15 February 2024 | The Focus Paper provides an overview of the financial and economic impacts of the measures of the Budget Law approved by Parliament on 29 December 2023, as analysed together with the law converting Italian Decree-Law 145/2023 and the legislative decrees related to the tax reform that as a whole constitute the budget manoeuvre. The financial effects with respect to the 2023-26 scenario under unchanged legislation, the impact on beneficiaries and economic bases, and the main changes introduced during the parliamentary process are analysed.

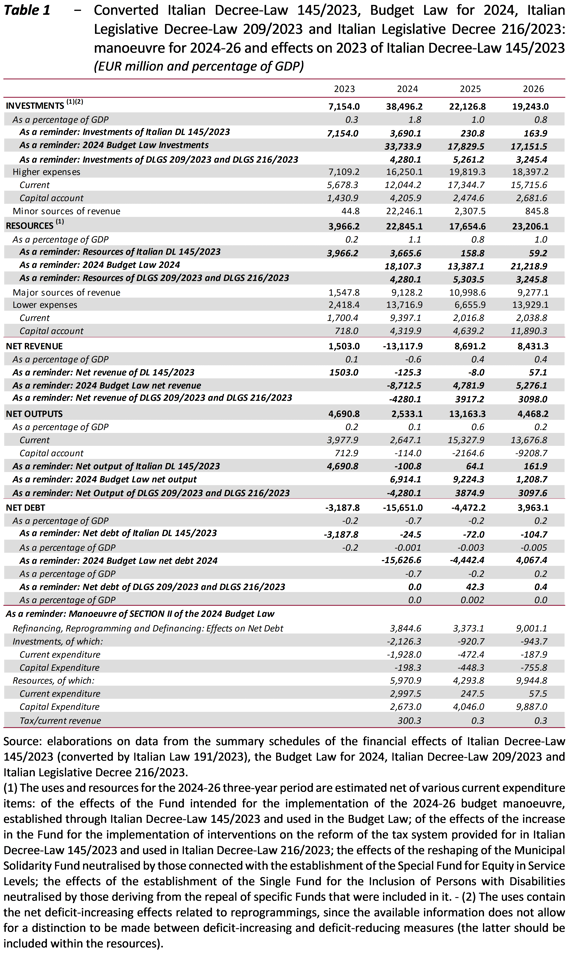

The Focus Paper notes that the impacts on the fiscal balances featured in the initial version of the manoeuvre have been substantially confirmed, with only a slight improvement in the deficit in the 2024-26 three-year period, i.e. less than EUR 50 million in the first year and EUR 100 million in each of the two subsequent years. Compared to the trends under current legislation, the manoeuvre will worsen the public deficit in the 2023-25 three-year period and improve it in 2026.

Compared to the trend framework, net revenues have increased, with the exception of 2024 (as a result of the cut in employee social security contributions and the revision of IRPEF); net expenditure will increase throughout the four-year period. The return of the deficit to below 3 per cent of GDP planned in the EFD Update for 2026, given the increase in current expenditure, derives from an increase in net revenues and a reduction in capital expenditure.

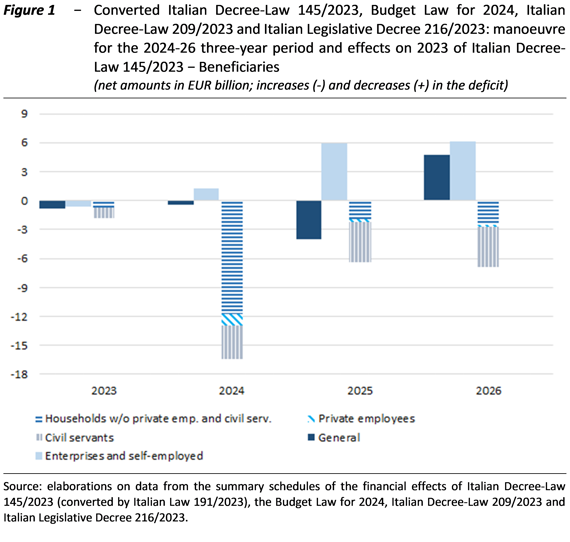

With regard to the main beneficiaries of the manoeuvre, the Focus Paper highlights the year-by-year net impacts on each of the three macro groups of measures: those for households, those for businesses and the self-employed, and the ‘general’ ones, i.e. those aimed at several types of subjects at the same time. In 2024, households will benefit most from the manoeuvre, especially those with employees among their members, with net benefits totalling EUR 16.4 billion, of which EUR 3.4 billion for public employees alone. Also in 2025 and 2026, the main beneficiaries of the manoeuvre will be households (about EUR 6.4 billion and EUR 6.9 billion, respectively), especially civil servants. For the 2024-25 period, albeit to a lesser extent, net resources have also been earmarked for general interventions and purposes (net benefit of 4 billion). On the other hand, the net impact on businesses and the self-employed is restrictive, contributing to the improvement of the balance in all years of the 2024-26 period compared to the scenario under unchanged legislation.

In 2024, compared to the trend scenario, labour-related revenues will decrease significantly, and consumption revenues will decrease to a lesser extent; capital-related revenues will increase instead. In 2025-26, revenue on all economic bases will increase, most markedly on capital.

On the net expenditure side, the largest net increase concerns defence, healthcare and other expenditures that cannot be clearly classified for 2024, while in 2025-26, the largest net increase will be directed to health, non-classifiable expenditures, social protection and general government services.

On the other hand, in the 2023-24 period, expenditure savings will be concentrated mainly in the general services function of the public administration, while in 2026 significant expenditure savings will be provided for the economic affairs and defence functions.

Overall, after the parliamentary procedure, the approach of the budget manoeuvre remained unchanged: indeed, the changes made to the budget law by Parliament had a marginal impact on the balances and the numerous new measures were of a limited magnitude. Finally, there were limited changes to Decree-Law 145/2023, and none to the two legislative decrees related to the tax reform.