Updated forecast for Italy: closer to the 1.0 percent growth target in 2024, while 2025 will probably be influenced by international risks and the NRRP factor

August 1, 2024 − The Parliamentary Budget Office (PBO) released today the Report on recent economic developments, an analytical document in which PBO examines, on a quarterly basis, the scenario of the international and domestic business cycle based on the latest available indicators and short−term trends, with specific forecasts for the Country. Based on the latest data, the August Report on recent economic developments describes a moderately expansionary economic phase and estimates Italy’s GDP growth at 1.0 percent in both this year and 2025.

International scenario: monetary policies toward easing but various risk factors weigh in

After the severe shocks of the past four years, the international economy is undergoing a normalisation phase. The major advanced economies show a moderate growth boosted by the labour market currently expanding also in the Euro area. Within an international scenario of declining inflation, central banks are preparing to make monetary conditions more expansionary, albeit with timing to be determined based on information that will become available. The international scenario remains fragile, mainly due to ongoing military and trade wars and volatile commodity prices.

In this context and looking at the most recent forecasts, the second half of 2024 will be characterised by the further decrease of global inflation, but price dynamics in services and the prospects of further tariffs in the automotive sector could slow the disinflation process. Despite the International Monetary Fund’s (IMF) expectations of strengthening global trade, uncertainty remains high, including with regard to economic policies, so financial market conditions could change quickly.

The cyclical phase of the major economies is moderately expansionary, with the United States accelerating beyond expectations in the second quarter of 2024. Growth in the Euro area remains moderate; in the second quarter of 2024, the GDP recorded a 0.3 percent cyclical change with heterogeneous trends among major countries. China foresees a 4.7 percent GDP in the second quarter, down from the 5.3 percent recorded in the previous period, due to the prolonged real estate crisis.

Inflation shows moderately downward dynamics in the main areas. Price dynamics remains persistent in the U.S. − still suggesting possible rate cuts in the fall − while it remains lower in the Euro area despite a small increase in July (to 2.6 percent).

In the second quarter, the Italian GDP dynamics remains subdued

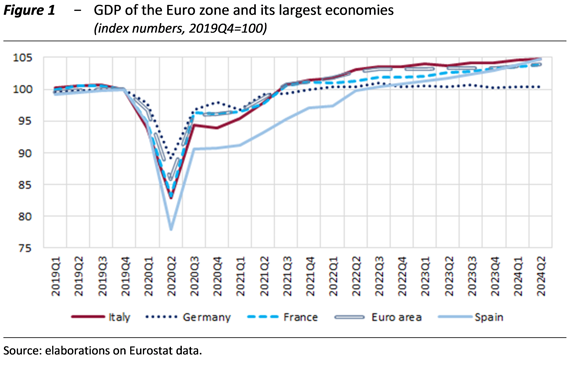

Based on preliminary data from Istat, in the second quarter the GDP grew by 0.2 percent, slowing down on a cyclical basis (0.3 percent in the first quarter) but accelerating to 0.9 percent compared to the same quarter of previous year; the change for 2024 grew to 0.7 percent. The growth recorded in the spring was driven by expansion in services, compared with declines in agriculture and industry (which includes the construction sector). The quarterly dynamics of Italy’s GDP is similar to that of the euro area and France (both at 0.3 percent), while Germany is 0.1 point lower and Spain confirms its good cyclical phase. Compared with pre-pandemic levels, our economic activity levels remain broadly higher, with a differential equal to that of Spain and slightly greater than that of France (Figure 1); in contrast, Germany’s GDP levels remain broadly in line with those at the end of 2019.

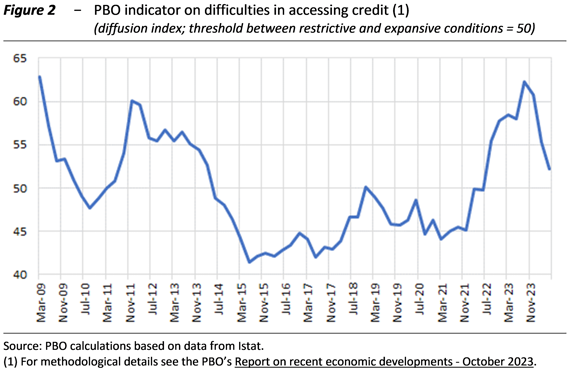

According to estimates by the Parliamentary Budget Office (PBO), uncertainty for Italian households and businesses remains high, especially for businesses, which are nevertheless seeing easing difficulties in obtaining financing.

In fact, the PBO indicator on credit access difficulties in the most recent quarters has shown a gradual decrease in tensions from the peaks recorded during the previous year (Figure 2). As for deposits, costs incurred by financial intermediaries remain high, contributing to a slowdown in the delivery of credit to businesses.

Industry remains weak, the construction sector slows, but the tertiary sector expands

Industrial production is declining since the end of 2022 and in the average March-May it recorded a contraction of 1.6 percent over the previous three months. In the construction sector, the production index recorded two increases in April and May, although it declined from the previous quarter in the March-May average due to the sharp decline in March. Surveys conducted among businesses do not seem to anticipate any reversals in the short term (June-July) in the manufacturing and construction sectors. In the first three months of this year, value added in services resumed its growth (0.3 percent q-o-q) after a slight slowdown at the end of 2023. In 2023 tourism remains a driving factor for the Italian economy recording the highest values ever, with a strong trend growth in the tourism balance of payments in the first quarter of 2024. In the second quarter, the composite indicator of business confidence declined by about 2 percent, while the PBO’s uncertainty index registered a marginal increase.

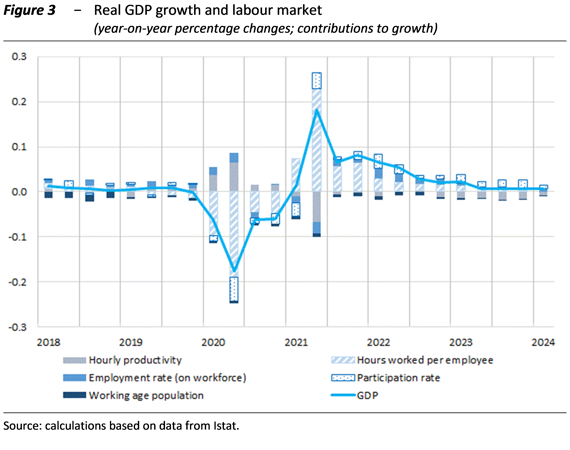

Employment is still growing and wage dynamics are moderately strengthening

During winter employment has increased more than economic activity. According to INPS data, job creation in the first part of the year was driven by services, particularly in the trade and tourism sectors, while manufacturing contributed negatively. Also in the first quarter, wage subsidy measures showed a first increase after three years of continuous reduction. Wage treatments were intensified in manufacturing and decreased in construction and trade sectors. The unemployment rate fell to 7.2 percent and continued to decline in April-May (6.8 percent on average), mainly due to an increase in female employment. Good labour demand conditions encourage labour market participation (Figure 3), which however is subject to persistent large imbalances between supply and demand.

For the overall economy, contractual wage dynamics strengthened moderately in the first half of 2024 (3.1 percent q-o-q) driven by the acceleration in the private sector. However, compared with three years before, the loss of real wages of Italian workers is still large: -5.0 percent compared with the first quarter of 2021.

Inflation is back above one percent, but remains lower than in the Euro area

Inflation remains low and although in July it exceeded the one percent threshold, it rests well below the values recorded in the Euro area; the gap is mainly explained by deflation of energy items, but is also affected by dynamics in services, which in Italy are lower than those in Europe by about 0.5 percent. The year on year change in the national consumer price index (NIC) remained stable just below 1 percent throughout the second quarter and strengthened to 1.3 percent in July, mainly due to recovery in the energy component. Consumer and business expectations are overall stability-oriented, and consumers are optimistic about price tensions: their spending decisions could be influenced by the improvement, however small, in the gap between wage and consumer price growth.

Updated forecasts: GDP at 1.0 percent for both 2024 (up from 0.8) and 2025 (down from 1.1)

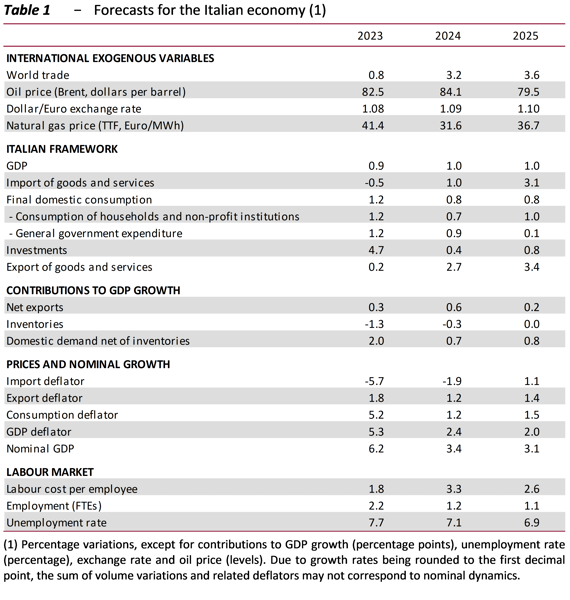

Economic activity is expected to continue at a moderate pace in the second half of the year. Considering the recent evolution of international exogenous variables and incorporating the data improvement recorded in the first part of the year, Italy’s GDP is estimated to increase by 1.0 percent in both 2024 and 2025 (Tab. 1). Forecasts also assume full utilisation of National Recovery and Resilience Plan (NRRP) resources, according to the interventions outlined in the National Reform Programme (Economic and Financial Document – EFD 2024, Section III).

Specifically, compared with the macroeconomic scenario outlined in April by the PBO as a EFD 2024 forecast endorsement exercise, economic activity forecasts were slightly revised upward over 2024 (by 0.2 points of GDP) and marginally lowered by 0.1 point in 2025. The 2024 growth is positively affected by the strengthening of international trade and the cyclical recovery observed in Italy in the first part of the year, while the 2025 is weighed down by higher energy commodity prices and the less buoyant trend in global trade.

According to valuations and as already pointed out by the PBO in previous reports, exogenous risks related to geopolitics at international level and the evolution of the NRRP at domestic level remain. Risks appear balanced in the short term but predominantly decreasing in the medium term.

At the international level, assumptions about global trade are crucial, as its strengthening is currently uneven in geographical and sectoral terms. The start of the ECB’s official rates lowering phase will provide a positive boost to growth, but with timing and effects currently not definable with absolute certainty. Market trends will be affected by both these issues and electoral developments for possible repercussions on economic policies globally. The overall picture should also consider environmental risks, particularly those related to adverse weather conditions.

On the domestic side, investments represent the most uncertain variable of the macroeconomic context; indeed, it is difficult to predict the timing and magnitude of the economic effects of regulatory changes to the Superbonus. In the medium term, the evolution of NRRP implementation may cause further critical issues, especially considering the concentration of projects in the next two years, which could cause supply bottlenecks. Regarding the macroeconomic effects, the PBO released an updated assessment (2024 Budgetary Policy Report) that, compared with government assessments, estimates similar impacts on GDP up to 2023 (cumulatively for 0.7 percentage points), while the expansionary effects tend to be less in the subsequent three-year period.

A two-year period driving domestic spending, with increasing NRRP investments and declining Superbonus-activated investments

This year the manufacturing activity would be supported by lower inflation and higher employment, as well as stronger international trade. In 2025, GDP dynamics, projected at 1.0 percent, would be confirmed to be driven by exports and domestic demand, particularly for European-funded investments. Capital accumulation would fall from 4.7 to 0.6 percent per year on average in the 2024-25 period, reflecting the reshaping of the Superbonus, to a large extend offset by the acceleration of NRRP investment.

The export variation recorded this year (2.7 percent) is expected to be more moderate than that of global trade, foreshadowing a loss of international market share after the growth of 2021-22. Exports are projected to gain more momentum in 2025, almost equalising the pace of international trade. The balance of payments’ current account balance as a percentage of GDP, which turned positive this year largely due to the reduction of the energy balance deficit, is expected to widen in the two-year forecast period (to 1.4 percent on average).