- The global economy is fragile and unstable due to geopolitical tensions

- The cyclical phase of the Italian economy is weak, but gradually recovering at the end of 2023

- Employment supports incomes while wage dynamics remain moderate

- The PBO estimates GDP to grow by 0.8 per cent in 2024 and 1.1 in 2025

- After a sharp fall in the autumn, inflation is rising slightly but temporarily

- The forecasts for Italy are subject to multiple uncertainties, and risks are tilted downwards

2 February 2024 | With its February Report, the Parliamentary Budget Office (PBO) updates the macroeconomic forecasts for 2023-25. The PBO estimates an annual change in GDP at 0.8 per cent for 2024 and 1.1 per cent for 2025. Inflation continues to decline and the labour market remains resilient.

The PBO forecasts deteriorated slightly compared to those formulated in October for the endorsement of the macroeconomic scenario in the EFD Update. This is mainly attributable to the deterioration in the international environment (conflicts in the Middle East and unfavourable performance of important trading partners, such as Germany). The macroeconomic scenario is thus subject to a number of risks, which are generally tilted to the downside.

The international context amid geopolitical tensions and inflation

Global repercussions arising from the Middle East conflict

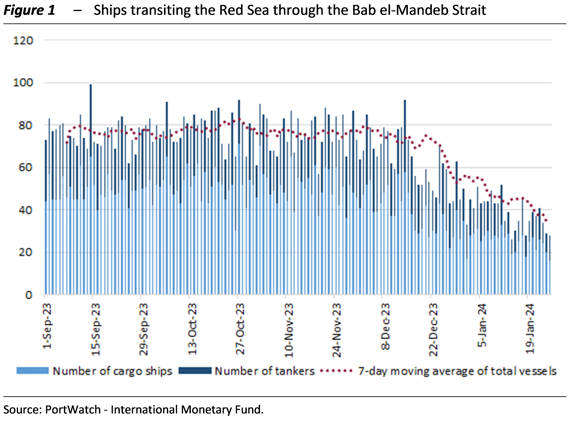

The global economic environment faced new elements of imbalance between the autumn of 2023 and the beginning of 2024. The conflict between Israel and Hamas militias is generating tensions throughout the Middle East region. Attacks on merchant ships in the Red Sea have caused cargo traffic on the Suez Canal to decline (Figure 1) which could result in increased transport costs. Although the high tensions in the Middle East region have not affected energy commodity prices so far, the new risk factors weigh on the prospects for monetary policy easing this year.

Inflation has peaked on both sides of the Atlantic

Aggressive monetary policies to combat inflation in 2023 have produced significant results, also helped by the decline in commodity prices. The sharp drop of inflation both in the euro area (to 2.8 per cent in January) and in the US (to 3.4 per cent in December), however, was accompanied by the greater stickiness in core inflation. Inflation expectations appear relatively stable, between 2.0 and 2.5 per cent.

The decline in inflation and the expected reduction in key interest rates in the euro area have supported the fall in ten-year bond yields. Sovereign debt issued by Italy saw a slight recovery in confidence, resulting in a narrowing of the spread between BTP and Bund yields.

Outlook for Italy in 2023: moderate growth, slightly higher than in the euro area

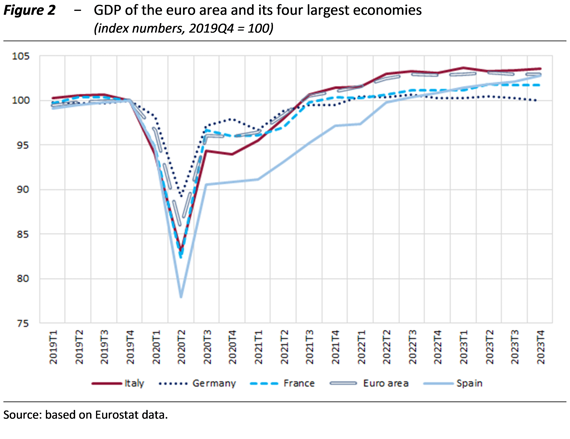

Since the third quarter of 2022, the Italian economy performed weakly overall, with a quarter-on-quarter change in GDP averaging just one-tenth of a point over the six quarters. However, Italy experienced a higher increase in activity levels compared to before the outbreak of the pandemic than that recorded by Germany and France (Figure 2).

Based on the quarterly accounts, GDP increased by 0.7 per cent in 2023 as a whole; growth calculated on the annual data (to be released by ISTAT on 1 March) may be slightly lower.

Household and corporate spending is cautious; exports are suffering from the weakening of global trade

Household spending started to grow again in the third quarter, thanks to an increase in employment and therefore in purchasing power. However, the increase in nominal incomes was eroded by rising prices and Italian households remain cautious in their spending.

Investment spending was weak last year. Manufacturing companies reported credit and liquidity conditions still tight in the fourth quarter, although improving. According to business surveys, companies anticipate a moderate expansion of investments in the current year.

After the marked contraction in the first half of 2022, attributable to the slowdown in world trade, exports recovered in the summer quarter. According to the data currently available, the change in exports in 2023 was in any case less negative than that experienced in Germany and the euro area.

Sectoral trends are uneven, increasing uncertainty for households and companies

Recent sector indicators point to an overall weak economy, with marked sectoral differences: the industrial sector contracted, the tertiary sector remained stable and the construction sector recovered quickly in the last months of 2023.

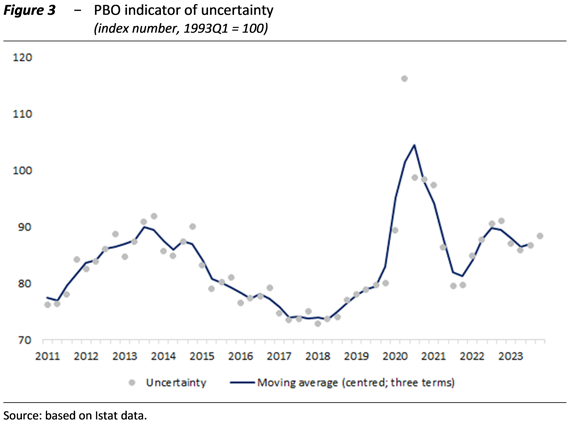

As measured by the PBO indicator (Figure 3), household and business uncertainty rose markedly at the end of last year, driven by both components.

The unemployment rate declines and wage growth intensifies moderately

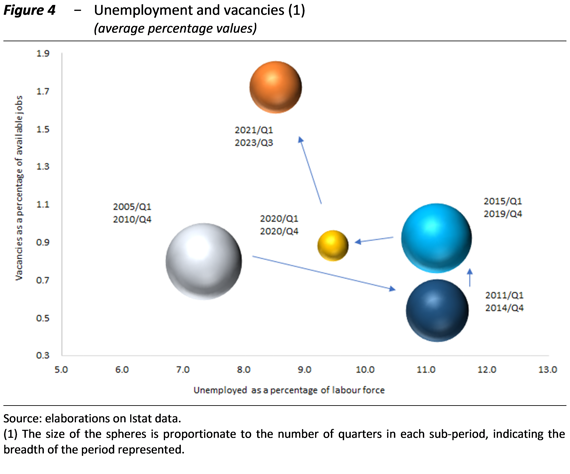

Employment increased by 1.9 per cent in 2023, driven by permanent contracts, against a decline in fixed-term contracts. The employment rate (15-64 years) reached almost 62 per cent in December, the highest value since the beginning of the survey. In the last quarter of the year, the unemployment rate decreased slightly to 7.4 per cent; the imbalance between labour supply and demand remained high over the same period (Figure 4).

The increase in hourly contractual wages intensified in the summer quarter (3.0 per cent year-on-year). According to the projections made by Istat, and taking into account the provisions of the contracts in force until last December, contractual wages are expected to increase moderately this year (to 2.3 per cent on average in the first half of the year).

Inflation falls, but energy remains uncertain

Inflationary pressures are subsiding also in Italy, and wage dynamics do not point to a wage-price spiral, as expectations normalise.

Inflation declined in 2023 (5.7 per cent the NIC index) reflecting the deflationary nature of the energy component in the autumn. However, food and service prices increased, with a not insignificant carry-over effect into 2024. On the other hand, core inflation increased in 2023 (5.1 per cent), as did inflation for the grocery and unprocessed food component, which reached a very high value in historical terms (9.5 per cent), with a sharp impact on the budgets of households with lower incomes.

Compared to 2023, where price increases were rapid, there is an unfavourable base effect in the winter period, which should lead to a temporary rise in inflation in the first quarter of 2024 compared to last autumn’s figures.

Macroeconomic forecasts for the Italian economy for 2023-25

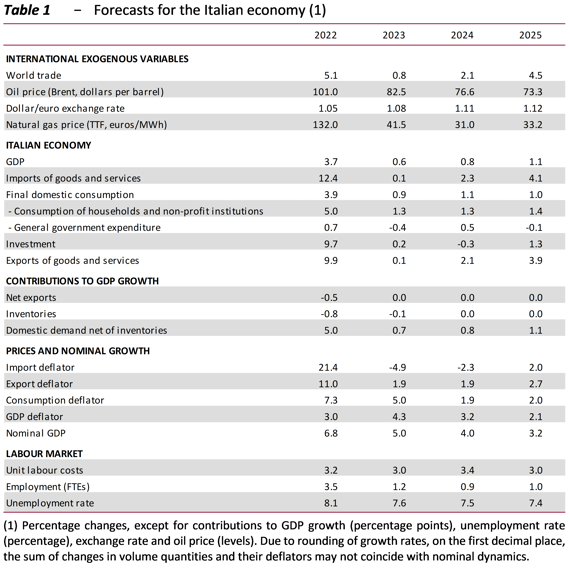

Economic activity in Italy is estimated to grow by 0.6 per cent in 2023 (Table 1), compared with the 0.7 per cent growth derived from the quarterly data. GDP is expected to accelerate slightly this year, to 0.8 per cent; after a still weak first quarter, attributable to persistent global tensions, growth is expected to strengthen gradually, benefiting from lower inflation and the acceleration of foreign demand. GDP is expected to consolidate at 1.1 per cent in 2025, assuming a gradual improvement in the international geopolitical and economic environment and a normalisation of monetary policy starting from the middle of this year (Table 1).

The forecasts assume that the NRRP investment programmes will be fully implemented and that geopolitical tensions in the Middle East will subside in the short term.

Modest revisions compared to the October forecast. Risks are tilted to the downside

Compared with the macroeconomic scenario formulated by the PBO in October for the endorsement of the forecasts in the 2023 EFD Update, the lower GDP growth (averaging two-tenths of a point in 2024-25) reflected the deterioration of assumptions on international trade and the slight appreciation of the exchange rate.

The outlook for the Italian economy is exposed to multiple risks, overall unfavourable. Most sources of uncertainty are exogenous in nature as they stem from international factors, particularly of a geo-political nature (war in Ukraine and the Middle East), which could dampen global trade. However, the robust recovery of international trade by 2024 will be essential to ensure an acceleration of Italian GDP in the two-year forecast period.

With regard to the effects of price tensions, according to a scenario constructed with the MeMo-It econometric model, increases in transport costs caused by the attacks in the Red Sea could affect consumer prices in Italy by a couple of tenths of a percentage point over the two-year horizon.

On the whole, falling inflation is a key pillar of the macroeconomic scenario and price developments this year will depend heavily on external variables, such as raw material costs. Moreover, as already pointed out by the PBO, there remain critical issues related to the efficient use by Italy of the European funds of the Next Generation EU (NGEU) programme. Finally, there is uncertainty surrounding monetary policies and the reform of EU economic governance, particularly regarding the timing of upcoming developments.