PFD. The update of the forecasts is therefore affected by interest expenditure that is slightly more favourable than the PFD forecasts, with a reduction in the average debt burden from 2025 of approximately 0.9 billion per year.

The timing of NRRP expenditure has been revised again, with a shift from the two-year period 2025-26 to subsequent years. It can be roughly estimated that the update of the expenditure schedules considered in the baseline scenario of the PFPD would result in lower overall expenditure in the period 2020-26 of 4.6 billion financed by grants and of 26 billion financed by loans.

It should be noted that the PFPD’s baseline scenario lacks some information, particularly with regard to the evolution of the net expenditure indicator and NRRP expenditure, which prevents a comprehensive assessment of the public finance framework.

The public finance policy framework. − According to the government’s indications, the budgetary stance for the three-year period 2026-28 will be geared towards continuing measures to promote economic growth, while ensuring compliance with the new EU fiscal rules. In accordance with EU legislation, the public finance policy framework realigns net expenditure growth with the commitments set out in the MTFSP approved by the EU Council.

In the policy scenario, after reaching the 3 per cent limit in 2025, the deficit-to-GDP ratio would continue to decline in the following years, laying the groundwork for an exit from the excessive deficit procedure in the spring of next year. The net debt-to-GDP targets for the three-year period 2026-28 remain identical to those in the baseline scenario of the PFD: 2.8 per cent in 2026, 2.6 per cent in 2027 and 2.3 per cent in 2028.

The net expenditure growth targets are consistent with the availability of fiscal space in terms of net borrowing in the three-year period 2026-28. The budget should therefore include net expansionary measures in terms of net borrowing for a cumulative value of around 0.5 percentage points of GDP. The measures outlined in the PFPD include a rebalancing of the tax burden, aiming to reduce the impact on labor income, and the refinancing of the National Health Fund. In addition, measures will be introduced to support business investment and strengthening competitiveness, in line with previous interventions. Public investment financed with national resources will be preserved, so as to maintain an average level of 3.4 per cent of GDP over the programming period. Policies to support birth rates and work-life balance will also be strengthened. The measures would be financed not only through the deficit but also through unspecified measures on both the revenue and expenditure sides.

Implementation status of the NRRP and the new proposed amendment. − The trend-based public finance scenario reflects the postponement of the NRRP implementation, while the policy scenario incorporates the effects of the renegotiation currently under discussion and approval. This hearing provides an update on the current state of NRRP implementation and offers reflections based on the available information regarding the proposed amendment to the Plan.

As of 25 September 2025, a total of 447,174 projects were registered in ReGiS, with allocated funding of €157.8 billion and declared expenditure of €85.8 billion. Of these, 94 per cent of the projects, corresponding to 88.5 per cent of the total allocated funding (€139.7 billion), are either underway or in the final stages. The remaining 6 per cent (11.5 per cent of resources, €18.1 billion) are currently at critical stages, i.e. in the initial stages of planning, design and awarding (0.6 per cent, €2 billion), or no information is available (2.9 per cent, €7.2 billion), or only the theoretical stage is specified (2.5 per cent, €8.9 billion).

Of the NRRP funding available for regional allocation in ReGiS (approximately €148 billion), the share currently allocated to the Southern Italy would amount to a total of 36 per cent. This is slightly below the minimum regional allocation target set in the Plan (at least 40 per cent). However, this percentage could potentially increase if a majority of the projects not yet recorded in ReGiS pertain to the relevant macro-area.

This is the context for the sixth request for revision of the Plan which, after the recent parliamentary discussion, is expected to be formally submitted to the European Commission for final approval by ECOFIN by mid-November. The proposed amendment maintains the total value of the NRRP unchanged at €194.4 billion and is based on four of the eight revision options outlined in the Commission’s communication NextGenerationEU – The Road to 2026: strengthening existing measures; reduction of funding for interventions that cannot be implemented on time; use of facilities; transfer to the InvestEU programme.

Currently, apart from the total amount of the NRRP revision, only qualitative information is available. The PFPD itself, while stating that the programme scenario reflects the effects of the Plan’s renegotiation, does not provide further details. However, there is a possibility that this reprogramming frees up national resources in the final years of the programming period, which could then be used to create additional fiscal space.

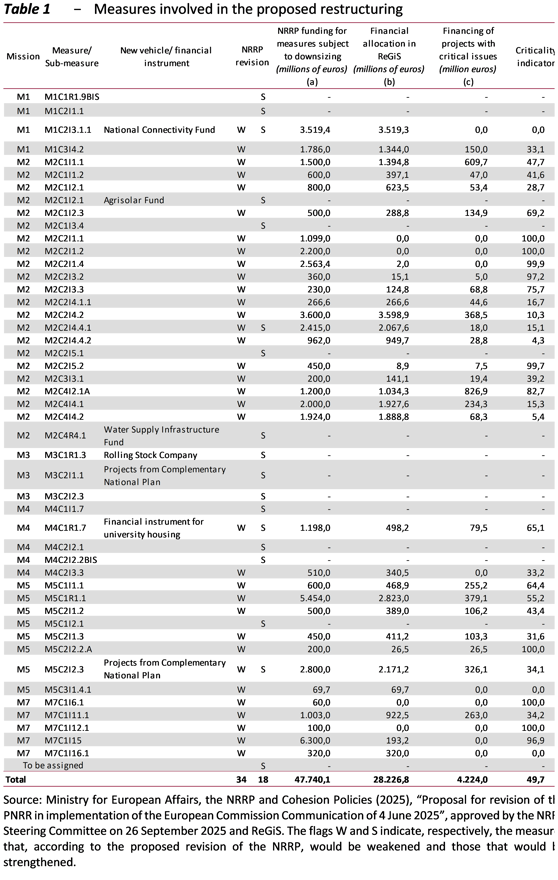

The proposed financial reallocation affects 34 measures identified as facing critical issues potentially jeopardising full implementation (indicated with a W in Table 1). These measures currently account for €47.7 billion in total allocated funding. A reduction of €14.15 billion has been proposed for these measures. The downsizing affects all Missions, with the exception of Missions 3 (Infrastructure for sustainable mobility) and 6 (Health). Just over half of these affected measures are concentrated in Mission 2 (Green revolution and ecological transition). The resources thus made available would be reallocated to 18 interventions (4 of which are also subject to a downsizing), most of which are pre-existing, together with the introduction of new measures or financial instruments (indicated with a S in Table 1). It cannot be ruled out that part of these resources will be used to include in the NRRP measures already implemented in recent years and financed with national resources.

According to the information provided to Parliament by the Minister for European Affairs, the NRRP and Cohesion policies, this would bring the total amount of resources leveraged through facilities and financial instruments to €20 billion.

Based on ReGiS data as at 25 September, a criticality indicator (Ic) was used to verify whether the 34 measures subject to downsizing were indeed the most at risk of non-implementation, and whether other measures were in worse condition. Overall, 12 of the 34 measures subject to revision exhibit a high degree of criticality (Ic > 75 per cent). Conversely, 19 of these measures have an Ic below 50 per cent. Notably, the criticality values for these 19 measures are in many cases still higher than those found for measures not subject to changes.

For comparison purposes, the criticality indicator was also calculated for measures not subject to downsizing, excluding those involving the use of facilities and financial instruments. Overall, the indicator shows very low values. Specifically, the Ic for all Missions is below 25 per cent, with the exception of Mission 1, which is slightly higher, and Mission 7, which is 77 per cent. For Mission 7, the high value is due to a significant incidence of projects in one of the critical phases (especially in the theoretical phase), likely caused by data not being updated in the ReGiS platform, also due to its recent introduction in the NRRP. However, although no critical issues are identified at the Mission level, potential problems related to individual interventions cannot be ruled out.

The full implementation of the NRRP remains subject to the effective resolution of the critical issues that led to the request for the sixth revision. In the remaining period until the conclusion of the Plan, the ninth and tenth instalments are due, subject to the achievement of 240 milestones and targets, 56 of which are involved in the revision just analysed.

Considerations on the public finance policy framework. − It is welcome that the policy framework confirms and, in some cases, improves uponthe main objectives set out in the MTFSP endorsed by the EU Council. Net expenditure growth, including the effects of the budgetary measures, is expected to remain within the limits set by the new EU fiscal rules, although additional information on the various components of the indicator would be desirable for a comprehensive assessment.

However, the almost full utilization of the available fiscal space exposes the country to the risk of not having additional resources available to accommodate unexpected needs.

The PFPD provides only general information on the budgetary measures. Although the deadline for submission to Parliament has been postponed, the autumn planning document does not contain any more information on the structure of the next budgetary measures than was indicated in the Economic and Financial Document (EFD) Update. In particular, there is a notable lack of information on financial coverage.

The trajectory of the debt-to-GDP ratio, which envisages a gradual reduction from 2027, could prove less favourable than planned. Firstly, nominal growth in the three-year period 2026-28 could be significantly lower than forecast in the PFPD, with an unfavourable impact on primary balances and the so-called snowball effect. Furthermore, failure to achieve the assumptions underlying the stock-flow adjustments component, including the ambitious divestment programme, could jeopardise the decline in debt-to-GDP ratio.

More generally, public finances are affected by geopolitical uncertainty, which has a negative impact on both growth prospects and financial market volatility. This calls for continued prudence in fiscal policy and for strengthening transparency and control mechanisms that enhance the credibility of the objectives, especially in the medium term.

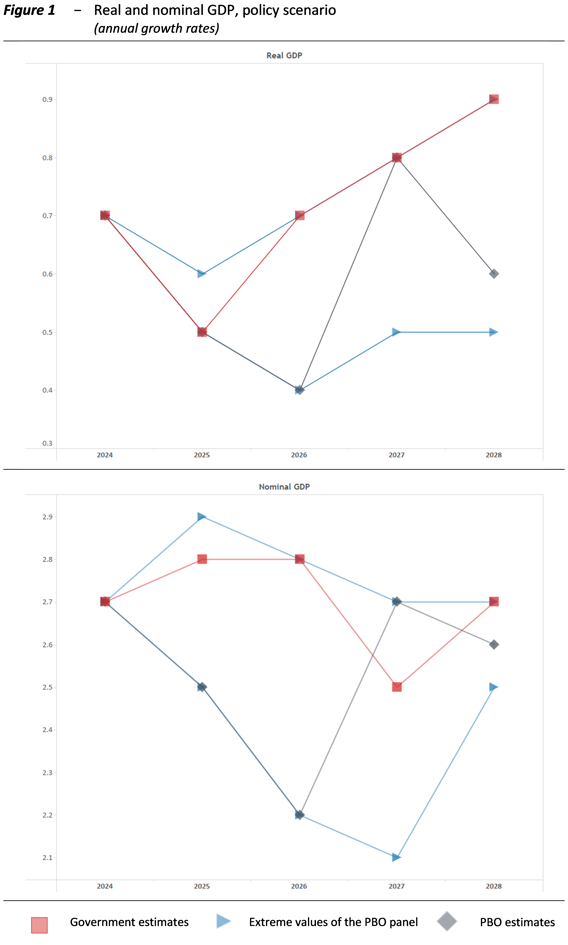

Validation of the macroeconomic forecasts in the programme. − The macroeconomic forecast in the PFPD has been assessed by the PBO, which has validated both the programme scenario and the trend scenario, as the estimated values for the main variables fall within the range of acceptability defined by the PBO panel. The validation of the PFPD’s QMP is based mainly on the following evidence: a) the forecast for annual GDP growth does not exceed the panel’s validation range (Fig. 1), nor does the cumulative increase at the end of the period, although the PBO’s estimates are more cautious; b) similarly, nominal GDP growth falls within the panel’s range, although in several years it is at the upper end, around which the cumulative increase is also located; c) the macroeconomic impact of the budgetary measures is consistent with the panel’s estimates and, at the end of the period, GDP levels coincide with those estimated by the PBO.

PBO macroeconomic forecasts. – Under the PBO’s current legislation scenario, a period of moderate expansion is expected, characterised by an average change in GDP over the forecast horizon of just over half a percentage point per year. Economic activity would be supported by the absence of inflationary pressures and the resilience of the labour market but would be held back by the deterioration in the international geopolitical situation and the loss of competitiveness resulting from the appreciation of the euro. A crucial factor is the PNRR, whose project implementation timetable will soon be revised; when the Plan is completed, the easing of aggregate demand stimuli, financed by both national and European funds, could pose significant challenges for the Italian economy.

In the PBO’s forecasts, the impact of the budgetary measures on the cumulative change in GDP over the entire PFPD forecast period is a couple of tenths of a percentage point, as in the MEF’s estimates.

Risk factors for macroeconomic forecasts. − Italy’s macroeconomic forecasts are exposed to multiple risks, which are balanced in the short term but predominantly downward in the medium term, largely attributable to international conflicts and capital accumulation.

Protectionism, wars and rearmament plans. − Ongoing conflicts and the tightening of trade restrictions by the United States are having negative effects on economic activity that are difficult to quantify. In its latest Annual Report, the PBO presented an assessment of the impact of US customs duties on the Italian economy, estimating a loss of GDP of around half a percentage point based on assumptions that have since worsened, given that the definition of duties is constantly evolving. In the medium term, the consequences of protectionism could become structural, affecting the reorganisation of production chains. In Europe, the economic situation remains uncertain, especially for industrial exporters, while new stimulus measures for military spending and infrastructure are expected, particularly in Germany.

The dynamics of construction investment. − Risks related to the timing of interventions financed by the NGEU programme in the near future weigh on investment forecasts in Italy, as this could generate bottlenecks on the supply side, slowing growth. Expectations for residential investment also appear uncertain, as a negative response cannot be ruled out in terms of capital accumulation in the sector, which has benefited from exceptional public support in recent years.

Financial market instability and monetary policy. − On the financial front, equity prices remain high, volatility indices are relatively subdued and central banks continue to ease monetary policy. However, the unstable and uncertain international environment could lead to sudden changes in risk appetite in the coming years, the effects of which would quickly spread to the Italian economy, which remains characterised by high public debt.

Climate and environmental risk. − Environmental and climate change remain structural vulnerabilities. Global warming generates extreme weather events, with repercussions on prices and production capacity. The impacts are no longer expected only in the short term, but according to some recent estimates, they will also be significant over the next five years. The increasing frequency and intensity of such events requires governments and private operators to allocate resources for prevention and emergency management.

The planned evolution of debt and debt financing. − In the PFPD’s policy scenario, debt-to-GDP ratio would continue to grow until 2026 and begin to decline in 2027-28. For the current year, the ratio is estimated to increase to 136.2 per cent of GDP, up 1.3 percentage points compared with 2024, and would rise further to 137.4 per cent in 2026. From 2027 onwards, the ratio would begin to decline slightly to 137.3 per cent of GDP and continue to fall to 136.4 per cent in 2028.

Analyzing the annual dynamics of debt-to-GDP ratio in terms of its various determinants, the primary balance makes an overall favourable contribution to debt reduction of 5.5 percentage points of GDP over the forecast horizon. The snowball component, linked to the differential between interest expenditure and the contribution of nominal GDP, would have an unfavourable effect on the dynamics of debt-to-GDP ratio, especially in 2027-28. The stock-flow adjustment would have an unfavourable impact on the debt path, amounting to a total of 5.3 percentage points of GDP in the period 2025-2029.

Given the public finance objectives and the gradual reduction of the Eurosystem’s balance sheet, it is possible to estimate the net flows of government securities to be absorbed by private investors in the two-year period 2025-2026. Gross government bond issues to be placed on the market are estimated around 500 billion in 2025 and would increase to 541 billion in 2026, mainly due to a higher volume of maturing bonds. Net government bond issues, net of Eurosystem secondary market programmes, are estimated at 173 billion in 2025, up 11 billion from 2024. In 2026, net government bond issuance net of Eurosystem secondary market programmes is estimated at 176 billion in 2025, slightly up from 2025.

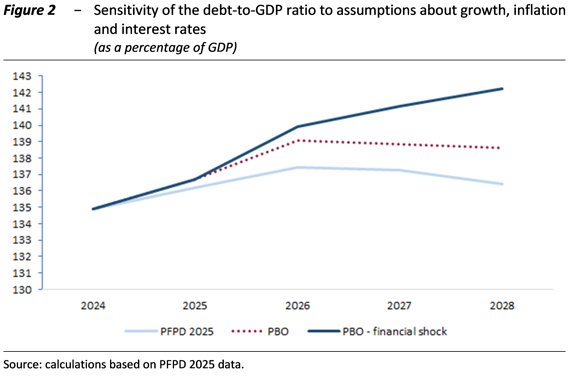

The sensitivity of the debt-to-GDP ratio. − The sensitivity analysis of the debt-to-GDP ratio in the PFPD’s policy scenario was carried out both by using alternative scenarios based on changes in specific macroeconomic assumptions and by adopting probabilistic methodologies. First, an alternative deterministic scenario (‘PBO scenario’) was developed by applying the differentials between the forecasts for real GDP growth, the GDP deflator and the consumption deflator formulated by the PBO during validation and those contained in the PFPD’s policy framework. Throughout the forecast horizon, the profile of the debt-to-GDP ratio in the PBO scenario is higher than that planned in the PFPD. In the two-year period 2025-26, the debt-to-GDP ratio resulting from the PBO scenario would be on an upward path, peaking at 139.0 per cent in 2026, 1.6 percentage points above the corresponding value in the PFPD. Only from 2027 onwards would the debt-to-GDP ratio in the PBO scenario begin to decline marginally to 138.6 per cent in 2028, which would be 2.2 percentage points of GDP higher than the corresponding forecast in the PFPD (Fig. 2).

In order to assess how the debt-to-GDP ratio would evolve in the event of heightened pressure on the government bond yield curve, a variant of the PBO scenario with high market volatility (PBO scenario – financial shock) is also considered. In this scenario, the debt-to-GDP ratio would show a steadily increasing trajectory over the three-year period 2026-28. In 2026, the debt-to-GDP ratio would stand at 139.9 per cent of GDP, about 2.5 percentage points above the corresponding value in the PFPD. In the following years, the debt would continue to increase, reaching 142.2 per cent of GDP in 2028, about 5.8 points above the Government’s policy scenario.

A probabilistic analysis was also carried out, highlighting a high degree of uncertainty regarding the evolution of the debt-to-GDP ratio planned in the PFPD. The results show that the path envisaged in the PFPD lies close to the 40th percentile of the distribution of scenarios over the entire horizon, pointing out that approximately 60 per cent per cent of the simulations produce less favorable debt dynamics than those planned by the Government. Furthermore, the probability of a year-on-year reduction in the debt-to-GDP ratio appears to be relatively low, especially in the initial years of the forecast horizon (slightly above 30 per cent in 2025 and below 5 per cent in 2026), though gradually increasing in 2027 and 2028.

EU guidance on fiscal policy. On 4 June, the European Commission issued a Communication providing guidance on Member States’ fiscal policies, taking into account the MTFSPs and the first annual progress reports submitted by Member States. The European Commission highlights that there has been a lack of investment and, in general, spending on Europe’s defense capabilities in recent decades. Member States are invited to increase their overall defense spending while ensuring debt sustainability. The Commission therefore calls on all Member States to comply with the maximum growth rates of net expenditure recommended by the Council, including Member States under the excessive deficit procedure, such as Italy, with a view to ensure the timely correction of excessive deficits.

In March 2025, the Commission presented the ReArm Europe Plan/Readiness 2030 containing the EU strategy to strengthen the Europe’s defense capabilities. The national safeguard clause has already been granted to fifteen countries that requested it in recent months. In addition to budgetary flexibility afforded by the safeguard clause, the SAFE financial instrument will provide Member States that request it with loans of up to €150 billion guaranteed by the EU budget to support the strengthening of defense capabilities through coordinated joint procurement.

Italy is among the 19 Member States that have expressed interest in accessing the SAFE instrument and has been provisionally allocated €14.9 billion. At present, the Government is deferring any decision on the activation of the national safeguard clause pending the finalization of the SAFE program and confirms that its primary objective remains the abrogation of the excessive deficit procedure.

In June, as part of its spring package, the Commission assessed Italy’s compliance with the net expenditure path for 2025 and placed the excessive deficit procedure in abeyance on the basis of the annual progress report submitted by the Italian government. The decision to hold the procedure in abeyance acknowledges that Italy is complying with the recommended corrective path, although fiscal surveillance will continue until the deficit is brought and maintained below the reference value of 3 per cent of GDP.

The planned net expenditure path in the context of the Stability and Growth Pact. − The PFPD presents updated estimates for net expenditure growth and its components over the period 2024-25. According to the PFPD, net expenditure declined by 2.0 per cent in 2024, 0.1 percentage points below the maximum growth rate recommended by the Council. For 2025, the PFPD reaffirms net expenditure growth of 1.3 per cent, as previously set out in the PFD, in line with the maximum growth rate recommended by the Council. For the following three years, the PFPD sets targets for net expenditure growth of 1.6 per cent in 2026, 1.9 per cent in 2027 and 1.6 per cent in 2028, broadly in line with the net expenditure path recommended by the Council. A preliminary assessment of the cumulative deviations in net expenditure based on the information presented in the PFPD suggests that Italy is complying with the path recommended by the Council over the plan period.

A comprehensive assessment consistent with the methodology used by the European Commission for monitoring the indicator would require the amounts in euro of net expenditure and its components for the period 2025-28, which are not disclosed in the document.

Under the policy scenario, the ratio of nationally financed public investment to GDP is projected to average approximately 3.4 per cent over the period 2021-26, exceeding the medium-term level recorded in the period 2024-28. Should the Government confirm these targets in the budget law, the requirement for extending the fiscal adjustment period to seven years would be satisfied.

A comparison of the PFPD policy scenario with the MTFSP targets. − Although the new SGP rules require monitoring compliance with the net expenditure path proposed in the MTFSP and endorsed by the EU Council, it is nevertheless important to verify that the main public finance balances and aggregates are broadly consistent with the Plan.

Overall, the better-than-expected fiscal outturn for 2024-25 is projected to be partly offset by a less favourable trajectory in subsequent years relative to the Plan. As a result, the main fiscal balances and debt-to-GDP ratios projected in the MTFSP remain broadly unchanged at the end of the programming period in 2028.

As regards the medium term, using the PBO Debt sustainability framework (DSA), allows to extrapolate the evolution of the debt-to-GDP ratio in the PBO scenario over a horizon extending to 2041. Although starting from lower levels, the debt-to-GDP ratio in the PBO scenario would display a more pronounced upward trend than that projected in the MTFSP during the initial years of the projection horizon. After peaking in 2026, the debt-to-GDP ratio in the PBO scenario would remain above the MTFSP trajectory in the PSB. In the medium term, the debt-to-GDP ratio in the PBO scenario would decline at a slower pace than projected in the MTFSP, mainly due to more cautious assumptions about real and nominal GDP growth. By 2041, the debt ratio under the PBO scenario would reach 122.5 per cent of GDP, 8.8 percentage points above the corresponding level in the MTFSP.

Finally, in order to assess the short- and medium-term implications for the debt-to-GDP ratio trajectory in the event that Italy were to activate the national safeguard clause for the financing of defence expenditure, a variant of the PBO scenario has been developed. In this scenario, in line with the expenditure profile proposed by the Government, defence outlays are increased by 0.15 percentage points of GDP in 2026 and 2027 and by 0.2 points in 2028. Under such assumptions, debt would continue to decline, albeit at a slower pace than in both the PBO scenario and the MTFSP trajectory, reaching 130 per cent of GDP in 2041 (7.5 percentage points above the corresponding level in the PBO scenario).

It should be stressed that the results of this scenario are to be interpreted as a technical assumption, as any deviation from the MTFSP targets currently in force due to the safeguard clause would need to be reabsorbed, at least from 2029 onwards, through the budgetary adjustment that will be planned in the next MTFSP.