10 October 2023 | The Parliamentary Budget Office (PBO) has endorsed the macroeconomic policy forecasts of the Update of the 2023 Economic and Financial Document. The Chair of the PBO, Lilia Cavallari, spoke today before the Joint Budget Committees of the Senate and the Chamber of Deputies and announced the positive outcome. The hearing concerned the Update of the 2023 Economic and Financial Document and the Report to Parliament through which the Government requests authorisation to revise the convergence path to the medium-term objective. Below are the main issues addressed.

Endorsement of the macroeconomic trend and policy scenario of the 2023 NADEF

On 21 September, the PBO submitted to the Ministry of Economy and Finance the Endorsement Letter for the macroeconomic trend scenario (under the current legislation) contained in the NADEF.

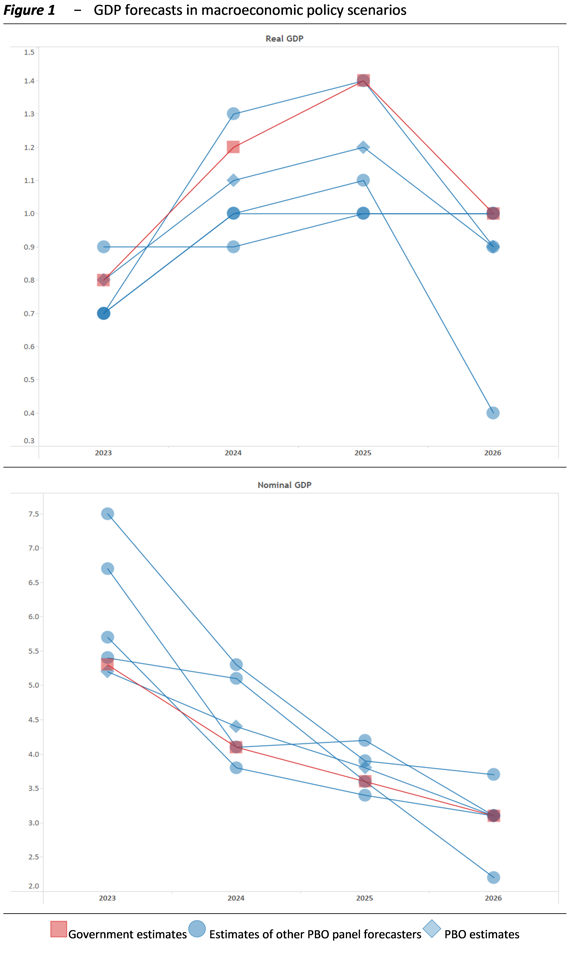

The macroeconomic policy scenario has also been endorsed: the forecasts are consistent with those of the PBO panel (CER, Oxford Economics, Prometeia and Ref. Ricerche, in addition to the PBO itself), while being at the upper end of the range. The endorsement of the macroeconomic policy scenario specifically concerns 2024, when the effects of the budget of the government are expected to become tangible.

Specifically: a) the official forecast on real GDP growth in 2024 (at 1.2 per cent) is found to be within the panel’s acceptance range, although close to the upper range of the panel’s expectations; b) the estimate on nominal GDP growth (at 4.1 per cent in 2024) appears conservative, as it is below the panel’s median; c) the impact of the fiscal package on economic activity in 2024 is similar to the average defined by the panel and coincides with that estimated by the PBO.

In the 2025-26 two-year period, which is not subject to endorsement procedure, the NADEF’s macroeconomic policy scenario appears acceptable, although borderline as real GDP growth coincides with the upper end of the panel’s expectations (Figure 1).

Risk factors for the Italian economy

The macroeconomic scenario appears to be exposed to different risks, mainly external or international, which are overall tilted to the downside. In particular:

NRRP and public investment. Critical issues persist on the assumption underpinning the projections of a full, timely and efficient utilisation of the European funds of the NGEU programme by Italy. New public investment has been sluggish in the first two year of the plan, and the government outlined proposals to amend the plan this summer. In a context of tightening credit conditions, interventions and structural reforms are to be promptly deployed and implemented to ensure significant and long-lasting support to the economic activity. Implementing most of the interventions under the NRRP in the two last years of the plan, in addition to leaving no further room for postponement, could fuel bottlenecks in supply, both in terms of the skills needed to manage and start up the interventions, and in terms of displacing other investments.

The ongoing wars and the outlook for Germany and China. The persisting conflicts at the borders of the European Union represent a major risk, as they expose the system of international relations to adverse and unpredictable shocks. German industry has already shown signs of weakness that, if persistent, might strongly affect production systems highly integrated with Germany such as Italy’s. Moreover, the Chinese economy is currently struggling, not only because of the hardships in the property sector; the recovery of world trade, assumed in the forecasts, is at risk.

The inflation persistence. The sharp decline in inflation next year is a cornerstone on which the entire macroeconomic scenario rests. While this circumstance remains possible, several risks persist. The external variables are set in line with commodities futures market prices, which are extremely volatile. Moreover, the new geopolitical tensions could drive commodity prices up again, which would in turn generate spillover effects on consumer prices.

Financial risks and economic policies. Possible uneven recovery patterns between countries and the potential sudden increase in market operators’ risk aversion might fuel new global financial tensions, with significant impacts on an open economy with high public debt, such as Italy’s. A further risk factor concerns the forthcoming developments in monetary policy guidelines, which are currently restrictive for the main developed countries yet expansive for China, which is experiencing deflation.

Environmental, climate and territorial risks remain in the background.

The Update of the EFD (NADEF) and the public finance scenario

The 2023 Update of the Economic and Financial Document (NADEF) revises upwards the trend deficit in each year of the 2023-26 period compared to the 2023 Economic and Financial Document (EFD). The updated forecasts show a general government deficit of 5.2 per cent of GDP in 2023, 3.6 in 2024, 3.4 in 2025 and 3.1 in 2026, an increase compared to the EFD forecast of eight-tenths of a percentage point of GDP for the current year, one-tenth for the next, four-tenths for 2025 and six-tenths for the last year of the forecast.

The worsening of the 2023 deficit stems from the higher expenditure for building bonuses that emerged from the in-year monitoring. Excluding this latter expenditure, despite the macroeconomic deterioration and lower revenues from social contributions connected with the cut in the tax wedge provided for by Decree-Law 48/2023, the deficit would have been lower than expected in the EFD due to the lower-than-expected NRRP projects mainly related to investments.

Still in the trend scenario, the higher deficit in 2024, compared to EFD forecasts, is exclusively due to higher interest expenditure. The primary surplus improves slightly as the lower revenues related to the slowdown in growth and the expenditure set aside in the fund earmarked for reducing the tax burden as provided for by Decree-Law 48/2023 are offset by the deficit-containment effects related both to the postponement of some NRRP projects and, above all, to the different accounting of building refurbishment bonuses.

The higher deficit in 2025 results from the carry-over effect of lower indirect taxes. The impact of the higher NRRP measures postponed from previous years is offset by the positive effects of the reclassification of building refurbishment bonuses.

In addition to the carry-over effect of indirect taxes, the higher deficit in 2026 is due to the late implementation of the NRRP measures in addition to the negative effects of building refurbishment bonuses.

In the policy scenario, deficit-to-GDP ratios worsen compared to the EFD by 0.6 percentage points of GDP on average per year. They stand at 5.3 per cent in 2023, 4.3 in 2024, 3.6 in 2025 and 2.9 in 2026. In the EFD they were respectively 4.5 per cent for the current year, 3.7 for next year, 3.0 for 2025 and 2.5 for the following year.

The policy plan is deficit-increasing in the 2023-25 three-year period compared to the trend scenario (to a greater extent in 2024) and becomes deficit-decreasing compared to the trend scenario in the last year of the planning period.

The achievement of a deficit below 3 per cent of GDP and a primary surplus near pre-pandemic levels is postponed by one year. The deficit is expected to fall below 3 per cent of GDP in 2026 instead of 2025, and the achievement of a primary surplus is postponed from 2024 to 2025.

The decline in the public debt-to-GDP ratio slows down significantly. Over the 2023-26 period, the NADEF projects a cumulative reduction of 2.1 percentage points, almost half the 4-point reduction expected in the EFD. However, the public debt-to-GDP ratio is projected to remain below the level projected in the April document in each year, thanks to the upward revision of the GDP level in 2021-22 by ISTAT, which is also reflected in the future forecasts.

At the end of the policy period, the ratio is expected to be more than 15 percentage points below the 2020 peak (154.9 per cent) but more than 5 per cent above the pre-pandemic level in 2019 (134.2 per cent). In order to reach the pre-pandemic level by the end of the decade − a target confirmed in the NADEF − further reductions in the ratio should be achieved over the 2027-2030 four-year period, averaging about 1.4 per cent of GDP per year.

In the coming months, debt issue strategy will have to take due account of the gradual reduction of Italian government bonds held by the Eurosystem. The share of Italian general government debt held by the Eurosystem, estimated at 28.8 per cent at the end of 2022, is expected to start decreasing to 26.6 per cent in 2023 and continue to decrease to 24.1 per cent in 2024.

General remarks

The NADEF provides general information on both the financial coverage and the measures of the plan; the mid-October Draft Budgetary Plan will provide more information in this regard. Below are some general remarks based on the content of the NADEF.

The achievement of a primary surplus in line with pre-pandemic levels will take longer compared to the EFD plan. Full utilisation of the available fiscal space entails the risk of lacking additional resources to support the economy if cyclical conditions deteriorate.

As regard the estimates of deficits in the coming years, some degree of uncertainty remains in the context of the Eurostat’s decisions regarding the registration of building refurbishment bonuses (such decisions should not affect the estimates of public debt).

The de-facto stabilisation of the debt-to-GDP ratio is based on assumptions exposed to some degree of uncertainty. A greater fiscal effort than the one envisaged in the NADEF will become essential should any of the assumptions only partially materialise. Specifically, these assumptions will be influenced by the full implementation of the measures under the NRRP (for which further postponements do not seem possible) and by the possible in-itinere changes that may stem from the revision of the Plan – including the REPowerEU chapter − recently sent to the European Commission. Uncertainty also emerges in the context of the actual implementation of the privatisation programme announced in the NADEF, which is expected to generate proceeds amounting to at least 1.0 per cent of GDP by 2026. These amounts become significant when looking at the privatisation proceeds for the years preceding the pandemic crisis.

The Report to Parliament and the recommendations from the EU

In parallel with the NADEF, the Government submitted a Report to Parliament to request authorisation to revise the adjustment path to achieving the Medium-Term Objective (MTO) by setting policy targets for the deficit-to-GDP ratio at higher levels than in last spring’s EFD. The request is based on the need for a more expansionary fiscal policy than planned in April to restore momentum for the economy in a context of increasing uncertainty.

More information than that contained in the Report and the NADEF appears to be needed to assess the existence of grounds to justify a revision of the recovery plan to achieve the MTO.As far as 2023 is concerned, it is not possible to assess the consistency of the planned measures with the requirements set by the European Commission to justify the extension of the general escape clause, i.e. measures must be temporary and targeted. For 2024-26, the Report does not mention any exceptional events. Moreover, with regard to business cycle developments, the Report contains general arguments on potential downside risks for the economy where the NADEF output gap estimates are positive over the entire 2023-26 four-year period.

As far as EU budget rules are concerned, the European Commission presented the ‘European Semester 2023 − Spring Package’ Communication in May, while delivering country-specific recommendations. In the document, the Commission reiterated its intention, in light of the expected cancellation of the general safeguard clause and pending the introduction of a new framework of rules, to propose possible excessive deficit procedures in spring 2024 based upon the deficit performance of individual countries recorded in 2023.

The NADEF projects a deficit above 3 per cent in each year of the 2023-25 three-year period. Should this result be confirmed in 2023 and the government confirm a target above the 3 per cent threshold in the following two years, the European Commission might propose the Council to open an excessive deficit procedure in spring 2024.

Public finance scenarios in the new regulatory framework proposed by the Commission

In April 2023, the European Commission presented its proposals for the reform of the EU’s governance framework, requiring Member States to draw up Medium-term − four- to seven-year – Structural Budgetary Plans (SBPs) to be submitted to the European Commission for assessment and approval by the Council.

Using the methodology developed by the PBO, several medium-term scenarios have been prepared to describe an evolution of the debt-to-GDP ratio and of the main public finance variables that are generally consistent with the approach outlined in the legislative proposals on the new EU governance.

The PBO analysis shows that, with four- to seven-year multi-year budgetary adjustments consistent with the proposed new EU framework, the debt-to-GDP ratio is expected to be on a constant downward path.

To this end, assuming a 4-year adjustment starting in 2025, net borrowing is projected to reach a level of 1.7 per cent of GDP by 2028 in a more favourable growth scenario and 1.4 per cent of GDP in a less favourable growth scenario. Under a 7-year adjustment, the deficit is projected to reach 2.0 per cent and 1.8 per cent of GDP by 2031, respectively.

The policy deficit-to-GDP evolution reported in the NADEF, if actually achieved, would be more ambitious than the scenario with a seven-year budgetary adjustment, but would require a greater fiscal effort in the case of a four-year adjustment plan.