6 April 2023 | In the first quarter of 2023, the Italian economy is showing signs of moderate recovery, after the slowdown in the last three months of 2022, while inflation is declining even though the core components affecting the “shopping basket” remain on the rise. Employment is recovering, mainly because of permanent contracts, although imbalances between labour supply and demand continue to exist, holding back production.

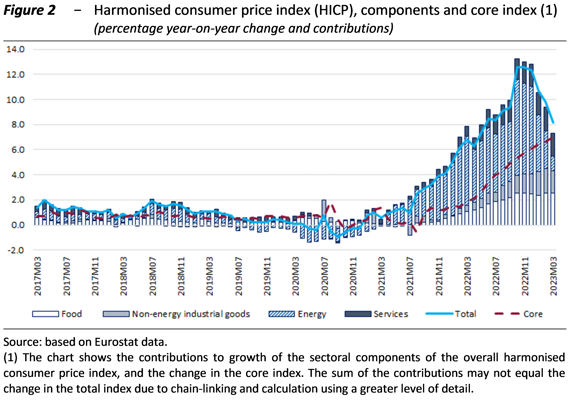

According to the April Report on Recent Economic Developments by the Parliamentary Budget Office (PBO), uncertainty in the short term for Italy is decreasing, while downside risks on growth and upside risks on inflation prevail in the medium term. In addition to the conflict in Ukraine, potentially adverse factors include the timeframe for the implementation of the NRRP, global financial tensions, the persistence of inflation, and climatic and environmental risks.

Global economy shows signs of being resilient to the war in Ukraine

Faced with a conflict in Ukraine that shows no sign of abating, global economies show signs of being resilient, adapting to the changed international scenario. European countries have reduced their dependence on Russian gas imports, both by diversifying their supply sources and by reducing their overall consumption. In fact, the EU’s dependence on Russia fell in a few months from almost 50 per cent in mid-2021 to just under 13 per cent in November 2022. Also due to a mild winter, tensions in the gas market gradually abated and by the end of March the price of gas per Mwh had returned to around EUR 40, i.e. to end-July 2021 levels.

Quarterly data on global economic activity point to a slowdown in the fourth quarter of 2022, although at the same time projecting an improvement in the first part of the current year.

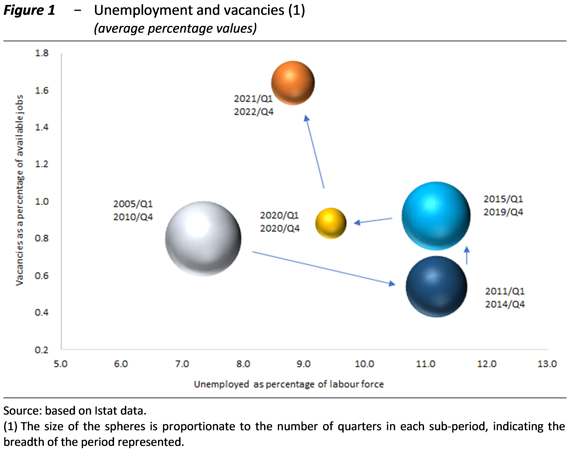

Lower energy commodity prices have contributed to the decline in inflation in Europe: since the peak recorded last October, when prices in the euro area had risen by 10.6 per cent, inflation has been falling steadily. According to preliminary estimates by Eurostat, inflation fell to 6.9 per cent in March, more than one and a half percentage points lower than in the previous month; the energy component registered a negative trend for the first time since February 2021. However, the gradual increase in prices has now spread to the other components of the basket, particularly food products. Still, the downward trend is not sufficient to manage a normalisation of monetary policies. The central banks continue to adopt a vigilant approach in light of the available data. The budgetary policies of the member states of the European Union are also moving towards a reabsorption of the imbalances that have accumulated following the pandemic and the conflict in Ukraine.

In 2022 the Italian economy grew more than its main European partners, but slowed down in the fourth quarter

Last year, Italy’s GDP grew beyond expectations, rising by 3.7 per cent, higher than its main European partners for the second year in a row, thus continuing the post-pandemic recovery it began in 2021. Growth was driven in particular by private domestic demand, i.e. household consumption and gross fixed capital formation, as well as by exports.

The final quarter of 2022, however, saw a slight contraction (-0.1 per cent compared to the average of the summer months). Private consumption grew by almost five percentage points in 2022 compared to 2021. After the leap forward during the middle quarters of the year, household spending declined noticeably in the autumn (-1.6 per cent), suffering from the sharp loss in household purchasing power caused by price increases.

Employment increases but the imbalances between labour supply and demand slow down production

According to preliminary data, employment continued to grow in January and February this year (0.3 per cent compared to the previous three months), driven in particular by permanent and self-employed workers. The employment rate (for 15-64 year-olds) rose to an all-time high (to 60.8 per cent), partly as a result of the contraction in the working population, although still far from euro area levels. The upturn was also due to an increase in the participation of women in the labour market, which substantially returned to pre-pandemic values.

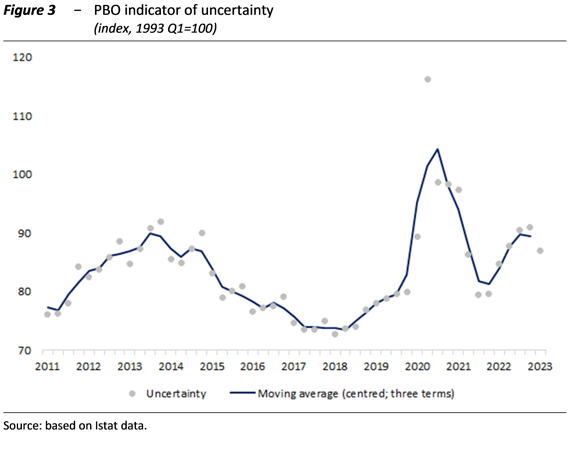

However, the imbalance between labour demand and supply remains significant and holds back production (Figure 1). According to the ISTAT survey on capacity utilisation and obstacles to production in manufacturing firms, the number of companies facing obstacles is decreasing overall, but labour shortages are becoming more frequent.

Inflation decreases but not for the “shopping basket”

The decline in inflation over recent months is gaining momentum due to the fall in energy prices and the easing of upward pressures in the distribution chain. However, moderate price pressures remain on food products and certain services, which continue to drive core inflation and the “shopping basket”; thus, the price of basic necessities increases further, affecting mainly households with lower incomes (Figure 2).

Impact of tax incentives on the price of energy-efficient home systems

In Italy, the price of certain energy-efficient home products (heating and air-conditioning appliances) grew at a higher rate than the European average since the second half of 2019. Between the third quarter of 2019 and the fourth quarter of 2022, the cumulative increase in the prices of this subset of goods amounted to almost 40 per cent in Italy, compared to smaller increases not only in Germany and the euro area (around 20 per cent), but also in France and Spain, where the change was between 3 and 10 per cent.

An in-depth study using data mining techniques, conducted by collecting data on the prices of around 7,000 home air-conditioning products (boilers and air conditioners) sold online in different countries (Italy, France, Germany and Spain) on a major distribution platform, showed that until mid-2021, Italian prices tended to be lower than those in France and Spain, while the gap closed and became positive last year, in the quarters during which the works financed with the Superbonus intensified rapidly.

Italy’s GDP starts growing again in the first quarter of 2023. Uncertainty decreases but downside risks remain in the medium term

Industrial activity between the end of 2022 and the start of 2023 was very volatile. According to the PBO, in the first three months of the year, household and business uncertainty (Figure 3) declined for the first time since the second half of 2021, and household and business surveys overall point to a strengthening of the economic cycle. In the first three months of the year, the PBO estimated that GDP began to expand again, at a moderate pace, with balanced risks in the short term.

On the contrary, downside risks on growth and upside risks on inflation continue to prevail in the medium term.