2 August 2023 | Despite the setback recorded in the second quarter (-0.3 per cent), Italian GDP is expected to grow by 1.0 per cent this year and 1.1 per cent in 2024. These are the findings of the August report on recent economic developments, in which the Parliamentary Budget Office updated its forecasts. Compared to estimates presented in spring, drawn up upon validating the 2023 Economic and Financial Document (Documento di Economia e Finanza – DEF), the PBO revised partially upwards (0.1 per cent) its growth outlook for 2023, as the unexpected positive data relating to the first quarter prevails over the negative date of the following period; the forecast for 2024 was instead adjusted downwards (0.3 per cent), due to weaker foreign demand and global financial conditions. However, Italy’s macroeconomic scenario remains predominantly uncertain and vulnerable to downside risks.

Global economic slowdown. Tighter credit terms

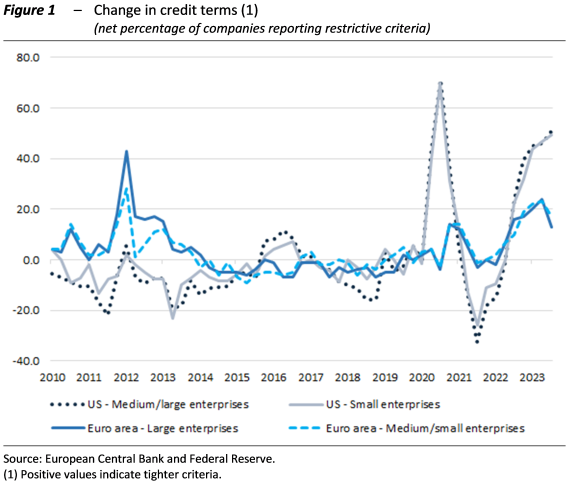

The global economy is slowly adapting to the conflict in Ukraine. Commodity prices, which had been most affected by the war in 2022, are settling down; specifically, natural gas prices are back below pre-war levels. However, the global economic performance is weakening; in Europe and the US, the level of inflation is causing central banks to raise interest rates, leading to a tightening of credit standards that is dampening aggregate demand (Figure 1). China’s economy appears sluggish despite zero inflation and the expansionary monetary policy. At the end of July, the International Monetary Fund (IMF) confirmed expectations of a slowdown in global growth this year.

Italy GDP drops in the second quarter

After a strong rebound in the first quarter, with a cyclical growth of 0.6 per cent, the Italian economy slowed down in spring; according to preliminary data published by Istat at the end of July, GDP shrank by 0.3 per cent, due to contraction in domestic aggregate demand, particularly for consumption.

Household spending is volatile. Private consumption recovered in the first three months of 2023 (0.5 per cent, on a cyclical basis), after the sharp decline recorded at the end of 2022; however, consumer spending behaviour developed a more prudent behaviour in the second quarter. Furthermore, investments are hindered by credit terms, although businesses reported a slight easing in restrictions on access to credit in the second quarter.

Although exports of goods and services fell by 1.4 per cent in the first quarter, they remained high compared to those of the major euro area countries, having also benefited from a specialisation in less energy-intensive sectors.

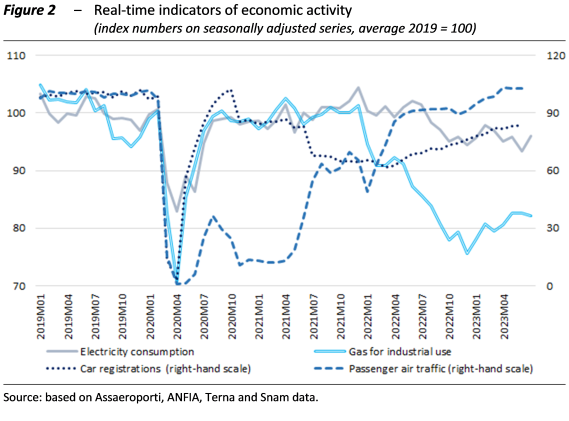

Despite the slowdown in the economic cycle, uncertainty among households and businesses, as measured by the PBO index, is decreasing, especially among consumers. The monthly quantitative timely variables suggest an uncertain scenario in the short term (Figure 2). In the June-July period, electricity consumption reached its post-pandemic low, despite the increase in the past month probably attributable to the above-average temperatures; gas consumption for industrial use almost stabilised, almost twenty per cent below the values prior to the health emergency, partly as a result of the reconversion undertaken by companies to cope with price increases. Passenger air traffic in June confirmed its recovery, after the lows reached in spring 2020; new car registrations showed further indicators of recovery, also thanks to the easing of restrictions in supply chains; however, there are still margins for increase before achieving end-2020 levels.

Employment continues to expand and wage growth strengthens

The labour market strengthened in winter. The hours worked increased in the first quarter of the year (1.3 per cent compared to Q4 2022), with significant growth in industry, as well as the number of employed persons (0.4 per cent). In the April-June period, employment increased at a similar pace, driven by permanent and self-employment. This upsurge was fuelled by both genders, young employed (15-34 years) and older workers, also due to demographic dynamics. The employment rate (15-64 years) rose further, although it had reached its all-time-high (60.9 per cent) since 2004 as early as the first quarter.

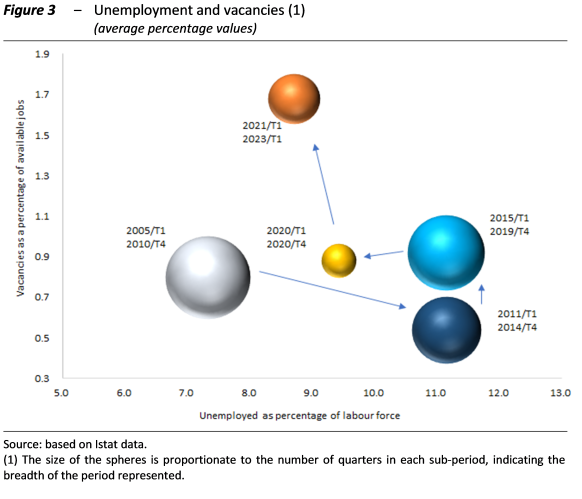

The gap between labour supply and demand (Figure 3) remained wide in manufacturing and market services in the first quarter. Conversely, in the construction sector, the vacancy rate decreased for the first time since the pandemic crisis, returning to last year’s average values.

Hourly contractual wages in the second quarter of this year increased by 2.7 per cent on a trend basis (0.5 higher than in the previous three months), driven by the upsurge in the private sector (to 2.1 per cent); the dynamic remained strong (at 4.5 per cent) in the public sector, due to increases related to several contractual renewals for the three-year period 2019-2021 (concluded in May 2022 and paid in the second half of the year).

Core inflation down, but stubborn double-digit food price increases

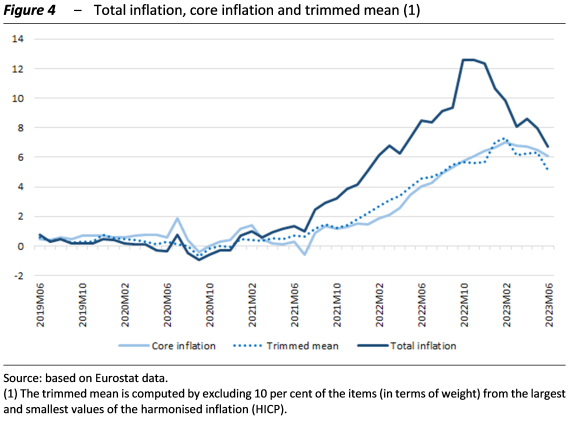

The inflation continues to decline in line with the previous months, with core inflation following the same downward trend; however, pressures on food prices and some tourism-related services remain high (Figure 4).

The inflation (as measured by the NIC index) rate fell in the second quarter by 1.5 per cent, thus reaching 7.4 per cent (from 8.9 per cent in the previous quarter), largely due to a significant setback in energy and food prices, while services remained broadly stable.

In July the inflation fell again, to 6.0 per cent (from 6.4 per cent in June). The drop is uneven across the different Italian regions, with values still above 7 per cent in June in Liguria, Tuscany and Umbria, and below 4 per cent in Basilicata. The gap between Italian inflation and euro area inflation remains positive, about 1.5 per cent on average over the past quarter.

Core inflation, which excludes energy and fresh food, decreased to 5.2 per cent in July (from 5.6 per cent in June) mainly thanks to decline in transport prices and water and electricity utilities.

Inflation expectations recorded in the Istat confidence surveys continue to suggest an easing of inflationary pressures.

PBO forecasts on the Italian economy

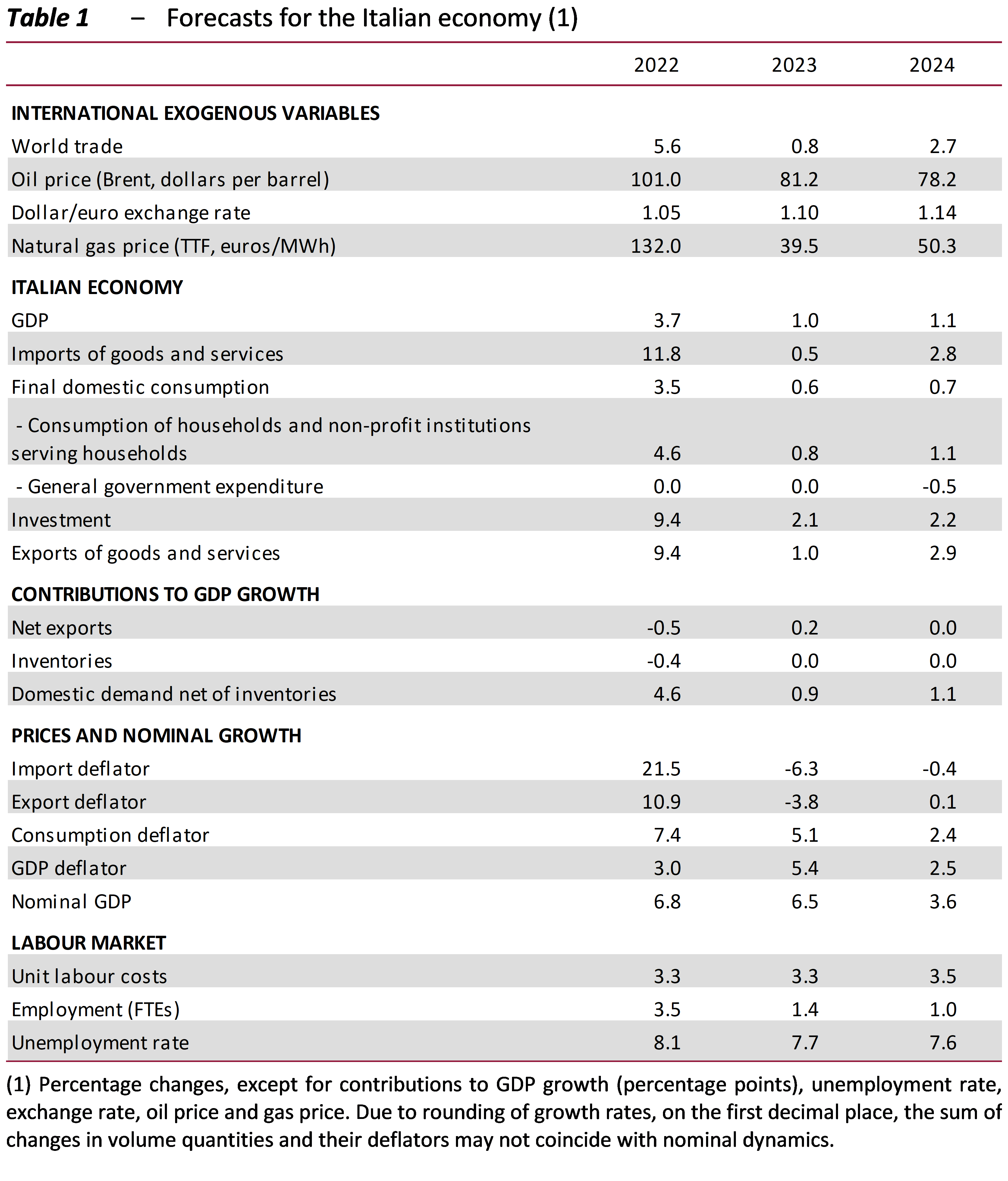

According to the PBO’s latest estimates, Italy GDP is expected to increase by 1.0 per cent this year, mainly driven by domestic demand, which benefits from the increase in employment and the easing of inflation (leading to the cancellation of some emergency income support measures). In 2024, GDP growth is expected to remain stable (1.1 per cent), driven by domestic demand, and in particular by investments financed with European funds (Table 1).

The partial upward revision of GDP estimates for 2023, compared to spring estimates, is ascribable to historical data (the unexpected positive figures in the first quarter outweighs the negative data in the following period); conversely, the downward adjustment for 2024 is exclusively due to the deterioration of international exogenous variables.

Employment is expected to increase slightly more than economic activity in the average of the 2023-2024 two-year period. Inflation, as measured by the consumption deflator, is expected to decline gradually over the two-year period 2023-24.

The macroeconomic scenario of the Italian economy appears to be subject to downside risks. The main risks are international, with particular regard to the European cycle and the volatility of commodity markets. However, there are also significant elements of uncertainty in Italy, especially on the evolution of the NRRP, for which the Government has recently proposed some amendments.