24 October 2025 |

International scenario: the effects of protectionism are showing up gradually

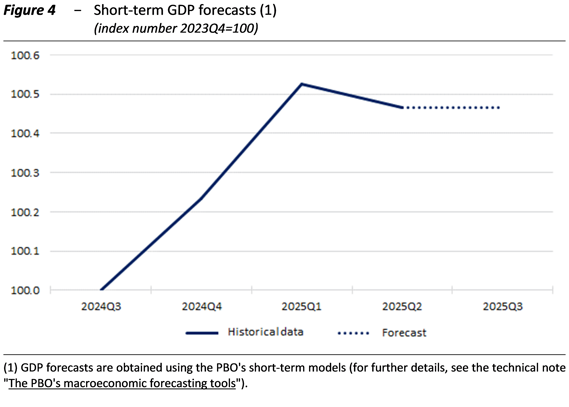

The international context remains unstable due to the deterioration of international relations. In the first part of 2025, trade was strongly driven by imports from the United States, which, however, slowed sharply from spring onwards (Fig. 1). So far, the effects of protectionism do not appear to be having a tangible impact on prices. However, the imposition of tariffs by the United States coupled with euro’s appreciation of 13 per cent against the dollar since the beginning of the year, is causing European exporters to lose competitiveness. The International Monetary Fund (IMF) has improved its expectations for this year but has lowered its GDP growth forecast for the euro area next year; the forecasts are subject to a high degree of uncertainty, particularly with regard to trade policies. Although energy commodity prices remain low, central banks (the ECB and the FED) are cautious about easing monetary conditions. This depends mainly on the evolution of consumer inflation.

Italian economy: GDP growth lower than in Europe

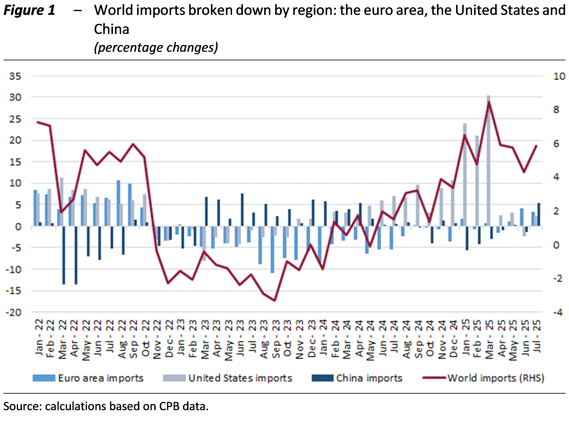

After a temporary acceleration in winter, Italy’s GDP declined in the second quarter (-0.1 per cent quarter on quarter; fig. 2) for the first time in almost three years; production growth remains lower than in the euro area. The volatility of the economic cycle in Italy is attributable to foreign trade: the recovery in exports in the first three months of 2025 (2.2 per cent), in anticipation of trade before the new tariffs came into force, was followed by a similar contraction in the spring (-1.9 per cent); according to the latest information, exports fell significantly in August, especially to the United States. Consumption remains constrained by high savings rates, while capital accumulation is buoyant, supported in part by improved credit conditions. On the supply side, the service sector is stagnating and industry shows no signs of recovery. Italian inflation (measured by NIC) is stable at 1.6 per cent in September, remaining lower than in the euro area. On the labour market, employment remained unchanged in the spring months and the growth of contractual hourly wages slowed; real wages remain well below those of 2020.

Focus: businesses report growing obstacles to exports attributable to tariffs

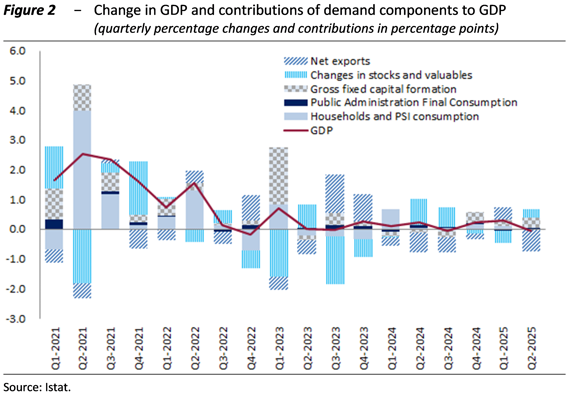

Household and business confidence remains relatively low, while uncertainty is high. The box analyses surveys of Italian manufacturing companies regarding obstacles to exports; as expected, these obstacles have become significantly more acute in recent quarters (Fig. 3), especially with regard to categories affected by tariff barriers. A detailed analysis of the areas and sectors shows that these obstacles are particularly noticeable in the North-East and for companies operating in the beverage, clothing and other sectors normally associated with Made in Italy.

Short-term forecasts: economic activity is expected to have essentially stagnated in the summer

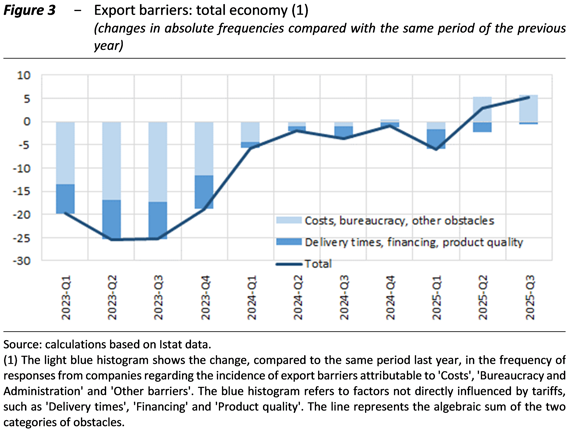

The UPB’s short-term model estimates indicate that the economy will remain weak and essentially stagnant in the third quarter (Fig. 4). The GDP growth forecast for 2025 as a whole remains at around 0.5 per cent, as indicated by the PBO when endorsing the macroeconomic scenario of the 2025 Public Finance Planning Document (DPFP); however, the outlook is characterised by significant risks, mainly due to the fragmented international environment.