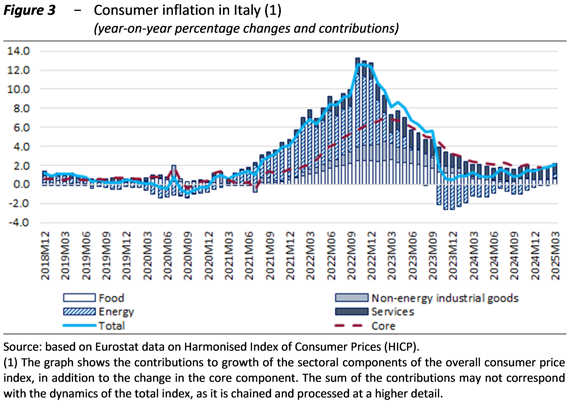

11 April 2025 | The international economic situation is characterised by growing uncertainty, resulting from protectionist policies as well as persistent geopolitical tensions. The strong tariff barriers announced on April 2 by the United States of America, which led to sudden falls in the prices of financial assets, have been largely reduced more recently. Even before April 2, growth expectations were deteriorating, with the OECD forecasting a gradual deceleration of global GDP in the coming years. In the final part of 2024, the US economy slowed down and may have weakened further in the first quarter of this year (Fig. 1). In the euro area, significant heterogeneity remains, with Germany still contracting and Spain growing rapidly. Global inflation is showing signs of renewed pressure, so the path of monetary easing by the major central banks is becoming narrower.

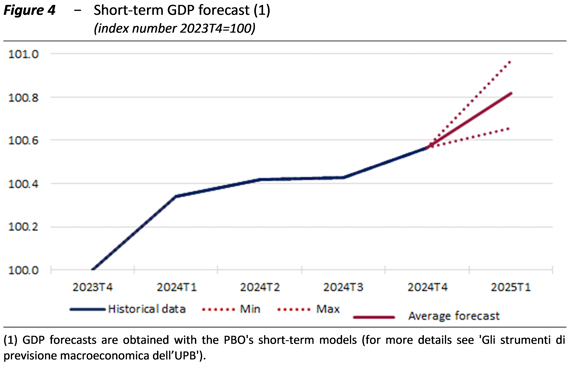

In 2024 the Italian economy grew by 0.7 per cent, consistently with the previous year but less than the euro area for the first time since 2021. Last year’s change in GDP was supported by domestic demand, in particular consumption, as well as by net foreign demand, amid falling imports. As far as aggregate supply is concerned, the weakness of the manufacturing sector was confirmed, while the services and construction sectors were more resilient. In the final part of 2024 the cyclical phase was nearly stagnant, barely better than in the summer period (Fig. 2). Household consumption was held back by the loss of purchasing power, capital accumulation recovered, partly due to improved credit conditions, but the housing component remained in contraction. Exports recorded their fourth consecutive quarterly decline, while the more pronounced drop of imports favoured an improvement in the balance of payments trade balance.

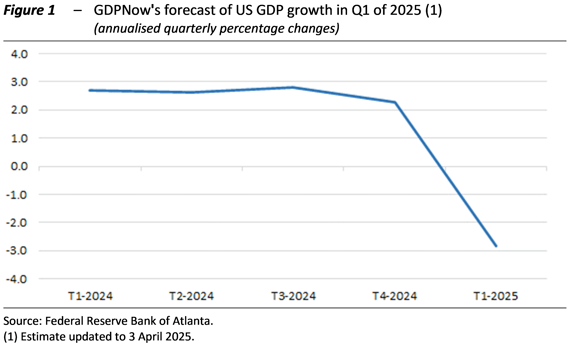

Employment strengthened in 2024, although slowing down towards the end of the year, while wages gradually regained purchasing power. Labour hoarding phenomena are confirmed and the vacancy rate remains high, showing a mismatch between labour supply and demand. In this regard, the Quarterly Report includes an in-depth study on the relationship between productivity and reallocations in the labour market of the manufacturing sector; it is reported that inefficiencies in the mobility of workers between companies hold back productivity increases, with consequences also on wage dynamics. After the significant drop in 2024, consumer inflation in Italy showed signs of recovery in the first quarter of 2025, mainly due to the increase in the prices of energy goods (Fig. 3); this resulted in a reabsorption of the gap with euro area inflation, which almost bridged in March.

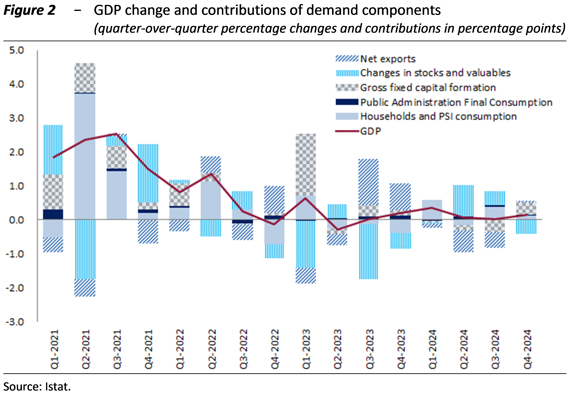

Industrial turnover between the end of last year and the start of 2025 recovered and according to the short-term models handled by the Parliamentary Budget Office (PBO), GDP accelerated in the past quarter, growing quarterly by 0.25 percentage points (Fig. 4). The risks of the forecast are downside oriented and sharply exacerbated in the medium term, mainly due to geopolitical tensions.