23 October 2024 | Today, the Parliamentary Budget Office (PBO) released the October Report on recent economic developments which analyses, on the basis of the latest available indicators and short-term trends, the scenario of the international and domestic business cycle with specific forecasts for the Country. In particular, new growth forecasts for the third quarter and for the whole 2024 are released.

Below is a short summary of the Report.

For 2024, PBO forecasts an 0.8 per cent growth for the Italian GDP

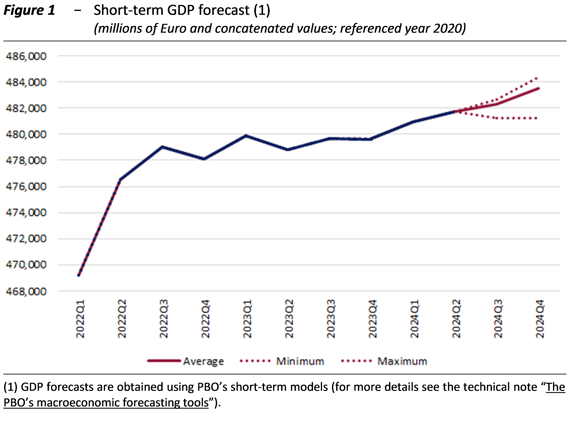

The available timely economic indicators do not agree on a clear development of the cyclical phase. Based on the PBO’s models for the third quarter, GDP should see little changes between -0.1 and 0.2 percent (Figure 1), so there is a non-negligible probability that it has essentially stagnated; activity remains held back by weakness in the manufacturing sector and the outlook for construction is uncertain.

In 2024, the GDP would increase by 0.8 per cent, two-tenths of a point less than forecasted by the PBO at the time of the validation exercise of the Structural Budgetary Plan (MTFSP) forecasts; the revision is attributable to the worsening of the acquired variation for 2024 from the quarterly data recently published by Istat.

Forecast risks are tilted to the downside

The forecast risks for the Italian economy are tilted to the downside. In the short term, the persistent weakness of industry, in particular the manufacturing sector, as well as uncertainty about the outlook for construction, weighs heavily, also because of the withdrawal of incentives for residential investment.

For the coming years, the risks are mainly attributable to the economic fallout of the ongoing wars and the geopolitical tensions that hamper international trade; domestically, the pace of progress in the National Recovery and Resilience Plan (NRRP) will be crucial, as repeatedly emphasised by the PBO.

International context between geopolitical instability and falling inflation

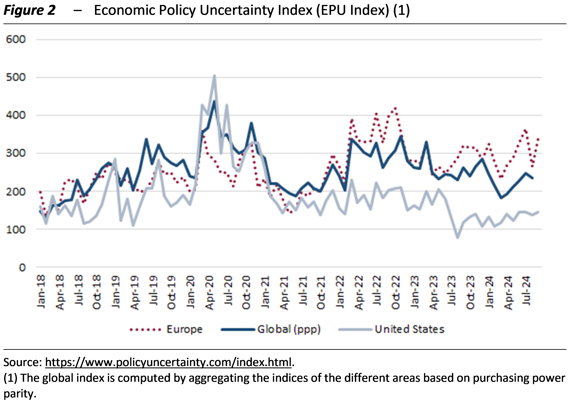

The international context is fragile and unstable due to various conflicts on the EU’s doorstep, as well as geopolitical tensions and trade wars. Lately the energy commodity markets have not experienced large fluctuations, but remain very volatile. Global economy is fragmented, the cyclical phase is more solid in the US than in Europe, held back by the stalemate in Germany: in the second quarter, the US GDP grew more than expected (3.0 percent in economic and annualised terms), while the Euro area stagnated (0.2 percent cyclical change). The unstable international environment makes the actions of Governments more unpredictable, as also shown by the Economic Policy Uncertainty Index (EPU Index – Figure 2), which shows more unpredictability in Europe than in the United States.

The International Monetary Fund (IMF) continues to foresee a sharp acceleration in world trade this year, while the growth of economic activity would remain broadly constant (hence an increase in the elasticity of trade to GDP). According to most recent estimates, the second half of 2024 will be characterised by a temporary interruption in the downward phase of inflation. However, the downward inflation trend is confirmed in the medium term, with the Euro area falling below two percent (1.7 per cent in September), its lowest value in three years. Central banks have embarked on a path of easing monetary conditions and the next steps will depend on the development of prices and other economic indicators.

Italian economy: GDP weakness and positive signals from inflation and employment

In recent quarters, Italian economy has grown by a few tenths of a point, like the Euro area. In spring, our country’s GDP grew by 0.2 per cent, driven by consumption (private and public) and inventories, while net foreign demand had a negative impact. Inflation fell below one percentage point in September and remains well below that of the Euro area; almost 60 per cent of prices now show increases below 2.0 per cent.

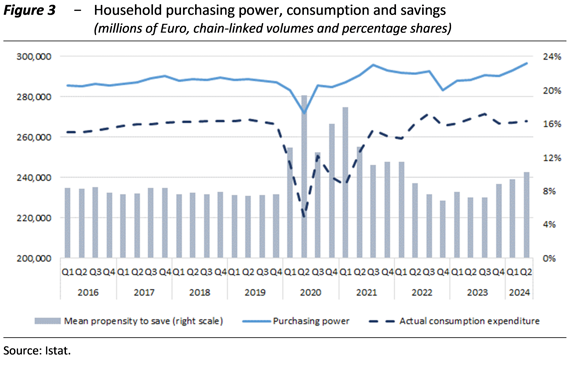

Permanent employment continues to rise, the unemployment rate falls, and real wages begin to recover some of the loss in purchasing power accumulated over the past two years. In fact, consumer spending is rising slowly as households are very cautious, and the savings rate has exceeded ten per cent (Figure 3). Based on the imbalance between supply and demand, the PBO’s indicator on tensions in the credit market points to substantial stability in the spring and summer quarters, after the strong improvement observed in previous months. A stabilisation is also emerging for the mortgage market.

Housing investment slows down, but other components of accumulation increase. Exports weakened by 1.2 per cent in the second quarter, continuing the trend observed in the previous period, while on the industrial activity front production fell by 3 points in the first eight months. The outlook shows no signs of improving in the short term, and manufacturing business confidence is at its lowest in three years.

During summer, uncertainty measured by the PBO index remained almost unchanged, with a slight deterioration for businesses and a slight improvement for households.

Italy’s growth accounting based on new Istat data

In this edition of the Report on recent economic developments, the PBO devotes an in-depth look at the recent revision of Istat’s national accounts time series, which changed the scenario of Italy’s macroeconomic dynamics from 1995 to 2023. According to the new accounts, there is a significant increase in the overall level of economic activity in 2021-23, with an average annual growth rate of almost five per cent, largely driven by the improved dynamics of services and construction sector.